Q3 2021 Earnings Calls

Third quarter earnings calls across the group of public auto dealers began with similar themes from the prior two quarters: record profits and earnings, record Gross Profits Per Unit (GPU) on new and used vehicles, and tightening inventory conditions. Additionally, the public franchised dealers continue to post large scale improvements in SG&A expense as a percentage of gross profit or revenues.

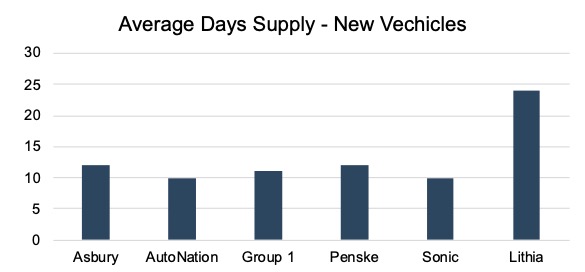

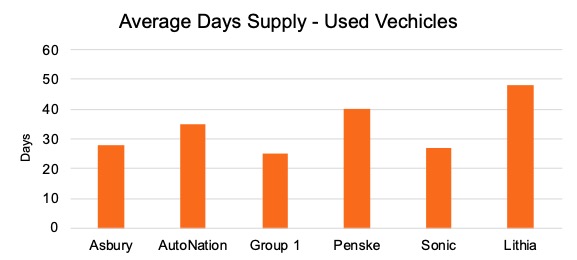

Supply chain disruptions caused by the microchip shortages continue to impact inventory levels on new and used vehicles for all auto dealers. The public auto dealers are not immune from these conditions as well. Average days’ supply for new and used vehicles for the six public auto dealers as of September 30 are as follows:

We have focused previous blogs on the conditions impacting new and used vehicles and their contribution to overall profitability. While those themes still existed for the Q3 earnings calls, we will focus on other areas of profitability for the public auto dealers, including Fixed Operations and Finance and Insurance (F&I). Additionally, the M&A market for the entire industry continues to accumulate transaction volumes at record levels. While much has been discussed regarding the pricing of those transactions in terms of multiples paid and which historical earnings to consider for ongoing performance, we will discuss some of the other factors public executives consider when making acquisitions.

Will inflation be the next disruptive force to impact the auto dealer industry as we close out 2021 and head into 2022? Find out how public executives view inflation to the auto consumer and how that might affect new and used vehicle transactions.

Finally, we will examine some of the themes and performance enhancements that public auto dealers continue to experience from the digital and omnichannel platforms outside the obvious digital transactions of new and used vehicles.

Theme 1: Public auto dealers report improvements in Fixed Operations and Service stemming from recovery in vehicle miles driven post-pandemic. Customer pay has continued to improve while collision work has lagged.

- “Consumers are approving more work than they had in years past, and they’re spending more dollars per order […] We do see more opportunity to be more digital and be more engaged and transparent with the consumer […] and mainly our source is text messaging. We’re communicating through text message.”

– David Hult, President & CEO, Asbury Automotive Group - “The strong areas, obviously being areas of customer pay have continued to perform well versus both 2020 and 2019. The one area that continues to be a little bit of a laggard is collision, we do anticipate as miles continue to improve that will fully recover.”

– Joe Lower, Chief Financial Officer, AutoNation - “Our customer pay continues to ramp -up following a very strong first half of the year with 19% same-store dealership gross profit growth compared to the third quarter of 2019 […] despite continued headwinds in warranty and collision, both of which we believe will reverse in time.”

– Daryl Kenningham, President U.S. and Brazilian Operations, Group 1 Automotive - “Our service and parts […] it’s a huge tailwind for us. Our warranty was only off 9% […] our customer pay was up 21%”

– Jeff Dyke, President, Sonic Automotive

Theme 2: Public executives report strong results in the F&I department fueled by escalating transaction prices and low-interest rates. The lower volume of new vehicle units retailed is also affecting the mix of F&I revenue as penetration from product sales is outpacing warranty and reserve components.

- “Our strong, consistent and sustainable growth in F&I delivered an increase of $155 to $1,955 per vehicle retail from the prior quarter […] We like the fact that 70% of our F&I number is product sales and only 30% is reserve […] [regarding our recent acquisition] Larry Miller group has better penetration numbers than we do. So we’re certainly excited to learn from them and grow as well.”

– Dana Clara, SVP of Operations, and David Hult, President & CEO, Asbury Automotive Group - “The real driver for us [on F&I] has been increased penetration […] about two-thirds of F&I for us comes out of product versus financing.”

– Joe Lower, Chief Financial Officer, AutoNation - “22% increase in F&I income […] The adjacency that we are furthest along with is Driveway Finance or DFC […] Driveway Finance earns three times the amount earned than when we arrange financing with a third-party lender […] Driveway Finance can penetrate 20% of our financed retail sales.”

– Bryan DeBoer, President & Chief Executive Officer, Lithia Motors

Theme 3: Supply chain disruptions have affected all industries including the auto dealer industry. Executives are watching how inflation and rising interest rates might impact the purchase of new or used vehicles in the coming months.

- “We’re watching inflation and the CPI […] what they’ve missed is the consumers are very happy with that pre-owned valuation that they own, that the 275 million vehicles on the road in America are worth more. That has made the consumer happy, not unhappy […] so once you see the other side of the coin, that consumers are not unhappy with this, they don’t consider it inflation [….] [consumers say] oh I made a pretty good investment […] it’s worth more. And if I want to sell it, I can get a nice check. And if I want to trade it, I have a reasonable difference. As soon as you realize that the consumer doesn’t view that as inflation, but as a win for them, then you understand our optimism and our confidence about the future of automotive.”

– Mike Jackson, Chief Executive Officer, AutoNation - “I don’t think there’s any doubt that inflation is a business factor […] I don’t think we can call it transitory or anything like that […] the costs are going to go up on everything, but the affordability of vehicles is more dictated by retail financing and leasing. And with high used car values, and low interest rates, I don’t see this inflation raining on the vehicle sales parade in the foreseeable future.”

– Earl Hesterberg, Chief Executive Officer, Group 1 Automotive

Theme 4: M&A continues to dominate headlines. 2021 will see more transactions than any year in recent history.

- “I think fragmentation provides an opportunity for consolidation. With the investment required today, I think there’s a number of smaller dealerships that will become available. I think the deals that we see, the bigger deals are expensive. And many of them require CapEx and also then would provide some input from the standpoint of framework agreements with the manufacturers.”

– Roger Penske, Chairman and Chief Executive Officer, Penske Automotive Group - “So we visited all of the RFJ stores […] the entire management team is coming along for the ride […] we kind of walk into one of their stores and if feels like a Sonic store, they run their playbooks very similar to us. […] They are a fantastic leadership team. […] This is a perfect fit for us.”

– Jeff Dyke, President, Sonic Automotive - “[Regarding the Greeley Subaru, Kahlo CDJR, and Arapahoe Hyundai announced transactions] The brand mix is about 50% luxury and then mostly, import with one domestic store as well. It’s a really a very strong group with the right brand mix in a market that we’ve been trying to grow.”

– David Hult, President & Chief Executive Officer, Asbury Automotive Group

Theme 5: Digital/omnichannel advancements are happening to meet consumer demands and enhance the retail experience. Improvements consisted of more than just unique digital visitors and increased online transactions. Improvements include average deal time, used vehicle procurement, headcount efficiency, and the ability to serve consumers with all credit scores.

- “I think the reason you are seeing higher credit scores and higher down payments on the tool [Clicklane] is it’s simplistically someone with a 750-Beacon score understands that they’re not worried about financing and understands that they can get what they want […] [we] certainly see [sic] lower credit scores as well on there […] there’s a broad mix, but again, the score average is certainly higher.”

– David Hult, President & Chief Executive Officer, Asbury Automotive Group - “We’ve demonstrated that we can operate the business at a lower relative cost than was done historically in large part by the deployment of digital tools that are making our sales and service associates far more effective […] we’ve been able to continue to operate with 3,000 plus fewer heads within the store environment on a same-store basis year-over-year.”

– Joe Lower, Chief Financial Officer, AutoNation - “We’ve increased the productivity of our salespeople by 30%, pre-Covid versus today […] selling 13 or more units a month instead of 10 […] nearly 40% of our customers are scheduling appointments online these days”

– Earl Hesterberg, Chief Executive Officer, and Daryl Kenningham, President of U.S. and Brazilian Operations, Group 1 Automotive - “The average Driveway consumer is averaging exactly 50 points lower on their FICO scores. So there are 671 versus 721 in Lithia […] We did finance a higher percentage of customers in Driveway at 75% and only financed 67% of Lithia customers.”

– Bryan DeBoer, President & Chief Executive Officer, Lithia Motors - “Omni-channel is just not selling vehicles. You think about service appointments, online payments – that is key.”

– Roger Penske, Chairman and Chief Executive Officer, Penske Automotive Group - “EchoPark is all about buy the car, transport the car, recon the car, merchandise the car and moving like 12 days to getting on the frontline, it’s gone […] EchoPark model is a one-to-five year old model under 60,000 miles”

– Jeff Dyke, President, Sonic Automotive

Conclusion

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. These give insight into the market that may exist for a private dealership which informs our valuation and litigation support engagements. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights