Last Quarter Took an L, but This Quarter We Bounce Back

SAAR Is Reaching a Post-Pandemic High, and Pent-Up Demand Is Leading to an Expected Bounce Back of M&A Activity

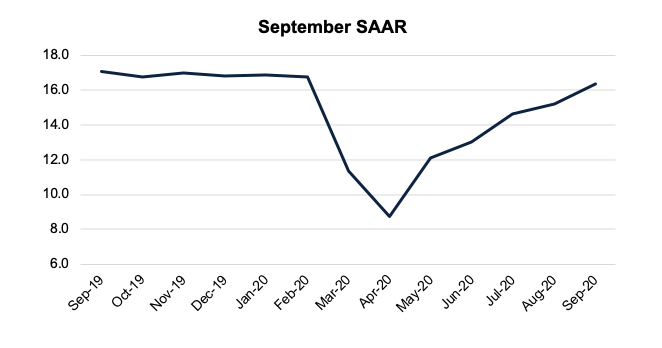

In September, lightweight vehicles marked a notable accomplishment during a tumultuous year, increasing to a seasonally adjusted 16.3 million. This is a 10% pickup from August, and the fifth consecutive monthly increase as the industry is recovering from lows at the beginning of the year. Though this is the highest SAAR seen post-COVID, it was still 4% below September 2019. Raw sales volume in September was actually up 6.1% from this time the prior year at 1.34 million, but this increase can be attributed to calendar year differences (and two additional selling days) with Labor Day weekend sales being including in September this year rather than August.

Still, these are encouraging signs after a year of uncertainty for the industry. Strong demand for light trucks continued in September and supported volume growth, as well as ASPs. JD Power noted that a shift toward more expensive trucks/SUVs is a key driver of this price growth, with trucks and SUVs on pace to account for 76% of retail sales vs. 72% a year ago. The ASP is expected to rise 5.6% to $35,655. Despite overall price increases, the Fed has indicated interest rates will remain near zero for an indefinite period of time, which will aid in vehicle financing and help mitigate some of these transaction price hikes for consumers. Higher trade-in values are helping to offset some of the price increases as well, as used vehicle sales have been doing well with consumers seeking budget friendly options as economic struggles continue. Inventory constraints continue to plague the industry, although there has been some recovery. Inventory on dealers’ lots totaled 2.66 million units, an increase of 3.6% from August 2020 but down 26.7% compared to September 2019.

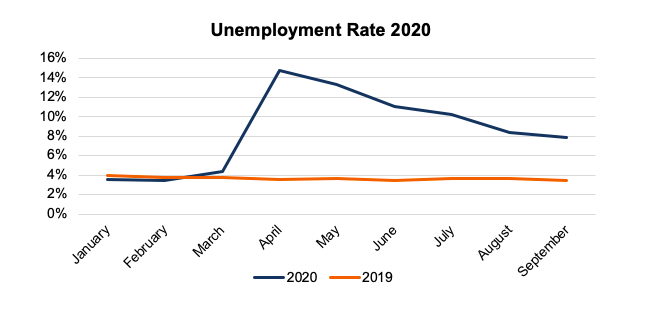

Potential headwinds for the rest of the year include unemployment and the stalled government response to providing pandemic relief to consumers. Though job rates have been continuing to improve, the rate of recovery has slowed, and weekly jobless claims remain above pre-pandemic levels. Earlier this year, personal income levels were actually higher than pre-pandemic months due to increased unemployment benefits. Now that these benefits have elapsed, personal income levels are declining, but the unemployment rate remains elevated. As of September 2020, the unemployment rate was 7.4% compared to 3.5% the same time last year. More people out of work (without long-term job stability regardless of enhanced unemployment benefits) means less disposable income that can be directed toward large purchases such as vehicles. Slowed government response is also troubling for the industry as capital injection into the economy would help consumers increase spending levels. However, with Congress still at odds on a relief bill, and the current administration calling for halted negotiations due to differences in the appropriate stimulus amounts with House Democrats, the timing of further government assistance to reach consumers is uncertain.

M&A Climate

As we mentioned in our blue sky multiples post last week, M&A activity for dealerships in the first half of the year has been delayed or cancelled as uncertainty has widened the bid-ask spread. However, there is evidence of pent-up demand with Haig indicating that of the 42 dealerships that transacted in Q2, 33 were sold in June. As buyers and sellers start coming back to the market, there are expectations of the second half of the year to reach record levels as buyers continue to have strong convictions on the industry’s earnings growth and are impressed by the resiliency of the auto retail’s business model. And with interest rates poised to remain low indefinitely, buyers seek to capitalize on the low cost of capital. As Erin Kerrigan, managing director of Kerrigan Advisors noted,

I see buyers really looking at this period as a moment in time to truly transform their business and make significant acquisitions to capitalize on the benefits of economies of scale.

Public dealerships in particular are interested in the benefits of economies of scale as they try to further their prevalence in the market. Though there has been a bit of stagnation on the deal side during the beginning of the year, as we mentioned in our Q1 earnings call, executives believe consolidation in the industry will ultimately resume, and companies focused on maximizing liquidity may be best positioned to partake.

Some of these public dealerships haven’t been holding off, however, with Asbury and more notably Lithia, resuming their acquisition efforts in Q2. As we discussed previously, Asbury acquired 12 franchise locations in Texas in July after the deal had initially been stalled at the beginning of the year. This acquisition has brought Asbury’s franchise mix to approximately 50/50 luxury and non-luxury.

Lithia has been particularly acquisitive, as they have agreed to purchase various dealerships which are expected to generate an additional $2 billion in annual revenue. This is tacked onto their previous purchases this year that are expected to generate $1.7 billion in annual revenue (highlighted by the 10 Texas stores from John Eagle Dealerships that are anticipated to contribute $1.1 billion in revenue). In total, Lithia is expected to add $3.7 billion in additional revenue through store acquisition for 2020. This is part of Lithia CEO’s Bryan DeBoer goal set in July of the retailer reaching $50 billion in annual revenue by 2025 (almost four times their 2019 revenue). As he told Automotive News,

The opportunity for consolidation within our industry remain plentiful, and our pipeline for acquisitions remains full.

In total, Lithia has purchased 16 stores this year for a total now of 200 dealerships nationally. The Q3 earnings call that will be coming up should shed more light on the overall dealership sentiment toward acquisitions for the rest of the year. Be sure to stay tuned for our Q3 earnings call blog where we will break down the overall themes for the industry.

M&A is going to be particularly important going forward as dealerships try to scale and consolidate fixed costs. Inventory constraints are leading to high gross margins per vehicle for the time being, but once inventory returns, margins will most likely decline once again. Volumes sold will return as an important consideration for dealerships. Furthermore, scale can be beneficial for dealerships in terms of expanding their technological capabilities and reach consumers digitally.

Implications for Your Dealership

With SAAR and the buy/sell market bouncing back, the situation for many auto dealers seems to have improved significantly since the spring. Overall better sales and higher blue sky multiples are contributing to many dealerships increasing in value, and with the second half of 2020 predicted to have an active market of both buyers and sellers, now may be a good time if you are looking to sell or buy.

If you are interested in how these current trends may be affecting the value of your dealership specifically, feel free to reach out to us. Mercer Capital has worked extensively with dealerships for the purposes of corporate planning, gift tax and estate planning, buy-sell agreements, and litigation support.

We hope that everyone is continuing to stay safe and healthy during this time!

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights