Vroom in the Tomb and Used Vehicle Gloom

What Does the Collapse of Vroom Say for Auto Dealers?

This week, we’re following up on our “Vroom, Zoom, and Stock Market Boom” from the end of Q2 2020, as Vroom announced it is ceasing e-commerce operations. Vroom is very much a sign of the times for its era. We discuss its short, checkered history as a public company and what auto dealers can learn from the past few years.

Vroom Price Movements Since IPO

Vroom flew out of the gates on June 9, 2020, with interest rates on the floor and consumers in various stages of leaving their houses. The online automotive retailer priced the 21,250,000 shares at $22/share. By the end of the trading day, Vroom’s stock had increased 118% to $47.90. For perspective, the NASDAQ rose only 0.3% that day. The stock peaked briefly at $73.87 on September 1, 2020, and dropped below the IPO price on October 1, 2021, before dropping to below $3 by March 2022. It generally trended lower as growth slowed and the cost of capital rose. Vroom’s ultimate demise could spell the end for any used dealer—Ally suspended its credit line, and dealers have no business if they can’t floor or otherwise afford their inventory.

As we noted at the time of Vroom’s IPO, Carvana’s IPO trajectory was the exact opposite, finishing 26% below its IPO price before significantly increasing to triple-digit quarterly revenue growth for 23 consecutive quarters, a feat that was never likely to be duplicated by Vroom. Vroom hoped its asset-light approach would make it a better investment than Carvana, but maybe more assets that could support financing would have helped them stick around longer.

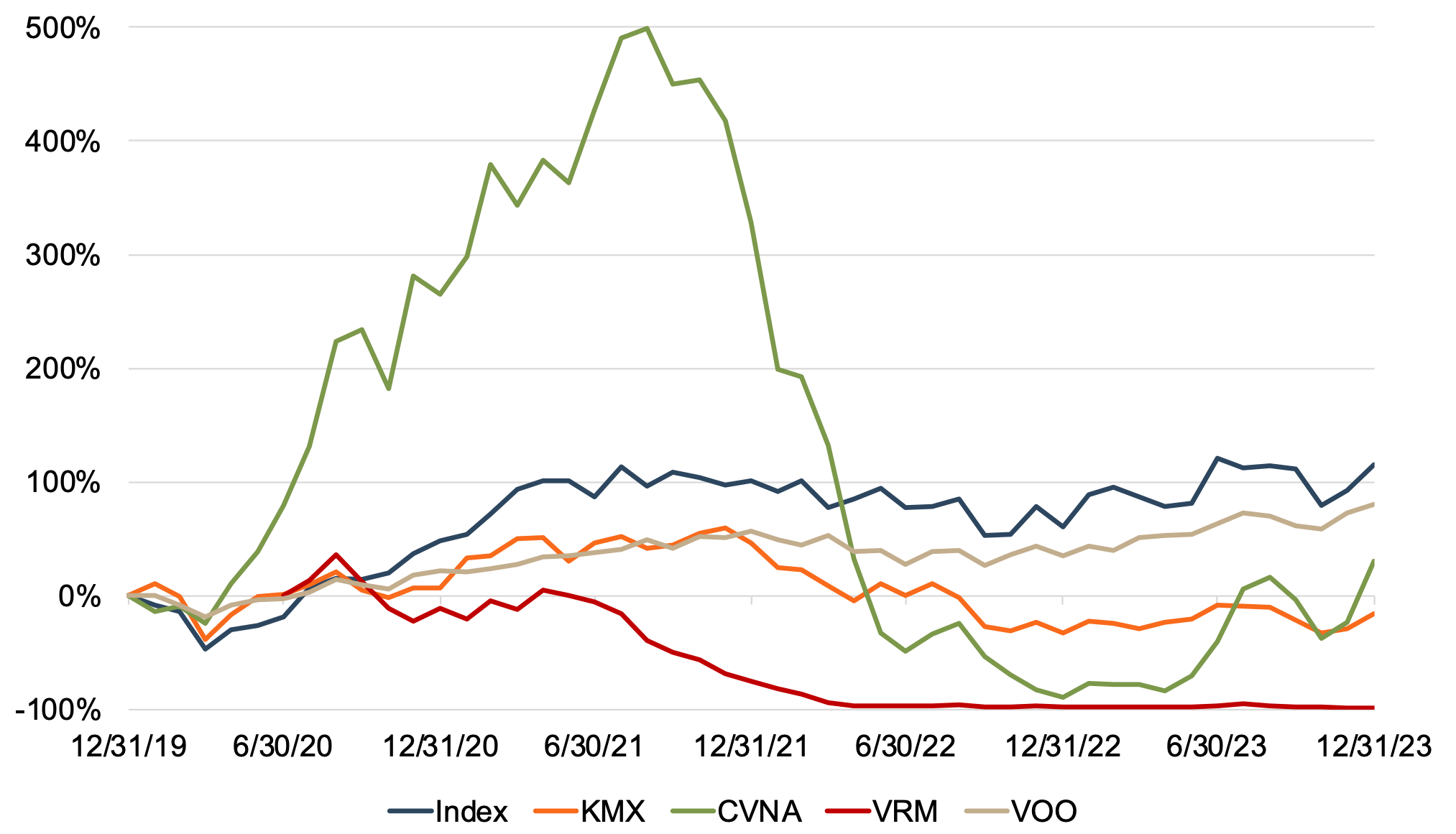

Below, we show a price return graph for the six publicly traded franchised auto retailers as a market cap-weighted index, Carmax (used only), Carvana (used only and predominantly online), Vroom (Carvana without the vending machines), and the S&P 500 (VOO ETF). Vroom didn’t have quite the same boom as Carvana, which itself looked like it was on the brink of collapse. Carvana fell 95% from its year-end 2019 market cap to year-end 2022, though it recovered to lose only 54% of its 2019 market cap. Note that the index of franchised dealerships fared the best, even outpacing the S&P 500, which was driven forward by the likes of Amazon, Google, Apple, etc.

Is Vroom a Sign of Something Bigger?

As noted on X (formerly Twitter) by the anonymous “Car Dealership Guy” (worthwhile follow), Vroom is one of four used car dealerships to close this week, including Northwest Motorsport, which had 11 physical locations. He wonders whether this was the used car industry’s “SVB moment,” referring to the infamous implosion of Silicon Valley Bank, which had ripple effects through the entire banking system last year. There may be some worthwhile parallels in the analogy. The Fed’s quick rise in interest rates in 2022 and through 2023 turned banks’ worlds upside down. The banking business model is built on leverage and the term premium, with short-term liabilities usually paying interest at lower rates than long-duration assets. With banks reaching for yield during the ZIRP era, many turned upside down. While my own online savings account pays a higher interest rate than my mortgage right now, it’s not hard to visualize the problems banks are grappling with.

Auto dealers have different issues that are less obvious to the average consumer. Rising interest rates play a role in the supply chain shortage, throwing a meaningful wrinkle. With a depressed supply of new vehicles, dealers are able to charge above MSRP. A lack of available and reasonably priced substitutes causes used vehicle prices to rise as well.

Used vehicle prices rose faster than new, and the ratio of used to new vehicle pricing increased to 70% from a historical figure of about 55%. For example, if a new vehicle costs $10,000 (good luck finding that), a used vehicle of the same make and model might go for $7,000 instead of $5,500.

As new vehicle supply has improved, pricing has begun to normalize, depending on make, model, and market, of course. Used vehicle prices have unwound considerably, as it can be more difficult for dealers to accurately price vehicles given market volatility. This spelled trouble for dealers who were more aggressive on pricing and took trade-ins that may be harder to sell without taking a loss.

Given the uncertainty, some floor plan lenders exited the industry last year, notably Capital One and Fifth Third. At the time, Kerrigan noted this appeared to be more of a pull-back in light of the banking issues, but it undoubtedly signaled increased focus from floor plan lenders who stayed in the market. For years of floor plan profiting with OEM incentives exceeding interest expense, this has returned as a cost center where used dealers don’t benefit.

Future of Automotive Retail

Vroom and other used-only dealerships are more squeezed because they aren’t tied to a franchise. They can only sell used vehicles whose prices have been more volatile, and they don’t have access to captive financing from their OEMs. In short, we don’t think traditional franchise dealers will be stung by the forces that took down Vroom. However, we believe Vroom shouldn’t be ignored as it can provide valuable insights. Its S-1 highlighted e-commerce penetration in the industry sits at just under 1%, compared to about 16% for total retail.

Two and a half years ago, we ironically pointed out how e-commerce had become so prevalent due to Amazon’s huge reach, which is now partnering with Hyundai to sell cars. While that partnership is still in the early innings, we think this could be a net positive for dealers, depending on how it’s ultimately structured. We can envision a utopian world where consumers can seamlessly choose across brands by price and features (think Google Flights). Dealers will still be necessary for handling trade-ins, fulfillment, and servicing, even if online tools can eventually figure out the rest of the purchase transaction. Carvana and Vroom’s struggles may influence the importance of dealers even if the industry continues to move further online. Contact a Mercer Capital professional to discuss the effect the dynamic auto dealership industry is having on your business today.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights