March 2025 SAAR

The March 2025 SAAR came in at 17.8 million units, up a staggering 11.0% from last month and 13.3% from March 2024. March 2025 saw the highest SAAR since April 2021, reflecting not only the recent trend of strong consumer demand but also the additional demand generated by consumers motivated to purchase a vehicle to avoid potential tariff-related price increases.

On April 2, 2025, the Trump administration implemented an array of tariffs on foreign imports in an effort to further advance American manufacturing, among other stated initiatives. As the tariffs go into effect, the auto industry will likely experience sluggish sales and tighter margins as the industry adjusts to global supply chain pressures.

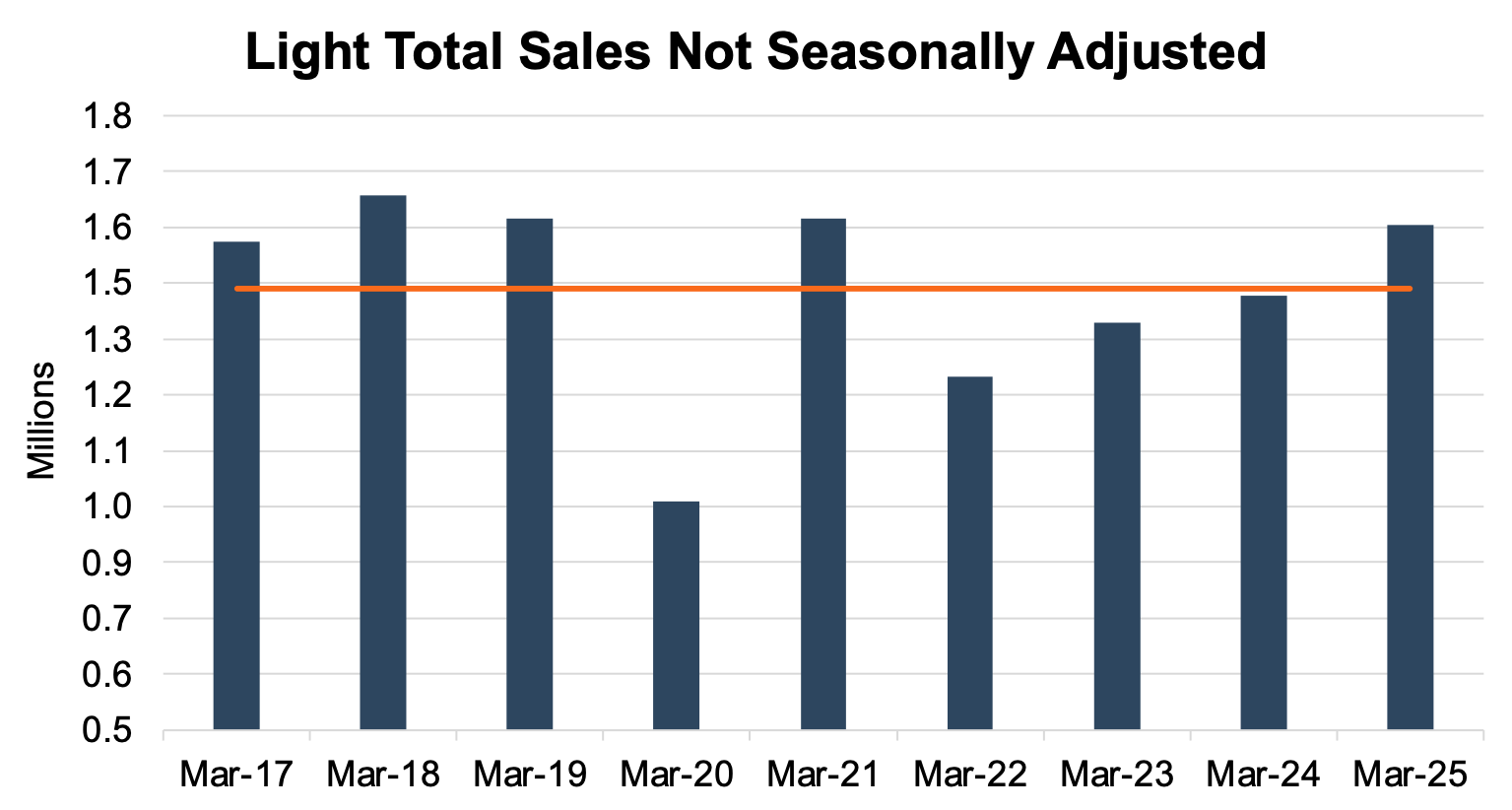

Unadjusted Sales Data

While March 2025 had one fewer selling day than March 2024, the industry (on an unadjusted basis) sold 1.59 million units in March 2025, a 29.9% increase from last month and a 10.7% increase from March 2024. This month’s unadjusted sales surpassed the nine-year March average of 1.448 million units (2017 – 2025) by over 137 thousand units. See the chart below for a look at unadjusted sales over the last nine Marches.

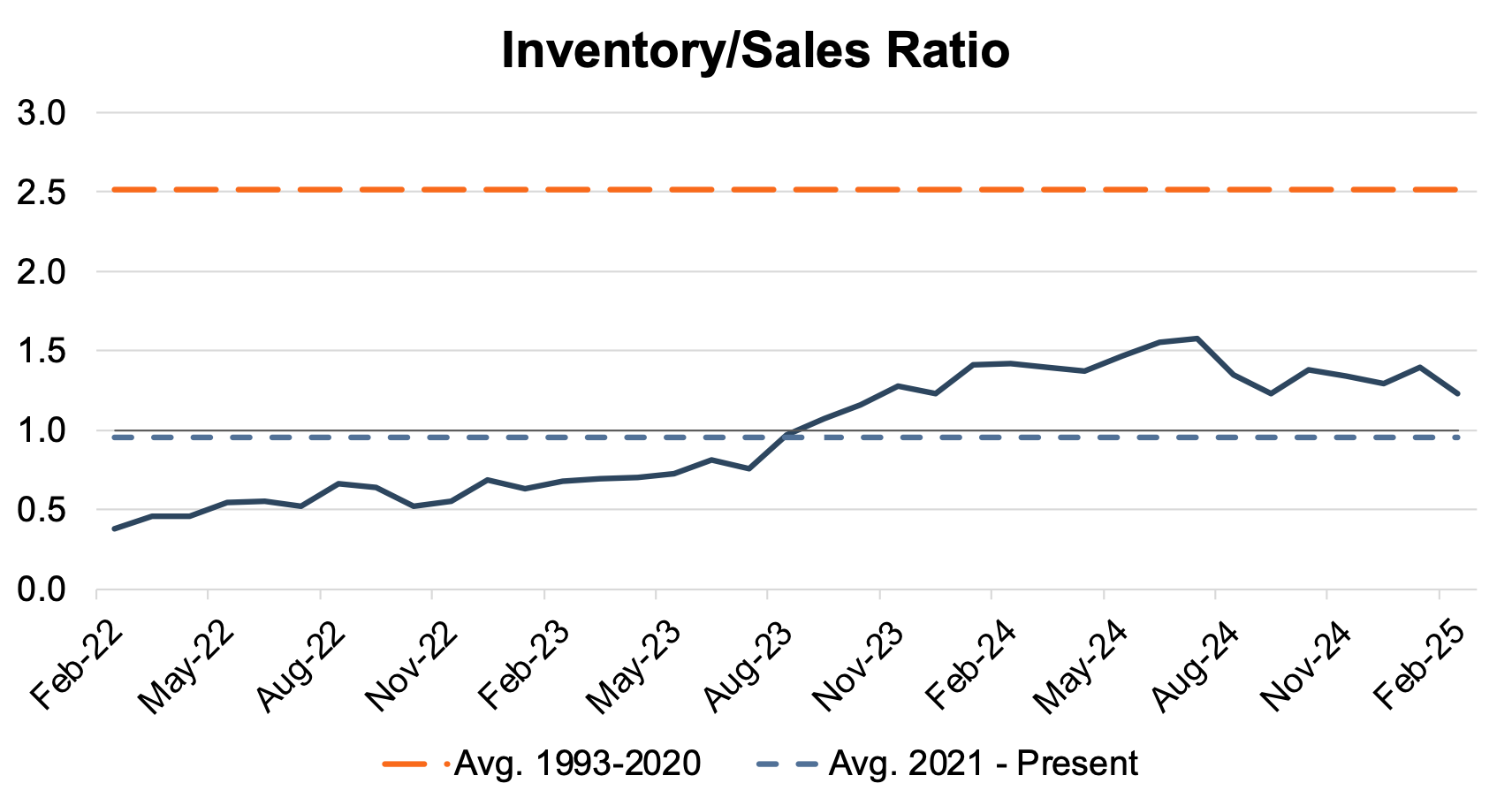

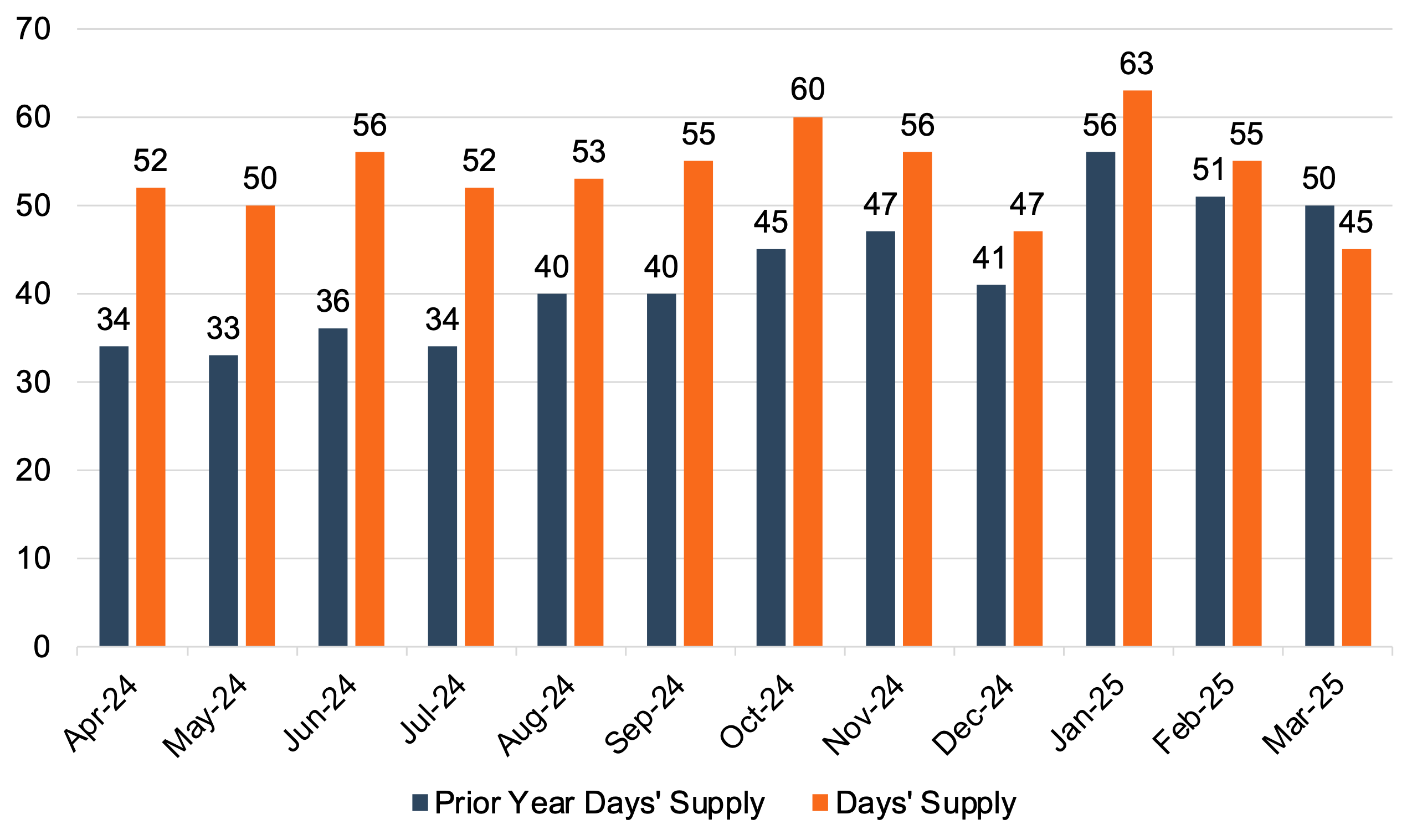

Days’ Supply

The industry’s inventory-to-sales ratio fell to 1.23x in February 2025 from 1.39x in January 2025. Over the next several months, the inventory-to-sales ratio will likely trend closer to 1.0x as the tariffs impact both import and sales volumes. The chart below presents the industry’s inventory-to-sales ratio over the last three years.

In March 2025, industry-wide days’ supply hit a twelve-month low of 45 days. While the margin between the current and prior month comparisons continues to narrow, March 2025 is the only year-over-year decline in days’ supply observed over the last year. With uncertainty surrounding the tariffs and their potential impacts on the auto industry, we will likely see days’ supply trending lower over the next several months. The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

As noted by Lithia Motors CEO on their recent earnings call, auto groups carrying higher days’ supply may benefit in the short term with the ability to sell vehicles at “yesterday’s price.”

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in March:

“New-vehicle retail sales for March 2025 are expected to increase from a year ago. Retail sales of new vehicles are expected to reach 1,268,200, a 13.0% increase from March 2024. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 8.9% from 2024.

New-vehicle retail sales for Q1 2025 are projected to reach 3,168,000 units, an 8.4% increase from Q1 2024 when adjusted for selling days.”

The average transaction price for new vehicles in March 2025 is expected to be $44,849, up 1.4% from March 2024. King states that as a result of the growth in both sales and average transaction price, spending on new vehicles in March 2025 will outdo March 2024 (and any other March in recent history).

Incentive Spending and Profitability

OEMs typically use incentive spending as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability. J.D. Power notes that average incentive spending per unit in March 2025 is expected to be $3,059, up 8.3% from March 2024. Incentive spending as a percentage of the average MSRP is expected to come in at 6.1% for March 2025, an increase of 0.3 percentage points from this time last year.

J.D. Power notes that March 2025 total retailer profit per unit (includes vehicle gross plus finance and insurance income) is estimated to drop to $2,212, an 8% cut from March 2024.

April 2025 Outlook

Mercer Capital expects the April 2025 SAAR to come much lower as we believe demand was pulled forward into March. Consumers on the margins were heavily incentivized to front-run the implementation of the April 2nd tariffs. Based on the reaction from equity markets, the magnitude of the tariffs has caught the global economy by surprise. Over the next several months, the industry will shift and react to the tariffs, with uncertainty surrounding electric vehicle tax policy on the back burner.

The recent import tax will be borne by some combination of manufacturers, dealers, and consumers. How each OEM and dealer elects to pass along prices will affect volumes and profitability and significantly impact Blue Sky values over the medium term. We’ll be watching the market to keep you up to date on tariffs and other industry-relevant news. Subscribe to our Auto Dealer Valuation Insights blog to get updates on industry-relevant topics straight to your inbox.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights