November 2024 SAAR

The November 2024 SAAR came in at 16.5 million units, which is 1.5% higher than last month and 6.2% higher than November 2023. Of note, November 2024 had one more selling day than November 2023. According to J.D. Power, the year-over-year increase in total new-vehicle sales for November 2024 was forecast near the end of the month at 6.7% after being adjusted for the additional selling day, compared to an approximately 11.0% increase without adjusting for the additional selling day.

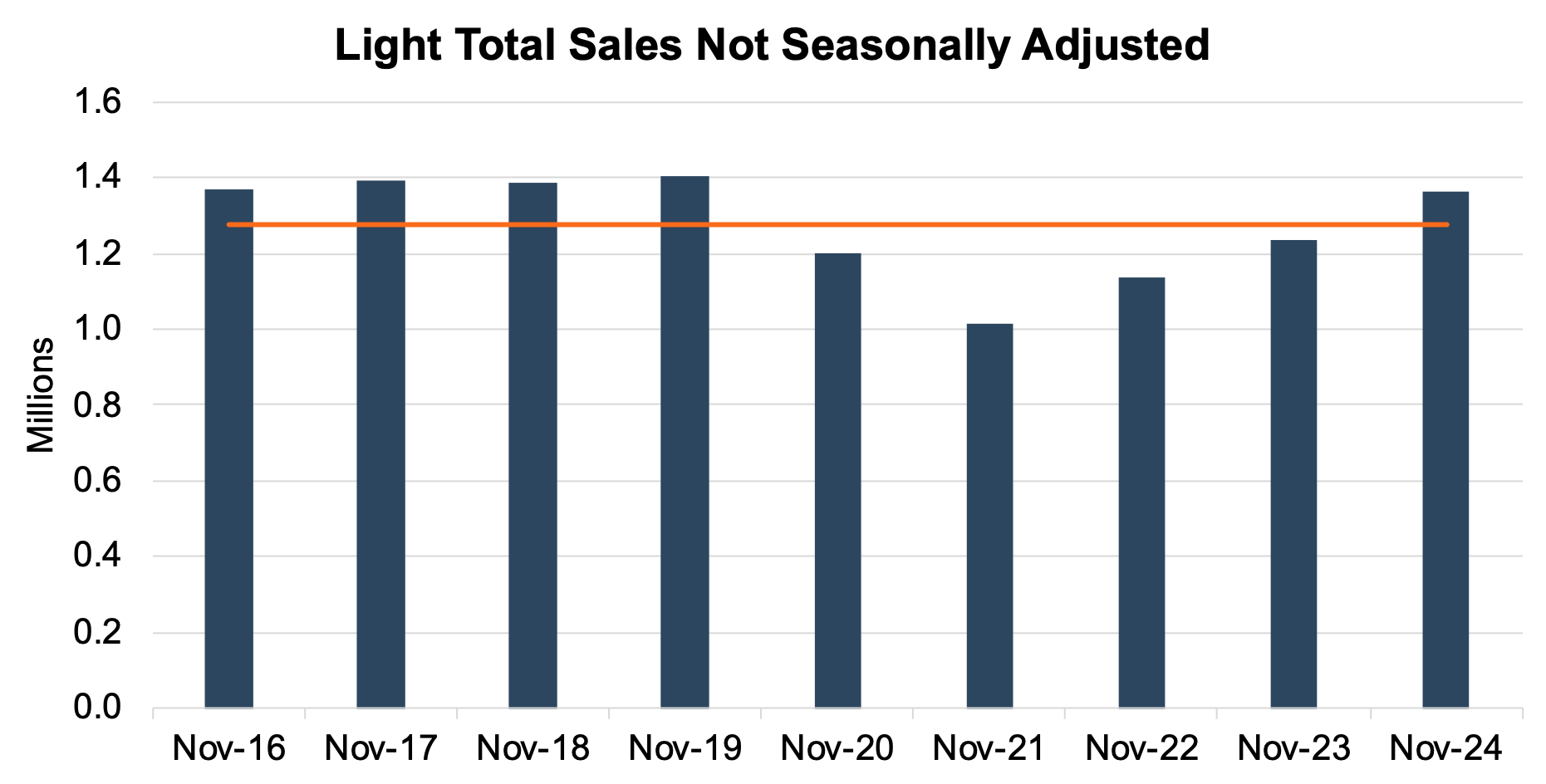

Unadjusted Sales Data

On an unadjusted basis, the industry sold 1.36 million units during November 2024, a 1.3% increase from last month and a 10.1% increase from this time last year. In fact, this month’s unadjusted sales landed 83 thousand units above the nine-year November average of 1.28 million units (2016 – 2024). This data underscores the strength of the recovery that has already occurred in the auto dealer industry, with sustained growth solidifying the upward trend over the past year. This month’s year-over-year increase highlights how the industry has not only rebounded but is now consistently outperforming historical averages (from a unit perspective) since 2020, reflecting steady consumer demand and improved supply conditions. See the chart below for a look at unadjusted sales over the last nine Novembers:

Days’ Supply

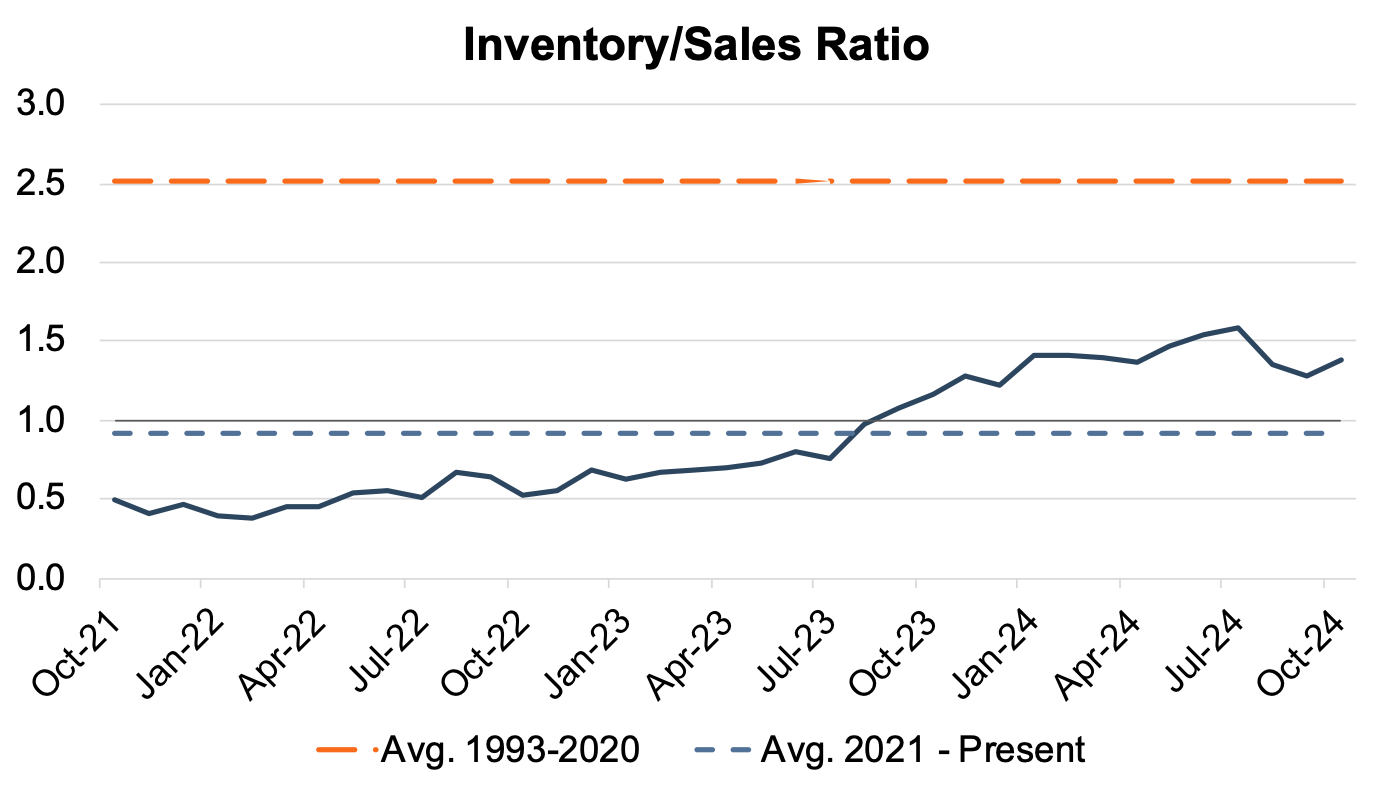

In October 2024, the industry’s inventory-to-sales ratio rebounded to 1.38x from 1.27x in September. The month-over-month increase in the inventory-sales ratio keeps the metric in line with the first half of 2024. This highlights how the industry’s inventory levels have normalized after the disruptions of previous years, reflecting a healthier balance between supply and demand during 2024. October’s rebound suggests automakers and dealers are better equipped to anticipate market conditions, ensuring inventory aligns with sales trends without overstocking or shortages.

The chart below illustrates the industry’s inventory-to-sales ratio over the last three years.

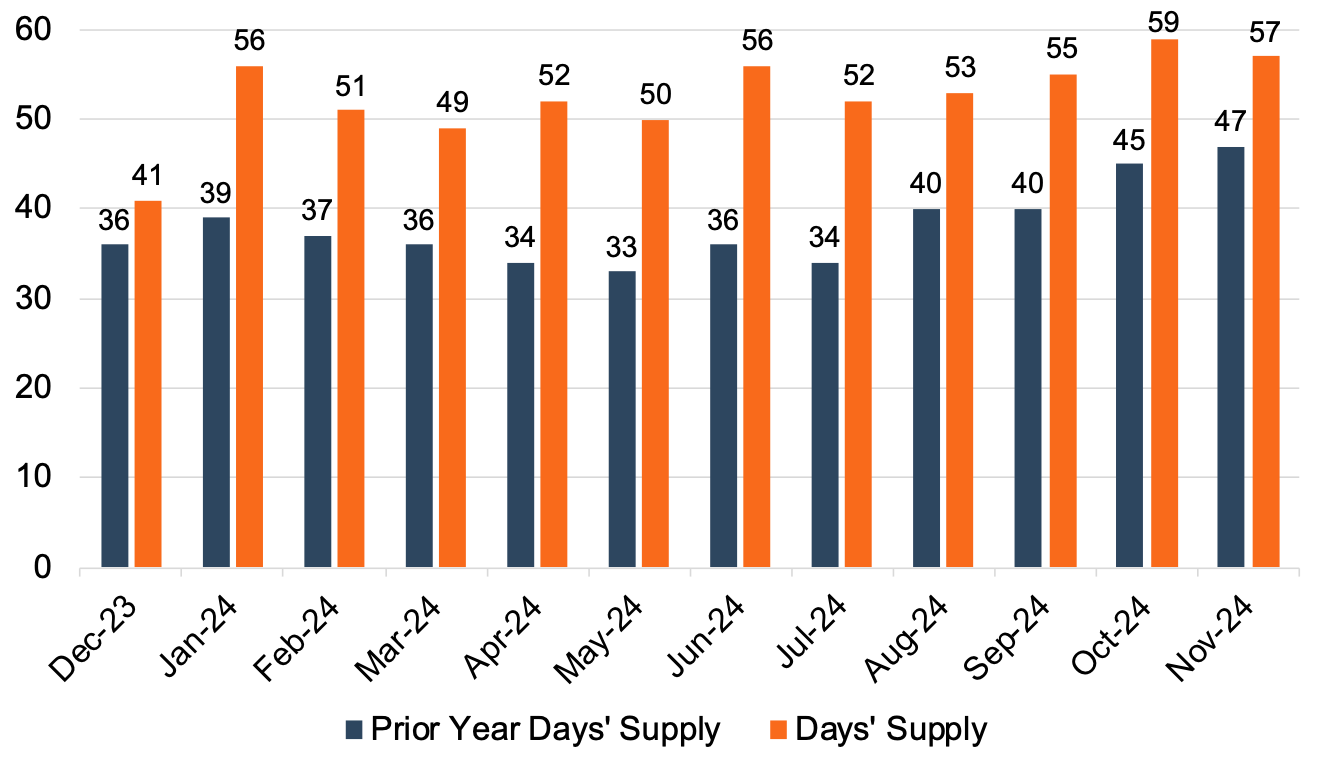

Days’ supply came in at 57 days in November 2024. Inventory levels throughout 2024 suggest that the global supply chain has largely restored inventory levels since the pandemic. It is important to note that inventory levels vary significantly from brand to brand. The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in November:

“The average retail transaction price for new vehicles has decreased slightly from a year ago, driven by higher manufacturer incentives and larger retailer discounts, offset by changes in the mix of vehicles being sold. Transaction prices are trending towards $45,471—down $150 or 0.3%—from November 2023. The combination of considerably higher retail sales and slightly lower transaction prices means that buyers are on track to spend nearly $49.8 billion on new vehicles this month—13.7% higher than November 2023, and the highest November on record.”

Moving into the final push of 2024, dealership profitability and margins continue their downward trend toward pre-COVID levels as inventories and incentive spending remain elevated and average transaction prices fall.

Incentive Spending and Profitability

OEMs typically use incentive spending as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability. J.D. Power notes that average incentive spending per unit in November 2024 is expected to be $3,291, up 42.3% from November 2023. Incentive spending as a percentage of the average MSRP is expected to reach 6.5% during November 2024, an increase of 1.8 percentage points from this time last year.

Approximately 11.6% of new vehicles were transacted at a price above MSRP in November 2024, bringing total retailer profit per unit down to $2,276. This figure represents a drop from 21% of the total sales last year and significantly below the shortage-inflated figures of prior years.

December 2024 Outlook

Mercer Capital expects the December 2024 SAAR to come in around 16.5 million. We expect the average transaction price to continue to moderate as vehicle purchasing will likely increase throughout the holidays and into the new year.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights