Market Insights on Auto Dealer M&A Activity

A few weeks ago, I sat down with Kevin Nill of Haig Partners to discuss the current state of the M&A market and other timely trends in the auto dealer industry. Specifically, I wanted to discuss some of the movements in Blue Sky multiples for various franchises and interpret the range of multiples that Haig Partners recently published with the release of their Second Quarter 2022 Haig Report (subscription required).

What is the current state of the M&A market for auto dealerships? Any signs of transactions slowing down? Are you seeing earnings or multiples start to plateau or revert?

Kevin: The market continues to be quite active, with a nice balance of buyers focused on strategic growth opportunities and sellers who see valuations still at or near peak levels. The pandemic accelerated the need for scale to effectively compete in a changing retail environment—consumers are ever more focused on a seamless buying experience and are embracing a digital world for researching, negotiating, and transacting the retail purchase. Couple that with the benefits of marketing a broad and large selection of inventory and dealers recognize they need more franchises and locations to effectively compete.

Our analysis indicates there may be over 8 million units of pent-up demand in the marketplace

NADA has suspended the publication of data on the performance of the total dealer body, but public company financial results do indicate we may have seen a plateau in earnings. Based on our analysis, the average public dealership earned $7.0M through the Last Twelve Months (LTM) ended 2Q 2022, down just slightly from $7.1M for the quarter ended 1Q 2022. However, that’s still up approximately $5M from 2019’s average of $2.1M!! From the data and research we are seeing, inventory constraints should continue for the next several years and ensure the dealer enjoys strong gross margins for some time. Our analysis indicates there may be over 8 million units of pent-up demand in the marketplace. Additionally, the high gross F&I and service departments continue to see an upward trajectory in results.

As for multiples, our firm tracks this very closely by monitoring transactions we represent alongside ongoing discussions with industry leaders in finance, accounting, and the legal communities. In summary, multiples overall have changed little since the pandemic: it’s the underlying earnings that have contributed to the elevated valuations. That said, some franchises are gaining traction and are more appealing to buyers. These include Toyota, Hyundai/Kia, and Stellantis.

Scott: With NADA’s suspension of dealership performance data, Mercer Capital has also pivoted to supplying information and trends from public companies in our recently published Mid-Year 2022 newsletter. Despite positive revenue growth in the last twelve and six months, revenue growth in the more recent period is less in all six public companies showing signs of slowing down. Additionally, public companies have continued to enjoy heightened gross profit from new and used vehicle departments compared to historical averages.

Any new trends in buy/sell negotiations in the last few months? Any sticking points?

Kevin: There really haven’t been any “new” issues that have arisen in buy/sell negotiations, but one trend we are seeing both in the industry and our practice is a willingness of sellers to entertain either a sale of just some of their dealerships or a minority/majority ownership stake in the entire enterprise.

The willingness of sellers to entertain either a sale of just some of their dealerships or a minority/majority ownership stake in the entire enterprise is a recent trend

Sellers are seeing these alternatives as additional strategic options for their families and organizations. In some cases, a seller may choose to take some proverbial chips off the table by exiting a market or selling a couple of stores. Further, as outside capital investors continue to target auto retail due to strong and consistent returns, some dealers are selling a percentage of the business, which allows them to stay on and operate the business. Our recent publications have gone into greater detail on this subject if readers want to know more about this trend.

Scott: The trend for dealers to sell a small minority stake in their entire group (or perhaps only divest of a rooftop or two) seems to be a new and interesting phenomenon. This trend appears to be a shift from dealers selling the entire enterprise or a majority stake in the dealership holdings. Auto dealers clearly value maintaining control and not having to answer to a family office group, private equity holders, or a third-party controlling stakeholder.

Operating an auto dealership is very much a day-to-day and month-to-month business. Auto dealers are usually heavily invested in their communities and care deeply about their legacies.

Selling a minority interest gives the auto dealer some liquidity. While dealerships have become very valuable and have generated record profits, often those profits are reinvested in the business or are leveraged against other assets, while the heightened value of the dealership only represents value on paper until a transaction or liquidation event occurs.

Mercer Capital provides estate planning valuation services that may benefit owners who take some chips off the table once a firm like Haig Partners has helped them negotiate a minority investment.

The latest Haig Report mentions Toyota is the most desirable brand. Is there any reason it would not obtain the same multiple as luxury brands?

Kevin: It’s no surprise to anyone active in the auto retail space that Toyota dealerships are in high demand. Manufacturer relations are best in class, and the underlying product continues to resonate with consumers.

Our firm has sold 33 Toyota dealerships, including the 2nd highest-valued dealership ever in August 2022 (John Elway’s Crown Toyota). Buyer interest is always substantial.

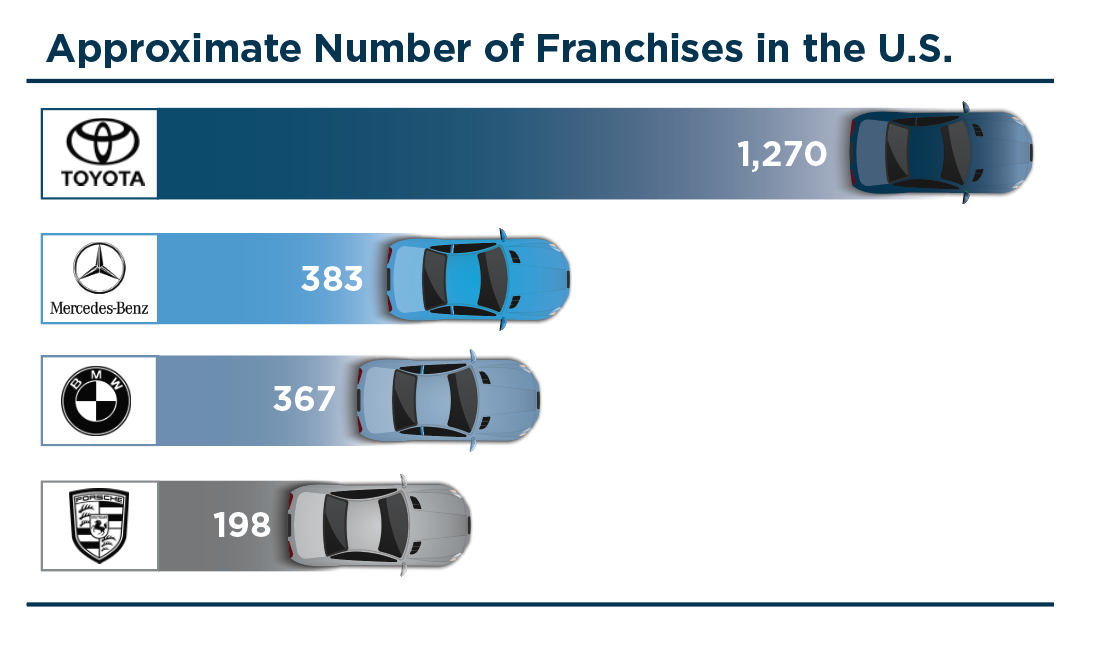

In most cases, Toyota stores will bring better multiples than some of the smaller luxury makes like Jaguar, Land Rover, and Audi. But in general, the high-profile luxury nameplates still command a higher multiple. There are a number of reasons, but the most impactful cause is there are far fewer Lexus, Mercedes-Benz, or BMW dealerships in the market and even fewer for sale. So “Economics 101” is in play—limited supply and high demand bring higher multiples.

Scott: Kevin’s comparison of a Toyota dealership investment to a luxury brand is equivalent to the allure of owning a professional sports franchise. Interested investors in luxury brands covet the exclusivity and market appeal of owning one of these franchises. There may only be a few luxury brands in each market, and if one becomes available, it may be a long time until another luxury franchise becomes available. To Kevin’s point, the approximate number of Toyota and various luxury brand franchises in the United States are as follows:

Will the shift for Cadillac, Infiniti, and Lincoln blue sky from a dollar amount to a multiple materially shift the value of these franchises?

Kevin: Over the past several years, several weaker franchises traded for a hard dollar amount rather than a multiple of earnings, given the lack of repeatable earnings. Buyers placed a value on the “shingle” and looked at used cars and fixed operations as their way to make money from these stores. However, as some of these brands have seen a resurgence in performance, partially from the post-pandemic bump but also from developing more appealing products, we have seen buyers take a more bullish approach. So, yes, these franchises have definitely seen an improvement in value.

Nissan is another brand we have seen improve in the eyes of buyers. The franchise still has a way to go, but many believe the worst is behind Nissan — their products are solid, and the OEM has learned from its “volume at all costs” approach.

Are there any new threats to the auto industry?

Kevin: Open any automotive periodical, and you will see discussions about the potential impact of EVs. One consequence of the forecasted shift away from ICE to EV is the desire of some OEMs to modify their retail strategies. Tesla and other EV startups have gone the direct selling route, foregoing the traditional franchise model, and some major manufacturers are eyeing this strategy with jealousy. All despite historically failed attempts to replicate the proven ability of the franchise retailer to best serve the consumer’s needs.

Ford, Hyundai, Mercedes-Benz, Volvo, and Polestar are examples of manufacturers who are overtly or quietly trying to change the retail model more toward the agency model seen in Europe.

Haig Partners encourages dealers to be active participants with their state dealer associations to ensure franchise laws remain robust and protective of retailers.

Scott: Despite the news and headlines dominated by EVs, the implications of EVs can vary drastically by brand. In other words, some OEMs are further along in producing EV models, while others do not anticipate producing EVs before 2024 and 2025. Additionally, the requirements of the various OEMs to auto dealers are also quite different. Some brands do not require any additional dealer commitments, while others, such as Ford, are forcing auto dealers to declare at what level they want to opt-in for selling EVs. Ford’s financial requirements can range from $0 for dealers that do not opt-in to selling EVs (only selling ICE vehicles) to $1,200,000 for dealers that opt-in to selling EVs at the premium level.

What are the typical adjustments seen in negotiations for buy/sells?

Kevin: One of the most important aspects of representing a seller is ensuring the buyer has a solid understanding of the historic and expected cash flows generated by the dealership. Just looking at the dealership’s financial statement doesn’t accurately depict the earnings opportunity of the store.

Just looking at the dealership financial statement doesn’t accurately depict the earnings opportunity of the store

We extensively analyze the dealership to understand what add-backs and deducts should be applied to reflect recurring cash flow. Some are non-cash entries; others are one-time expenses or income that should be adjusted.

Some common add-backs are LIFO expenses, owner’s compensation (if excessive and/or not to be recurring for a future owner), owner’s perks that run through the statement (travel, airplane, etc.), and F&I over-remits/mailbox money that is generated outside the dealer statement.

Deductions to earnings include PPP funds and one-time settlement funds or gains from asset sales.

Scott: Similarly, Mercer Capital reviews the balance sheets of auto dealers for potential adjustments to inventories, fixed assets, working capital, goodwill, non-operating assets, and owner accounts receivable. Some typical areas for potential adjustments on the income statement include inventories, owner compensation, rent, other income, owner perquisites, and remittance, to which Kevin refers.

Remittance is related to the service contract and other warranty-related products the dealership offers in connection with the purchase of a vehicle. A dealer can act as an agent in this process by offering products from multiple third-party vendors or acting as the principal, whereby they own a reinsurance company that offers those products to their customers. In either case, the dealership retains a portion of the service contract or warranty product and remits the other portion to the obligor or administrator of the contract. In an example where a vehicle service contract is $800, the dealership might retain $400, report that as income, and remit $400 to the obligor/administrator.

In some cases, the dealer may have an “overpayment” arrangement in place with the third-party administrator or their reinsurance company, whereby the dealer might retain $250 in the previous example and then remit $550 to the obligor/administrator. The “overpayment” arrangement allows the dealership to determine the amount of the overpayment and designate a beneficiary outside the dealership to receive the overpayment amount. These arrangements effectively reduce or shift income out of the dealership. The presence and amounts of overpayments or over remittances should be considered as potential normalization adjustments to earnings when determining the value of a dealership.

We thank Kevin Nill and Haig Partners for their insightful perspectives on the auto dealer industry. To discuss how recent industry trends may affect your dealership’s valuation, feel free to reach out to one of the professionals at Mercer Capital.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights