Capital Shifts and LNG Lifts

Takeaways from the 2025 Hart Energy Capital Conference

The energy industry is at a critical point, where producers must not only meet the ever-growing global energy demand resulting from population growth, industrialization, and the increasing electrification of uses, but also adapt to ever-changing environmental regulations and shifting societal expectations related to sustainable practices.

On June 4, 2025, Hart Energy hosted its annual Energy Capital Conference, which brought together capital providers and industry executives for an update on the funding that drives the oil and gas segment of the energy industry. In this week’s post, we recap how the conference reflected this crossroads in the industry and summarize key topics, including capital allocation and the outlook for M&A and LNG.

Capital Is Still Flowing — But It’s More Strategic Than Ever

Wil VanLoh, CEO of Quantum Energy Partners, opened the day by underscoring a crucial shift: while energy capital remains available, the source and strategy behind that capital are changing. Most of the “new” capital is coming from existing investors re-upping rather than new entrants. PE firms, family offices, and foreign investors alike are seeking lower-risk, cash-flowing assets, often preferring producing over undeveloped assets to preserve downside protection.

Family offices, in particular, stood out this year as rising players, stepping in where traditional capital has pulled back. As Brad Nelson of Stephens noted, “Upstream yield is finally attractive again — and family offices are paying attention.”

M&A: Disciplined, Targeted, and Gas-Weighted

M&A was everywhere — but the consensus is that it’s a targeted, buyer-driven market. Deals are increasingly driven by gas-weighted assets (like those in the Haynesville or Utica) due to the rising global appetite for LNG and a more favorable price outlook for natural gas.

From Chord Energy’s CEO, Danny Brown, we learned that M&A still plays a central role in their capital allocation: 48% of the company’s $13 billion capital deployed since 2021 has gone to acquisitions. Chord’s model of combining M&A with capital efficiency and mature production was echoed by other operators, many of whom are holding off on drilling until prices justify new development.

The foreign capital panel added an interesting wrinkle: buyers from the Asia-Pacific region (INEOS, Osaka Gas, Tokyo Gas) are entering U.S. shale with long-term, vertically integrated strategies — not just for returns, but for the security of LNG supply. Their longer time horizons and lower return thresholds make them formidable competitors in bidding processes. Jeet Benipal, Managing Director at Mizuho Greenhill, projected that foreign investment could account for nearly $10 billion in combined deal value over the next six to twelve months.

LNG Demand Surge Is Reshaping Capital Allocation

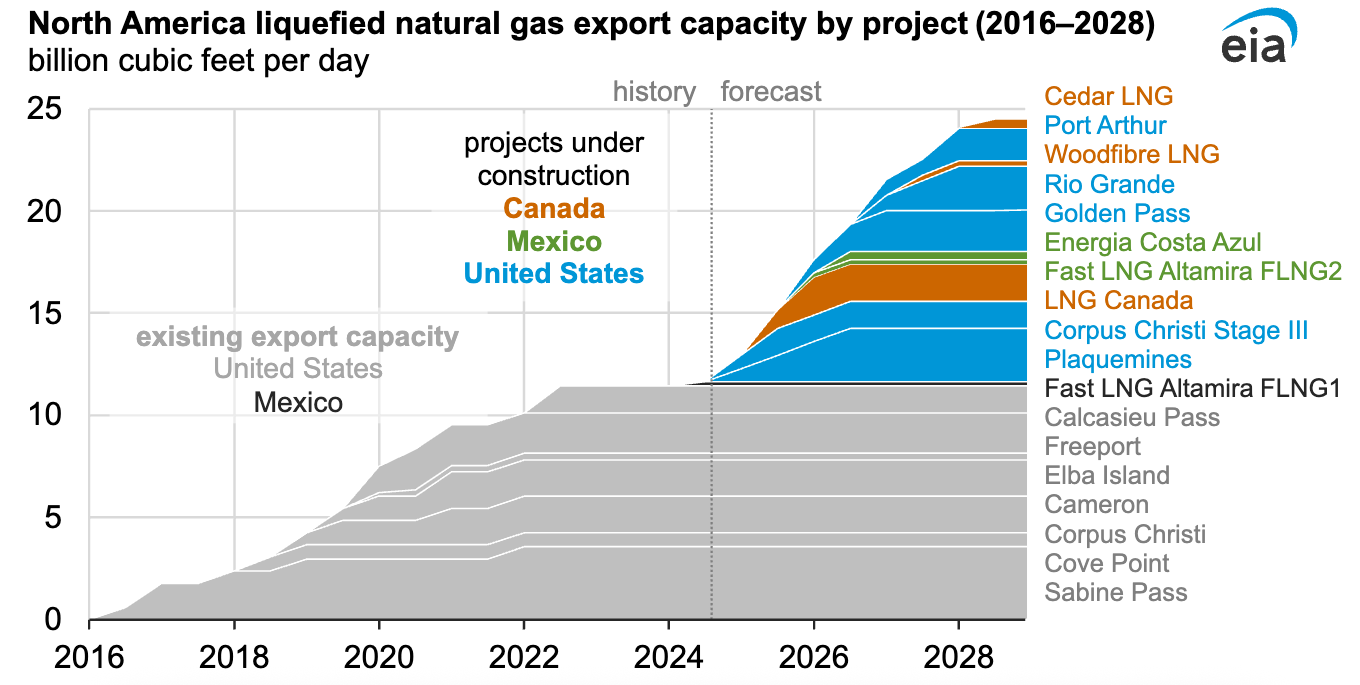

One of the most important long-term themes discussed was the projected surge in U.S. LNG demand — and how that’s driving both drilling strategy and capital flows.

Operators like Aethon Energy and Expand Energy emphasized that the U.S. is at the front end of a massive LNG buildout. Today’s U.S. LNG export demand sits around 16 BCF/day but could rise to 30+ BCF/day within a decade. Add to that 5–7 BCF/day of new domestic demand from sectors like AI-powered data centers, and you are looking at a structural shift in gas fundamentals.

This demand is triggering a strategic pivot toward Tier 2 and Tier 3 dry gas basins, such as the Anadarko and Barnett, despite their higher cost structures. Operators are now prioritizing proximity to Gulf Coast LNG terminals, vertical integration opportunities, and long-term capital efficiency over short-cycle returns.

As one speaker noted: “To meet that demand, we’ll need to drill smarter, not just faster.”

Final Thoughts: Volatility Remains — But Opportunity Is Growing

From foreign investors to family offices to LNG-focused operators, the message from the 2025 conference was clear: the energy capital landscape is evolving, not retreating. As natural gas steps further into the spotlight, strategic capital will continue to flow — just with more caution, more precision, and a sharp eye on long-term demand trends.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Our energy industry valuations have been reviewed and relied on by buyers, sellers, and Big 4 auditors. These energy-related valuations have been utilized to support valuations for IRS estate and gift tax, GAAP accounting, and litigation purposes. We have performed energy industry valuations domestically throughout the United States and in foreign countries.

Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights