May 2023 SAAR

The Road Ahead: SAAR Predictions for the Rest of 2023

The May 2023 SAAR was 15.1 million units, a decrease of 6.5% from last month but an increase of 19.6% from this time last year. Last month also marks the tenth straight month of year-over-year improvements in the SAAR, highlighting almost a full year of rising tides in national auto sales. On an unadjusted basis, May 2023’s sales were up 22.8% from this time last year and are much closer to pre-pandemic levels.

Over the last ten months, consistency has been paramount as steady improvements in inventory and sales are strong signals to the market and consumers that the industry is moving on to greener pastures. However, added context around our position in the recovery timeline can be helpful as we frame our expectations going forward. For example, inventory levels were still worsening a year ago in May 2022, and the SAAR reported three straight months below 13.3 million units the following June, July, and August. Inventory started to improve in August, and sales followed suit in September, sending the industry on the path to recovery. Looking ahead to the next few months, with this context in mind, we can expect even larger year-over-year increases in the SAAR for at least a few more months.

So, what does this mean for the rest of 2023? As we look toward the SAAR in the second half of the year, we explore two timely questions:

Do we think the pace of sales improvements will heat up or cool down? The magnitude of year-over-year improvements is likely to increase through September and then begin to cool down after that. Late 2023 and early 2024 are when we expect year-over-year improvements to be tested and potentially flatten out. On a month-to-month basis, we expect to continue to see seasonality (as is common in the industry) alongside generally improved sales numbers when compared to the second half of 2022.

There are combatting forces in the sales equation: supply and demand. For a long time, inventory constraints have crimped supply, leading to higher near-term profits for dealers. While many were asking when inventory shortages would end, the better question has always been: “What would the demand side look like once supply improves?” While improving inventory availability should point to sales heating up, it’s possible that increasing availability of inventory is actually a sign of cooling down. That is, if inventories buildup due to a lack of demand, given recession fears and affordability issues with rising interest rates, we may overshoot the perfect equilibrium between adequate supply and ample demand.

What are our expectations for total new light vehicle sales in 2023? We believe 14.5 million units in 2023 are a very reasonable estimate of total sales and that 15 million units are also attainable.

Through five months in 2023, the industry sold 6.5 million units, averaging 1.3 million units per month. If the industry stays on this average sales pace for the next seven months, total sales will be 15.6 million units in 2023. This oversimplification has problems, however, because we believe there has been some level of pent-up demand acting as a tailwind during the first five months of 2023. If this demand unravels, we expect retail and fleet sales to cool off heading into the fall. For the industry’s 2023 total sales to reach 14.5 million units, the remaining seven months must average 1.14 million units per month. To highlight a more favorable scenario, the remaining seven months must average 1.22 million units to arrive at total sales of 15 million units. December is also a big month for auto sales, but 2023 sales may suffer overall if economic conditions are low by the time we get to the end of the year.

Inventory

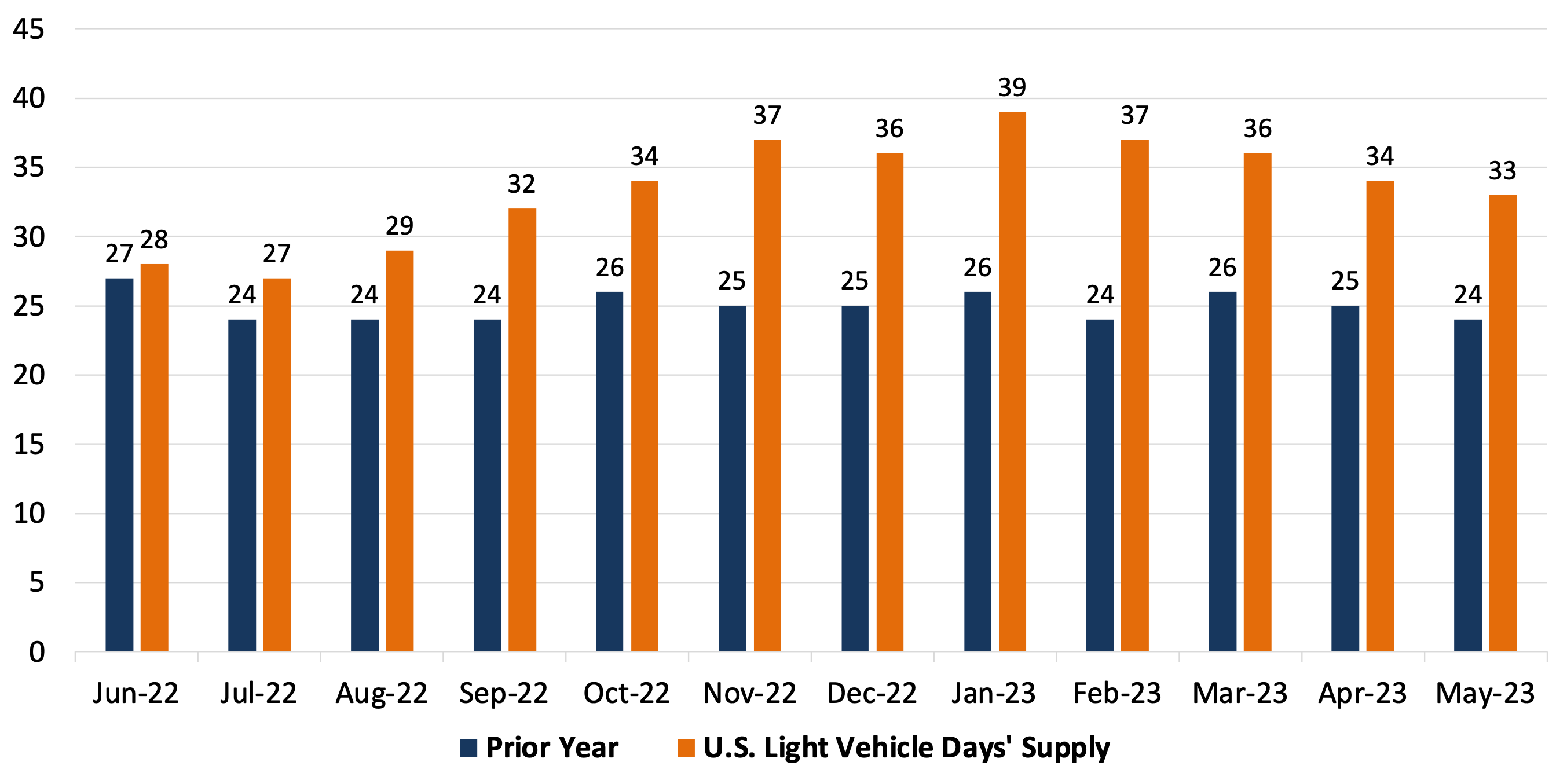

Industry-wide inventory on the lot or in transit has continued to improve over the last month. According to NADA, total inventory in the United States was reported at 1.8 million units in May. However, the industry’s days’ supply of inventory has actually decreased over the last few months due to increased sales. See the chart below for the last twelve months’ days’ supply (per Wards Intelligence). We have included prior year data to highlight how much conditions have improved since August/September 2022.

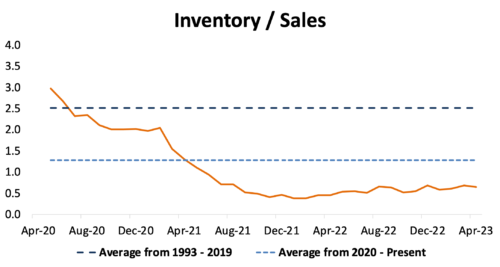

Over the last month, the industry’s inventory to sales ratio has remained relatively flat. Over the previous year, sales continue to improve incrementally alongside the available inventory balance, leading to marginal increases in the ratio. Pent-up demand from commercial and fleet customers (who did not have the opportunity to cycle out aging fleets during 2020-2022) has kept the ratio below 1.0, but a consistent sticky trend of improvements in 2023 is expected to continue throughout the remainder of the year.

Transaction Prices and Incentive Spending

Transaction Prices – The average transaction price for a new vehicle in May was $45,838, down from last month’s figure of $46,044 and even further down from March’s $48,008. Transaction prices have continued to fall in May and seem to be normalizing from their peak in 2022. This month’s price drop is not nearly as pronounced as last month, indicating that normalized price levels may not be far away from where they are now. This marks the third month in a row that the average transaction price has been below MSRP after twenty consecutive months of the contrary.

Incentive Spending – The average OEM incentive spend per unit was $1,788 in May, up from $1,599 last month and up 88% compared to last year. While incentive spending varies widely by OEM, the larger trend of increasing incentives is expected to stick around and potentially normalize in the same way that transaction prices are expected to normalize.

June 2023 Outlook

Mercer Capital’s outlook for the June 2023 SAAR continues to be optimistic. Industry supply chain conditions are improving. Sales volumes have continued to improve as dealers are seeing better inventory availability. However, with concerns of a recession looming, it will be important to monitor consumer activity which may begin to cool off as affordability becomes an issue, as evidenced by falling transaction prices.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights