Toyota’s Steady State Battery

Breakthrough or Yet Another Long-Dated Production Target?

In early July, Financial Times reported Toyota’s solid-state battery breakthrough. According to Keiji Kaita, president of Toyota’s research and development center for carbon neutrality, the goal is to cut the size, weight, and cost of both liquid and solid-state batteries in half. In this post, we get into the details of this report, what auto dealers should know about solid-state batteries, and provide some context for realistic expectations. For consumers, we don’t recommend delaying your vehicle purchase by four years based on this news.

Toyota’s Announcement

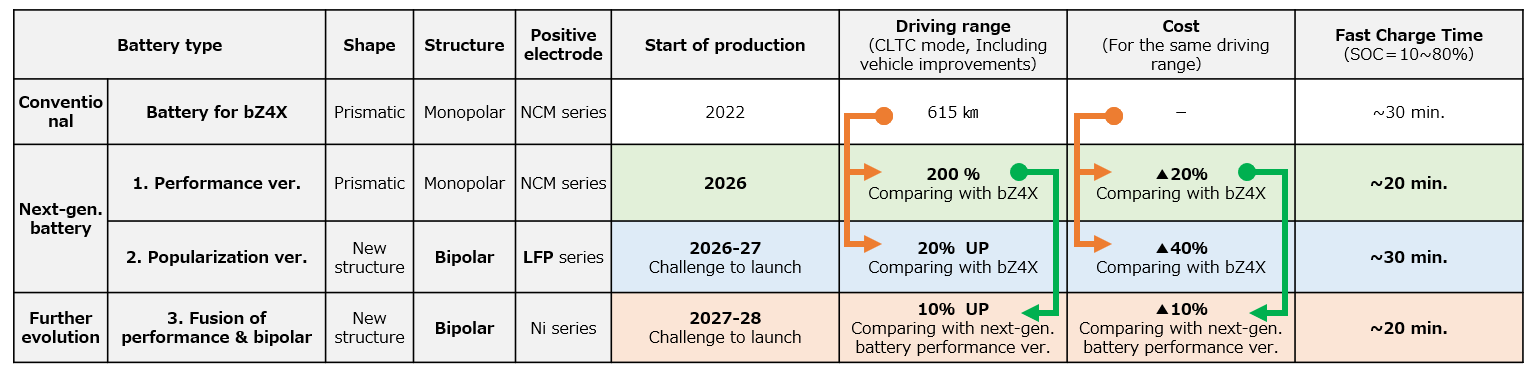

Toyota announced it had discovered ways to address durability issues in solid-state batteries, delaying the technology. The company is now confident it can mass-produce EVs with solid-state batteries by 2027 or 2028. According to Toyota’s claims, this “technological breakthrough” allows an EV to have 750 miles of range in just 10 minutes of charging time, a significant improvement to models on the market today. The current longest range EV is the Lucid Air, with a range of 516 miles, and 80% of its battery can be recharged in 46 minutes. While Toyota was a trailblazer in the hybrid space, Toyota’s only fully-EV model is a mid-size SUV, the bZ4X which was only introduced last year. The manufacturer plans to add to its lineup as demonstrated in the following graphic:

Click here to expand the image above

What Is a Solid-State Battery?

Solid-state batteries replace a liquid electrolyte with a solid material, and the anode is made of lithium instead of graphite. Industry experts have indicated that solid-state batteries are the most promising technology to fix the most prominent issues with EV batteries: how long the car can drive on a single charge and how long it takes to recharge. Solid-state batteries may also reduce safety concerns.

Because these batteries have high energy density, they have a higher capacity, delivering more energy with the same or less materials. This should help reduce costs, as batteries are the costliest input in EVs. High cost has been a primary reason EVs have largely been constrained to luxury models, but improvements in this area could increase mass market appeal. All this should also reduce the environmental impact, which was the goal of EVs in the first place:

However, it requires 35% more lithium to make these batteries. Others have noted that increasing needs for lithium is a non-trivial concern, particularly considering the carbon emissions required to extract lithium, though solid-state batteries also use far less cobalt and graphite when compared to current battery tech. If this technology is the breakthrough that Toyota claims, then lithium will become increasingly important in the geopolitical landscape. A professor of business economics at the University of Birmingham (England, not Alabama), David Bailey, offered the following quote on the topic:

“Often, there are breakthroughs at the prototype stage by then scaling it up is difficult. If it is a genuine breakthrough, it could be a game changer, very much the holy grail of battery vehicles.”

Don’t Hold Your Breath

While Toyota’s announcement was hailed by many as a major breakthrough, the article is clear to point out that their expectations were more ambition than concrete promise. Further, others have noted that Toyota has been working on this since 2012, with numerous headlines making similar promises in the past:

- “Toyota’s Quick-Charging Solid-State Battery Coming in 2025” by caranddriver.com in July 2020.

- “Toyota’s New Solid-State Battery Could Make its way to cars by 2020” by techcrunch.com in July 2017, which cited a WSJ article.

- “Toyota to Offer High Performance Solid-State Batteries in 2020” by autoevolution.com in December 2014.

In 2014, the liquid electrolyte was to be replaced by a solid ceramic polymer electrolyte. The update in 2017 did not provide further clarity on the materials to be utilized in the solid-state version other than the continued utilization of lithium. In 2020, Mr. Kaita, then EVP of Toyota’s powertrain company, indicated the company had a working prototype, but the potential had not been harnessed due to safety and durability issues, specifically that solid-state batteries tend to fail after repeated charging. This is in part due to the formation of dendrite, which occurs during the charging process and has been more of an issue for solid-state batteries than liquid versions.

Naysayers will point out that Kaita has been promoting breakthroughs for years without anything to show for it. Kaita, however, acknowledged that Toyota isn’t very good at promoting its technology until it’s commercially applicable. He indicated that the early breakthroughs 3 years ago (discussed in his 2020 statements above) were still far from commercialization due to the durability issues but that he now has confidence this has been resolved.

Toyota has lagged behind its peers in terms of EV adoption, which is viewed as either positive or negative depending on your stance on the issue. In fact, the former CEO Akio Toyoda is no longer at the helm in part due to his slow approach towards EVs. His stance was informed in part by his famous quote, “carbon is the enemy, not the internal combustion engine.” Toyota spent years asserting that all-electric vehicles were inferior to gas-electric hybrids as well as hydrogen fuel cells. The new CEO will be less focused on hydrogen combustion engines and will be pushing electrification.

From an auto dealer perspective, Toyota dealers are heavily favored with high Blue Sky multiples in part because the company hasn’t gone all in on electric. Contrast this to manufacturers who require significant investments to sell EVs before fully proving the market demand for the products. Toyota’s approach, whether grounded in preferred battery technology or economic viability, has been beneficial to auto dealers so far. However, if Toyota isn’t able to be a meaningful competitor in what is likely to become an increasingly large share of the market, it could end up being left behind.

Conclusions

Mercer Capital provides business valuation and financial advisory services, and our auto team assists dealers, their partners, and family members in understanding the value of their auto dealerships and related entities. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights