Analyzing the Relationship of Rent and Real Estate Values in Dealership Acquisitions

The Opposite, Break-Even or Something In-Between?

My favorite TV show is Seinfeld. It’s seemingly about nothing, but the situations and characters still resonate today.

One of my favorite Seinfeld episodes is “The Opposite.” A brief (and incomplete) summary of the episode: George decides to turn his life around by doing the exact opposite of what he would usually do, and finally finds success, while Jerry keeps breaking even in life. Jerry marvels how things always just even out for him.

What does this have to do with auto dealer valuations and the relationship of rent and real estate values in dealership acquisitions? In this post, we examine if the rent factor and value of the real estate all even out, just as Jerry Seinfeld’s character did in “The Opposite.”

The Impact of Rent and Real Estate

Often dealership operations are organized in two entities: an entity holding the underlying real estate and an entity containing the dealership operations. We have chronicled the importance of normalization adjustments in the valuation process of the dealership operations including an assessment of rent. Since these entities are often owned by related parties, the level of rent should be examined.

Dealers that own both the real estate entity and the dealership operations entity can control the amount of rent charged. Hypothetical buyers will assess the market rental rate and make adjustments to the valuation to keep this in line with the market.

An Example

Why would dealers want to shift value and/or rental income to the real estate entity? Let’s examine this through an example highlighting increasing real estate values and one highlighting decreasing real estate values.

Real estate is valued based upon a return of Net Operating Income. In our example, we assume a constant capitalization rate of 8% or a capitalization factor of 12.5x the rental income. In our example, this capitalization factor, or multiple, is higher for the real estate than the Blue Sky multiple of 6x, so the impact of the value of the real estate will have a greater impact on the overall acquisition value. Since Blue Sky multiples average around 6x, and range generally between 3-10x this will typically be the case. Fortunately or unfortunately, auto dealers cannot manipulate the underlying value of the real estate itself. Most, if not all auto dealership acquisitions will require a fair market value appraisal of the underlying real estate.

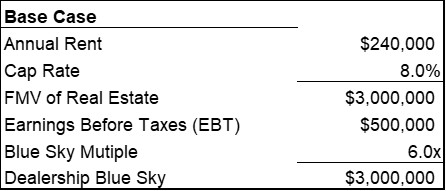

Based on the assumptions above, the dealership operations would have a value of $3,000,000 (EBT of $500,000 times a Blue Sky multiple of 6x) and the real estate would have a value of $3,000,000 for a total acquisition value of $6,000,000 as seen below.

Appreciating Real Estate Values

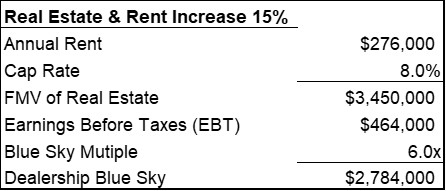

In times of appreciating real estate values, let’s assume the fair market value of the real estate increases by 15% to $3,450,000. If annual rent is kept at a constant capitalization rate of 8% with more of a long-term view, annual rent would increase to $276,000 and the resulting increase in rent would decrease normalized earnings to $464,000. While the real estate value climbs, the implied blue sky value for the dealership operations declines slightly since earnings are lower due to increased rent. However, the overall total acquisition value (operations + real estate) would increase by 4% ($6,234,000 vs. $6,000,000), despite the 7% decline in blue sky value as seen below.

Depreciating Real Estate Values

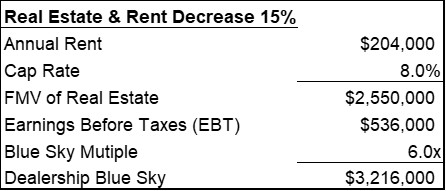

Now let’s examine the alternative where real estate values are declining. Let’s assume that the fair market value of the real estate declines by 15% to $2,550,000. If annual rent is kept at a constant capitalization rate of 8% with more of a long-term view, annual rent would decrease to $204,000 and the resulting decrease in rent would increase normalized earnings to $536,000. While the real estate value declines, the implied blue sky value for the dealership operations increases since earnings are higher due to decreased rent. However, the overall total acquisition (operations + real estate) would decrease by 4% ($5,766,000 vs. $6,000,000) despite the 7% increase in blue sky value seen below.

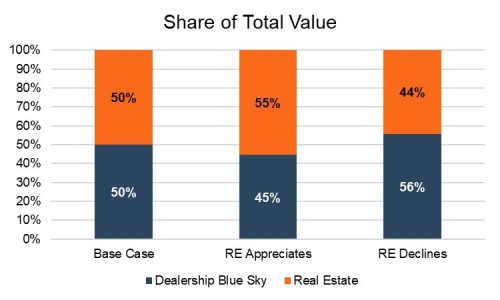

For comparative purposes, we can also view this graphically:

Seen differently, a 15% increase in FMV rent with no change in the cap rate of blue sky multiple shifts approximately 5% of the total value to the real estate. About the opposite is true for a 15% decline.

Conclusions

The relationship between rent and fair market value of the real estate has an impact on the components of an auto dealer acquisition. While the impacts may be opposite and felt on both sides of the two entities, the impact on the real estate can have a greater effect given lower capitalization rates and/or higher capitalization factors than most implied blue sky multiples.

Back to the Seinfeld episode, does the rent factor and value of the real estate all even out? While a decrease in annual rent will materialize in a greater implied blue sky value all other things held constant, the total effect would not mitigate a corresponding decline in real estate values.

While auto dealers that own both the dealership operations and the real estate can control the charged rental rates, they cannot influence the ultimate value of the real estate. Frequently, the rent paid by a dealership is either higher or lower than true market rent as dealers are more concerned with running the day-to-day operations of their business than trying to pinpoint rental cap rates. A proper valuation of the dealership operations will assess and adjust the charged rental rate to reflect the perceived fair market value of the real estate.

To discuss the impact of the rental rate or for an assessment of the valuation of your dealership operations, contact a professional on Mercer Capital’s Auto Team.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights