Q2 2020 Earnings Calls

Constrained Inventories and Improved SG&A Margins Expected to Normalize While the Future of Omnichannel Initiatives Stays Top of Mind

As expected, the COVID-19 pandemic has thrust many dealerships into relying on their digital and omnichannel offerings due to complications arising from stay-at-home orders. Further government restrictions have curbed new vehicle supply as manufacturers have struggled to ramp up supply. Many dealers noted inventory shortages. However, with sales volumes significantly below the 17 million seen over the last several years, both the numerator and denominator of the days of supply statistic are declining. Lower sales mean lower inventory isn’t a deal breaker; in the short term, limited supply has led to some gross margin improvement. However, total gross profit is still significantly down due to the lower sales (combination of lower inventory and lower demand). While sales have improved sequentially as restrictions have eased, parts and service (particularly collision) have trailed in their recovery as fewer miles driven has translated into reduced demand. Analysts inquired about the potential for stay-at-home orders to be ramped back up, particularly in large states such as Texas, California, and New York, though executives largely downplayed the likelihood and the impact it would have on their businesses.

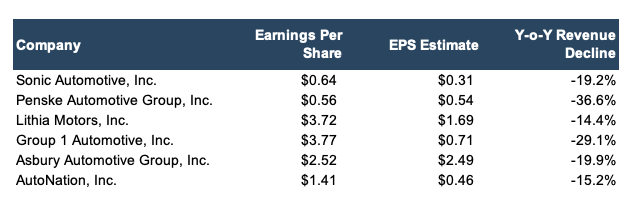

On Q1 calls, public auto dealer executives played down incremental costs related to digital initiatives and highlighted the reduction in SG&A related to online sales. Specifically, advertising and personnel costs are much lower for digital. In Q2, public auto dealers saw these initiatives come to fruition, and earnings largely beat estimates despite year-over-year revenue declines of 15-35%. Despite the successful cost cutting, executives were quick to point out not all of these cost savings were sustainable.

Theme 1: Manufacturer plant closures have caused inventory shortages, but lower sales levels require less inventory. Some dealers noted higher gross margins due to their limited supply, while others highlighted issues sourcing their most popular models.

- Our second quarter new vehicle volumes declined 28%, and used vehicle volumes were down 14%, the latter of which was caused by inventory shortages. However, gross margin was extremely strong. New vehicle gross profit per unit was up 40% in the quarter. […] we are seeing a bit of an inventory strain in new and used and especially on the new side with some hot models that are typically our volume sellers. -Daryl Kennigham, President of U.S. and Brazilian Operations, Group 1 Automotive

- It’s going to be a tough road for July August September although we are seeing inventories improve. They’re just not going to improve rapidly. I would look for October November time frame to get some normalized inventory levels. And the great news is this low supply equals high margin. -Jeff Dyke, President, Sonic Automotive

- We are clearly constrained in inventory, and that means that for any given customer that comes to the site, the odds of them seeing the car they’re looking for is lower, and therefore, your conversion rates will be lower. -Ernest Garcia, Founder, President, CEO & Chairman, Carvana

- Our day supply was 52, down 34 days from the prior year. These levels are low, because of temporary OEM factory shutdowns. However, we expect the day supply to increase gradually through the summer selling season. -Dan Clara, SVP Operations, Asbury Automotive Group

Theme 2: Service & parts (primarily collision) fared better in April than vehicle sales. As the pandemic persisted, less mileage driven led to decreased demand due to less wear and tear.

- Collision is really what’s taken the big hit for us […] when April really shut down for sales and service, collision was actually okay and then collusion took their hit in May forward. With less people driving on the road there’s been less accidents. So collision has been a little bit further behind. -David Hult, CEO, Asbury Automotive Group

- There’s just been people driving less mileage. And so our collision business, which isn’t a massive part of our business overall. But it’s probably the weakest when you look at it year-over-year. -Earl Hesterberg, President & CEO, Group 1 Automotive

Theme 3: SG&A declined to lows as a percentage of growth for many of the public auto dealers. However, analysts and executives noted these results were unsustainable in the long-term.

- Store leaders continue to take prudent and decisive cost savings measures and personnel and advertising expenses, which comprise approximately 75% of our SG&A. These actions lead to significant sequential improvements throughout the quarter. Same store adjusted SG&A to gross profit was down to 64.8% in the quarter, an improvement of 480 basis points over the prior year. […] for the month of June, our company [SG&A] to gross profit improved to 57.4%, […] significant leverage in the cost structure is attainable as we maintain discipline and look to our e-commerce and digital home solutions to provide incremental sales with lower delivery costs. […] Our stores are well aware that their largest SG&A item is personnel. The next one is advertising. […] As we move forward, the target in SG&A gross percentage is 65% which we’ve talked about for years, I think it seems a lot more attainable in the near term. -Chris Holzshu, EVP & COO, Lithia Motors

- We were 64% which I would never [have] thought we’d be in the 60s with SG&A when looking at July 77% last year. […] We see less salespeople necessary to drive the business. The same thing on the fixed side. We’re seeing better utilization of our people. […] I think advertising is moving from traditional to obviously online which obviously is less costly. -Roger Penske, Chairman & CEO, Penske Automotive Group

- We drove significant SG&A leverage through extensive cost reduction efforts, including leveraging our digital capabilities to reduce expenses across labor, advertising and discretionary spend. As Mike stated we will continue to maintain a discipline in our cost structure going forward, targeting to continue to operate SG&A as a percentage of gross profit below 69%. […] We were down about 40% in advertising year-over-year. Really driven by the environment and our digital capabilities and being far more efficient. -Joe Lower, CFO, AutoNation

Theme 4: Digital innovation requirements loom large for smaller players who lack the scale to make the necessary investments. However, online used vehicle retailers do not have the same issues inherent to new vehicle retailing for traditional franchised players.

- Suddenly, buying cars online is becoming normalized. This is a big deal. We have restrictions on where we can market our new vehicle sales service to some degree in CPO where there are no restrictions or out and out pre-owned sales. -Ernest Garcia, Founder, President, CEO & Chairman, Carvana

- I think there is a yearning in the pre-owned market for a brand that can be trusted. And scale also brings in the consumers’ mind an idea of trust. And if you really have a good experience and you stand behind the product I think that’s where the business is going to consolidate around and whether that’s Carvana, CarMax, AutoNation, Vroom, I think the big players that are branded are clearly going to take share. It’s a share consolidation in a very big ocean. That’s how I see it developing. -Mike Jackson, Chairman & CEO, AutoNation

- It’s getting tougher and tougher for smaller independent dealers to be competitive in a world where the omnichannel and scale really matters so much. -John Rickel, SVP & CFO, Group 1 Automotive

- I know there’s a lot of vibe in the market about growth and how big people can get over the years in consolidation in national branding. We have to remember that this is a franchise business. And that there’s dealer agreement with every single one of these brands and then there’s framework agreements on that. So until those documents materially change, I don’t see the massive consolidation […] Once you start having multiple rooftops of any brand beyond your dealer agreement that exists, you have a framework agreement. And within those framework agreements there are limitations and how many you can acquire in an annual season […] And for a company A to buy company B of 40-plus stores overnight would take a significant amount of work with the manufacturers to make that happen and it would be a true test of some documentations that are out there. […] We all have restrictions on where we can market our new vehicle sales service to some degree in CPO where there are no restrictions or out and out pre-owned sales. -David Hult, CEO, Asbury Automotive Group

Conclusion

Despite public auto dealership’s excitement surrounding the addition of online sales and lower SG&A expenses, key questions still remain. First, are the true costs being measured? “Omnichannel” requires both an online and in person presence. Quoting GPUs or SGA as % of gross may become muddled when trying to apportion which line item expenses are stuck in. What’s important to remember is these costs still exist, even if they seem small relative to the potential sales pickup. Digital may be more cost effective, but a full-on shift into digital for auto dealers likely sheds less cost than expected. Unless dealers plan to significantly shift their real estate strategy, it appears there are limits to how much cost can be taken out of overhead, even if advertising and personnel can be more efficient.

How long dealerships can keep advertising and personnel costs low also remains to be seen. In a period of high unemployment, people may be happy to have their jobs. If we forecast out a few years, will people remain as jubilant to continue to do the work previously assigned to more people? Technology should help reduce personnel costs, but we’re simply pointing out there are limits. And on advertising, digital is the cheaper option – for now. Digital advertising is less established but gives more insight into the successful conversion of customers. For example, how are you supposed to know if someone decided to buy because they saw your billboard? In the long-term, this could lead to higher pricing power for digital advertising platforms.

Finally, while large auto dealers have the scale to invest in digital platforms, smaller dealerships do not have such luxury. Their digital platforms may be limited to only when consumers looking to buy a specific make or model Google the closest location and head to the dealership or their website for an omnichannel experience. While these platforms may pale in comparison to larger players, it works for now. The question may become whether smaller players are forced to make commensurate digital investments. In the bear case, dealers would look to exit when deal multiples recover. For those with a more bullish view, we tend to agree with comments made by Asbury’s CEO (worth noting Asbury has the fewest dealerships of the publics). Dealerships may not want to overburden themselves with overinvesting in digital initiatives that aren’t being pushed by their OEMs. While dealers can be prisoners of the moment or attempt to “Keep up with the Joneses”, to use two puns in one sentence, we also caution it could be a risky play for dealers that step out of their lane and look to materially shift their operations online to compete with the well capitalized players in the nascent space.

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. These give insight to the market that may exist for a private dealership. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights