March 2021 SAAR

After a tumultuous February due to weather conditions, March SAAR has bounced back with a vengeance. March SAAR of 17.75 million units is the second-highest of all time for the month, just shy of March 2000. There are two main factors driving this increase. While the winter storms had a negative impact on February SAAR, it likely caused pent-up demand that helped drive sales in March. Beyond simple delays, flooding forced some to replace damaged vehicles. Secondly, the Biden administration passed a Covid-19 stimulus bill at the beginning of March, and $1,400 paychecks hit many Americans’ wallets. This influx of cash may have also spurred a massive increase in vehicle sales.

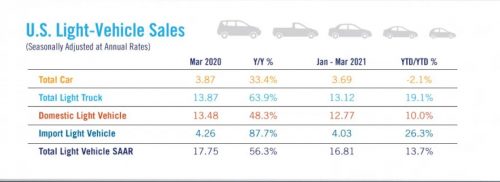

Now more than 12 months into the Covid-19 pandemic, we don’t think that comparing March 2021 SAAR to March 2020 SAAR is prudent due to the change in the economic landscape (it’s a 56% increase for those of you who were curious). For the next couple of months, this year-over-year comparison will continue as spring 2020 SAAR values were horrendous as dealers scrambled to grapple with the challenging operating environment. We will instead try to show both a comparison to 2020 and 2019 levels. Even with this adjustment, March SAAR for 2021 was an increase of 44% compared to 2019.

Driving March SAAR were sales of light trucks which accounted for 78.1% of all new vehicle sales in March 2021. This metric is a slight uptick from the 74% they accounted for in March 2020. Breakdown of SAAR by vehicle type as presented by NADA is below for March 2021:

Inventory and Production Problems

The March record sales levels come at the same time as lean inventories and production problems plague the industry. Thomas King, president of data and analytics at J.D. Power, noted this:

“At an aggregate industry level, Q1 inventories have been sufficient to meet consumer demand and delivered the opportunity for manufacturers and retailers to sell those vehicles with smaller discounts. Manufacturers who are experiencing supply chain challenges are prioritizing the production of their most profitable and desirable products, minimizing the net effect. There is no question that sales of specific models in specific geographies are being disrupted by low inventories, but consumers are nevertheless demonstrating their willingness to buy despite having fewer vehicles to choose from the in-retailer inventory.”

It will be interesting to see how long inventory levels can meet demand, and if consumers will continue to be as flexible on car model choice. This factor likely hinges on the continuing chip shortage and how that impacts manufacturers during the rest of the year. We have discussed the chip shortage at length in a prior blog post, and it ultimately could pose a problem to the current growth trajectory.

At the end of February, dealers had 2.7 million vehicles in stock or being shipped to stores, a 26% drop from the same month last year. The lack of availability has been more acute for crossovers and SUV models, including Jeep’s Wrangler and Chevrolet’s Tahoe, whose stock is running between 43-70% lower than last year. Pickup trucks are the most recent type to be impacted by the shortages, with dealers having about 414,000 trucks at the end of February, about half of what they had a year earlier. As a result, many consumers have had to order models from the factory or pick up vehicles in transit to dealerships.

Long gone are the initial pandemic incentives to drive consumers to dealerships, and buyers are having a harder time finding bargains. According to JD Power, average incentive spending per unit is expected to total $3,527, a decrease of $888 and $262 relative to March 2020 and March 2019. High demand is driving record transaction prices, and reduced incentives are improving gross profit margins and overall profitability for dealers. JD Power notes that average transaction prices are expected to reach $37,286, just below the all-time record set in December 2020.

Fleet Sales

While new vehicle retail sales have been booming, fleet vehicle sales have not seen the same resurgence and remain depressed. According to NADA, manufacturers are prioritizing production of the most popular and profitable segments for retail customers. Fleet customers have had their orders pushed back or canceled for the 2021 model year in some cases. Fleet buyers typically get discounts for buying in bulk. Fleet sales have struggled mightily during the pandemic and have not seen the same type of rebound experienced by retail sales.

JD Power notes that fleet sales are expected to total 180,200 units in March, down 33% from March 2020 and down 51% from March 2019 on a selling day adjusted basis. Fleet volume is expected to account for 12% of total light-vehicle sales, down from 26% a year ago. Fleet sales struggled inordinately compared to retail partially due to a decline in travel amid the pandemic. Although the introduction of a vaccine and more consumer confidence in travel should have been a bright spot for bringing back fleet sales, the reallocation of vehicles to retail due to the chip shortage is another blow to an already struggling segment of the industry. With supply low, OEMs are prioritizing buyers willing to pay top dollar, so fleet buyers are losing that allocation.

Conclusion

Looking toward the rest of the year, vehicle sales success is going to be contingent on being able to acquire inventory. Consumer demand is high, and if dealerships can navigate the chip shortage and lack of models, they may see more numbers like that posted in March. However, if the chip shortage worsens and dealerships are unable to acquire inventory, this may be a headwind.

If you have any questions on SAAR and what it means in the broader context of a valuation of your dealership, please do not hesitate to reach out to any member of the Mercer Capital Auto Team.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights