October 2020 SAAR

October lightweight vehicle sales had their second month in a row above 16 million, coming in at an annualized rate of 16.2 million for the month. Though this is down 0.6% from the September SAAR of 16.3 units, it is still a positive sign for the industry that sales have shown notable improvement since the start of the pandemic. As Thomas King, president of data and analytics at J.D. Power noted:

“Two consecutive months of year-over-year retail sales increases demonstrates that consumer demand is showing remarkable strength. The strong sales pace is occurring despite tight inventories. The combination of strong demand and lean inventories is enabling manufacturers to reduce new-vehicle incentives and is allowing retailers to reduce the discounts they typically offer on new vehicles.”

SAAR for October 2020 is off by 3% from that of October 2019. Light trucks are continuing to bolster sales, coming in at 77% of new vehicles sold in October and 76% of new vehicles sold this year.

The average new vehicle turnover from lots to consumers has fallen to 49 days, the first time it has fallen below 50 days in more eight years. 20% of vehicles are being sold after being on a dealer lot for only five days or less.

As we mentioned in our Q3 earnings call blog post, public auto dealers noted how vehicle demand has been outstripping supply as manufacturers struggle to get new vehicles to dealers. Among the major public dealerships, there is consensus that this inventory shortage will continue through year-end before beginning to normalize in 2021. However, tighter inventory has contributed to higher gross margins and higher selling prices. In October, these prices are expected to reach another all-time high, rising 7.3% from last year to $36,755. More expensive trucks and SUVs have been drivers of this average transaction increase.

Looking toward the rest of the year, not much is anticipated to change unless there is an unexpected relief to the inventory constraints. The sales calendar for November 2020 is shorter than that of 2019 (28 days in 2020 vs. 32 in 2019), so slightly deflated SAAR is expected.

Dealership Valuations Looking Up

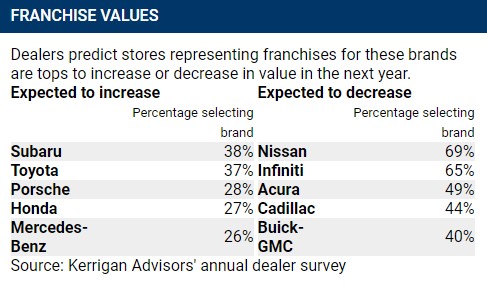

When considering the year that auto dealerships have experienced, an outside observer would likely assume that dealership values are down. However, more dealerships are bullish on their valuations over the next twelve months according to a Kerrigan Advisors survey of dealers. The second annual survey found that 33% of dealers expect the value of their stores to rise in the next year, up from 26% in 2019. Another 53% expect values to remain the same, while 14% think their values will be lower. This is a change from 2019 where 60% expected values to remain the same and 14% to expect a decrease. Erin Kerrigan, managing director of the firm, noted “The rebound in auto sales coupled with reduced dealership expenses and higher vehicle margins will result in record industry earnings in 2020.”

As seen in the table above, Subaru, Toyota, Porsche, Honda, and Mercedes-Benz have the highest expected valuation gains. These trends are in line with Blue Sky multiple increases as well, as Subaru’s blue sky multiple has seen an increase to 5.0x – 6.0x, while dealerships such as Infiniti and Cadillac continue to be below blue sky multiple levels.

Some Caveats

Though dealers being bullish on their valuations is a good sign in terms of the recovery of the industry, every dealership is different. While there are many factors that need to be considered when determining the value of a dealership, here are three that are critical, especially when considering the operating in a pandemic.

Location

While 38% of Subaru dealerships surveyed anticipate valuation growth this year, that percentage is unlikely to be consistent across the country.

When determining the value of a dealership, it’s important to consider the local economy where the dealership operates, especially considering stay-at-home orders and business restrictions stemming from the pandemic.

In March and April, dealers in the northeast were harder hit by the stay-at-home orders than the dealerships elsewhere. As of today, with the virus surging across the country, looking at the impacts in each specific region is important to determining dealership values.

Sales

While many dealerships are seeing earnings growth in Q2 and Q3, what is the quality of that earnings growth and how do dealerships’ earnings compare to that of prior years?

If earnings have only increased due to operation cuts, that growth should be scrutinized a bit. Cutting costs can improve the bottom line in the short run, but it may not contribute to overall company growth over the long-term. We’ve had clients remark how the Great Recession taught them just how lean they could operate. Since then it’s likely that dealers have added back some expenses but the pandemic has again forced cost cutting. The sustainability of earnings in 2020 will depend on how many of those expenses can continue to stay low and how gross profits look once inventories become less scarce.

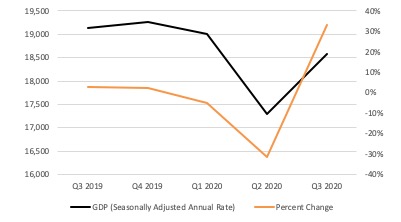

Earnings growth must also be evaluated in the context of pre-pandemic levels, not just improvement from the bottom. The recent pattern in GDP growth is a good example of this. In Q3, GDP increased an impressive 33.1%, after having fallen 31.4% in Q2. While 33.1% is greater than 31.4%, we can see in the graph below that GDP has not fully recovered.

Operations

In an increasingly technological environment due to the pandemic, a dealership’s digital presence can contribute to their overall valuation. A dealership that has invested in their digital offerings has set themselves on a platform for growth.

Conclusion

The valuation outlook for many dealerships is positive but dealerships are not created equal. The individual characteristics and performance of each dealership has to be analyzed in any valuation process.

Feel free to reach out to us for more information about how current economic conditions may affect your dealership’s valuation or to discuss a specific valuation need in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights