Return to Status Quo or a New Normal?

Auto Leasing Trend Update

Consumers are typically faced with two options when considering their next vehicle transaction at the dealership: buying an automobile or leasing one.

Leasing a vehicle has historically been a popular option for nearly one-third of drivers, as leases typically offer lower monthly payments and the opportunity to drive a vehicle that otherwise might be out of their price range. This is why auto leasing can be described as “optimizing for lifestyle” as opposed to “optimizing for value.” Other upsides to leasing include driving a vehicle during its most trouble-free years, incentives like free oil changes, fewer headaches related to trade-in value, and tax advantages for business owners.

On the flip side, leasing a vehicle has some drawbacks. For example, lessees are left with no equity value in the vehicle at the end of the lease term, and there are typically mileage restrictions in the contractual terms of an auto lease.

Decline in Leasing — A Shift in Consumer Behavior During 2022

According to the Wall Street Journal, the percentage of Americans in 2022 who leased new vehicles dropped to the lowest level since the Great Recession in 2009, averaging about 16% of overall retail sales in the second half of the year. This is roughly half of what it was before the pandemic. The downturn in leasing can be attributed to the industry’s persistent inventory shortage, higher interest rates, and lower leasing incentives from auto manufacturers. Simply put, leasing has become much more expensive, and lease offers are less favorable than they once were.

We think that affordability issues have eliminated buyers from the market. Potentially returning lease customers may not have returned at all, opting to buy their vehicle at the end of the lease term due to nationwide growth in used vehicle values during the pandemic. While the option (not the requirement) to purchase at the end of a lease term is a nice feature that has long been part of the lease vs. buy equation, increased purchases make these leases look more like outright purchases. On top of that, (according to Forbes) consumer sentiment has changed considerably throughout the pandemic. The idea of returning to the dealership every two or three years to obtain a new car, truck, or SUV may be falling out of favor.

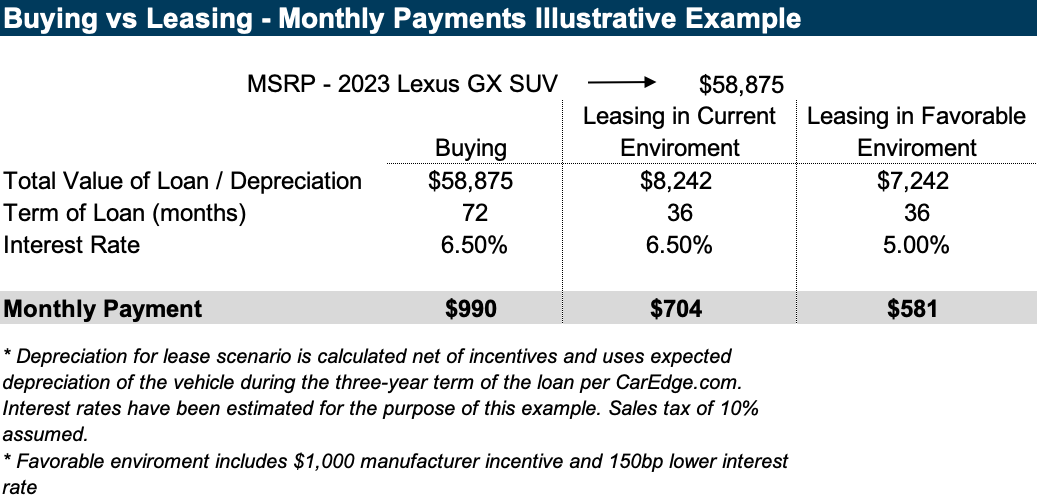

It is worth noting that leasing a vehicle is still cheaper than buying one. See the illustrative example below for a look at the differences in monthly payments between buying a vehicle, leasing a vehicle in the current environment, and leasing a vehicle in a more favorable environment. These calculations are based on depreciation estimates from caredge.com and a lease payment calculator from bankrate.com.

This shift in consumer behavior in leasing departments around the country is notable to both auto dealers and manufacturers. For example, Jaycie Dane, GM of sales operations for Toyota Motor Corp.’s Lexus division in North America, stated that “the cycle is definitely out of cycle” in January 2023. If we look at Lexus sales in late 2022 as an example, leases accounted for 20%-25% of sales, compared to pre-pandemic highs of around 40%. Likewise, according to a statement by Jeff Dyke, president of publicly traded auto retailer Sonic Automotive, “The pandemic has disrupted the [leasing] ecosystem, and we need to get it back on track.”

Leasing Activity Shows Signs of Recovery in 2023

The industry’s decline in leasing somewhat reversed itself in 2023. J.D. Power reported that leasing is expected to account for 22.4% of retail sales this month, up significantly from 16.4% in November 2022 but still well below November 2019, when leased vehicles made up 30% of all new-vehicle retail sales. This can be attributed to improved inventory availability and relative stability in new vehicles’ average transaction price.

As vehicles continue to fill dealer’s lots and the nationwide inventory balances recover, dealers and manufacturers are probably wondering what comes next for auto leasing. Will the recovery persist? Can we expect a return to around 30-40% of total retail sales as leases?

At Mercer Capital, we expect auto leasing to follow many other trends within the industry, including a continued recovery and an expected proportion of leases modestly below pre-pandemic levels (somewhere between 25-30% of total retail sales). This will likely be supported by persistently high average transaction prices for new vehicles and fewer consumers returning to the lease market after making long-term purchases over the last two years.

How Does This Affect Auto Dealerships Moving Forward?

Leasing vehicles to consumers provides a lot of value to auto dealers and manufacturers, as leasing supports brand and dealership loyalty when lessees sign their next lease with the same dealer. Furthermore, auto dealers rely on lease terminations as a source of late-model used vehicles to support their used vehicle inventory. Dealer profit is typically higher on lease transactions due to using a “money factor” rather than a stated annual interest rate in contract negotiations. Most dealers can mark up the money factor above the effective interest rate provided by the financing company and get money back from the leasing company to contribute to gross profit.

Going forward, dealers should focus on their incentives, marketing, and sales efforts in their leasing departments. While the spike in used vehicle prices is unlikely to repeat in future years, it certainly provided a boon to those who leased before the increase in values, so highlighting this benefit may improve lease penetrations.

There will always be a market for leasing, and dealers will need to find the consumer demographics they can focus on. For example, dealers could look at whether their specific brand lends itself to individual or corporate lessees and structure their marketing and sales efforts toward the most likely consumer. We know luxury vehicles tend to have stronger leasing penetration, but geographical markets also play a role. If incentives, marketing, and sales are done well at a dealership, the leasing department should be able to fill its crucial role going forward.

Conclusion

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights