United Auto Workers Strike

What It Means for Auto Dealers

The UAW strike officially began Friday, September 15th. Before this, there was much posturing on either side and auto dealer executives downplayed concerns. For context, UAW President Shawn Fain was elected in March 2023, which may play a role in a more contentious, protracted fight. On August 25th, the UAW had a 97% approval of its voting members to strike, with the Union representing approximately 150,000 workers.

On August 14th, The White House put out a statement in support of unionized auto workers and called upon OEMs, specifically the Detroit Three (or “Big Three”), to pay wages that can support a family, honor their right to organize, avoid plant closings, and focus EV transition efforts on maintaining factories in the same communities in which they currently operate.

The strike comes at an inflection point in the automotive industry

The strike comes at an inflection point in the automotive industry. It will be important to monitor the language used by the CEOs of the Big Three automotive OEMs (Jim Farley of Ford, Mary Barra of General Motors, and Carlos Tavares of Stellantis — who manufacturers Chrysler, Dodge, Jeep, and Ram vehicles) as it pertains to the context of the strike. Auto dealers benefited from the profitable supply/demand imbalance, particularly in 2021 and 2022. Increases in MSRP did not keep up with demand, and auto dealers have been able to charge higher than MSRP, particularly for in-demand models. This means more money captured later in the supply chain, which allows the UAW to push their OEM to capture more of the profit than auto dealers and share those benefits with their workers. Like auto dealers struggling to find qualified service technicians, the labor market for auto manufacturers is also tight, which gives leverage to the UAW.

Further, there has been much speculation about the future of mobility, specifically electric vehicles. Automakers will need to make significant investments to make their assembly lines profitable, and newer/reworked plants could lead to reduced investment in the workforce. While the UAW wants to secure the economic future of its members, the OEMs contend that fundamental changes surrounding EVs are beyond the agreement terms sought in this latest round of negotiations and are, therefore, unnecessarily dragging out the process this time around.

Some OEMs have postured selling electric vehicles directly. While direct sales would not necessarily impact the UAW, new factories that eschew unions or focus more on automated production could pose threats. OEMs must balance the concerns of their workers and dealers, so a public debate with their workforce may give clues to dealers about how their manufacturers are planning for the future.

What the UAW Wants in the Strike

The UAW began its negotiations prior to the strike with the following demands:

- Eliminate tiers on wages and benefits. Currently, domestic automakers have a tiered wage system in which those in the first tier earn about $28 per hour, while those hired after 2007 are in the second tier and earn about $16 to $19 per hour. The number of second-tier workers is growing, fueling this contract demand.

- Increase wages by 46% over four years.

- Restore cost-of-living allowances.

- Establish a defined benefit pension for all workers.

- Re-establish retiree medical benefits.

- Ensure the right to strike over plant closures.

- Create a working family protection program.

- Make all temporary workers permanent.

- Institute more paid time off.

- Significantly increase retiree pay.

- Possibly institute a 32-hour work week.

It’s important to keep in context that these were simply the initial demands, with the expectation that there would be negotiation. Many of these demands were made within the context of reestablishing benefits lost in the wake of the Great Recession and wage increases that failed to keep up.

Fallout from the UAW Strike

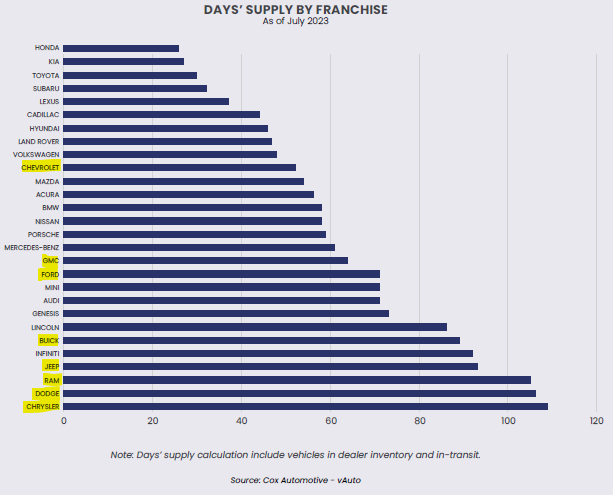

There are many estimates of how much a strike would impact the economy, with a wide range of economic impacts depending in part on the length of the strike. From an auto dealer perspective, the effect has been most acute on the manufacturers involved, but there are second-order impacts on other dealers. In the short term, this will reduce supply, increasing profits for auto dealers who can source vehicles or already have them on their lots. As Haig reported in its Q2 newsletter, Days’ Supply was highest among the brands impacted most by the strike, indicating that auto dealers may survive a short-term strike and even use it as leverage with consumers. However, it is notable that Days’ Supply can vary drastically by model, which matters when various plants tend to produce specific models. The UAW has a strike fund that should partially cover the cost of striking workers, which is expected to last about 11 weeks.

Click here to expand the image above

Context Surrounding the UAW Strike

The UAW last went on strike in 2019, before the pandemic and ensuing chip shortage. The SAAR was at 17 million, and dealers carried significantly more inventories on their lots. This strike was only with GM, as Ford and Chrysler (pre-name change to Stellantis) struck deals. The strike lasted about six weeks, with 48,000 GM auto workers on strike, the longest strike since 1970 and impacting 34 plants across several states. This led to a significant decline in vehicle production for GM, who reported net income 9% lower than the comparable prior year period. The SAAR was hardly impacted because it was contained to one OEM, and consumers in need of vehicles substituted other brands, which can have longer-term effects.

More recently, UPS workers secured substantial pay increases (which led to a 50% increase in job searches referencing “UPS”) as drivers now average $170,000 in pay and benefits. The deal made headlines nationally, and the timing of the agreement gives the UAW leverage to ask for the substantial pay increases it’s seeking.

Updates on the UAW Strike

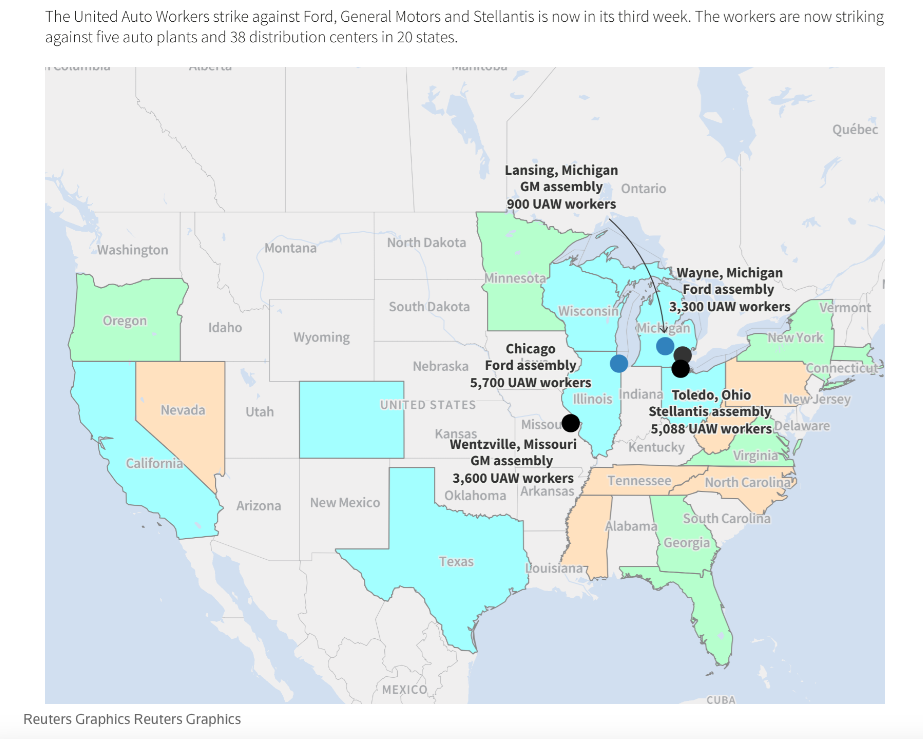

According to the NADA, the UAW initially targeted plants from each OEM that make more profitable models. The strike represents the first coordinated strike against each of the Big Three simultaneously, with 13,000 workers at the three facilities. One week later, 5,000 more workers at 38 parts distribution facilities nationwide began to strike. These strike expansions only impacted GM and Stellantis, as the UAW indicated that talks with Ford were progressing more than the others.

The UAW strategy uses the simultaneous strikes as leverage to ensure each OEM continues to negotiate

The UAW strategy uses the simultaneous strikes as leverage to ensure each OEM continues to negotiate, using progress with one OEM as a sign that they’re willing to cooperate, but the other OEMs are being unreasonable. CEOs of the Big Three claim that the strike expansions are a sign the UAW has no plans to reach an agreement. Both sides continue to put out rhetoric to win in the court of public opinion, and the UAW is touting that a supermajority of Americans supports their cause.

On Friday, September 29th, two more plants (GM and Ford) with 7,000 workers were added to the strike, totaling 25,000 on strike as of this writing. Ford was not spared in the latest round, and Stellantis was, as UAW President Fain noted talks with Stellantis had significantly improved that week. In a prior drafting of this blog, we speculated that based on the trend, it appeared GM was likely next to negotiate and potentially be spared. Yesterday, Mr. Fain indicated that GM had “leapfrogged” the pack in negotiations with the UAW, sparing a strike at GM’s highly profitable Arlington, Texas plant. Departing from prior Fridays and Mr. Fain’s implication in a meme posted Thursday afternoon, there were no new plant strikes at Ford or Stellantis, indicating continued progress may limit future strikes.

The UAW was prepared for this fight, though it would be disingenuous to say that merely being methodical about the strike indicates that the UAW was unwilling to make compromises and was striking for striking’s sake. Of the 146,000 UAW workers, only 17% are on strike, meaning plenty more disruption potential is available, though the pause in additional strikes is encouraging.

In response to the strikes, OEMs have furloughed or laid off workers, citing the lack of availability of parts from distribution centers on strike. In total, the WSJ reported workers out of work that aren’t on strike at approximately 7,000, or double previous estimates by the NADA.

We have seen limited reporting on the specifics of progress being made, which could be by design given the concurrent strikes; the UAW and each of the OEMs don’t want it known which of their demands they’ve conceded across the various negotiations. However, according to a research note from JPMorgan cited by NADA, the two sides were “close on pay and benefits.” Mr. Fain indicated that the strike of the GM plant was called off due to including battery factory under the union’s main labor agreement, which has been a point of contention, particularly with Ford. GM and Ford have also submitted updated offers which may have sought to address concerns about enhanced retirement benefits and perhaps a return to a traditional pension plan. Ford’s offer also reinstates cost of living adjustments.

Impact on Auto Dealers

Rising wages for automakers will ultimately raise MSRP, though as noted above, this was a likely outcome regardless of the strikes due to the larger share of profit realized by auto dealers in the past few years. A drawn-out strike would reduce vehicle availability, but with relatively higher Days’ Supply, domestic dealers can weather the storm if they can successfully steer consumers toward models that are in greater supply. If not, other brands stand to benefit from increased market share.

It may be more consequential for auto dealers to continue following the news and dissecting what the CEOs of their brands are saying about the future of the industry and the role to be played both by its workers and its franchisees. For example, Ford’s Farley stated that jobs from future battery plants would be additive to its workforce, not a reduction or retraining. If true, that means Ford plans to bring more of its processes in-house, which makes sense in light of supply chain constraints in the past few years.

Conclusions

Mercer Capital provides business valuation and financial advisory services, and our auto team assists dealers, their partners, and family members in understanding the value of their auto dealerships and related entities. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights