Plan for the Unexpected

Succession Planning for Auto Dealers

March is one of the best months of the year for avid and casual sports fans. Last week, the NCAA College basketball tournament began. Many of us have been checking our brackets obsessively. There’s a reason it’s called March Madness. Who would have predicted that Fairleigh Dickinson would upset Purdue or that Princeton would upset Arizona and advance to the Sweet 16? The tournament and the bracket challenges are an opportunity to unite friends, co-workers, and family members in a spirited competition. But, they can also be a source of frustration with stumbling blocks and unexpected turns. In many ways, succession planning can leave auto dealers with confusion and frustration over the process and about some of the decisions made along the way. Just as the thought of a #16 seed beating a #1 seed wasn’t on our radars before 2018 (when #16 University of Maryland-Baltimore County beat #1 Virginia 74-54 on March 16, 2018), thoughts of a global pandemic or an inventory crisis caused by a microchip shortage weren’t expected either. The lesson to be learned: Plan for the unexpected.

What Is Succession Planning?

Succession planning involves the transfer of value or leadership in a company or organization. For auto dealers, the dealership can represent a lifetime of efforts and relationships with key employees and customers. Hopefully, the dealership has also provided the owner wealth and income over the years. These factors make the discussion of succession more complicated for auto dealers because of the deep emotions tied to the legacy that they have created.

So, let’s discuss a few of the key factors involved in the succession planning process and why they are so critical.

Determining the Value of the Dealership

One of the first steps in the succession planning process is to determine the value of the auto dealership. Often there is a difference in the expectation of value between the owner and other interested parties. That’s why obtaining a formal business appraisal is important. Most valuation professionals offer different levels of service based on the strength of the conclusion, the level of procedures performed and the information analyzed, and the style of the report. While engaging a business valuation professional to perform limited procedures may be more cost beneficial, a formal valuation is the better course of action. If decisions are ultimately made to transfer the auto dealership in some estate planning tool, a formal valuation will help protect the integrity of that transaction or transfer. In other words, if the transfer was ever to be audited or challenged by the IRS, a formal business valuation serves to justify the indication of value used in the estate planning process.

A business valuation can also benefit auto dealers for other reasons besides the formal event requiring the valuation. A formal business valuation can be useful to an auto dealer when examining internal operations. While the business valuation represents an estimate of value at a certain point in time, the value can also be examined relative to the business over time. An auto dealer may use additional valuations to evaluate the dealership’s performance over time to assess its performance relative to a budget or long-term plan. Valuations can also give auto dealers insight into the value drivers of their dealership. Auto dealers can continue focusing on areas of strength that contribute to value while addressing other areas of weakness that may detract from value. Finally, a business valuation could serve to evaluate the dealership relative to its peers and competition.

Who Should Perform the Business Valuation?

The selection of the business appraiser is critical to the succession planning process. A quality business valuation will not only determine the dealership’s value but also provide a well-reasoned report to explain the basis of value and the underlying assumptions. Further, the valuation helps the auto dealer and their advisors understand how the dealership is valued. Dealers and their advisors should select a business appraiser that is properly qualified and credentialed. Additionally, the auto dealer industry differs from others due to its unique financial statements, terminology, and specific valuation methods. When selecting a business appraiser, dealers should also seek a firm or individual with experience in your particular industry.

Timing of Decision-Making

Auto dealers have faced many daily challenges and operational decisions over the past three years. Decisions that can be made tomorrow, such as succession planning, may be shifted to the back burner. However, these decisions should be made sooner rather than later, as unexpected events can impact the value of your auto dealership and the succession planning process. Since succession planning refers to the transfer of leadership to key employees, a life-changing event to the owner or the departure or thinning of key leadership over time can also impact the dealership’s value.

Profitability and implied values of auto dealerships have been climbing over the last two years, but will those trends continue? For auto dealers that have seen their dealership value rise in recent years, why not consider transferring some of that value to your family? While there has been a lot of talk about estate planning and tax law changes since Biden took office, no material changes have been enacted as of yet. But changes could still be on the horizon. In addition to annual gifting, the lifetime estate and gift tax exclusion is set to sunset in 2026. The current exclusion allows individuals to transfer $12.06 million ($24.12 million for a married couple) without being subject to estate taxes. These levels are set to drop by almost 50% in 2026. Auto dealers can transfer considerably more value today under the current exemption levels than if those levels are reduced in 2026.

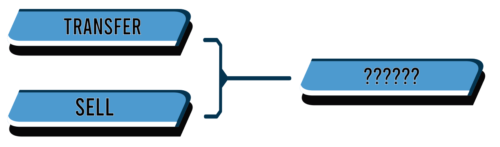

The Ultimate Decision

The current environment in the auto industry has placed many auto dealers at a crossroads in terms of their ultimate decision: Should they consider transferring the dealership to the next generation, or should they sell? High profitability and high blue sky multiples have translated to heightened valuations for most franchises over the last two years. Continued evolution and adoption of electric vehicles force many dealers to contemplate the additional expenses and challenges of retailing and servicing these vehicles. Further, consolidation in the industry by the public companies and larger private auto dealership groups forces the smaller auto dealer families to compete with companies that have much larger resources and economies of scale. What decision should auto dealers make?

Aspects of the decision revolve around the expectation of value discussed earlier in this post. Does the dealer’s perception of value equal reality? If the dealership is worth less than what a dealer expected, perhaps it makes sense to retain it and improve operations and certain value drivers to eventually increase the dealership value. If it’s worth more than the dealer expected, perhaps it makes sense to consider selling the dealership at a time of heightened value.

The other critical factor to succession planning, and in this case, transferring the ownership of the dealership, is assessing the business’s existing leadership talent. Is there a second generation of the family that is currently involved and familiar with the operating environment? If not, can a key employee step in and continue the dealership’s legacy? In either case, an auto dealer must consider whether the OEM would approve either of these individuals. The OEM has to approve the dealer principal of an auto dealership. This consent is not always guaranteed and presents another unique element to the succession planning process for auto dealers.

Conclusion

At Mercer Capital, we perform valuations of auto dealerships for owners and advisors all around the country for a variety of purposes. Additionally, we follow the auto industry closely to stay current with trends in the marketplace. These give insight into the market that may exist for a private dealership which informs our valuation engagements. If you are contemplating succession planning with your dealership, contact a professional at Mercer Capital to discuss your valuation needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights