NADA Is Busy Working on Capitol Hill on Behalf of Auto Dealers

In last week’s blog, we wrote about attending some of the Tennessee Automotive Association meetings and explored the buy/sell considerations discussed there. That topic is certainly timely for auto dealers, as record profits are the norm rather than the exception during the ongoing inventory shortages and supply chain disruptions. However, transaction considerations were not the only updates that attendees received. This week’s blog touches on federal legislation that NADA prioritizes and how that legislation could impact your dealership’s operations.

Tax Hikes That Impact Dealerships

One of NADA’s top priorities has always been to keep taxes low for dealerships, and that mission has not changed. In their outlined legislative priorities, NADA states that it is concerned that significant tax hikes will weaken the nation’s auto industry. Specifically, NADA is opposed to the tax structure currently laid out in the pending House Reconciliation Bill. Here is a breakdown of the potential tax changes included in the bill that could affect your dealership:

- Most auto dealerships are tax pass-through entities, and the current blended tax rate on pass-through earnings is about 29.6%. This tax rate accounts for the 20% Qualified Business Income (QBI) deduction, individual income taxes, and a Net Investment Income (NII) tax.

- According to NADA, if the House Reconciliation Bill were passed as proposed, the blended tax rate on pass-through earnings could be as high as 43.4%. The QBI deduction would reduce, corporate and individual income taxes would increase, and the NII tax would expand to essentially all pass-through income.

From a valuation standpoint, higher tax rates reduce after-tax cash flows to auto dealers, which all else equal would lead to lower values for auto dealerships.

No one wants to pay more than their fair share of taxes, and NADA is lobbying to improve the rates at which dealerships are exposed to them. Like all business owners, auto dealers would see lower after-tax proceeds that could be reinvested in their business. While NADA is lobbying on behalf of auto dealers, this is an issue that hits businesses across all industries, and it appears to be a legislative priority for the White House.

From our perspective, we find it likely that taxes will increase from current levels, though just how much of an increase might occur and the timing of the increase remains to be seen. Dealers should be aware of the tax law changes and prepare accordingly. From a valuation standpoint, higher tax rates reduce after-tax cash flows to auto dealers, which all else equal would lower auto dealerships’ values.

Electric Vehicle Incentives Need to Work for Dealers

On September 15th, the House of Representatives, Ways and Means Committee, approved a new electric vehicle incentive program as another part of the pending House Reconciliation Bill. This program supports tax credits to consumers for purchasing an electric vehicle and would increase the tax credit from $7,500 to $12,500. The bill would also make the tax credit “transferrable”, meaning that the dealership could claim the incentive and the consumer could treat that incentive as “cash on the hood”.

NADA is concerned that dealerships are being asked to front-load the credit on these transactions and wants to make sure that the IRS pays the full value of these credits to dealerships in a timely manner. Dealers will remember this cash drag as an issue during the Cash for Clunkers program. Additionally, NADA wants to ensure that every franchised brand receives the benefits of these incentives, meaning that no one gets left out. From a valuation standpoint, we know certain brands change hands at higher blue sky multiples than others. If only certain brands were able to participate in a program that benefits dealerships, those brands could see better multiples in the short term.

Further incentivizing consumers to purchase vehicles is almost always a positive thing for dealers. If the IRS is accurate and timely with its payment of EV credits, the program could be a success, but if credit payments become unreliable or too sluggish, dealers may choose not to participate in the program and lose sales to competitors.

Treasury Should Grant Lifo Tax Relief for Dealerships

Last November, NADA petitioned the Treasury Department to exercise its authority by allowing dealerships that use LIFO (Last-In, First-Out) inventory accounting to replace their new vehicle inventories over a three-year period. This request responds to LIFO recapture taxes that are expected to heavily impact dealers in the current environment of rising prices but declining inventories.

While prices are generally expected to increase over time, inventory levels are also expected to remain somewhat constant or slightly increase over time as well.

Many, though not all, auto dealers report their inventory on a LIFO basis. This typically leads to lower reported taxable income because inventories sold are based on the last price. In a typical inflationary environment, this means the cost of goods sold is higher under LIFO than FIFO.

While prices are generally expected to increase over time, inventory levels are also expected to remain somewhat constant or slightly increase over time as well. However, during the recent supply shortages, inventory balances have dropped considerably, affecting dealers’ reported LIFO reserve more drastically than many dealers would expect.

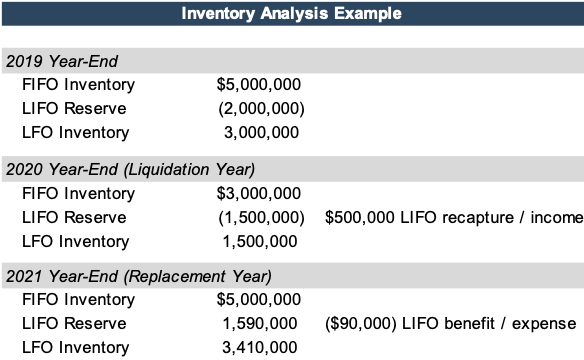

An example is provided below of how a dealer may have been impacted in 2020. However, because the supply chain issues have further devolved since this case was presented in December 2020, the income reported by dealers in 2021 is expected to be considerably higher due to accounting and not cash flow.

Dealers should not hold their breath when it comes to the possibility of avoiding LIFO recapture taxes. The request was submitted by NADA a year ago and Treasury Department has not formally responded to the petition yet. While unique supply chain issues may be negative in the near-term, eventually inventory balances will rebuild, which would lower future tax bills. In essence, dealers on LIFO would be forced to pay taxes on front-loaded phony profits, which would eventually smooth out. Dealers that are subject to LIFO recapture could use the forgiveness as a chance to invest in replenishing inventory, EV infrastructure, and employee training.

While this is clearly a negative for dealers, it is our understanding, legislators (generally speaking) would prefer to do away with LIFO entirely, so we do not anticipate much accommodation. It is more likely that subjected dealers should begin preparing for a larger-than-usual tax bill, though some options may exist.

From a valuation standpoint, LIFO recapture is unlikely to impact valuations materially. Many valuation professionals already adjust to FIFO, so this would already be normalized whether it is positive or negative to cash flow in any particular period. As with many pieces of legislation or contemplated legislation, LIFO may impact the motivations of buyers and sellers, though it will have less impact on the determination of ongoing cash flows.

Conclusion

NADA is busy working on Capitol Hill on behalf of auto dealers, but the organization’s influence can only go so far. This makes it even more important that dealers know the legislative issues that could affect their dealership ahead of time and regularly communicate with their local politicians. Being proactive instead of reactive can make a big difference when running an auto dealership, making it worth the dealer’s time to stay plugged in.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights