Understanding the Asset Approach

What Is It and How Is It Used for Auto Dealer Valuations?

Everyone in the auto dealer industry has likely heard of Blue Sky values. Under the market approach, valuation professionals add the indicated Blue Sky value to the dealership’s tangible net asset value. This is where the asset approach comes into play.

A dealership’s tangible net asset value is developed using the asset approach to valuation. This post aims to provide a detailed breakdown of how to make the appropriate adjustments to what’s reported on the first page of the dealer financial statement. We have included general commentary on the asset approach to value as well as auto-dealer-specific thoughts on each of the asset classes/adjustments below.

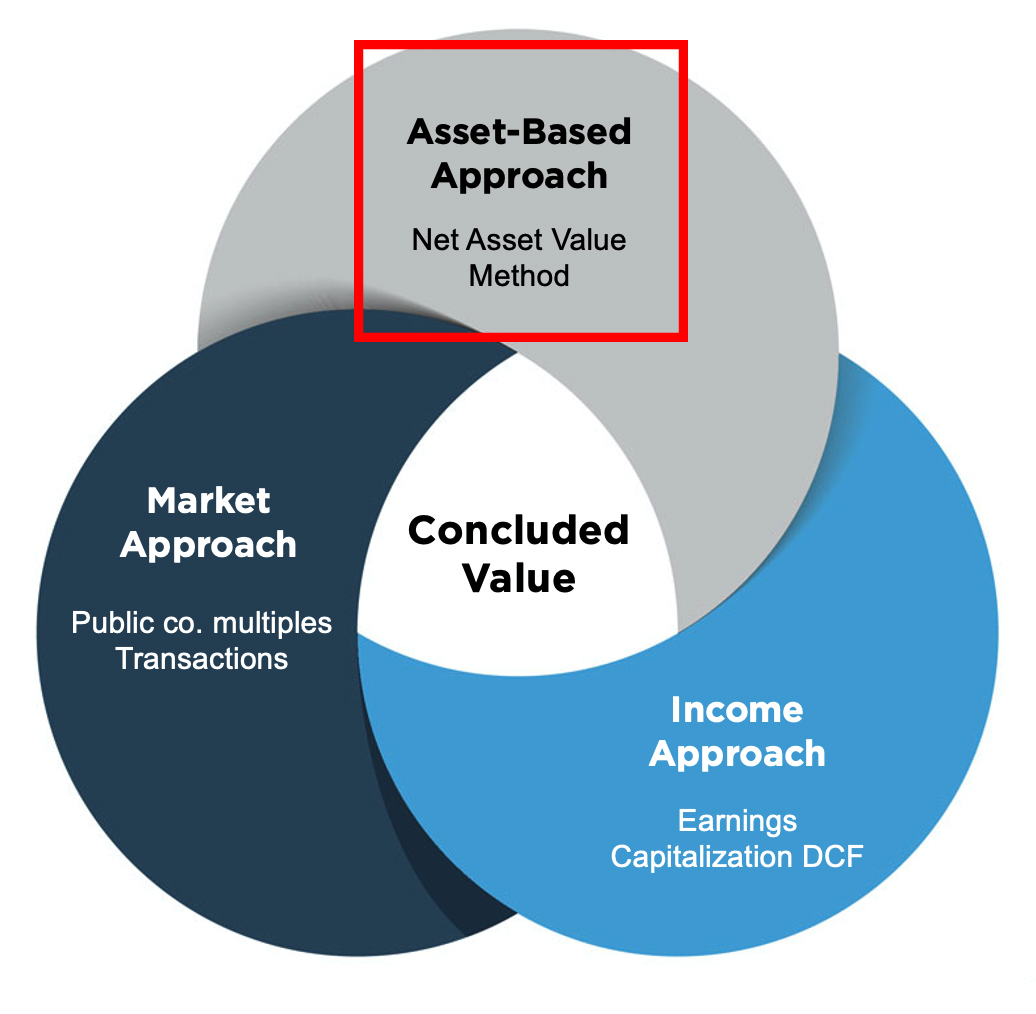

What Is the Asset Approach?

The asset approach refers to methodologies used under the economic principle that the value of a business can be viewed as an assemblage of net assets. In practice, appraisers begin with the company’s balance sheet, which lists the assets, liabilities, and equity. The values shown on a company’s balance sheet are the “book” or reported values of the assets and liabilities based on accounting standards. Furthermore, asset values typically reflect the price paid for the assets or the “cost basis.” As such, these book values may or may not align with current market values. The appraiser will analyze the assembled assets and liabilities and adjust values (as needed) to reflect market value. The market value of the company’s liabilities is then netted against the market value of the company’s assets to arrive at a Net Asset Value of the business.

Asset Classes and Typical Balance Sheet Adjustments

Generally, the identifiable assets fall into the following categories: Financial Assets (cash and receivables), Inventory, Tangible Real Property, Real Estate, Intangible Assets, and “Other” or commonly Non-Operating Assets.

Financial Assets

Financial assets include cash and highly liquid investments like marketable securities, accounts receivable, and prepaid expenses. This asset class is typically the most straightforward, as the book values of cash and receivables usually require no adjustments to reflect market value. Some receivables may be aged, but this is less of a concern than in other industries.

Inventory

It is common for auto dealerships to report the value of their new and used vehicle inventories on a last in, first out (“LIFO”) basis. Under the assumption that new vehicle values appreciate over time, LIFO accounting allows the dealership to reduce the value of their inventories and pay fewer taxes. General valuation theory calls for inventories to be restated on a first in, first out (“FIFO”) basis. The FIFO adjustment affects both the balance sheet and the income statement. On the asset side of the balance sheet, we add the LIFO reserve amount to the reported LIFO inventory, raising the value of the inventory. Liabilities also increase due to the additional taxes paid on a FIFO-equivalent inventory, calculated as the LIFO Reserve multiplied by the corporate tax rate.

Working Capital Adjustments

For auto dealerships, financial assets and inventory are the two primary components of a dealership’s working capital (current assets minus current liabilities). In particular, cash (and contracts in transit) and inventory are the largest components of working capital for auto dealers. A certain level of working capital is required to facilitate operations. Most factory dealer financial statements list the dealership’s actual working capital and the manufacturer’s requirements or “guide” on the face of the dealership’s financial statement.

A proper business valuation should assess whether the dealership has adequate working capital or perhaps an excess or deficiency. Comparisons to required working capital should not always be a rigid calculation. An understanding of the auto dealer’s historical operating philosophy can assist in determining whether there is an excess or deficiency, as different sales strategies can require different working capital levels, regardless of factory requirements. Check out our recently published blog that goes into more detail on working capital considerations for auto dealers.

Tangible Real Property and Real Estate Assets

Tangible real property and real estate include furniture, fixtures, equipment, land, buildings, and leasehold improvements associated with a dealership operation. The value of these assets may decrease over time through wear-and-tear or obsolescence. Accountants capture this effect by depreciating the book value of these assets over a period of time based on the expected useful life of the asset. If the assumptions used in the accounting depreciation of these assets align with the economic depreciation of these assets, the book value may be a reasonable indication of the assets’ market values. Otherwise, appraisals of the individual furniture, fixtures, equipment, and real estate may be necessary. While real estate is commonly appraised, we generally find it less common to get individual appraisals of the equipment as buyers are more concerned with the cash flows generated from these assets than their values if they were sold piecemeal on the open market.

Frequently, dealers own their real estate in a separate but related entity. This entity owns the underlying real estate and sometimes fixed assets but not the dealership itself. In those cases, most dealerships still report some cost value of leasehold improvements on their factory dealer financial statements. The business valuation expert must determine who owns the real estate, and if not owned by the dealership, the value of the leasehold improvements may need to be adjusted/removed.

Intangible Assets and Non-Operating Assets

Often, auto dealers might have intangible and non-operating assets such as goodwill from a prior acquisition, cash surrender value of life insurance, or excess/non-operating land, airplanes, etc. These assets do not contribute to the cash flow from core operations and/or are not included in the tangible assets of the dealership. Furthermore, Blue Sky multiples inherently capture the intangible value of a dealership’s expected future earnings. The appraiser must remove goodwill and intangibles on the balance sheet to establish the dealership’s tangible asset base before applying a Blue Sky multiple. While it can be worthwhile to consider the Blue Sky value paid, particularly in a recent transaction under the market approach, this does not factor into the net asset valuation method.

Conclusion

The asset approach is an intuitive approach to valuation, as it is based on the market value of a company’s equity, i.e., assets less liabilities. This analysis is incredibly important for auto dealerships due to the Blue Sky valuation method, which explicitly considers the dealership’s net asset value. A competent valuation expert is needed to thoroughly review a company’s balance sheet, assess the necessary adjustments to reflect the market value of the underlying assets and liabilities, and determine if the approach best represents the value of the business at hand. In our experience with single-store valuations, the operating market value of equity under the asset approach does not typically exceed $500 thousand – $5 million, as amounts significantly exceeding this likely include financial or other assets which are not necessary to generate the core earnings of the dealership. As a test of reasonableness, many dealers may consult the required net worth from their OEM, which, if listed (not all OEMs have these requirements), are presented next to working capital requirements on the front of the dealer financial statement.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights