No Soup for You

Lessons from Seinfeld on Customer Lifetime Value and Brand Loyalty in the Auto Industry

One of my favorite pastimes is attempting to explain abstract thoughts and experiences through the lens of a Seinfeld episode.

This week, two episodes came immediately to mind: The Soup Nazi and The Mango.

If you’re not familiar with either, the Soup Nazi is a restauranteur with an exceptional array of soups and recipe offerings but an impeccable lack of patience with the consumer’s etiquette in line and for the ordering process. The Soup Nazi would randomly accost a customer with his famous tagline “No soup for you; come back…one year” for any small infraction in this etiquette.

The Mango episode features Joe’s fruit stand whose produce offerings were so superior to grocery store alternatives that Kramer would only buy from Joe. After insulting Joe while trying to return a bad peach, Kramer, and subsequently Jerry, get banned from Joe’s fruit stand for life.

Both Joe and the Soup Nazi had superior products, but at some point, a negative customer experience could cause the customer to defect to another provider.

Like the price elasticity of automobiles, especially high-end automobiles, OEMs and auto dealers must confront the challenges of brand loyalty and customer retention. In this week’s post, we discuss customer lifetime value (“CLV”) and cost of customer acquisition (“CAC”) and offer tips to auto dealers to achieve greater customer retention.

CLV/CAC Definition and Example

To calculate the customer lifetime value of an automobile consumer, we must understand the entire lifespan of the relationship between the auto dealer and them.

That relationship begins with the first purchase of a new or used vehicle, hopefully followed by regular semi-annual (if not more) service visits, before purchasing the next vehicle from the same dealership.

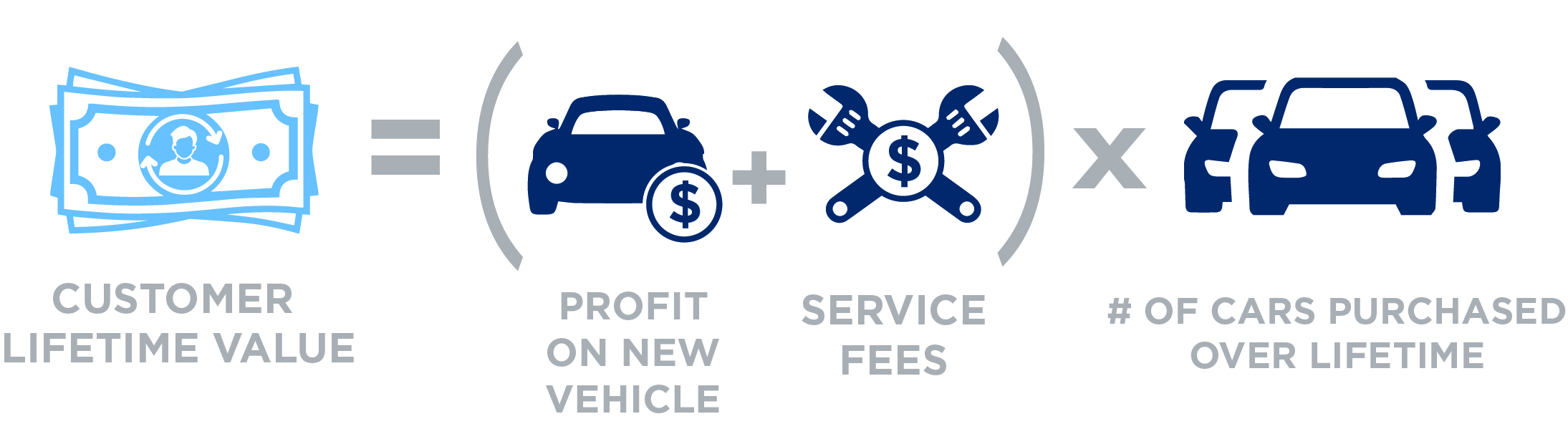

Therefore, the CLV to the auto dealer is the profit realized on the purchase of the vehicle, plus the incremental profits for the service visits during the life of that vehicle multiplied by the number of vehicles that a consumer will purchase and have serviced over their lifetime, as illustrated below:

To test the upper bounds of this formula, we must assume that the auto dealer is able to retain the customer during the entire life of the original vehicle and for the subsequent purchases of each new vehicle for the remainder of their life. However, maintaining customer loyalty by the OEM and the specific auto dealer retail location continues to be challenging.

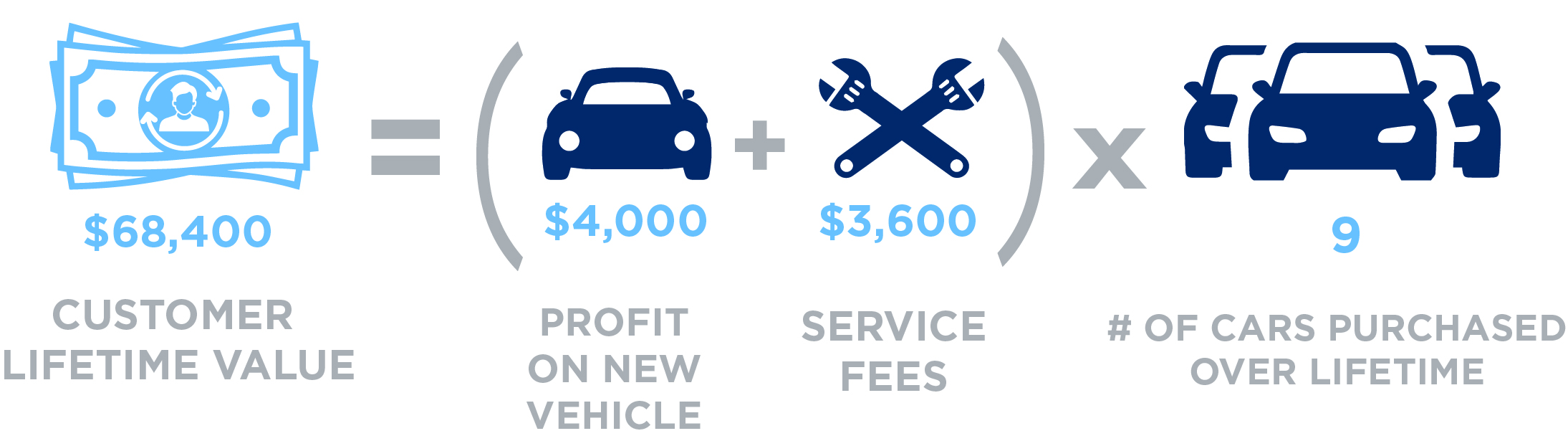

For illustration purposes, we have estimated new vehicle profits at approximately $4,000 per unit based upon recent monthly averages, though we recognize these are elevated relative to historical figures and are a cyclical industry. For service revenue and frequency, we have estimated service profits at $225 per visit based on the assumption that the dealer would earn 50% margins based on the average service and parts purchase order, as reported in the 2023 Mid-Year Report from NADA Data. We have assumed that the average consumer will frequent the original dealership twice annually over an eight-year life (2 x 8 x$ 225 = $3,600) and purchase nine vehicles in their lifetime. We have not factored in the profit to be gained from reconditioning and selling a trade-in.

Therefore, the CLV utilizing these assumptions is $68,400, as illustrated below:

To determine the net CLV, we must consider the costs of customer acquisition, as illustrated by the following formula:

Auto dealers and OEMs initially spend $692 per new unit sold, as reported by NADA. This cost would not reflect the additional marketing expenses that auto dealers would incur during the remaining life of each customer relationship. However, we have not added any additional customer acquisition cost because, as auto dealers know, the best advertising is a good experience.

The net CLV in our example would be $67,708, as illustrated below:

Brand/Customer Loyalty Statistics

In order for an auto dealer to realize the upper bounds of the net CLV in our example, a customer would have to remain loyal to the OEM and that particular dealer for their entire life. Both occurrences are far from guaranteed and come with many perilous opportunities.

Here are a few auto-related statistics to highlight the risks involved in maintaining the customer relationship at both the OEM and auto dealer levels:

- 74% and 79% : percent of all vehicle buyers and new vehicle buyers who reported a satisfying experience with the dealership or retailer experience in Cox Automotive’s 2023 Car Buyer Journey Study;

- 3% : percent of new vehicle buyers who remained loyal to the new car brand that they previously owned, as reported by a 2023 study by LexisNexis;

- 3% : percent of new vehicle purchases that were associated with trade-in vehicles from the same LexisNexis study;

- 30% : percent of all service visits that occur in dealership services lanes according to the 2023 Automotive Service Study by Cox Automotive, down from 35% just since 2021;

- 33% : percent of owners who indicated that “general repair shops” were their preferred service provider over auto dealerships (only indicated by 31% of owners) in the same Cox Automotive study;

Notably, none of these statistics touch on how frequently consumers move to a different city, where even the best customer service experience likely won’t retain the customer.

On the purchase side of CLV, auto consumers have expressed a preference for an omnichannel approach to the process with a hybrid mix of online and in-person elements. On the service side of CLV, auto consumers have expressed concerns over trust, proximity, and cost as reasons to select a general repair shop over the dealership service center.

Understanding customer behavior can be essential to auto dealers as they chase customer retention and maximize Net CLV. Consider these statistics from Semrush:

- 60 – 70% : percent chance of selling to an existing customer versus 5-20% chance of selling to a new customer;

- 67% : percent that repeat customers spend more than new customers;

- 45% : percent more that customers spend after 36 months from the initial purchase versus the first six months of the relationship;

Tips for Auto Dealers to Increase Net CLV

It would be wise for the fixed operations departments to align with the variable operations departments to strengthen customer loyalty together. What things can a dealership do to increase customer loyalty and, ultimately, net CLV?

- Personalized Experiences – Auto consumers have expressed a desire to receive a personalized experience, not only in the buying process that we touched on earlier but throughout the life of the relationship. Dealers can seek to differentiate themselves from their competition by emailing customers about special offers related to the customer’s vehicle of choice or opportunities to refinance their current vehicle under better rates.

- Unified Shopping Experiences – During the digital portion of the buying process, consumers want a seamless experience that consistently navigates them to the proper location from a digital advertisement rather than a website homepage. Execution of a unified shopping experience will build trust between the consumer and the auto dealership.

- Increased/Continued Contact – Reaching out to the customer throughout the relationship to schedule future service appointments, deals on vehicle upgrades, or lease renewals can be critical to increasing touch points. Connected cars make these contacts easier at both OEM and auto dealer levels. Service departments could increase the number of contacts by celebrating life experiences with their customers, such as birthdays, anniversaries, etc.

- Focus on Quality Customer Service – According to the Cox Automotive Service Study referenced earlier, 48% of vehicle owners were frustrated with at least one aspect of their recent service experience at a dealership. Frustrations include costs of service, service times extending longer than expected, service writers pushing additional repairs, and struggles to schedule appointments.

Conclusion

Even with superior products like the Soup Nazi’s cold cucumber, corn and crab chowders, and mulligatawny, or Joe’s avocados that are better too hard than too soft, customers will eventually seek alternatives if the customer service or overall customer experience declines.

OEMs and auto dealers must consider the customer’s lifetime value and identify those areas where their service department and new/used vehicle departments can coordinate to strengthen and maintain the relationship with the customer over their entire lives.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights