Public Auto Dealer Profiles: AutoNation

As we discussed in previous installments of this blog series, there are six primary publicly traded auto dealers that own approximately 923 new vehicle franchised dealerships as of year-end, or approximately 5.5% of the total number of dealerships in the U.S. The proportion of the total U.S. dealerships that these publics own demonstrates how fragmented the industry continues to be, despite recent consolidation. For example, in the back half of 2021, there were three significant acquisitions made by public dealers that captured headlines. (Check out our blog from October to explore how these acquisitions might matter to your dealership).

Our goal with the Public Profiles blog series is to serve as a reference point for private dealers who may be less familiar with the public players, particularly if they don’t operate in the same market. Larger dealers may benefit from benchmarking to public players. Smaller or single point franchises may find better peers in the average information reported by NADA or more regional 20 Group reports. However, they might still value staying plugged into public auto dealers’ performance. Public auto dealers also give dealers insight into how the market prices their earnings, the environment for M&A, and trends in the industry.

AutoNation Overview

AutoNation is the largest automotive retailer in the United States. As of December 31, 2021, the company owned 339 new vehicle franchises from 247 stores located in the U.S. At year-end, the company also owned and operated 57 AutoNation-branded collision centers, 9 AutoNation USA used vehicle stores, 4 AutoNation-branded automotive auction operations, and three parts distribution centers.

Locations

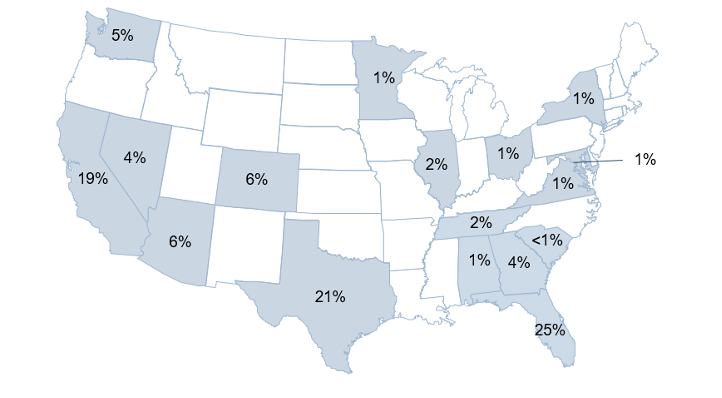

AutoNation’s stores are primarily set in the Sunbelt region, but the company has a presence in 17 states. A map of all states that the company operates in with associated percentages of total revenue is included below:

Source: AutoNation Investor Deck Fourth Quarter 2021

Brands

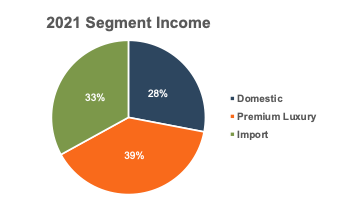

The company sells 33 different new vehicle brands, with 90% of its revenue coming from Toyota (including Lexus), Honda, Ford, General Motors, FCA, Mercedes-Benz, BMW, and Volkswagen (including Audi and Porsche). Comprehensive brand selection is important to AutoNation, as it hopes to provide customers with a broad range of products to choose from. Profit amongst these brands has remained relatively stable over the company’s history. However, in recent years the company has seen a slightly greater profit mix towards selling and servicing higher-margin, luxury vehicles.

The company is seemingly brand agnostic, which makes sense given its massive scale and complications with franchise agreements, where OEMs don’t want too many dealerships to be controlled by one company. A breakdown of income by brand from AutoNation’s Q4 2021 investor presentation can be seen below:

Source: AutoNation Investor Deck Fourth Quarter 2021

Historical Financial Performance

As we’ve discussed frequently, there are numerous hurdles to clear when comparing a privately held dealership to a publicly traded retailer. Scale and access to capital make the business models different, even if the store and unit-level economics remain similar. Despite these fundamental differences, we should still take a look into some of the financial metrics and trends that AutoNation has observed in its operations over the past few months.

There are numerous hurdles to clear when comparing a privately held dealership to a publicly traded retailer.

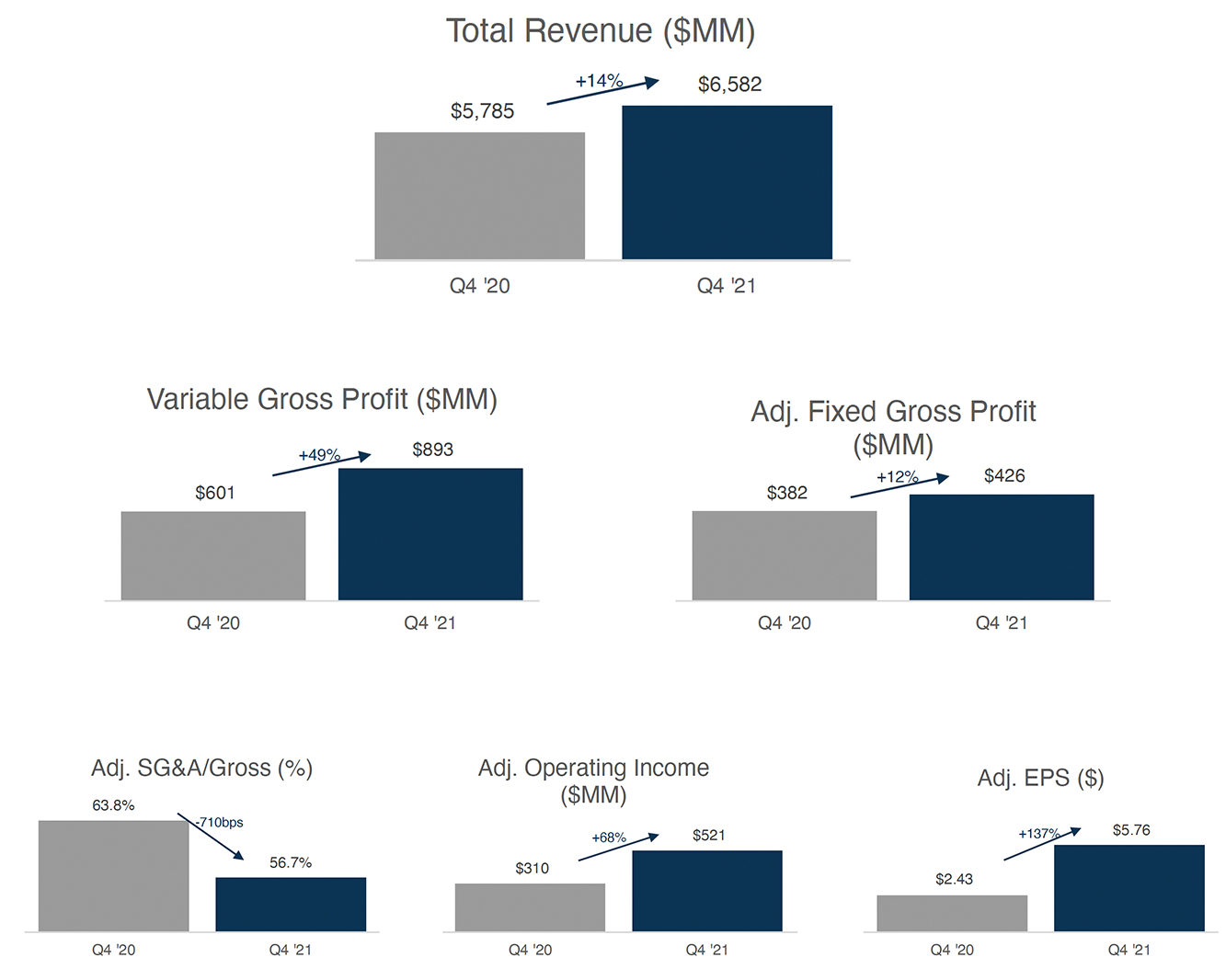

In the fourth quarter of 2021, AutoNation observed a 13.8% increase in total revenue and a 34.3% increase in gross profit compared to the same period last year. This asymmetric growth can be attributed to margin expansion as rising vehicle prices have benefitted the company’s selling operations. Remarkably, while sales prices have increased faster than the cost of the vehicles, OEMs are also more profitable, which demonstrates why public players want some of the status quo to remain the same once the chip shortage abates. AutoNation’s net income and EPS margins have expanded as well, with net income increasing by 78.3% over the year and EPS increasing by 137%. Changes in the individual components of the company’s income statement are broken down below:

Source: AutoNation Investor Deck Fourth Quarter 2021

Like most of its public and private counterparts, AutoNation has achieved an impressive financial performance in the midst of lower retail units sold and historically low numbers of units on lots. Day Sales Outstanding is an appropriate metric to show the magnitude of the inventory shortage’s effect on AutoNation. Throughout 2021, the company’s Days’ Supply dropped from 42 to 9, which is even more notable considering that sales volumes are also declining, which all else equal raises Days’ Supply. Used vehicles bridged some of the gap for AutoNation; as new retail units declined 20% due to manufacturer supply shortages, used vehicles increased by 21%.

AutoNation’s finance and insurance department also performed well in 2021, as higher margins on service contracts and increased product penetration resulted in gross margin expansion in the business segment. Parts and Service also saw an increase in gross profit, primarily due to growth in customer pay, internal reconditioning services, and the sale of wholesale parts.

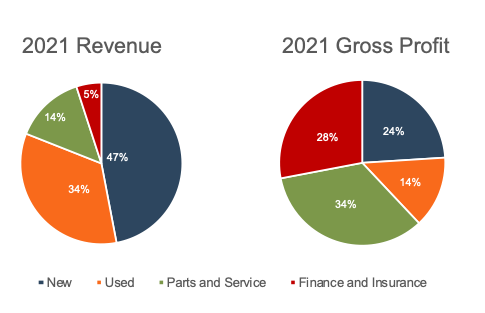

Across AutoNation’s four revenue segments, margin structure differences allow for variability between each segment’s revenue contribution and gross profit contribution, as can be seen in the company’s investor presentation and below:

Source: AutoNation 2021 10-K

AutoNation USA

In 2021, AutoNation’s capital allocation focused on its rollout of AutoNation USA, an exclusively pre-owned sales venture that the company is launching to target additional market share in the used vehicle market. Unlike Lithia that is actively acquiring new vehicle franchises, AutoNation, like Sonic, is investing in a network of used-only stores to compete with Carvana, Vroom, Shift, and other online retailers. They have the built in benefit of sourcing trade-ins when customers come to AutoNation’s new vehicle franchises as well as the scale of their vast dealer network.

AutoNation is targeting to have over 130 AutoNation USA stores in operation from coast-to-coast by the end of 2026, and has already launched 5 pilot stores, all of which were profitable. Of the 130 targeted openings, 12 stores are expected to open in 2022. Given they only have 9 currently, getting to 130 will take a significant investment in 2023-2026. If they stick to these plans, there may not be significant capital allocated to acquiring more new vehicle franchises.

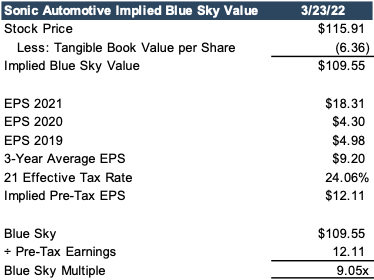

Implied Blue Sky Multiple

In prior blogs, we’ve discussed how blue sky multiples reported by Haig Partners and Kerrigan Advisors represent one way to consider the market for private dealerships. Below, we attempt to quantify the implied blue sky multiple investors place on AutoNation. If we assume that the difference between stock price and tangible book value per share is made up exclusively by franchise rights, then their Blue Sky value per share is approximately $109.55. Given recent outperformance, Haig Partners prescribes a 3-year average to determine ongoing pre-tax income. Using this methodology and applying the 24.1% effective tax rate implied by AutoNation’s financials, its ongoing pre-tax earnings per share would be $9.20 or 9.05x Blue Sky.

Source: AutoNation Investor Deck Fourth Quarter 2021

While this is relatively in line with all of its public counterparts, it is relatively high compared to import or domestic dealerships likely due to its size and growth potential and its tilt towards luxury brands.

Conclusion

AutoNation is a good proxy for the entire auto dealer industry in many ways. While the company is regionally clustered in Florida, California, and Texas, it has a presence in and is a product of several unique markets across the entire United States. Its presence in these states also isn’t random; these are three of the four most populous states in the country. AutoNation also sells almost all of the major domestic, import, and luxury brands, further emphasizing the very broad nature of its operations. Financially, the recent historical performance of AutoNation follows many of the same trends that privately held dealerships have been seeing over the past year.

At Mercer Capital, we follow the auto industry closely to stay current with trends in the marketplace. Surveying the operating performance, strategic investment initiatives, market pricing of the public new vehicle retailers gives us insight to the market that may exist for a private dealership. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights