January 2025 SAAR

The January 2025 SAAR came in at 15.6 million units, down 7.5% from last month and up 3.8% from January 2024. January is typically one of the lowest months of sales volume each year, but as seasonal adjustments usually account for this, it is notable that this month’s SAAR dipped to the lowest point since January 2024. It is also worth mentioning that this month’s SAAR exceeded the average of the last five Januarys (approximately 15.4 million units).

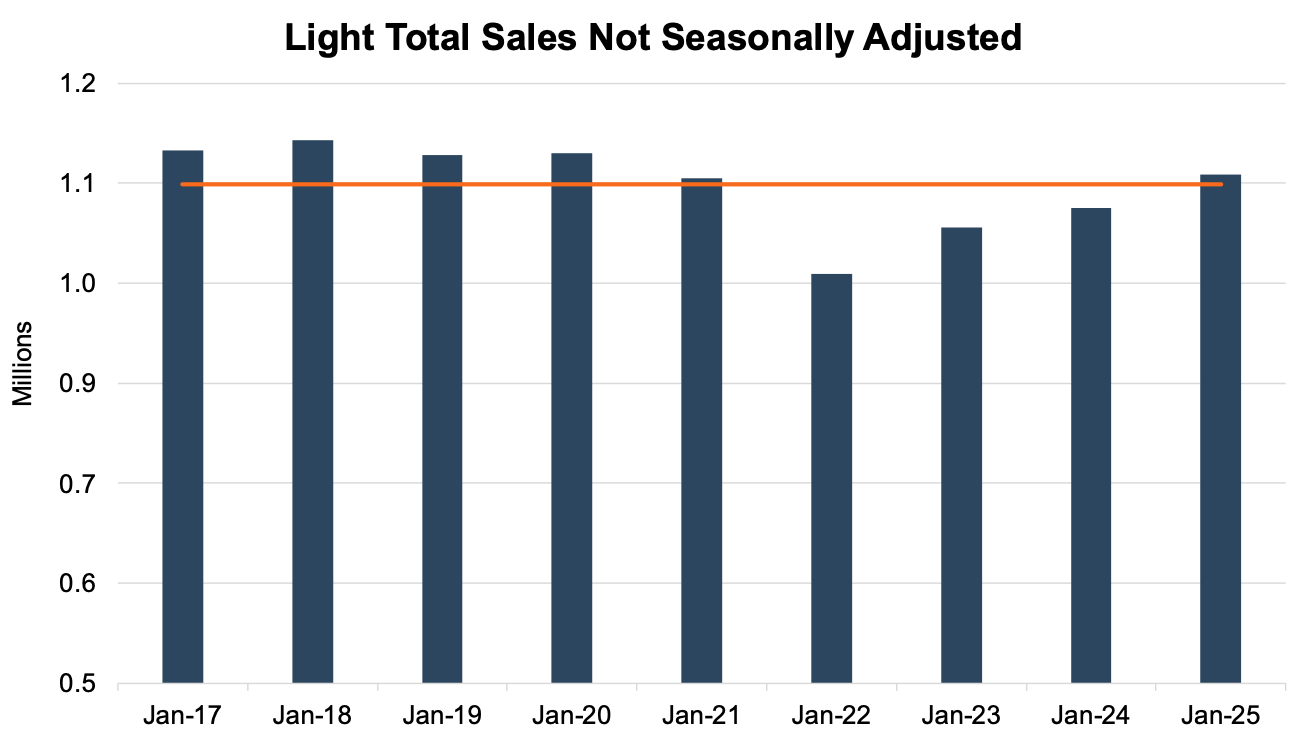

Unadjusted Sales Data

On an unadjusted basis, the industry sold 1.11 million units in January 2025, a 25.7% decrease from last month and the lowest unadjusted figure since January 2024. This month’s unadjusted sales finished about twelve thousand units above the nine-year January average of 1.098 million units (2017 – 2025), higher than recent years but still slightly behind pre-pandemic levels.

Throughout 2024 and into the new year, we have seen this trend play out nearly every month as unadjusted monthly sales make their way back toward their respective nine-year averages. See the chart below for a look at unadjusted sales over the last nine Januarys, which shows four consecutive years of improvement since the chip shortage low in 2022.

Days’ Supply

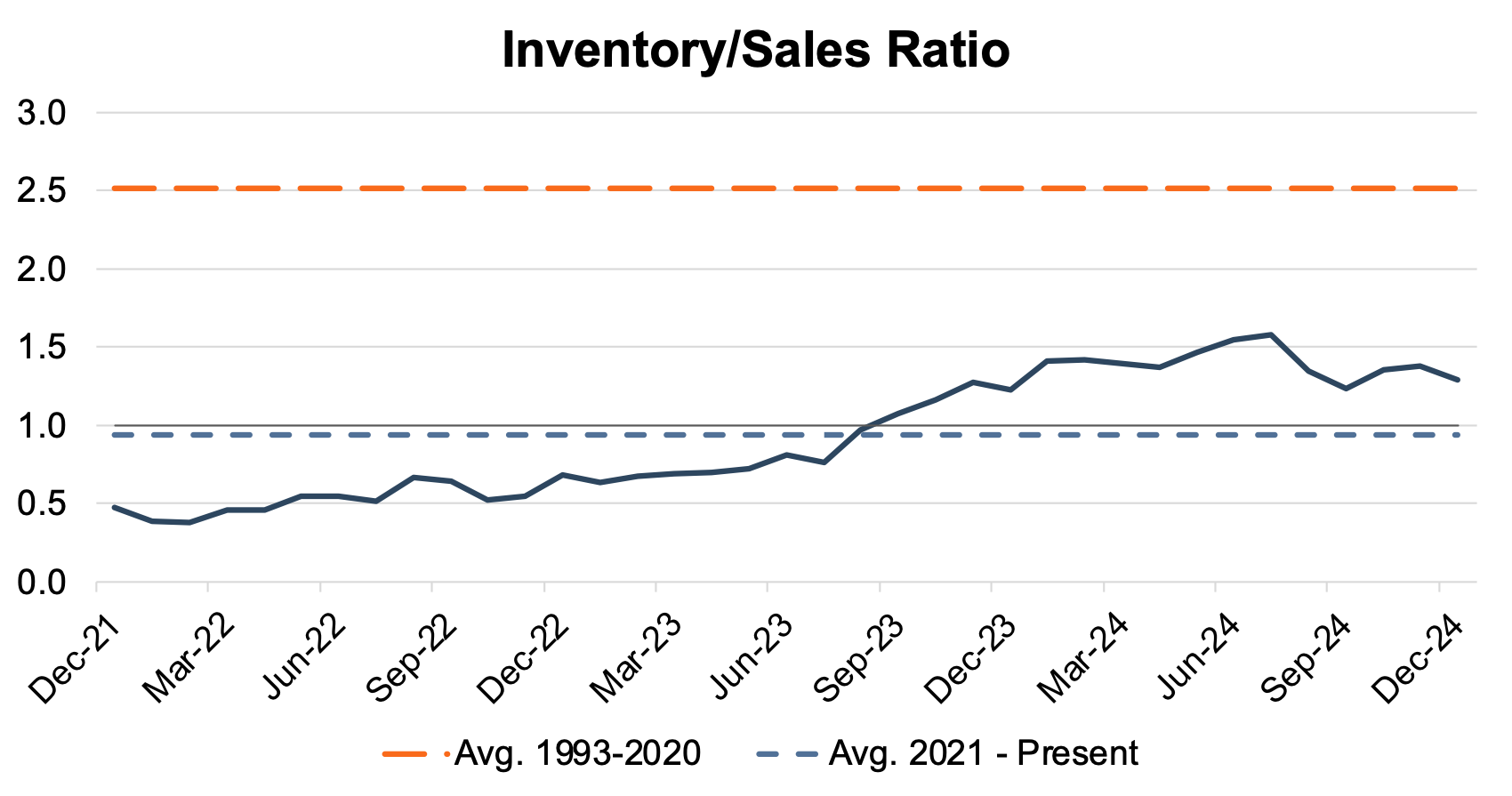

The industry’s inventory-to-sales ratio dipped from 1.38x in November 2024 to 1.29x in December 2024. This marks just the second month of 2024 below the 1.30x mark, the other instance being 1.24x in September 2024. The chart below presents the industry’s inventory-to-sales ratio over the last three years.

The decline in the inventory-to-sales ratio is likely the result of increased sales in December 2024, and we don’t believe it to necessarily indicate a downward trend in the metric moving forward.

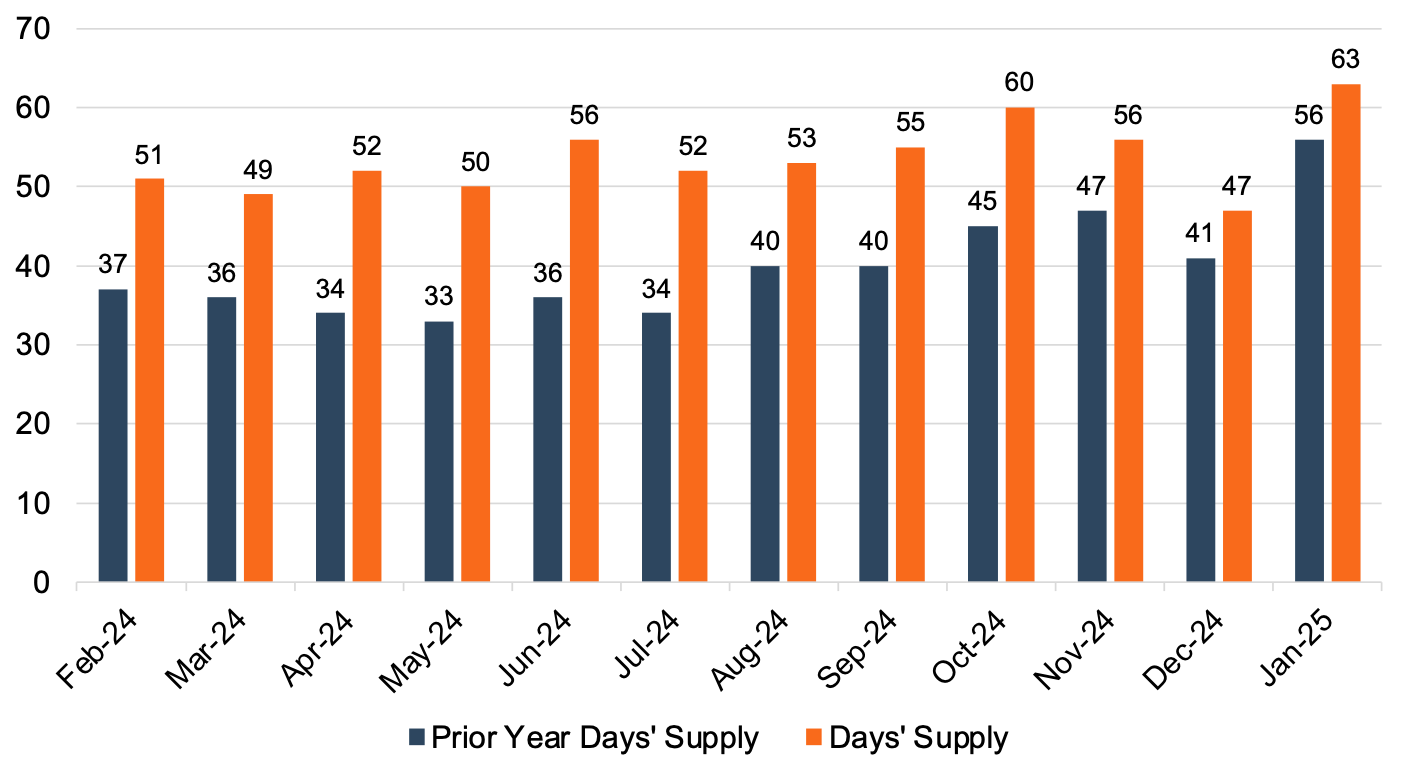

Following a dip to 47 days in December 2024, days’ supply came in at a two-year high of 63 days in January 2025. Since the end of 2023, we have seen days’ supply rebound from the lows of the COVID-19 pandemic, giving consumers access to a broader, more affordable inventory base.

The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in January:

“Nevertheless, consumers will spend more money buying new vehicles this January than any other January on record. This notable result shows that retail sales are rising while average transaction prices are declining only modestly.

The average retail transaction price for new vehicles is trending toward $44,636, down $238 (0.5%) from January 2024. The combination means that buyers are on track to spend nearly $38.5 billion on new vehicles this month—5.3% higher than January 2024, and the highest January on record.”

As noted above, relatively lower transaction prices driven by larger inventories and elevated incentive spending in January encouraged consumers to spend more on vehicles. While spending on new vehicles is up in January, retailers continue to feel some pressure regarding per-unit profitability.

Incentive Spending and Profitability

OEMs typically use incentive spending as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability.

J.D. Power notes that average incentive spending per unit in January 2025 is expected to be $3,226, up 29.3% from January 2024. Incentive spending as a percentage of the average MSRP is expected to reach 6.5% during January 2025, an increase of 1.3 percentage points from this time last year.

J.D. Power points out the following regarding retailer profit per unit:

“Total retailer profit per unit—which includes vehicles gross plus finance and insurance income—is expected to be $2,272, down 13.5% from January 2024. The decline in profits is primarily driven by rising inventory levels, with fewer vehicles selling above the manufacturer’s suggested retail price (MSRP). Thus far in January, only 11.8% of new vehicles have been sold above MSRP, which is down from 20.4% in January 2024.”

February 2025 Outlook

Mercer Capital expects the February 2025 SAAR to end up around 16.0 million as consumers continue to be drawn in by a wider array of available (and more affordable) inventory.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights