Nissan’s Search for a Merger Partner

On December 23, 2024, Honda Motor Co. and Nissan Motor Co. shook up the automotive world by announcing a memorandum of understanding (“MOU”) to explore a potential merger alongside Nissan’s partner Mitsubishi. In the deal, the three automakers promised to create the world’s third-largest automaker by global sales, trailing only Toyota and Volkswagen, and had the potential to reshape both the auto manufacturing and dealership landscapes.

However, the road to consolidation proved bumpier than expected. By mid-February, negotiations unraveled due to disagreements over the merger structure, with Honda seeking majority control and Nissan resisting a subsidiary-like role rather than both companies forming a joint holding company as initially discussed. Mitsubishi, in which Nissan holds a 24% equity stake, also voiced concerns about its influence in a combined entity.

Interestingly, the merger talks originally stemmed from discussions about a partnership to co-develop electric vehicle (EV) platforms. While the broader integration has fallen apart, both automakers remain committed to collaborating on EV technology, which is a sign that some level of strategic alignment remains in play. This is similar to the Toyota-Mazda partnership, which we discuss in more detail later in this post.

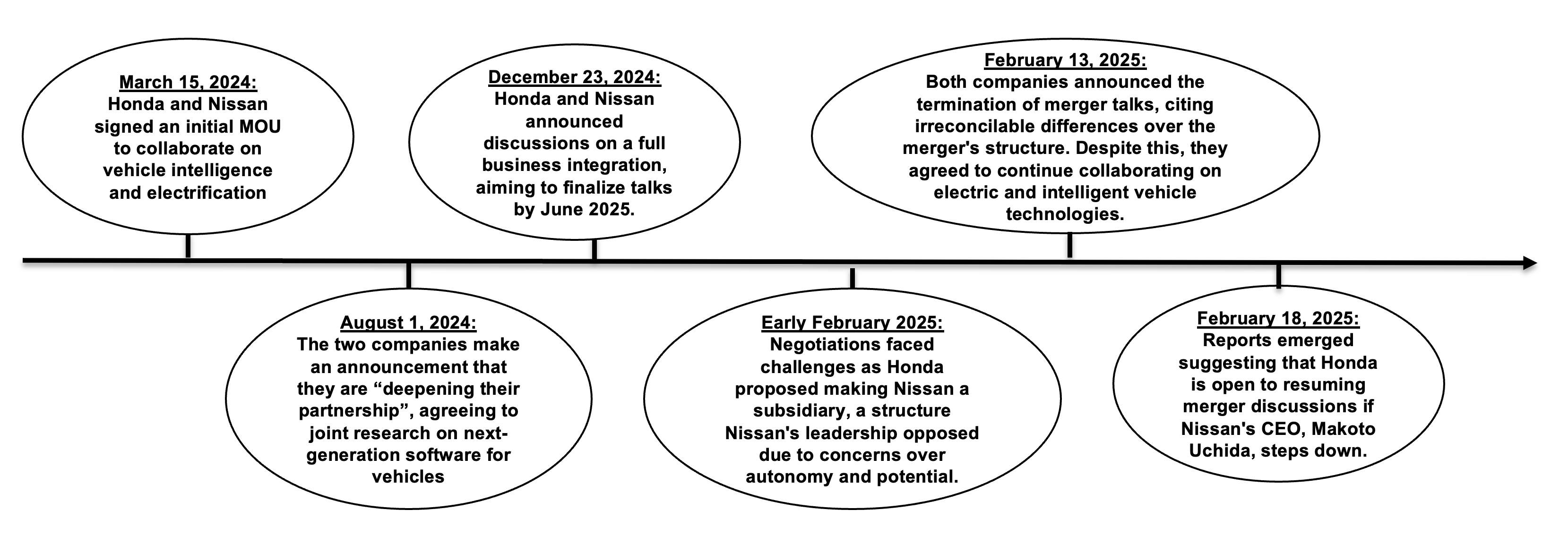

Below is a timeline of the key developments in this evolving story:

Click here to expand the image above

While the formal merger talks have been publicly shelved, the question remains: Does Nissan still need a strategic partner to secure its future? And what does this uncertainty mean for Nissan dealers navigating the industry’s shifting tides? Let’s explore the rationale of a Nissan merger and what this might mean for Nissan dealers if a merger agreement happens sometime in the next year or two.

Strategic Rationale for a Merger

Under the pressure of a changing global landscape, Nissan has decided that the best way to succeed in the future is to join forces with another automaker. Nissan has been suffering from significant losses and is currently restructuring operations and cutting costs. If Nissan merges with Honda or another company, new technology initiatives and strategies to address the Chinese market will likely be the top two priorities.

Technology Initiatives

The automotive industry has undergone a major shift over the past decade, driven by advancements in hybrid and electric vehicles (EVs), in-car entertainment, and autonomous driving technology. Meanwhile, Nissan has struggled to keep pace with rivals that have aggressively expanded their EV lineups and introduced cutting-edge features at a faster rate.

In response, Nissan has explored partnerships to bridge the gap—most recently with Honda, with whom it discussed shared EV platforms, battery acquisition agreements, and joint research efforts. While the merger talks have collapsed, Nissan’s need for a strategic ally remains, whether through deeper collaboration with Honda or a new partnership with another automaker. The company’s long-term competitiveness may hinge on its ability to secure access to next-generation battery technology and streamline production through shared resources.

Focus on Chinese Market

China, the world’s largest car market and a key battleground for global automakers, has become an increasingly challenging landscape for Nissan and Honda, among other manufacturers. Competition from domestic players like BYD has intensified, leading to a decline in sales for legacy brands that once dominated the market. Nissan’s leadership has expressed concerns that its market share in China could continue to erode without a stronger strategic position.

This concern was echoed in a Tokyo press conference, where Honda CEO Toshihiro Mibe acknowledged the growing dominance of Chinese automakers, stating, “The rise of Chinese automakers and new players has changed the car industry quite a lot […] We have to build up capabilities to fight with them by 2030, otherwise we’ll be beaten.” While this statement was made in the context of Honda and Nissan’s now-collapsed merger talks, the reality applies broadly—automakers that fail to adapt risk being left behind.

According to Reuters, Nissan and Honda sold a combined 2 million vehicles in China in the twelve months ending March 2024, a staggering one-third drop from five years prior. With demand in China still growing, their market share has eroded even faster, falling by half to just 8% over the past five years. Whether through renewed cooperation with Honda or an alternative partnership, Nissan faces an urgent need to rethink its strategy in China to remain competitive.

Toyota-Mazda Partnership as a Case Study

Mazda is a great modern example of how a strategic partnership can be a game-changer. In 2017, the automaker entered into a partnership with Toyota, a move that has since proven highly beneficial. While Nissan’s recent merger talks with Honda have stalled, the Toyota-Mazda alliance serves as a compelling case study for how a well-structured partnership could strengthen Nissan’s future.

By collaborating with Toyota, Mazda has gained access to advanced technologies and shared resources, leading to significant cost reductions and operational efficiencies. For instance, the joint development of in-vehicle software and hardware systems has allowed Mazda to save up to 70-80% in research and development costs year-over-year. Additionally, establishing a joint manufacturing plant in Huntsville, Alabama, has expanded Mazda’s production capacity and market reach. These collaborative efforts have not only fortified Mazda’s competitive position but also improved its financial performance.

For Nissan, a similar strategic partnership, whether with Honda or another automaker, could provide the scale, technology, and cost-sharing benefits needed to remain competitive in a rapidly evolving industry. The key lesson from Toyota and Mazda’s partnership is clear: collaboration, even short of a full merger, can be a powerful tool for long-term success.

What Does This Mean for Your Nissan Dealership?

If you own or manage a Nissan dealership, you likely have questions about what the company’s next steps mean for your business. Many of these questions are prudent, as Nissan’s ongoing search for strategic partnerships could still have significant implications for dealers down the line. Below are the key factors that could shape the future for Nissan dealers:

Anticipated Impact on Nissan Dealerships

- Expanded Product Lineup — A partnership with Honda or another automaker could lead to a more diversified product portfolio, giving dealers access to updated and optimized models. This could result in a more competitive lineup, particularly in high-growth segments like crossovers and electric vehicles.

- Better Inventory Availability — If Nissan secures a manufacturing or logistics partner to streamline production, dealers could benefit from improved inventory availability and fewer supply chain disruptions. Enhanced efficiency in sourcing key materials, such as EV batteries, could lead to more stable stock levels.

- Potential Dealer Network Consolidation — Any strategic realignment, whether through a future partnership or internal restructuring, could change Nissan’s dealership network. Geographic overlap or corporate strategy shifts may result in territory adjustments or consolidation. Nissan dealers should stay informed and consider proactive strategies to navigate potential restructuring.

- More Competitive Pricing and Incentives — With the right partner, Nissan could achieve greater economies of scale, allowing it to offer more competitive pricing, financing deals, and incentives. This could help dealers maintain a strong market position, especially as competition intensifies in the EV and hybrid segments.

- Technology and Service Enhancements — Even without a merger, Nissan remains focused on improving R&D, particularly in EVs, autonomous driving, and connected services. Future partnerships could accelerate these advancements, leading to better vehicle technology, improved warranty programs, and enhanced service tools that boost dealership fixed operations revenue.

Conclusion

Mercer Capital follows trends in the auto dealer and manufacturing industries. Mercer provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights