How Proper Normalization Adjustments Contribute to a Better Finished Product

Trusting the Process

“Head chef” in my family is a title and role that I not only enjoy but take very seriously. Like most folks, the last few months have created many more opportunities to refine my home cooking skills and sample different recipes and cuisines. My kitchen cooking repertoire has always exceeded my grilling capabilities. With the extra time at home, I decided to tackle the holy grail of grilling challenges: smoking a beef brisket. For those that have never tried, the brisket is one of the most intimidating cuts of meat to tackle. In addition to a million different temperature/time/technique recommendations, the brisket starts as a very tough piece of meat. It’s not uncommon to labor for 10+ hours smoking a brisket and still have it turn out like a leather shoe.

After spending some time researching, I honed in on my process. This included preparing the brisket by trimming excess fat and cooking the meat at a higher temperature for a period of 4 hours or until the meat reached a certain internal temperature. The next step involved lowering the cooking temperature for another set of hours until the internal temperature of the meat reached an ideal 203 degrees. Not 200, not 205……203! The final step involved foiling or tenting the brisket in a dark, damp, confined space for a period of several hours, allowing it to rest and come to its final temperature. How’d it turn out? I’ll revisit that topic at the end of the post.

Much like smoking a brisket, the valuation of an auto dealership is a process, and the client or intended audience for the valuation must trust the process (apologies to any Philadelphia 76ers fans that lived through the rebuilding years under Sam Hinkie).

In previous posts, we discussed the valuation methodologies and the value drivers of an auto dealership valuation. The next step in the process is to normalize the financial statements.

Normalization adjustments take private company financials and adjust the balance sheet and income statement in order to view the company from the lens of a “public equivalent.” Adjustments are often interrelated; a change to the balance sheet frequently will affect the income statement as we’ll discuss. Some typical areas of potential normalization adjustments in the automobile dealership industry include, but are not limited, to the following.

Balance Sheet

Inventories

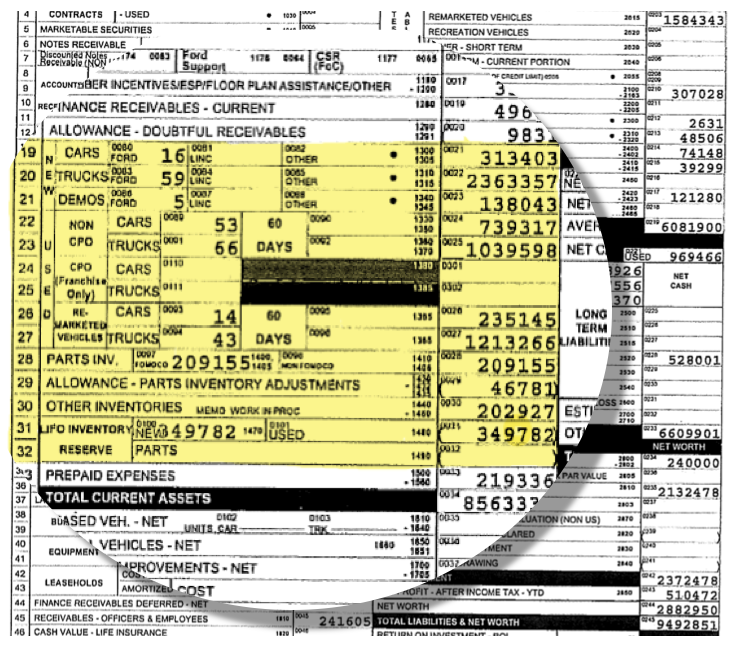

Most automobile dealerships report the value of their new and used vehicle inventories on a Last-In, First-Out (“LIFO”) basis. LIFO accounting allows the dealership to reduce the value of their inventories and pay fewer taxes. General valuation theory calls for inventories to be restated at First-In, First-Out (“FIFO”) basis. The FIFO adjustment affects both the balance sheet and the income statement. On the asset side of the balance sheet, we add the LIFO reserve amount to the reported LIFO inventory, raising the value of the inventory. Liabilities also increase due to the additional taxes that would be paid on a FIFO-equivalent inventory, calculated as the LIFO Reserve multiplied by the corporate tax rate. We will discuss the income statement impact later.

Most automobile dealerships report the value of their new and used vehicle inventories on a Last-In, First-Out (“LIFO”) basis. LIFO accounting allows the dealership to reduce the value of their inventories and pay fewer taxes. General valuation theory calls for inventories to be restated at First-In, First-Out (“FIFO”) basis. The FIFO adjustment affects both the balance sheet and the income statement. On the asset side of the balance sheet, we add the LIFO reserve amount to the reported LIFO inventory, raising the value of the inventory. Liabilities also increase due to the additional taxes that would be paid on a FIFO-equivalent inventory, calculated as the LIFO Reserve multiplied by the corporate tax rate. We will discuss the income statement impact later.

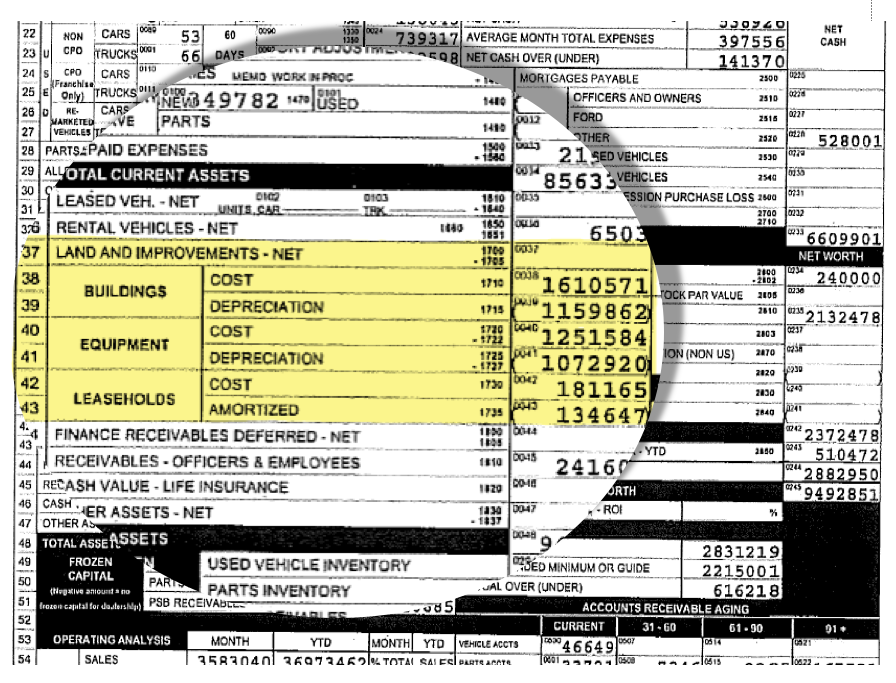

Fixed Assets

Frequently, dealers own everything in two separate, but related entities. One entity owns the operations of the dealership and other owns the underlying real estate. In those cases, most dealerships still report some cost value of land or leasehold improvements on their factory dealer financial statements. The business valuation expert must determine who owns the real estate, and if not owned by the dealership, the value of the land and leasehold improvements needs to be adjusted/removed. This adjustment reflects the true value of the tangible assets of the dealership. Failure to properly assess and make this adjustment will skew the implied Blue Sky multiple on the concluded value for the dealership.

Frequently, dealers own everything in two separate, but related entities. One entity owns the operations of the dealership and other owns the underlying real estate. In those cases, most dealerships still report some cost value of land or leasehold improvements on their factory dealer financial statements. The business valuation expert must determine who owns the real estate, and if not owned by the dealership, the value of the land and leasehold improvements needs to be adjusted/removed. This adjustment reflects the true value of the tangible assets of the dealership. Failure to properly assess and make this adjustment will skew the implied Blue Sky multiple on the concluded value for the dealership.

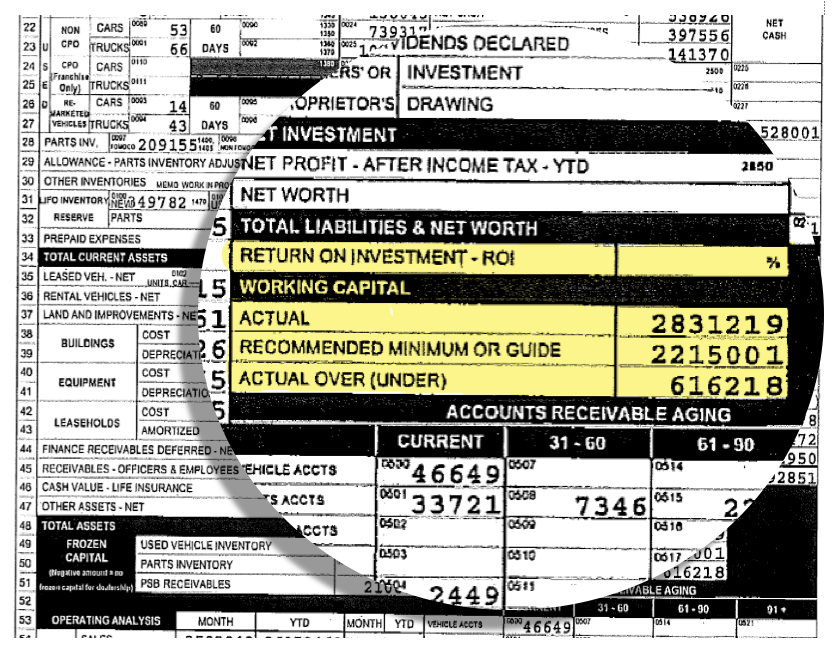

Working Capital

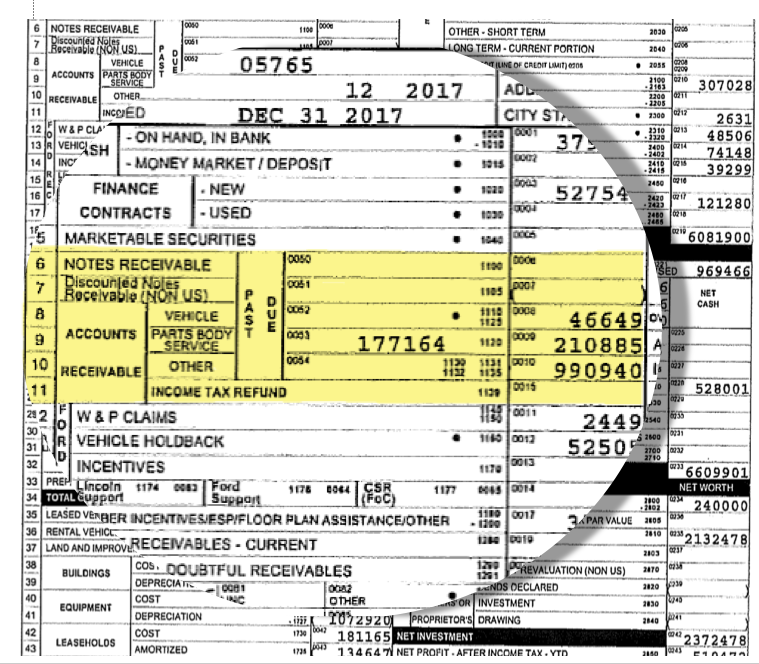

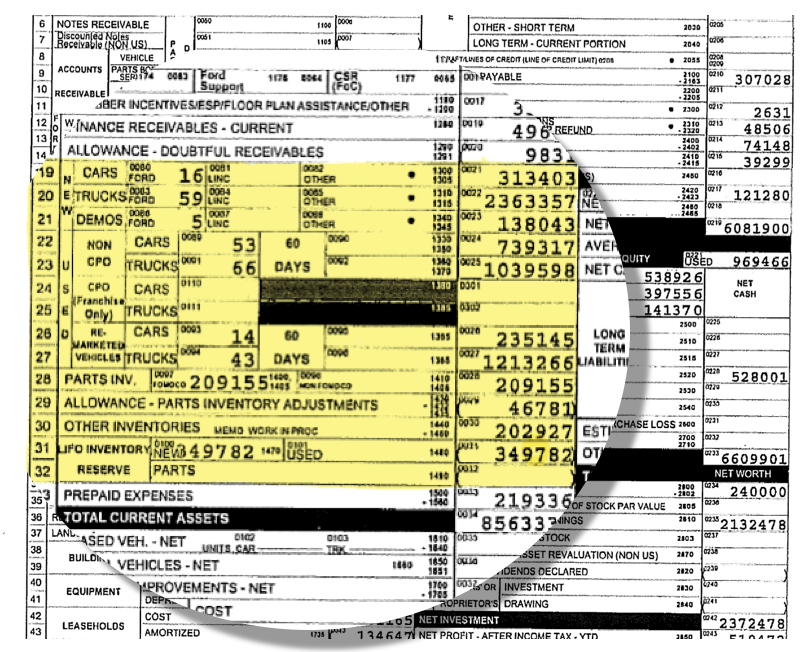

Most factory dealer financial statements list the dealership’s actual working capital, along with the requirements from the factory on the face of the dealer financial statement, as seen in the graphic to the right. It’s important for the business valuation expert to assess whether the dealership has adequate working capital, or perhaps an excess or deficiency. Comparisons to required working capital are not always rigid. An understanding of the auto dealer’s historical operating philosophy can help determine whether there is an excess or deficiency as different sales strategies can require different levels of working capital, regardless of the factory requirements.

Most factory dealer financial statements list the dealership’s actual working capital, along with the requirements from the factory on the face of the dealer financial statement, as seen in the graphic to the right. It’s important for the business valuation expert to assess whether the dealership has adequate working capital, or perhaps an excess or deficiency. Comparisons to required working capital are not always rigid. An understanding of the auto dealer’s historical operating philosophy can help determine whether there is an excess or deficiency as different sales strategies can require different levels of working capital, regardless of the factory requirements.

Goodwill/Intangible/Non-Operating Assets

Often auto dealers might have intangible and non-operating assets such as goodwill from a prior acquisition, cash surrender value of life insurance, personal seat licenses (“PSLs”), excess/non-operating land, airplanes, etc. These assets do not contribute to the cash flow from operations and/or are not included in the tangible assets of the business. Blue Sky multiples inherently capture the intangible value of a dealership’s expected future earnings. The appraiser must remove goodwill and intangibles on the balance sheet to establish the tangible asset base of the dealership before any application of a Blue Sky multiple.

Often auto dealers might have intangible and non-operating assets such as goodwill from a prior acquisition, cash surrender value of life insurance, personal seat licenses (“PSLs”), excess/non-operating land, airplanes, etc. These assets do not contribute to the cash flow from operations and/or are not included in the tangible assets of the business. Blue Sky multiples inherently capture the intangible value of a dealership’s expected future earnings. The appraiser must remove goodwill and intangibles on the balance sheet to establish the tangible asset base of the dealership before any application of a Blue Sky multiple.

Owner Accounts Receivable

Occasionally, auto dealers loan money into the dealership with no intention of ever repaying those funds, and dealers sometimes misplace or disguise items on the dealer financial statement to overstate working capital. Valuation analysts have to ask about these items specifically during their management interviews with the dealer principal or controller to know if adjustments to the dealer financial statement are warranted.

Occasionally, auto dealers loan money into the dealership with no intention of ever repaying those funds, and dealers sometimes misplace or disguise items on the dealer financial statement to overstate working capital. Valuation analysts have to ask about these items specifically during their management interviews with the dealer principal or controller to know if adjustments to the dealer financial statement are warranted.

Income Statement

Inventories

As discussed earlier, the use of LIFO inventory systems creates normalization adjustments on both the balance sheet and the income statement. On the income statement, the inventory adjustment affects the cost of goods sold (“COGS”), and ultimately, the gross profit margin. The shortcut method to the adjustment analyzes the change in the LIFO reserve year-over-year. If the LIFO reserve increases, the resulting normalization adjustment decreases COGS and increases profits. Conversely, if the LIFO reserve decreases, the resulting normalization adjustment increases COGS and decreases profits.

As discussed earlier, the use of LIFO inventory systems creates normalization adjustments on both the balance sheet and the income statement. On the income statement, the inventory adjustment affects the cost of goods sold (“COGS”), and ultimately, the gross profit margin. The shortcut method to the adjustment analyzes the change in the LIFO reserve year-over-year. If the LIFO reserve increases, the resulting normalization adjustment decreases COGS and increases profits. Conversely, if the LIFO reserve decreases, the resulting normalization adjustment increases COGS and decreases profits.

Officers’/Dealer Compensation

Like all valuations, the compensation of the officers’/dealer principal must be considered for potential adjustment. Typically, a business valuation expert will review actual compensation paid and determine a replacement or market equivalent compensation level; experienced business valuators in the auto dealer industry have techniques and benchmarks to determine a reasonable replacement cost. In addition, some auto dealers have non-active employees or family members on the payroll. The salaries of non-active employees also must be normalized by adding back those expenses as they would not be included for a public equivalent.

Rent

As noted previously, the underlying real estate utilized by the auto dealer is frequently owned in a separate, related entity. As such, the dealership pays rent to the related party entity. The business valuation expert needs to determine if the rental rate paid is equivalent to a market rental rate. Often, this rental rate creates additional profitability at either the dealership entity or the real estate entity. Experienced business valuators in the auto dealer industry have several techniques and benchmarks to determine a fair market rental rate for the facilities.

Other Income Items

Most factory dealer financial statements have a line item on the income statement for other income items/additions. This category can be sizeable for a dealership depending on its sales volume and level of profitability. It’s important for a business valuator to determine the items that comprise this category and how likely they are to continue at historical levels. Some common items that appear in this category include factory dealer incentives on sales volume levels for vehicles, factory dealer incentives for service performance, document/preparation fees on the sale of new and used vehicles, and additional costs for financing and other services sold as a part of the vehicle transaction (“PACKs”).

Discretionary/Non-Recurring/Personal Expenses

Like all valuations of privately-held companies, auto dealership valuations should normalize all expenses that are discretionary, non-recurring, or personal in nature. Often, these expenses can be determined during the management interview phase of the business valuation.

Expected Industry Profitability vs. Actual Profitability

The valuations of auto dealerships are also unique in that underperforming stores can often be more “valuable” than stores performing at or above the market from a multiple perspective. One reason for this phenomenon is that hypothetical buyers recognize the improvements they can make to profitability for underperforming stores. Experienced business valuators in the auto dealer industry know to consult expected industry profitability levels depending on the manufacturer, geographic region, and competition. Expected profitability levels can be an added benchmark to the totality of the other normalization adjustments determined in the valuation process.

Conclusions

Just like the cooking technique with the brisket, the process of normalization adjustments and the overall valuation is a roadmap for advancing from the start of the engagement to a finished conclusion. Skipping any steps along the way in the process will lead to a flawed/incomplete valuation conclusion, or a leather shoe of a brisket. I’m happy to report that trusting the process with smoking the brisket resulted in a happy family and a tasty/tender dinner!

We have highlighted many of the typical normalization adjustments that must be considered in the valuation of an auto dealership. With the many nuances that must be considered, hiring a business valuation expert that specializes in this industry rather than a generalist business appraiser can make all the difference in providing a reasonable valuation conclusion.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights