May 2022 SAAR

Can Auto Dealers Continue to Outperform OEMs?

The May 2022 SAAR was 12.7 million units down 12.6% from last month and down 24.9% from May 2021. This month’s SAAR did not meet expectations, and the dip in May’s sales pace increases the likelihood that the second quarter of 2022 will not improve on the first quarter’s average SAAR of 14.1 million units. May’s SAAR was low due to limited inventory around the country, which is not news to anyone following vehicle markets over the past year.

Vehicle production around the world has been constrained by the lack of manufacturing components available to auto manufacturers. The ongoing invasion of Ukraine, as well as globally lingering COVID-19 related effects, have come together to create a very tough environment for manufacturers to meet the demand for new vehicles (check out our March SAAR blog for insights into Ukraine’s impact on auto manufacturing). While most March and April forecasts reflected the impact of Russia’s invasion of Ukraine, updates in May to these projections addressed some additional challenges that have arisen, including a slow recovery in semiconductor supplies, the impact of further COVID lockdowns in China, and the longer-term influence of high raw material prices that put added pressure on new vehicle affordability. In short, May was a month that the production sting was sharp. One example is Toyota, which announced a 10% global production cut in May, citing tightened lockdowns in China.

In the U.S., transaction prices remained elevated throughout May, with dealers reporting an average transaction price of $44,832 per vehicle, an all-time May record and up 15.7% from this time last year. Likewise, incentive spending per vehicle has continued to fall, with NADA estimating just $965 per vehicle over the last month. Like new vehicles, trade-ins continue to demand higher values across the country, providing buyers with increased equity in their existing ride to mitigate climbing monthly payments. In May, the average monthly payment on a new vehicle contract was $687, another record high. The Fed’s two rate hikes in the early months of 2022 have not helped the affordability of monthly payments either. J.D. Power reported that the average interest rate on a new vehicle finance contract in May was 4.92%, up 62 basis points from May 2021.

Have Higher Interest Rates Hurt Auto Manufacturer Stock Prices?

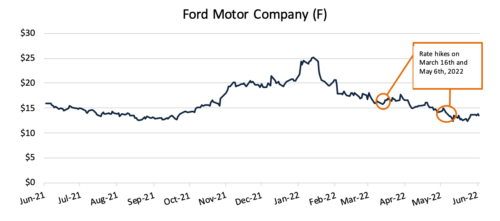

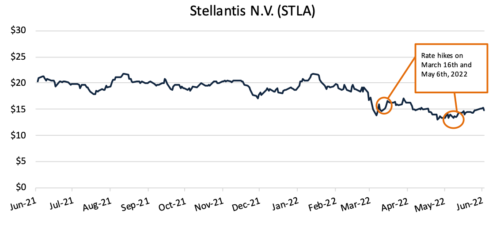

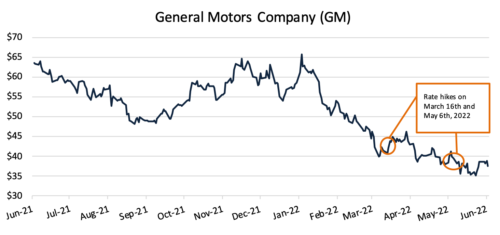

Higher monthly payments on new vehicle financing contracts are not the only impact that rate hikes have had on the auto industry. Domestic manufacturers like the Big 3 (Ford, Stellantis, and GM) have seen their share prices decline, though this drop in market cap was not exclusive to OEMs, as losses were observed throughout the United States economy across many growth-centric industries like technology and data science. The S&P 500 is down 13.3% in 2022 (see chart below). The Nasdaq 100, a technology-heavy index, is down 23.0%. The Dow Jones Industrial Average is also struggling, down 9.5% on the year.

An auto manufacturer has not traditionally been considered a “growth company.” In the last decade, that moniker has been reserved for the Apples, Microsofts, and Facebooks of the world. A growth industry is a sector of an economy that experiences a higher-than-average growth rate as compared to other sectors. Growth industries are often new or pioneer industries that did not exist in the past, and their growth is a result of newfound demand for products or services offered by companies in that field. Growth companies may carry large interest-bearing debt balances that finance the research, implementation, and expansion of their products and services. This means that, for a growth company, an increase in the cost of debt could make growth that much more expensive.

Tesla (TSLA) is a great example of a growth company. Tesla, which boasts a spot among the highest valuations in auto manufacturing, has benefitted from a changing regulatory environment and the emergence of new electric vehicle technology. From the perspective of Ford, Stellantis, and General Motors, it makes sense to begin investing in similar technologies to cash in on the growth story and unlock higher multiples and valuations, which is exactly what these companies have sought to do. On March 2nd, Ford announced it would boost its spending on electric vehicles to $50 billion through 2026, up from its previously announced $30 billion. In July 2021, Stellantis announced $35.5 billion in investments toward electric vehicles through 2025. Likewise, General Motors released its own plan in 2021 to invest $35 billion through 2025.

With the Big 3 committed to significant EV investments over the next five years, there is increased execution risk with delivering vehicles that fulfill the promise of EVs that benefit consumers without representing a trade-off between fuel efficiency and performance. To the extent these investments are financed by debt, the rising cost of financing may drag on profitability. Pushing returns further out into the future also tends to reduce valuations as interest rates rise, as seen in the decline in tech stocks. While the stock price of a public company is subject to exogenous forces outside of the realm of what may impact the valuations of closely-held businesses, the private markets ultimately are impacted by the public markets. See the charts below for a look into the stock prices of Ford, Stellantis, and GM compared to the timing of rate hikes by the Federal Reserve in 2022:

OEMs are also likely to see share price declines due to continued production cuts and rising input costs. A decline in the share price does not necessarily affect the company’s operations directly, but there are less direct impacts on manufacturers which executives keenly observe. What do lower valuations of OEMs mean for auto dealerships across the country? Over the long-term, OEM executives are not likely to tolerate sluggish shareholder returns while auto dealers are making record profits. While OEMs are down with the market as discussed earlier, it’s important to note that the publicly traded auto dealers are generally worth more than they were to start the year, a sharp contrast.

With talks of an agency model growing ever more present, it appears that there will be changes to the current landscape. Hopefully, these changes will benefit all interested parties including OEMs, dealers, and consumers.

June 2022 Outlook

Mercer Capital’s outlook for the June 2022 SAAR is consistent with the status quo. Industry supply chain conditions continue to stagnate. Sales volumes will likely continue to be closely tied to production volumes as vehicles leave lots within days of arriving. Elevated profitability across the entire industry will likely continue as high prices boost margins on vehicle sales. Long term, it will be interesting to see how the landscape evolves and whether OEMs try to wrestle a greater share of profits from their auto dealer partners. Stay tuned for more updates on next month’s SAAR blog.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights