October 2024 SAAR

The October 2024 SAAR came in at 16.0 million units, 1.7% higher than last month and 3.7% higher than October 2023. A strong October 2024 SAAR was accompanied by increased inventories and incentive spending levels industry wide, which put pressure on transaction prices and dealership profits.

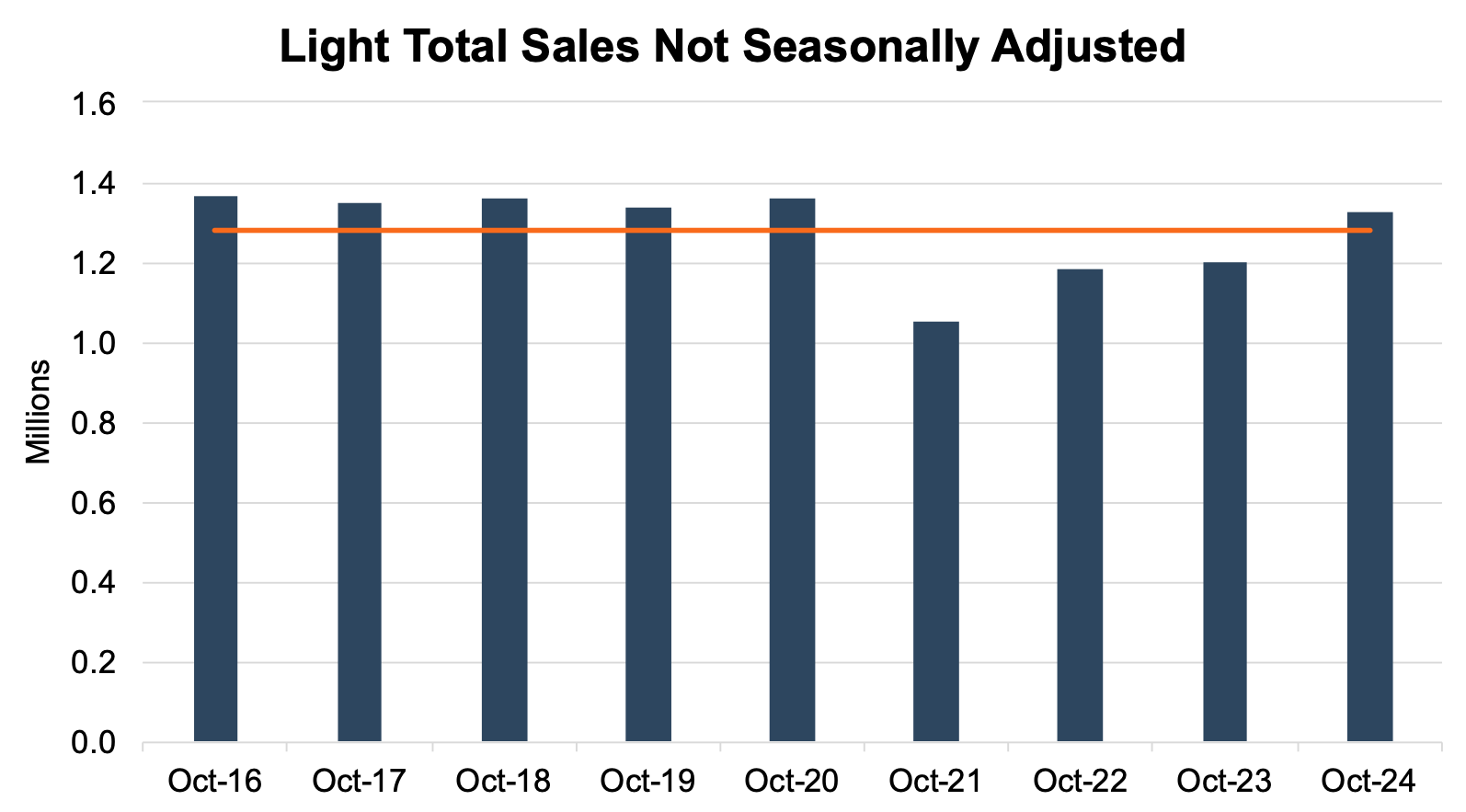

Unadjusted Sales Data

On an unadjusted basis, the industry sold 1.33 million units during October 2024, a 13.3% increase from last month and a 10.6% increase from this time last year. This month’s unadjusted sales eclipsed the nine-year October average of 1.35 million units (2016 – 2024). See the chart below for a look at unadjusted sales over the last nine Octobers:

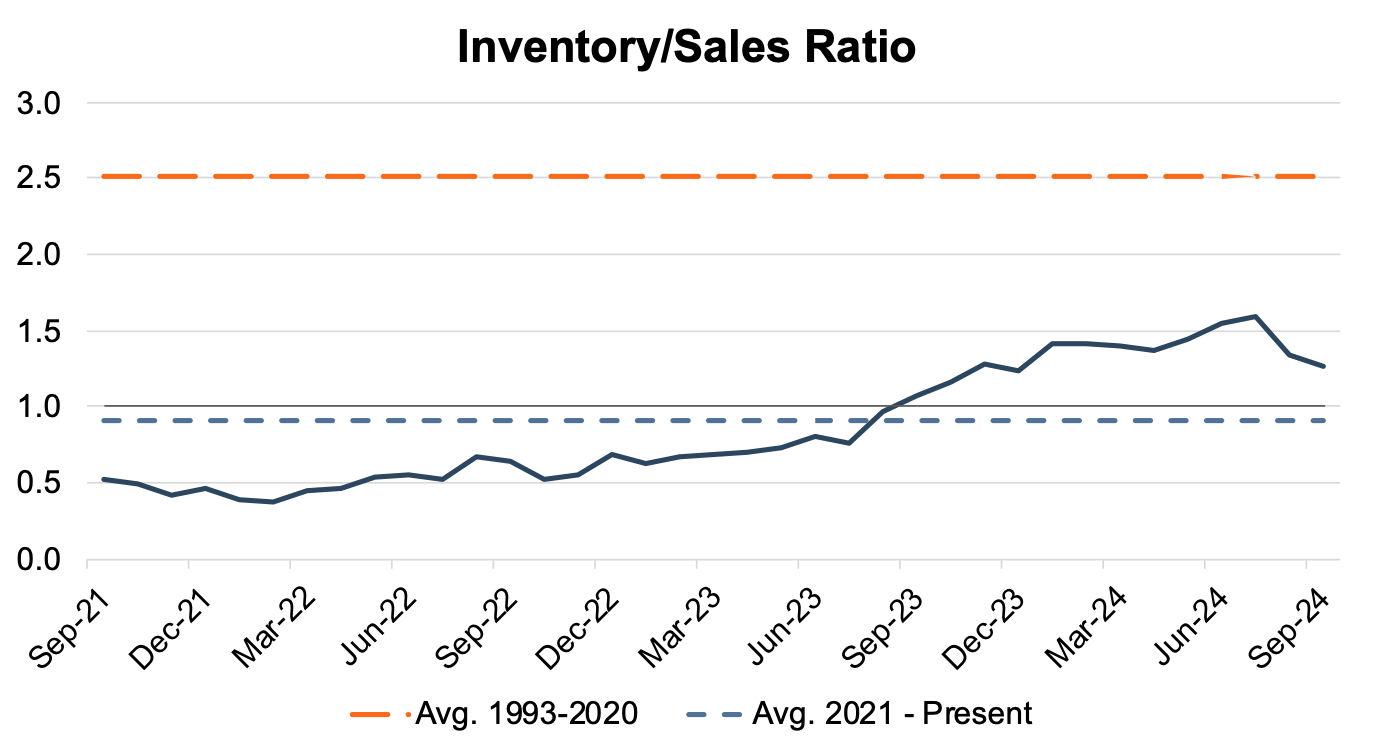

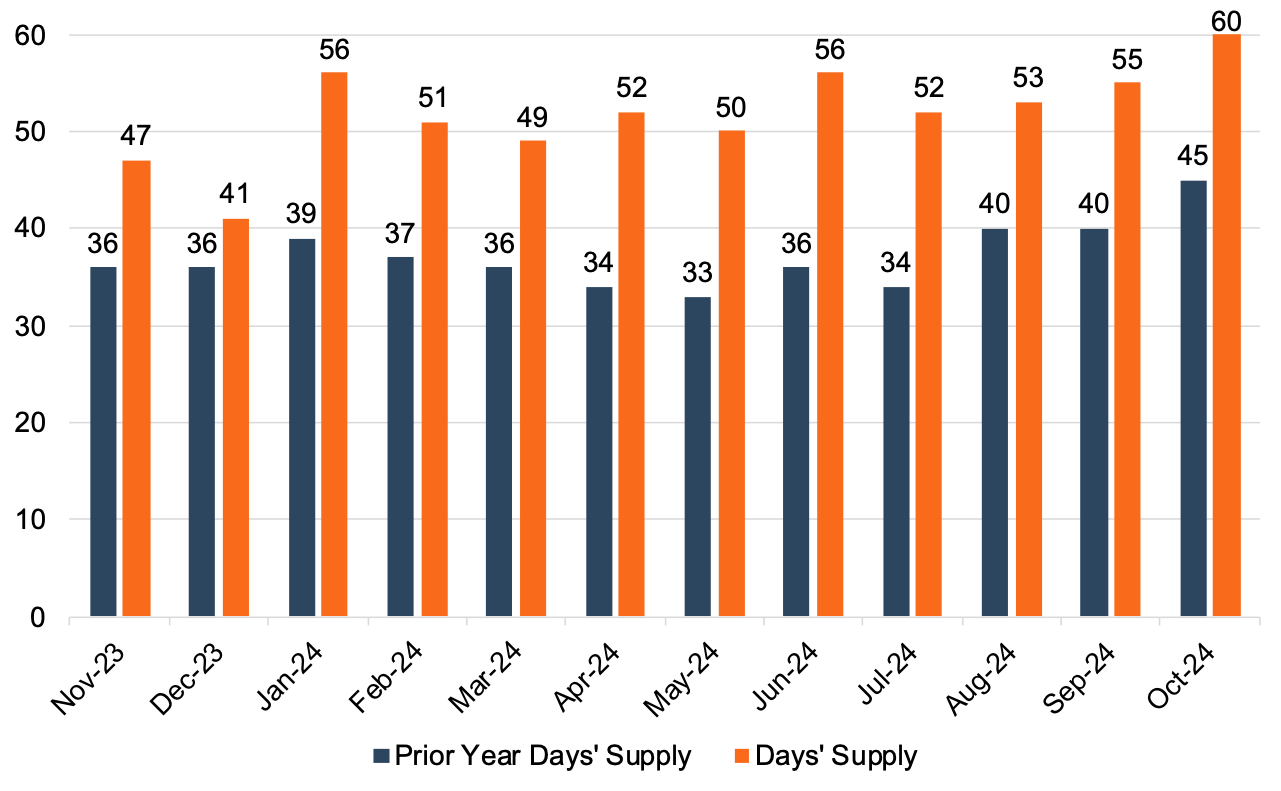

Days’ Supply

In September 2024, the industry’s inventory-to-sales ratio dipped to 1.27x from 1.34x in August 2024. The month-over-month drop in the inventory-sales ratio could signal a turning of the tide, but the September metric is still in line with the first half of 2024. In recent months, it seems that elevated sales volumes may be the driving factor in moderating inventory balances rather than supply side constraints. The chart below illustrates the industry’s inventory-to-sales ratio over the last three years.

Days’ supply came in at 60 days in October 2024, reaching the highest level in the last 24 months. Recent inventory levels indicate that the global supply chain has made large strides in building inventory levels up since the pandemic. It is important to note that inventory levels vary greatly from brand to brand. The chart below presents days’ supply for U.S. light vehicles over the past 24 months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in October:

“The average new-vehicle retail transaction price has fallen from a year ago due to higher manufacturer incentives, larger retailer discounts and increased availability of lower-priced vehicles. Transaction prices are trending towards $44,904—down $739 or 1.6%—from October 2023. The combination of higher retail sales and lower transaction prices means that buyers are on track to spend nearly $48.3 billion on new vehicles this month—11.8% higher than October 2023.”

Dealerships continue to feel the effects of rising inventory levels, increased incentive spending, and falling average transaction price as profitability and margin continue to move towards pre-COVID levels. Chasing volumes seems to be keeping industry revenue growth high for dealers and manufacturers alike while profitability at the dealer level lags behind.

Incentive Spending and Profitability

Incentive spending is typically used by OEMs as a tool to increase volumes at the expense of profitability, resulting in an inverse relationship between incentive spending from manufacturers and per-unit profitability. J.D. Power notes that average incentive spending per unit in October 2024 is expected to be $3,149, up 70.4% from October 2023. Incentive spending as a percentage of the average MSRP is expected to reach 6.3% during October 2024, an increase of 2.5 percentage points from this time last year.

Approximately 12.7% of new vehicles transacted above MSRP in October 2024, bringing total retailer profit per unit to down to $2,245. This figure represents a drop of 27% from this time last year. Over the next several months, it is likely that manufacturers, particularly for over-inventoried brands, will continue to employ incentives to sell units and manage inventory levels.

November 2024 Outlook

Mercer Capital expects the November 2024 SAAR to land around 15.5 – 16.0 million. In the last two months of 2024, we expect the average transaction price to continue to moderate. We also expect to see an increase in vehicle purchasing throughout the holidays and into the new year as consumers react to recent rate cuts.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights