News Update: How the Collapse of the Baltimore Bridge Might Impact the Auto Supply Chain

Source: NTSB.gov, Public domain, via Wikimedia Commons (https://commons.wikimedia.org/wiki/File:Francis_Scott_Key_Bridge_and_Cargo_Ship_Dali_NTSB_view.jpg)

By now, most of us have seen the harrowing images of cargo ship Dali wrecking into the Francis Scott Key Bridge in the Port of Baltimore in the early morning hours on Tuesday.

Besides the tragedy of lives lost, the disruption for Baltimore commuters, and the time needed for recovery and rebuilding of the bridge, the catastrophe will have a major impact on the global supply chain and will also impact the auto supply chain. But how?

Port of Baltimore – Background and Statistics

The Port of Baltimore is the 17th largest port in the United States, responsible for moving 52.3 million tons of cargo worth an estimated $81 billion in 2023, according to an article published by the Washington Post this week. The Francis Scott Key Bridge was completed and opened in 1977.

Digging deeper into the statistics, the Port of Baltimore is the largest in the nation for automotive shipments including vehicles and automotive parts.

… the Port of Baltimore is the largest in the nation for automotive shipments including vehicles and automotive parts

Baltimore was responsible for over 750,000 vehicles imported/exported in 2022, and those numbers are believed to have climbed to 800,000 – 850,000 vehicles in 2023.

To put this into context, this could mean weeks of delays of vehicles amounting to 5% of national vehicle sales, assuming SAAR of 16 million, with a much more acute impact on the East Coast.

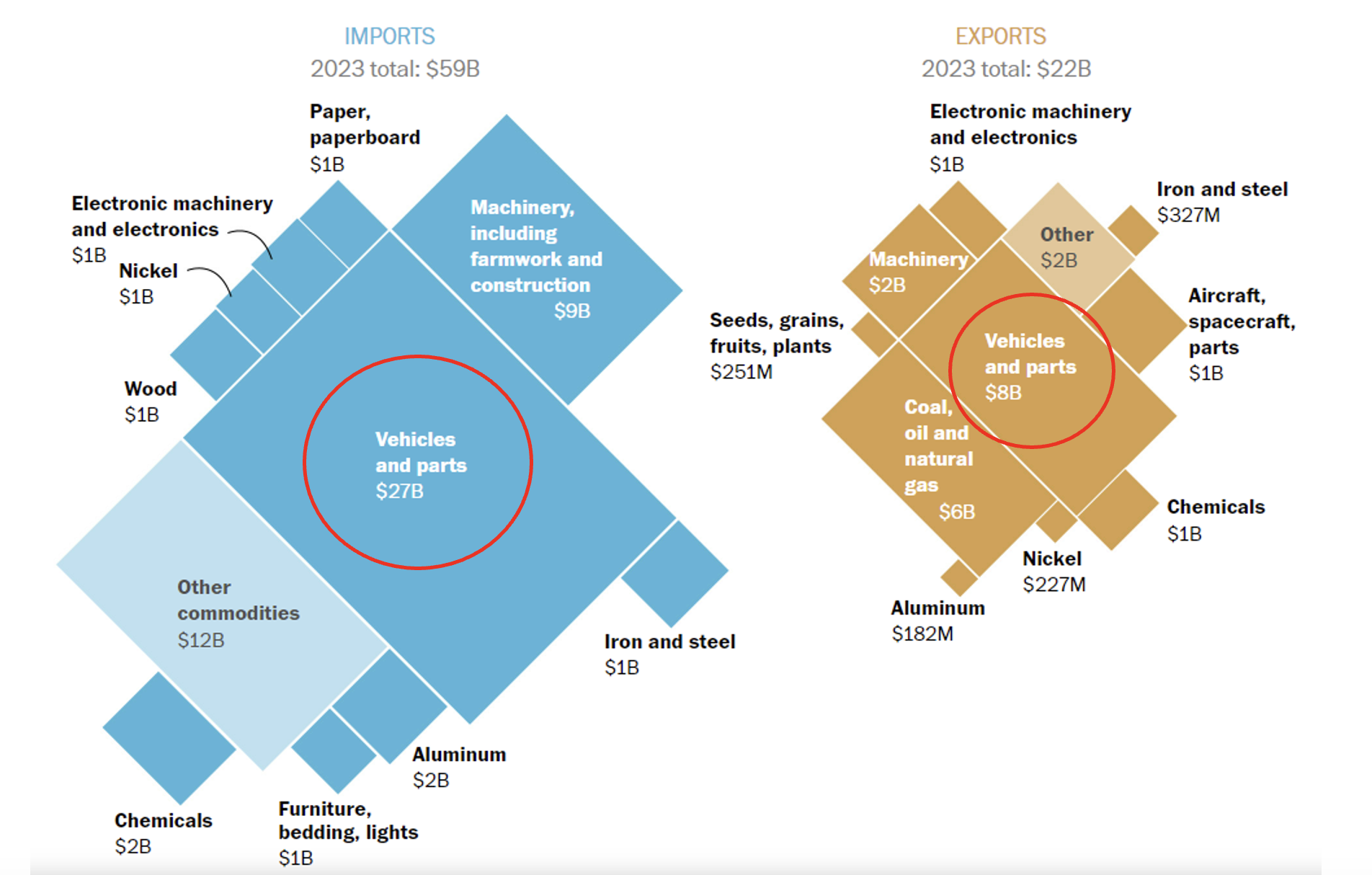

As seen in the graphic below from the Washington Post, automotive vehicles and parts comprise nearly $27 billion of 2023 imports, accounting for nearly 46% of all goods imported last year.

Following the same trends, automotive vehicles and parts comprise $8 billion of 2023 exports, accounting for over 36% of all goods exported in 2023. It may be too early to quantify the economic impact of this event, but it will undoubtedly have an impact on the automotive industry.

In the short term, freight shipping companies will look to alternate ports in Brunswick, Georgia, and Norfolk, Virginia, until the Francis Scott Key Bridge can be recovered and rebuilt.

Impact on Auto Industry

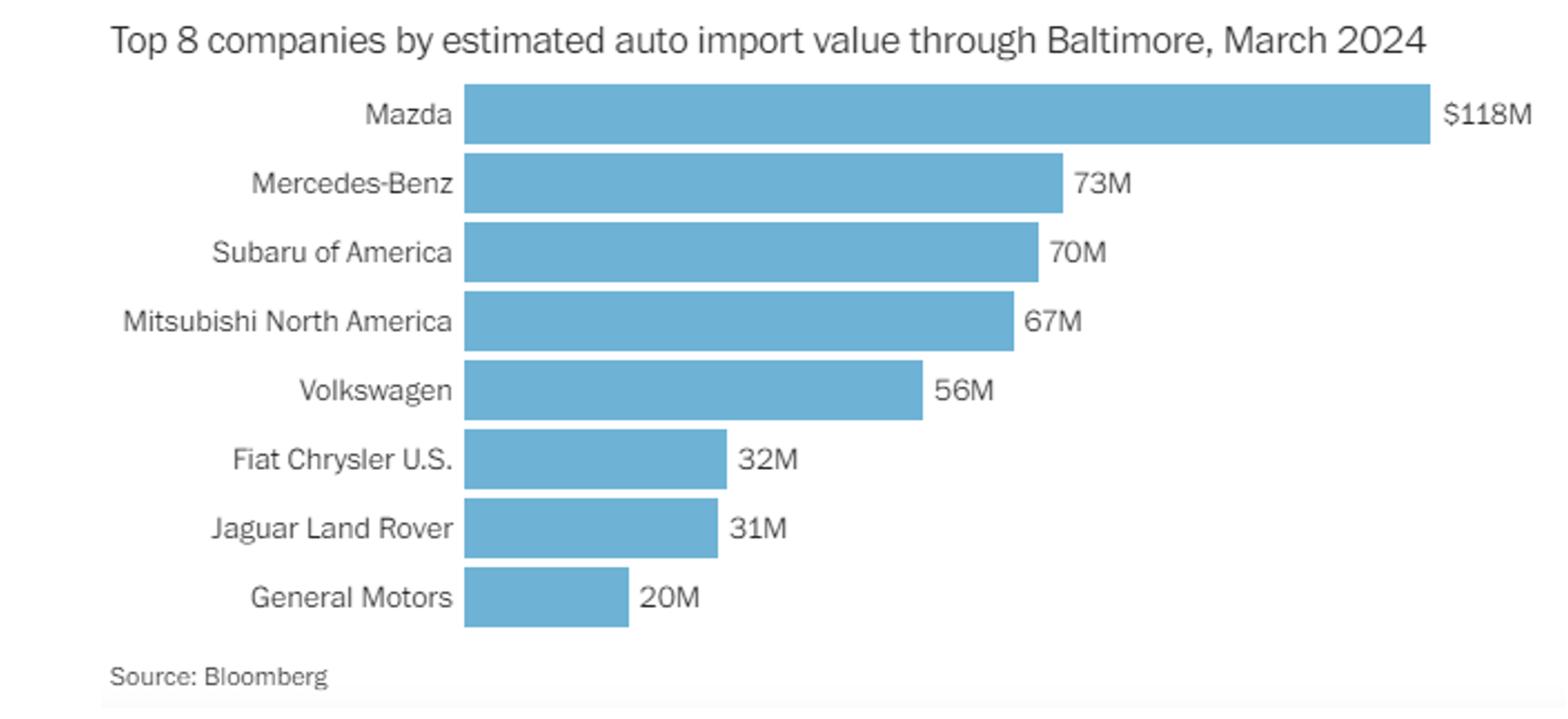

Automobile imports account for nearly 75% of all automobiles passing through the Port of Baltimore. Specifically, a majority of the vehicles are from foreign manufacturers such as Mazda and Mercedes-Benz. The graph below from Bloomberg displays the top eight automobile manufacturers (OEMs) that ship vehicles through the Port of Baltimore through March 2024:

Ford CFO John Lawler said the company will be forced to divert parts to other ports, which will impact the supply chain, but “where workarounds are necessary in the short term, our team has already secured shipping alternatives.” GM also indicated it would reroute shipments but it expected minimal impact. Mercedes Benz CEO said it was “too early to see an impact.”

Other foreign OEMs, such as BMW and Volkswagen, will not be impacted as much since their distribution centers are on the other side of the Baltimore harbor, beyond the site of the bridge.

We should also not discount this event’s impact on the automobile parts segment. According to operations management expert Tinglong Dai from Johns Hopkins University, “Baltimore is like Taylor Swift in the universe of US auto parts.”

… it is reasonable to expect delays in delivering vehicle inventories

On the consumer side of the auto industry, it is reasonable to expect delays in delivering vehicle inventories. Those who already purchased a pre-sold vehicle will have to wait longer, though pre-sales are declining as inventory issues have declined. We find it unlikely that consumers would change their preference for a vehicle based on these delays. A couple of weeks of delays might be small in the context of a long-term vehicle purchase, though it’s too early to know how long delays could last. We doubt this would materially change near-term pricing of vehicles, but it cannot be ruled out and could raise MSRP in subsequent periods if workarounds add costs to OEMs.

In the near term, we are optimistic that the auto industry can recall lessons learned regarding inventory shortages and challenges during COVID-19. Hopefully, the industry can mimic the adaptability that proved very successful for auto dealers and the industry in the latter part of 2020 and the subsequent two years.

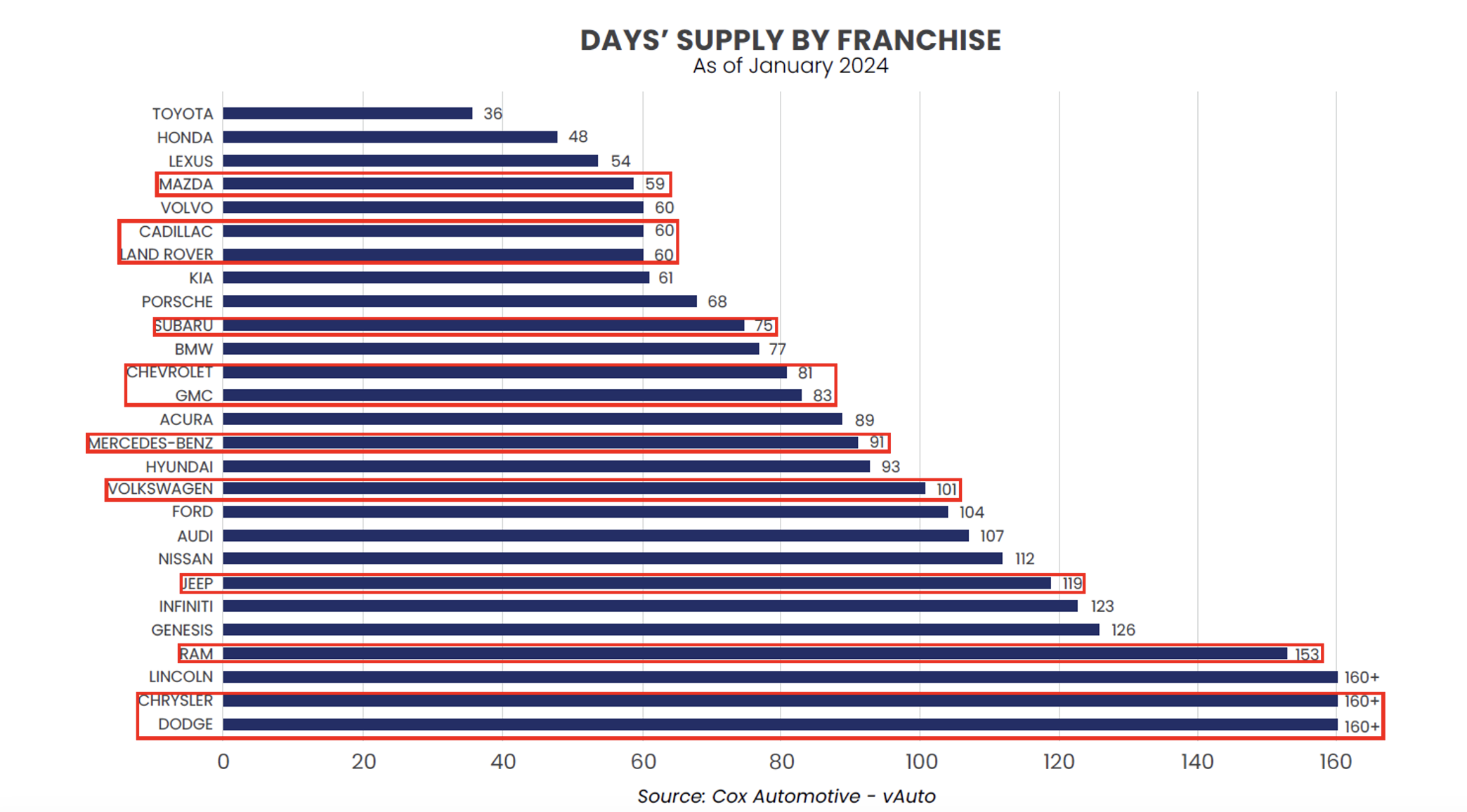

Haig Partners’ Q4 newsletter showed Days’ Supply by Franchise. Below, we’ve superimposed rectangles on the most impacted brands per Bloomberg above:

Click here to expand the image above

There is no correlation between Days’ Supply and those impacted by the bridge event, because statisticians would call an exogenous event like this bridge being damaged “random.”

If there are delivery delays, we could see Days’ Supply increase for Mazda, which is towards the low end of all brands. Stellantis’ brands also have the highest Days’ Supply, so any disruption may not negatively impact dealers who are seeing increasing holding costs. Still, it would depend on which brands and models are the most directly impacted, as we learned from the UAW strike.

Conclusion

Mercer Capital’s Auto Team constantly monitors the auto industry, global events, and economic factors that can directly impact the overall industry, supply chain, or auto dealers.

We provide business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights