Blue (Sky) Is in the Eye of the Beholder – Part 2

Ongoing Earnings and Other Valuation Considerations

In Part 1, we compared brand-level blue sky multiples and the consistency (and variation) in estimates from Haig Partners and Kerrigan Advisors. But as we noted, the multiple is only half the story. The real engine driving valuation is the earnings base, or the number to which that multiple is applied. And in auto dealership valuations, defining what we call “ongoing earnings” isn’t as simple as referencing last year’s net income. In this installment, we discuss our perspective on how dealership earnings are evaluated, adjusted, and normalized, based on our experience and discussions with dealmakers in the space.

How to Determine Ongoing Earnings: Adjustments and Averages

Many owners run discretionary items through the store, capitalize on depreciation schedules, and may not maximize reported income in a given year. Conversely, boom-year results (like 2021 and 2022 for many dealers) may overstate sustainable profitability. Therefore, the starting point of valuation is not reported net income, but a normalized earnings stream adjusted for one-time, discretionary, or non-recurring items. Valuation professionals and buyers typically consider a range of adjustments:

- Owner Compensation. Dealer-owners may overpay or underpay themselves. The adjustment normalizes compensation to a market-level GM or dealer principal salary.

- Rent/Real Estate. If the dealership rents from a related party (which is the most common structure we encounter), the rent expense may need to be adjusted to fair market value. Under-market rent artificially inflates earnings, while above-market rent depresses them. Appraisals or cap rate-based analyses are often used to test the reasonableness of rental expenses; we also consult other available industry data.

- Non-Recurring Items. One-time legal settlements, hail damage claims, PPP loan forgiveness, or non-core asset sales should be removed to reflect actual ongoing performance.

- Discretionary Expenses. Personal expenses, like club memberships, personal travel, or family salaries, are common in privately held businesses, and dealerships are no exception. These expenses are added back to reflect what a buyer could eliminate post-transaction.

- LIFO & Inventory Accounting. Accounting methods can distort earnings. LIFO adjustments, which may swing earnings up or down depending on market volatility, may be normalized to focus on cash-based operational profit.

After making necessary normalization adjustments, some sort of average of recent results is usually the next step. Many dealers saw record profits in 2021–2022 due to tight inventories and high front-end gross. Buyers will often apply a multi-year average or use another method to discount peak-year earnings to reflect expected reversion to mean profitability.

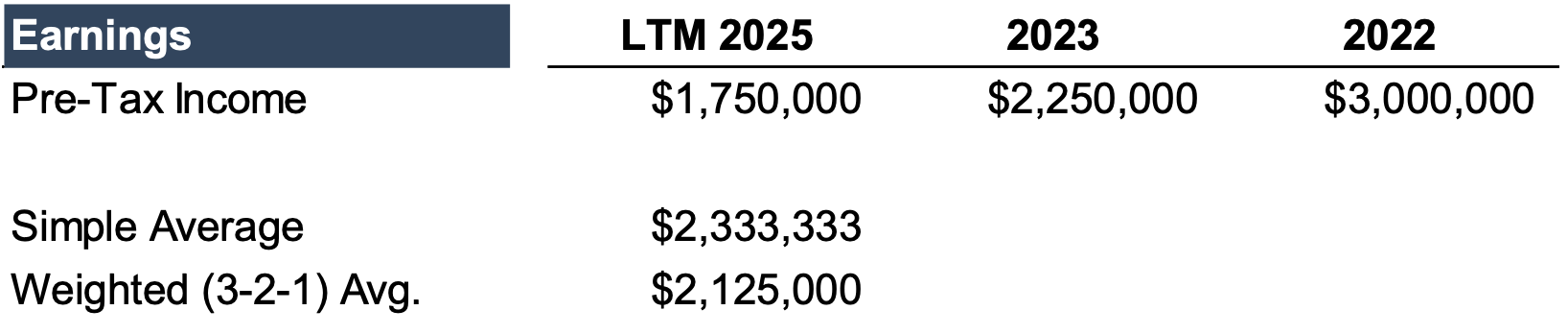

A simple example illustrates how even if two buyers are willing to pay the same multiple, their expectations for ongoing earnings may lead to significantly different offer prices. What would you pay for a dealership with the following trend?

Whether you take an average or a weighted average, ongoing earnings would be above the most recent performance. What if earnings continue to fall further?

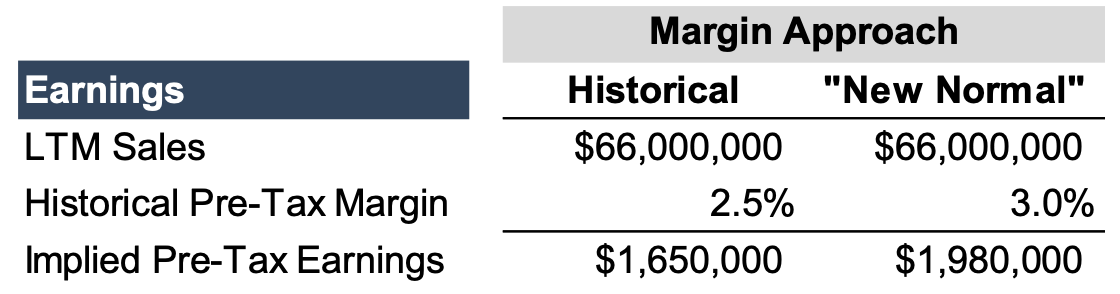

Another way to look at it is a margin-based approach. If sales were $66 million, and pre-tax margins decline all the way to pre-COVID levels, earnings might be even lower than current results. If margins settle at a higher-than-pre-COVID level, it might be above LTM results, but not as high as 2022 or 2023.

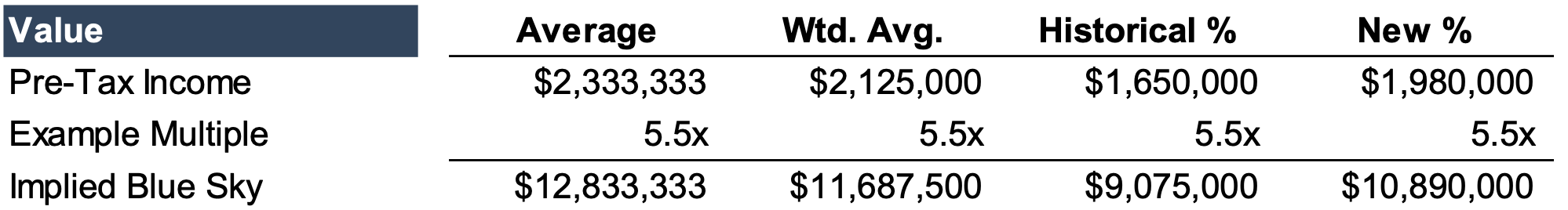

Numerous prospective buyers, even if they all agree to pay 5.5x, might offer different prices based on their determination of ongoing earnings:

Kerrigan Advisors notes that its multiples should be applied to LTM earnings, as buyers are placing less weight on results from 2022 and 2023. Haig Partners noted a similar trend, but they do not specify the earnings stream to which one should apply their multiples. We think it’s reasonable to suggest that peak earnings aren’t returning any time soon, but each dealership is different, and some dealerships are bucking industry trends with stronger performance in 2024 than in prior years. In such cases, using LTM earnings may or may not reflect what a buyer is willing to believe is sustainable.

Sellers want to sell based on peak earnings. Buyers can better service debt and obtain a reasonable rate of return when they acquire based on normalized earnings. If the two parties in a transaction can’t agree on ongoing earnings, it’s less likely they will ultimately agree on price, and a deal won’t get done. Buyers risk overpaying if they don’t properly adjust for inflated earnings. Sellers risk underpricing if they don’t articulate valid addbacks and sustainable profitability.

Valuation Perspectives Beyond Multiples

One of my colleagues who works in transaction advisory in the banking industry frequently discusses how buyers are primarily focused on their expected rate of return (like IRR) or other earnings-based methods. But because their earnings expectations may differ from those of sellers (including synergies only available to certain buyers), they may not communicate their offer in terms of earnings multiples. While earnings expectations are the primary consideration, a buyer may instead communicate the price as a multiple of book value (a much more prominent consideration in banking, which is much more balance-sheet driven than auto dealerships).

Value over a sufficiently long horizon is most closely correlated to earnings

For auto dealerships, the two sides in a negotiation may ultimately haggle over these valuation multiples, but in the end, value over a sufficiently long horizon is most closely correlated to earnings, which remains the primary focus regardless of the methodology utilized.

Based on our discussions with the Dave Cantin Group (DCG), only a subset of buyers appears to be thinking in terms of IRRs, a sentiment that was echoed in our other conversations. While sophisticated multi-period earnings projections have their place in corporate finance and large, well-diversified auto groups, they aren’t the norm in the industry. For these buyers, advisors will tell their buy-side clients the price it will take to get the deal done, within which they can determine the IRR and decide whether it fits into their return threshold.

DCG considers similar factors in determining a multiple to those noted by Haig and Kerrigan. They seek to take a more holistic approach that digs into the local economy, employers, dealer density, local doc fee laws, etc. They also note factors that drive value beyond franchise rights, including real estate or other earnings streams not utilized by all dealers, such as a body shop, wholesale parts, or a fleet.

We also spoke with Jacob and Matt from the northeast office of Performance Brokerage Services, who agreed that blue sky is only one part of the transaction and that a holistic approach is key, as negotiations can break down over seemingly small details. When they’re determining ongoing earnings, one (of many) notable aspects they look at is planning potential, and they can help quantify how an underperforming store might do upon acquisition for potential buyers.

Conclusion

A buyer offering a lower multiple may be the highest bidder

What I found most interesting in all our discussions is the overlap between determining ongoing earnings and an applicable multiple, as qualitative factors affect each when earnings are in flux, as they have been over the past few years. Pre-COVID, there may have been greater alignment on earnings, so the negotiation focused on the multiple. In a more dynamic environment, such as the one we have experienced post-pandemic, a buyer offering a lower multiple may be the highest bidder if they have the highest opinion of ongoing earnings.

There are plenty of reasonable ways to determine what someone is willing to pay for a dealership. We appreciate the blue sky multiple framework and market intelligence published by Haig Partners and Kerrigan Advisors, as well as the insights provided by DCG and our conversations with everyone. The surest way to know the value is to put it on the market and solicit interest from the most likely/motivated buyers. For dealers that aren’t ready to sell or tell the market they’re considering selling, a valuation is the next best way to understand the value drivers of what is likely your family’s most significant asset.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealership team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights