Valuation Considerations for Auto Dealership Entities with Multiple Franchises

The valuation of an auto dealership can be a challenging and complicated process. The structure of most auto dealerships consists of an entity holding the actual dealership operations and a separate entity owning the real estate and building. Often the latter is a related party entity that charges the dealership rent for use of the land and building. Occasionally, the real estate and the dealership operations are contained in the same entity.

We are all used to the local dealership in our town: Bill Jones Honda, Steve Smith Chevrolet. But what about the larger auto groups that have multiple franchises organized in the same entity? How are they valued and what special valuation considerations apply to them?

Financial Reporting

Franchised auto dealerships submit dealer financial statements to the manufacturer on a monthly basis. These dealer financials contain valuable information about the various departments, including profitability by department, overall number of new and used vehicle sold, individual models sold, etc. How does that differ for entities that contain multiple franchises under one structure? In our experience, those dealerships submit a combined dealer financial statement to each manufacturer. For example, if an entity owned a Chevrolet and a Honda franchise, they would submit an identical dealer financial statement displaying the combined operations to Chevrolet and to Honda. This can make it difficult to assess the individual financial performance of each franchise.

Most dealership financial packages will contain various support schedules that can provide additional insight. There should be a breakdown of new vehicle sales and gross profits by manufacturer provided or the auto dealer would maintain that data.

With this information, a valuation analyst can determine the contribution of each franchise to the combined operations by percentage of revenues, gross profit, or new or total units sold. Generally, these combined statements do not allocate the selling, general and administrative expenses by franchise, so individual franchise income statements are typically not available. We will later discuss how to incorporate this information into the valuation of an entity with multiple franchises.

Profitability and Benchmarking

Establishing the ongoing earnings of a dealership is critical to its determination of value under both the income approach and the market or Blue Sky approach. If individual profitability of each franchise isn’t discernable in a combined entity, how do you evaluate the profitability of the dealership?

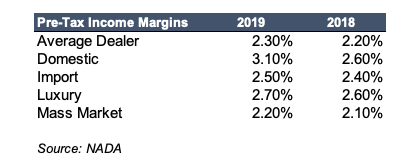

We have previously discussed in this space the use of industry benchmarking tools to assess a dealership’s profitability. One such tool is NADA’s Dealership Financial Profiles. These benchmark studies are released monthly and are categorized by the type of dealership including Overall Average, Domestic, Import, Luxury, and Mass Market. An analyst can use these tools to determine a blended overall industry profitability figure for the dealership based on the composition of each franchise to total operations and the specific category of dealership that each franchise represents.

The table below lists the average pre-tax income margins for the dealership categories for 2018 and 2019:

For example, let’s say you had a fictitious combined entity with a Chevrolet and a Honda franchise and that each comprised 50% of the total combined operations of the entity. As a guide, you could compile a blended profitability measure of 2.80% for 2019 to account for the domestic franchise (3.10% x 50%) and the import franchise (2.50% x 50%). These comparisons to industry profitability margins are not rigid but do provide a framework to assess the subject dealership’s performance against its peers. Since Chevrolet and Honda also would both fall under the “Average” category, one might be tempted to simply pull the average figure. However, as we see in our example, this may lead to a lower benchmark than is ultimately appropriate.

Franchise and Blue Sky Values

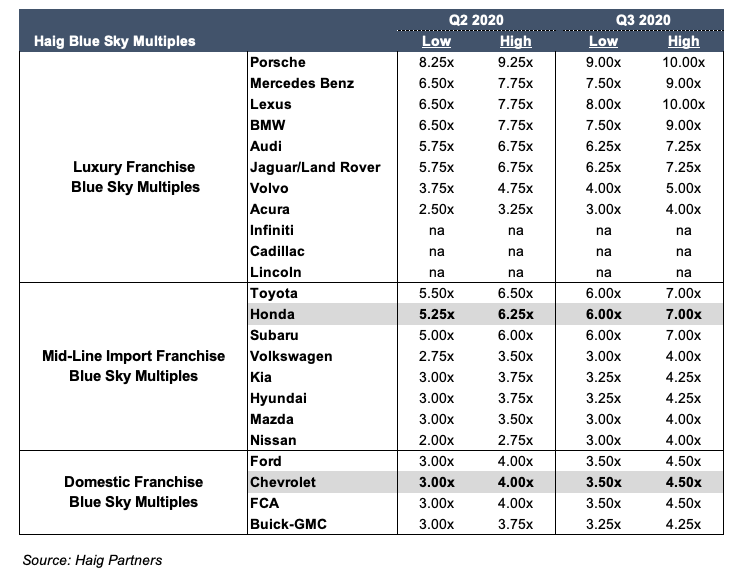

Multi-franchised entities can also pose a challenge since each franchise has inherent value and all franchise values are not created equally. The perceived franchise value is often reflected in a multiple of pre-tax income referred to as Blue Sky Value. Leading national firms that specialize in auto dealer transactions, such as Haig Partners and Kerrigan Advisors, publish their observed Blue Sky multiples by franchise each quarter.

Examples of Haig’s published Blue Sky multiples for the second and third quarters of 2020 based upon dealership category appears in the table below:

Using our previous example of a combined fictitious entity with a Chevrolet and Honda franchise, it’s clear from these Blue Sky multiples that it would be inappropriate to value the entire entity just based on Honda’s perceived value (6.00-7.00X) or Chevrolet’s perceived value (3.50-4.50x) alone. One technique that can be utilized is to establish a blended Blue Sky multiple for the two franchises based on the composition of each to the total combined operations. As we discussed earlier, this can be estimated based upon revenue or units sold composition of the two franchises in the subject dealership. Based on a 50/50 composition of each of these two, it would be reasonable to estimate a blended Blue Sky multiple of 4.75X on the low end and 5.75X on the high end using Haig’s Q3 2020 multiples. (Note: The valuation requires more in-depth analysis than just a high-low average.) A blended Blue Sky multiple would incorporate the inherent difference in values of the two franchises so as to not undervalue or overvalue the combined subject dealership in our example if either an exclusive Chevrolet or Honda multiple were considered.

After a direct valuation of the entity is performed, the corresponding Blue Sky value could be measured against this blended multiple. For example, if the conclusion of value for this example implied a 9x Blue Sky, this exercise would illustrate that the valuation conclusion or some of the underlying assumptions were flawed.

Recent Acquisitions and Divestitures

Most valuations of auto dealerships require the analysis of prior years’ performance and results. The golden period for valuation analysts seems to be reviewing five full historical years. In our projects involving entities owning multiple franchises, we often see activity within those franchises owned in those prior five years. It can be valuable to ask if there have been any acquisitions or divestitures of franchises during that historical period of reviewed financials. First, the analyst wants to establish that the comparison of historical years to one another are apples to apples. If an entity had sold off or discontinued a franchise, the earnings related to that particular entity should not be considered in any current value of the subject dealership. In the case of a divested franchise, the impact of those sales and earnings should be removed from prior year results as much as possible. This won’t always be possible for the same reason we can’t construct individual P&L statements by franchise. Again, this is due to the lack of itemized SG&A expenses by the franchise.

Conversely, if the subject dealership had recently acquired or added an additional franchise to its operations during the reviewed period, the value of that franchise should also be captured. If the franchise is recently acquired, information regarding the acquisition price and/or consideration paid for Blue Sky could be considered in the valuation analysis, especially if the operating results haven’t fully reflected the integration of the new franchise. Franchise value paid for acquisitions in historical periods can also be helpful information. For example, if a dealership acquired a particular franchise for a Blue Sky value of $10M but the dealership’s performance and earnings from that franchise had suffered in the years following the acquisition, the concluded value of that franchise might be lower today. In this example, the original $10M Blue Sky value for that franchise would have been helpful as a sanity check to the concluded value for that franchise today.

Conclusion

Entities owning multiple franchises pose unique challenges to valuation compared to a single-franchised dealership. While the conclusion of value for the entity is contained in a single value, we have discussed the importance of evaluating the individual value of the franchises involved or at least examining the concluded value in the context of the earnings and blue sky value inherent within each franchise.

Contact a professional at Mercer Capital to discuss the value of your multi-franchised or single-franchised auto dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights