State of the Industry From the Tennessee Automotive Association Convention

Musings From Mercer Capital’s Music City Office

Last week we attended the Annual Tri-State Convention for the Automotive Associations of Tennessee, Mississippi, and Alabama. The event provided a great opportunity to discuss trends in the automotive industry with industry participants and dealers from different manufacturers and geographic areas. In this post, we discuss some of the trends discussed last week, including a variety of topics that we have covered before in this space. We also incorporate highlights of a presentation from noted industry analyst Glenn Mercer (no affiliation with Mercer Capital) regarding the “Dealership of Tomorrow.”

Supply and Pricing

As the last few publications of the monthly SAAR figures (April and May) have indicated, the production of new vehicles by auto manufacturers and suppliers to auto dealerships continues to be impaired by a variety of economic factors.

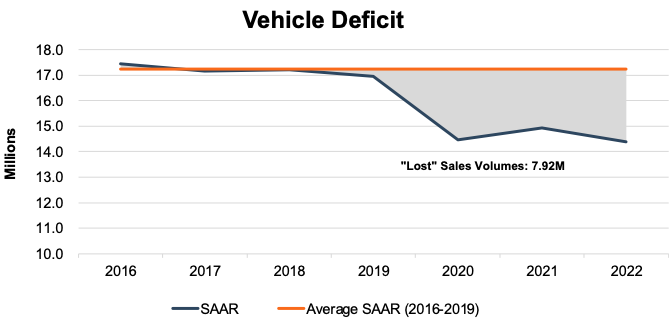

In fact, analysts from Cox Automotive have recently tempered 2022 estimates of new vehicle sales to 14.4 million units, from their original estimate of 15.3 million units. The average annual SAAR for 2016 through 2019 was approximately 17.2 million units. Using this figure as an estimate of the average demand in the United States, the lost sales caused by COVID-19, the microchip crisis, and continuing production issues will total approximately 7.9 million units from 2020 through estimates for 2022.

Even if auto manufacturers are able to scale production back to pre-COVID levels plus some excess to account for this pent-up demand, full recovery and stabilization could take 3-4 years.

Glenn Mercer forecasts that annual demand should continue at the 17 million unit average through 2030. While we find this reasonable, we plan to delve into this topic further in a future post.

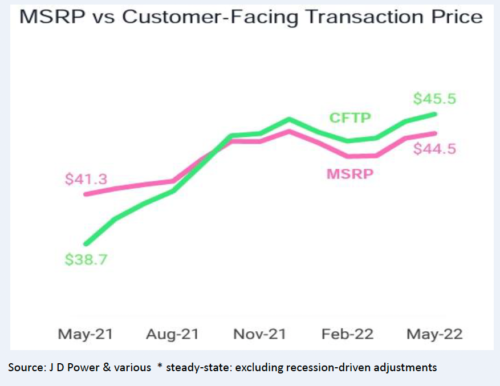

With demand exceeding supply for the last several years, auto dealers have continued to capitalize on higher margins for new vehicles. According to Cox Automotive, the average transaction price for new vehicles climbed to $47,148 in May 2022. One byproduct of these trends is that some auto dealers have been able to sell new vehicles for a higher price than the manufacturers’ suggested retail price (“MSRP”).

As the following chart indicates, the average customer-facing transaction price has exceeded the MSRP for the same vehicles since the fall of last year.

The question on most dealers’ minds that we spoke with is how long are these trends sustainable? With the rising costs of vehicle transactions coupled with general inflation and rising gas prices, how long will consumers be able to afford new vehicle purchases at these levels?

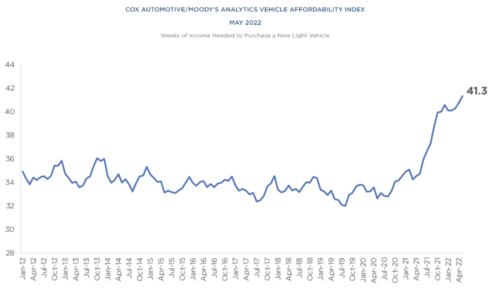

As the chart below indicates, the median number of weeks of income needed to purchase a new light vehicle has risen dramatically to 41.3 weeks in April 2022, fluctuating between 32-36 weeks for the prior decade. This figure will probably continue to climb as average transaction prices rose in May and are expected to climb again in June.

Click here to enlarge the image

Demographics of Number of Dealerships and Owners

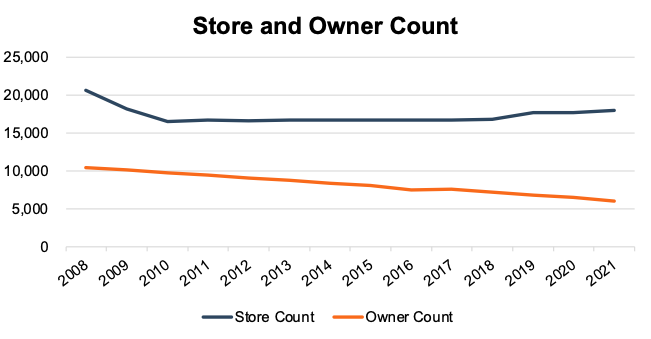

With all of the headlines of heightened transaction volume in the auto dealer M&A market and increased activity and investment by the public auto groups, we find two charts from Mr. Mercer’s presentation to be informative, which we have attempted to combine for comparative purposes: store count and owner count.

We have written numerous times about the resiliency and adaptability of auto dealers and the entire automotive industry during challenging economic times. Despite the challenges, the number of auto dealerships or stores in the United States has remained relatively stable at around 18,000 since 2009.

While store count has largely remained unchanged, consolidation has occurred in the owner count. Factors contributing to the decline in the number of owners include the retirement of aging owners, increased size and profitability of the average dealership, and the aforementioned activity and appetite for acquisitions by the public and larger auto groups.

The following chart displays the declining owner count from its previous high of just over 10,000 in 2008.

While we expect there may be further industry consolidation, conventional wisdom is that this reduction will continue to come in the form of fewer owners than fewer stores. However, as we discussed with Tony Karabon in a recent post, ownership counts may not continue this downward trajectory with the appetite displayed by first-time buyers.

Auto dealerships are attractive investments, and many dealers offer a minority equity stake in dealerships as part of the compensation package for GMs. We’ll be curious to see how this trend evolves because regardless of who owns the dealership and how many they own, someone still has to run each one. And after you own a piece of an attractive investment, you tend to want one all for yourself.

While larger groups benefit from their scale, there are limits to how large OEMs will allow their dealers to grow, and there is an appetite from smaller buyers looking to get involved.

Future Impact of Fixed Operations on Auto Dealerships

Another hot-button topic discussed at the Conference was the continued speculation that OEMs might shift to an agency model or direct sales to consumer model, which could decrease the auto dealers’ portion of profits from new vehicles. In some discussions, the auto dealers’ participation might shift to a delivery center whereby the dealer would receive a delivery fee if the customer selected that particular dealership to pick up their new vehicle.

These changes could lead to physical changes at a dealership if there are no longer requirements to house and showcase new vehicles. If costs can be removed from the sales and distribution model and shared in a mutually beneficial way, it may not be the worst thing for dealers, though most are reasonably skeptical.

Regardless of the prospects of a changing share of new vehicle profits, dealers would be wise to refocus on their fixed operations, specifically parts and services. Fixed operations have historically been a stabilizing segment for successful dealers. Even with heightened vehicle sales profitability, fixed operations remain the highest margin for a typical dealership, though their contribution to total gross margin has declined with higher GPUs.

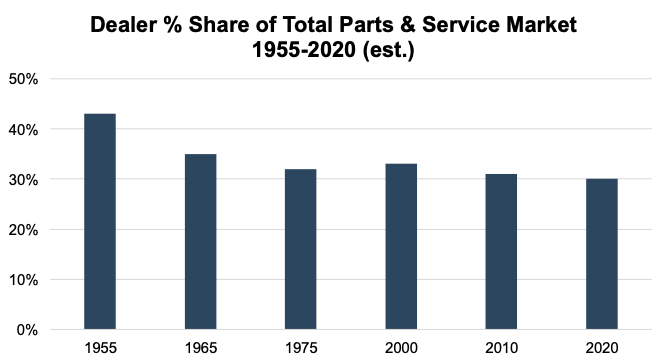

One trend lost in the shuffle of higher profits is that auto dealers’ percentage of the total parts and service market has actually eroded over time to independent and after-market repair centers. These alternative options have climbed in recent years, and consumers often cite their convenience and reluctance to the dealership experience as reasons for their selection.

The following chart illustrates that dealerships’ total parts and service market percentage has generally declined since 1955, hitting an all-time low of approximately 30% in 2020.

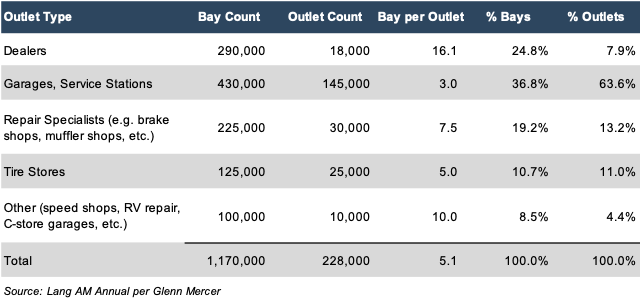

The bay and outlet count of the various types of parts and service outlets are as follows.

Dealers should strongly consider offering some versions of mobile service or potentially satellite locations to mitigate the locational and convenience factors of the aftermarket alternatives in an attempt to recapture some of this market and high-margin business.

And if the industry moves more toward an agency model, there may be fewer bad memories from the purchase experience that could negatively impact the likelihood of capturing after-sales work. We can even envision a situation where OEMs do more to push consumers back to the dealers for service work in order to make up for a decreased role in the sales process.

In the transport refrigeration business, it is more difficult for consumers to get repairs from non-dealer repair shops. With increasingly complex light vehicles with all the microchips being used and features being added, it’s possible service and repair work will naturally shift back towards auto dealers.

Electric Vehicles

The other widely discussed topic continues to be electric vehicles (EV). Industry participants all have their predictions based on early adoption rates, government subsidization, and other factors. While adoption rates are still relatively low, (EVs are ~5% of the market), Mr. Mercer predicts this penetration figure could reach 8% by 2025, but full-scale adoption could be years off.

The agency model discussions above have really picked up due to EVs. On the face of it, the sales method doesn’t depend on the vehicle’s powertrain, whether an internal combustion engine (ICE) or EV.

While adoption remains relatively low, there is a clear stratification in the marketplace as current EV buyers tend to come at the upper end of the market. These buyers are less likely to have low credit scores, have negative vehicle equity on their trade-ins, or have any other complications that generally push would-be online car buyers to the dealership for more help in the sales process. These buyers are also generally willing and able to pay for this convenience, so a top-down approach from the manufacturer to sell vehicles to this top end of the market makes more sense than the franchised distribution model utilized when sales become more complicated.

Political Considerations of Electric Vehicles

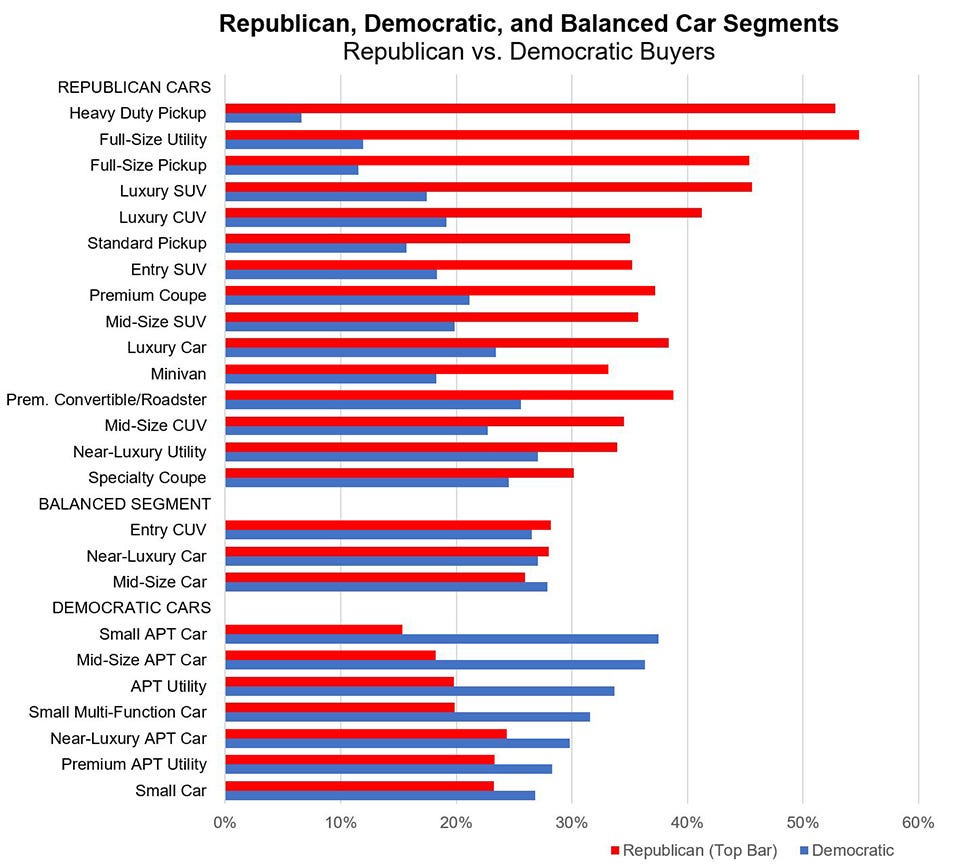

One factor impacting the adoption of EVs may be politics. As seen from the survey conducted by Strategic Vision in 2020, more Republicans purchase trucks and SUVs, while more Democrats have historically purchased alternative powertrain vehicles (APTs), including hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs).

It will be interesting to monitor the success of Ford’s Lightning (which recently had a recall for low tire pressure warnings) and other EV truck offerings to see if they break these political buying trends and lead to quicker adoption of EVs.

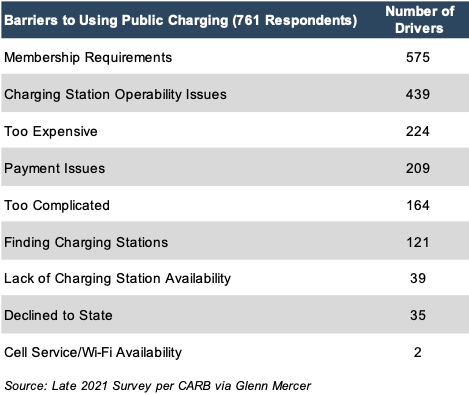

Other constraints against EV adoption have also been the battery life and difficulties with public charging stations. While the entire infrastructure of public charging stations would need to be built out with the continued adoption of EVs, consumers currently list the following barriers to their experience in areas where more charging stations currently exist, such as San Francisco: membership requirements, operability issues, price, payment issues, and locating a convenient charging station location.

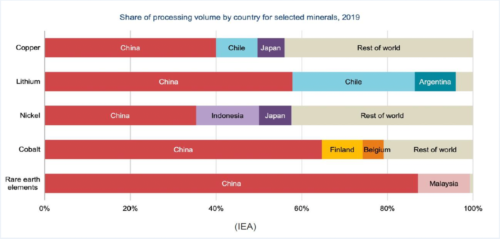

Full-scale adoption of EVs can also lead to other geopolitical factors. Just as the Russia-Ukraine conflict has made us aware of the industry’s dependence on Ukraine as a chief exporter of neon that is used in the production of microchips, many of the components in the batteries for EVs are exported from China. The following is a list of some of the key battery components and the share of processing volume by country in 2019:

Click here to enlarge the image

Conclusions

The recent Tri-State Convention (Tennessee/Alabama/Mississippi) provided a great forum to discuss current trends in the auto dealer industry and predictions for the future. It’s informative to hear how individual dealerships are confronting their own unique challenges.

All of the trends/factors discussed in this post will continue to impact the operations of dealerships and, ultimately, their profitability and valuation. We thank Glenn Mercer for his informative talk and him allowing us to reproduce many of the graphics in this post.

Mercer Capital provides business valuation and financial advisory services, and our auto team assists dealers, their partners and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your auto dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights