Understanding the Importance of Defining the Assignment in a Business Valuation

To celebrate a new year and everything that comes with new beginnings, the Mercer Capital Litigation Support Services Team has decided to start the year with a blog emphasizing the importance of the beginning of a family law engagement, defining the assignment.

What Is an “Assignment Definition” in a Business Valuation and Why Is it Important?

In an engagement that requires a business valuation, the first step that attorneys and valuation experts should take is to define the assignment. This process involves the following:

- What interest is being valued. Sometimes this answer is simple, but sometimes it can be complex with multi-tiered entities or multiple ownerships. It is not uncommon to receive organizational structures with multiple holding companies and operating businesses, and the engagement letter should clearly state what is being valued. However, sometimes just that falls within our scope of engagement, so, the engagement letter may allude to a “TBD” [to be determined] ownership percentage. Owning 100% of a Company is different than owning 10%. This discussion can also lead to conclusions around the “level of value” of the engagement, a concept which will be discussed later in this blog.

- The “as of” date for the appraisal. A valuation conclusion pertains to a specific subject interest (see above) as of a specific date. Markets change, business factors change, and the value of a business or business interest is not static across time. For reference, consider: the public market, where publicly traded companies change price and as a result, value, daily. For most engagements, the valuation report is issued after the “as of” date. In other words, there is usually lag between the effective date for the conclusion and when that conclusion is rendered. Some states require current date as close to dissolution as possible, which may in turn require additional services, such as an update, or another valuation as of a more current date. See this newsletter for a more detailed explanation of the importance of the valuation date in a valuation engagement.

- Fees. While some valuation engagements can be performed for a fixed fee, most litigation engagements are an hourly basis due to our open-ended involvement. This open-endedness comes from the nature of litigation, where depositions, testimonies and prep for the opposing experts may be required by the valuation expert. Throughout the course of the engagement, other requested services can include forensic accounting services or an estimation of damages. In either case, the engagement letter should spell out how fees will be calculated and terms on billings and collections.

- Standard of Value and Level of Value. The standard of value and level of value are both valuation concepts that are very important to the valuation experts work and conclusions. While we do not intend to dive too deep into valuation theory in this blog, we will briefly discuss the standard of value and level of value below:

Standard of Value

While defining the assignment, the Standard of Value is another important consideration. Some simple questions that can help determine the standard of value include: Will the business continue to operate as a going concern or is a liquidation value more appropriate? Is “fair market value” or “fair value” required by the letter of the law for that specific engagement?

There are four standards of value that should be considered when defining a valuation assignment:

- Fair Market Value (“FMV”) Business valuations performed using the FMV standard are valued from the perspective of a rational, third-party investor who is not under any compulsion to buy or sell. In marital dissolution matters, FMV is typically appropriate and most common. Depending on the assignment definition, it is important to note that valuations of a business interest under FMV can include valuation discounts like a minority interest discount or a discount for lack of marketability, which are explained in more detail in this whitepaper. Check out this blog post by Mercer Capital for a more in-depth look at Fair Market Value.

- Fair Value. Business valuations performed using the Fair Value standard are slightly different from FMV. Shareholder oppression cases are an example where Fair Value is typically used. It is important to note that valuation discounts are not typically applied under the Fair Value standard. Check out this whitepaper by Mercer Capital for a more in-depth look at Statutory Fair Value.

- Investment Value. Business valuations performed using the Investment Value standard represent the value of a business interest to a particular, specific investor. The value of the business to a party such as a competitor, supplier, or customer is typically higher than it would be for a rational third-party investor due to the expectation of business synergies. Investment value varies depending on the value of the business to the specific purchaser; the business may well be more valuable to one competitor than to another, for example.

- Liquidation Value. The other standards of value listed above all assume a “going concern” premise, where that the business will continue operations, either independently or as a part of an acquiring company. However, there are circumstances such as distressed companies or a sale of a material asset where the liquidation value is more applicable. As a result, liquidation value will look at value from the context of the business being terminated or materially altered.

Each of these four business valuation standards may result in a different number to represent the value of the business, depending on the circumstances. Selecting the appropriate Standard of Value is crucial, and an experienced business valuation professional should be well-versed in selecting the standard of value that is most appropriate for the subject business interest being valued.

Levels of Value

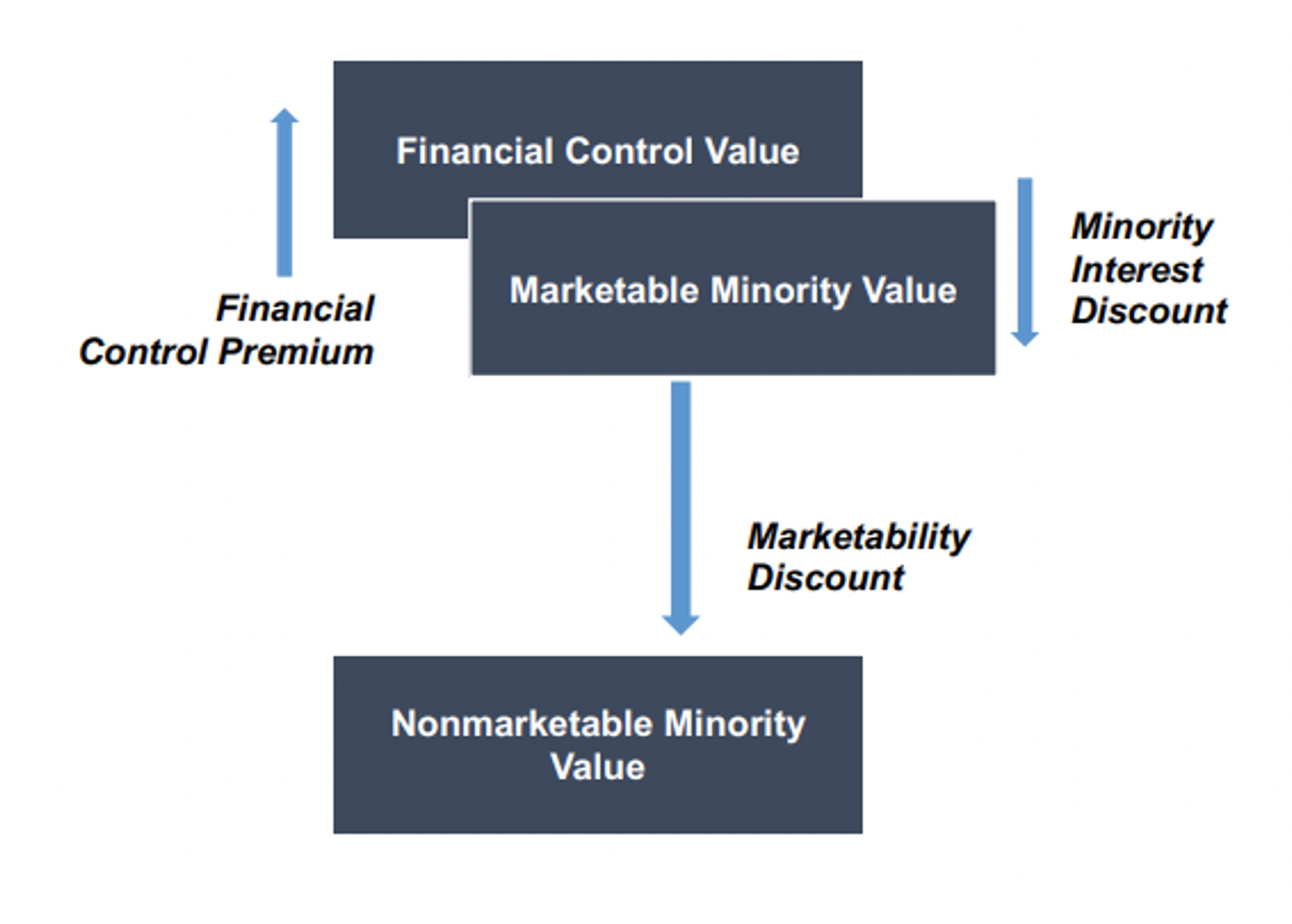

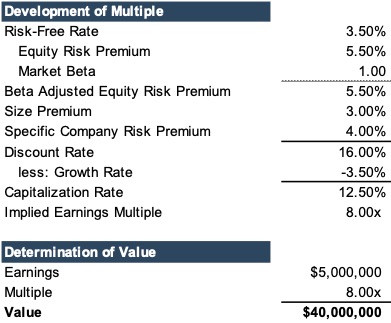

Business appraisers also refer to different kinds of values for businesses and business interests in terms of “levels of value.” As we noted in the Standards of Value section of this blog, the Fair Market Value standard of value opens the door for valuation discounts or premiums to be applied, which means that business appraisers may need to determine the appropriate Level of Value. See the chart below for the different Levels of Value that can be assigned to a valuation assignment:

To provide some examples, if the subject interest in a valuation assignment is a non-controlling minority investor, then the Nonmarketable Minority Value would likely be most appropriate. If the subject interest is a controlling owner, then the Financial Control Value could be considered. An experienced valuation expert should be able to help determine the appropriate level of value for an engagement and should also be able to quantify any Minority Interest Discount or Discount for Lack of Marketability that is deemed necessary in that engagement. Check out this blog post by Mercer Capital for a more in-depth look at the Levels of Value.

Important Takeaways for Attorneys and Valuation Experts

Defining the assignment in a valuation engagement can seem like a tall task but asking the right questions and having the right discussions with the right valuation expert at the beginning of an engagement can assist the process. You can think of the assignment definition process as building a road map for the valuation. Mercer Capital has extensive experience with a variety of valuation matters, including industry-expertise and complex scopes.

Bank M&A 2022 — Turbulence

At this time last year, we thought bank M&A would be described as a second year of “gaining altitude” after 2020 was spent on the tarmac following the short, but deep recession in the spring of 2020. Our one caveat was that bank stocks would have to avoid a bear market following a strong performance in 2021 because bear markets are not conducive to bank M&A.

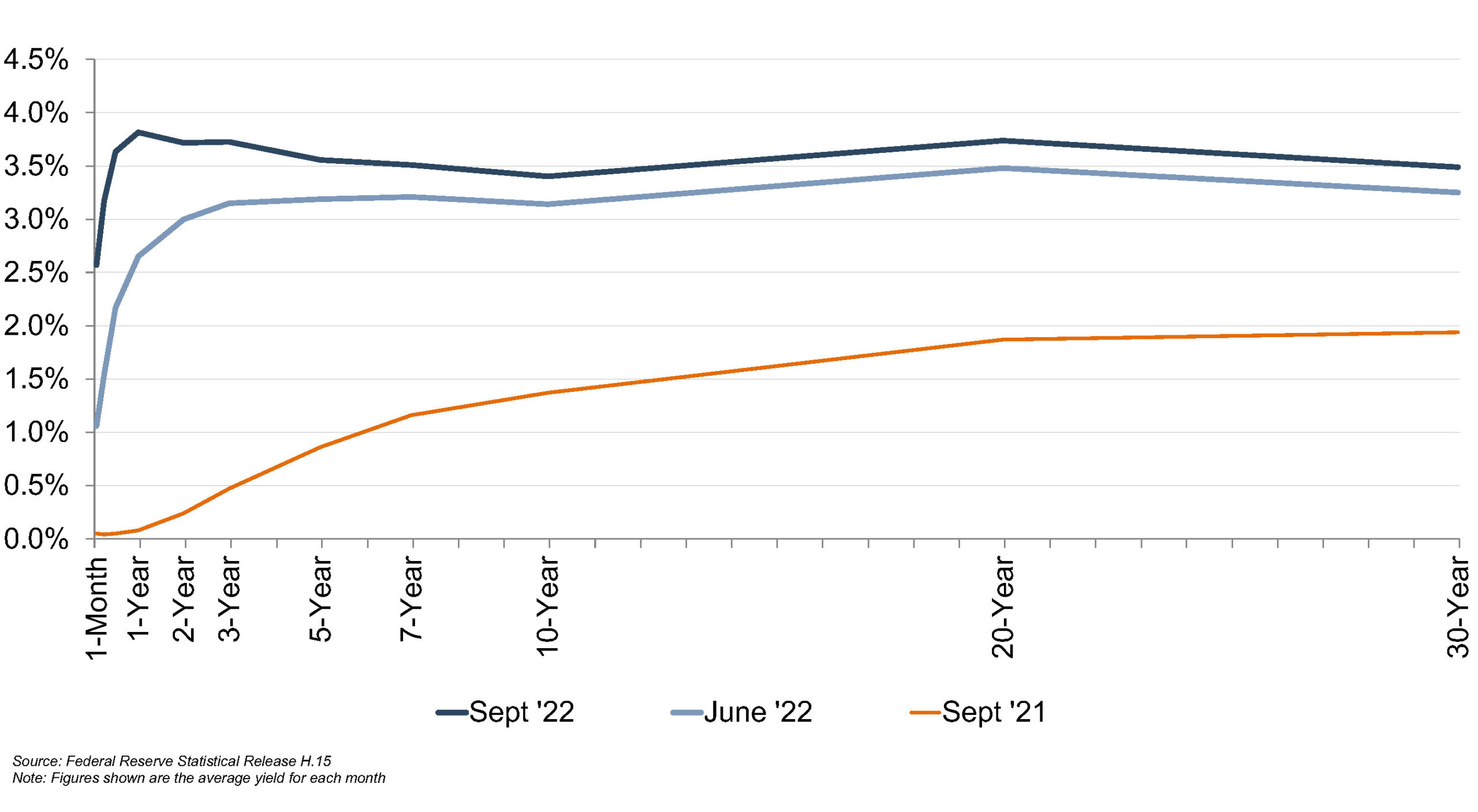

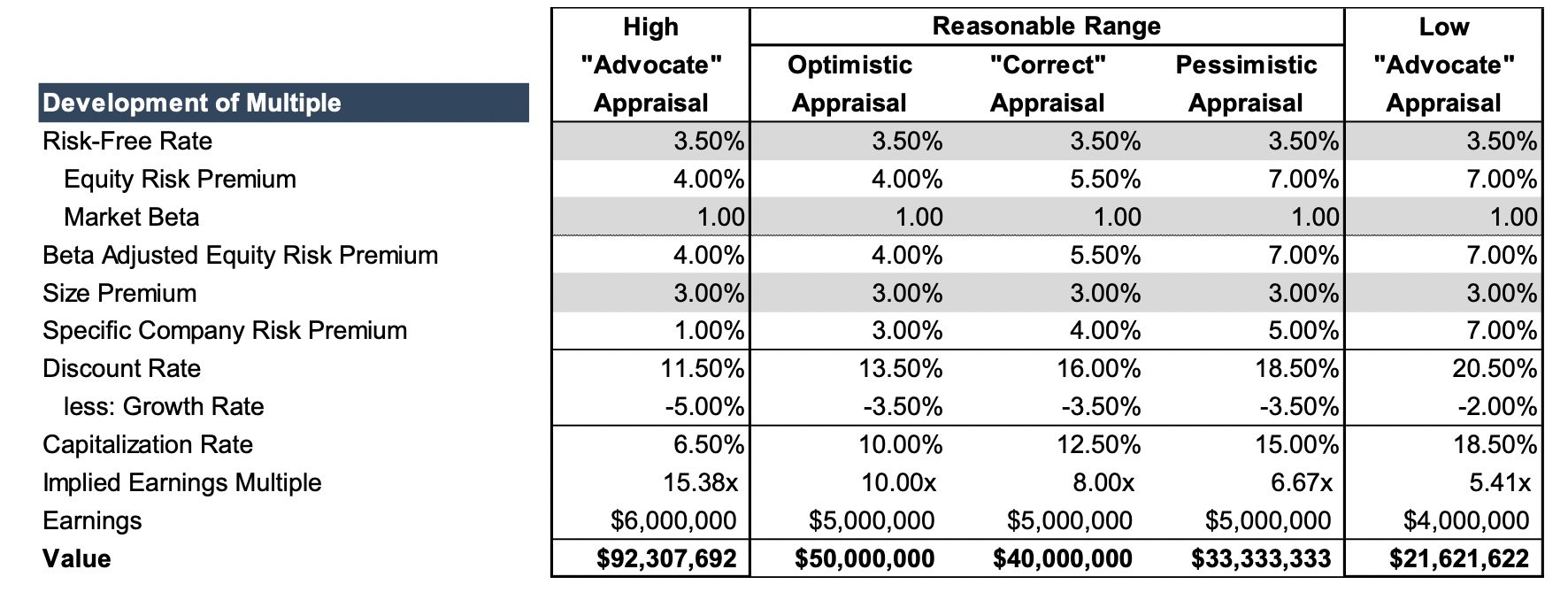

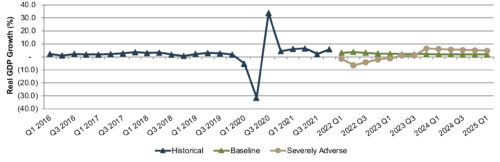

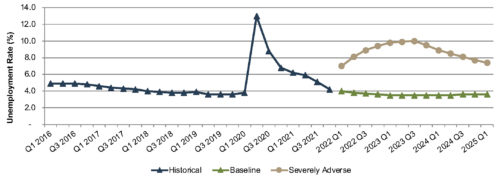

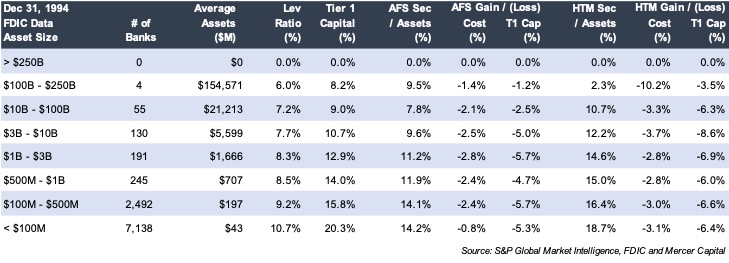

The caveat was correct. Bear markets developed in both bank stocks and fixed income that included the most deeply inverted U.S. Treasury curve since the early 1980s. Among the data points:

- The NASDAQ Bank Index declined 19% through December 28;

- The Fed raised the Fed Funds target rate 425bps to 4.25% to 4.50%;

- The yield on the 10-year US Treasury rose 236bps to 3.88%; and

- Credit spreads widened, including 150bps of option adjusted spread (OAS) on the ICE BofA High Yield Index to 4.55% from 3.05%.

The outlook for deal making in 2023 is challenged by significant interest rate marks (i.e., unrealized losses in fixed-rate assets), credit marks given a potential recession, soft real estate values, and the bear market for bank stocks that has depressed public market multiples. For larger deals, an additional headwind is the significant amount of time required to obtain regulatory approval.

However, core deposits are more attractive for acquirers than in a typical year given rising loan-to-deposit ratios, the high cost of wholesale borrowings and an inability to sell bonds to generate liquidity given sizable unrealized losses. A rebound in bank stocks and even a modest rally in the bond market that lessens interest rate marks could be the catalysts for an acceleration of activity in 2023 provided any recession is shallow.

A Recap of 2022

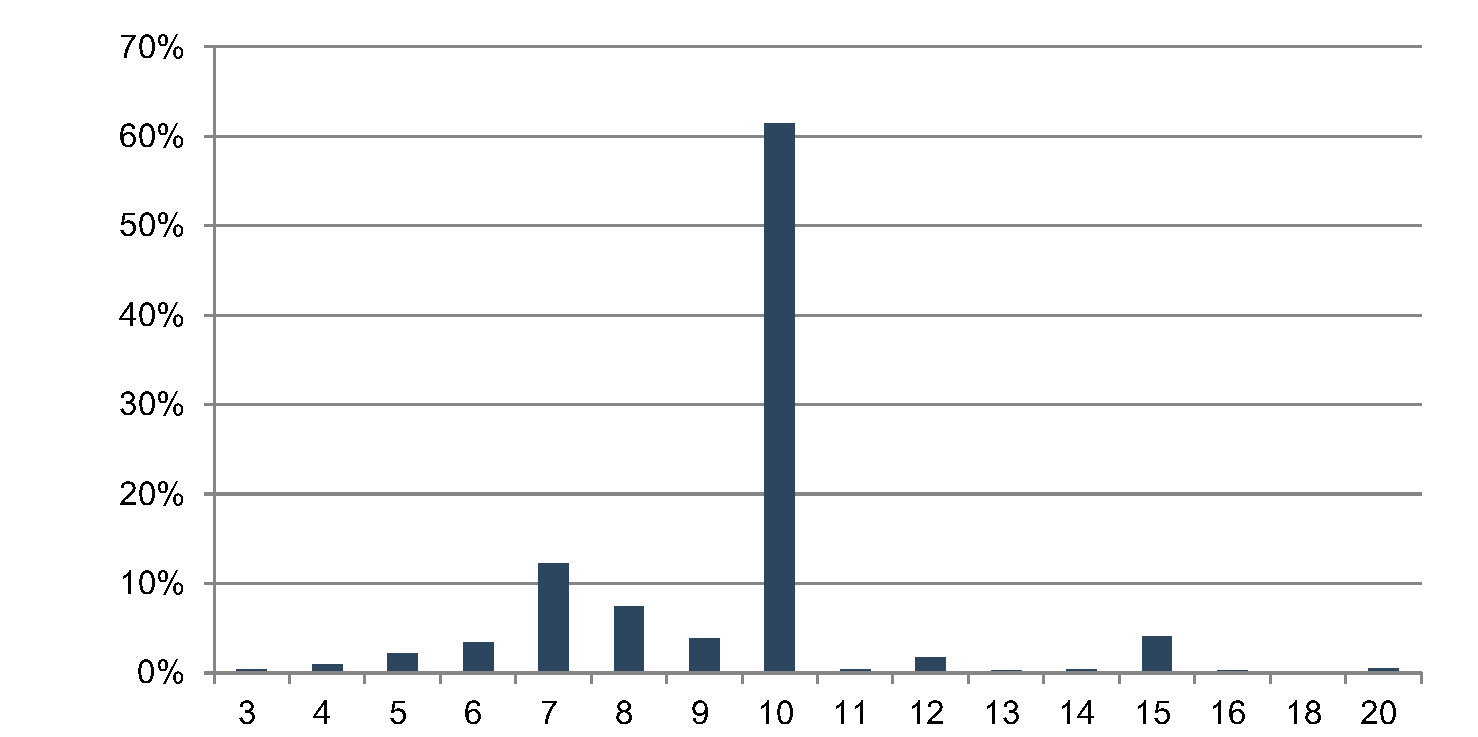

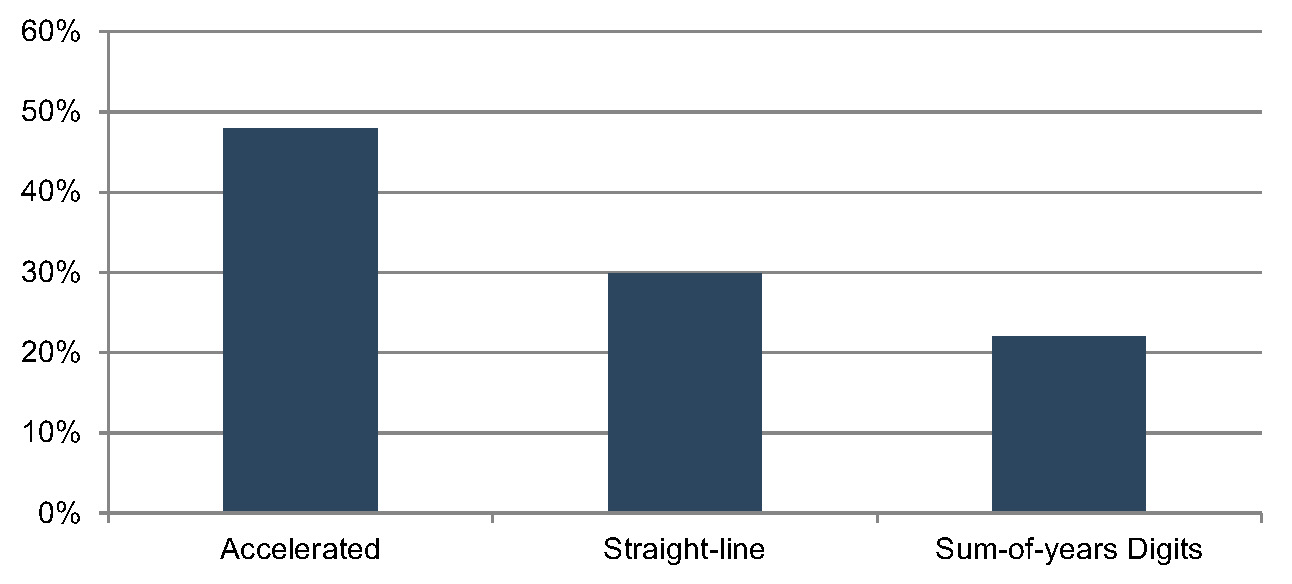

As of December 28, 2022, there have been 167 announced bank and thrift deals compared to 216 in 2021 and 117 in 2020. During the halcyon pre-COVID years, about 270 transactions were announced each year during 2017-2019.

As a percentage of charters, acquisition activity in 2022 accounted for 3.5% of the number of banks and thrifts as of January 1. Since 1990, the range is about 2% to 4%, although during 2014 to 2019 the number of banks absorbed each year exceeded 4% and topped 5% in 2019. As of September 30, there were 4,746 bank and thrift charters compared to 4,839 as of year-end 2021 and about 18,000 charters in 1985 when a ruling from the U.S. Supreme Court paved the way for national consolidation.

Also notable was the lack of many large deals. Toronto-Dominion’s (NYSE: TD) pending $13.7 billion cash acquisition of First Horizon (NYSE: FHN) represents 61% of the $23 billion of announced acquisitions this year compared to $78 billion in 2021 when divestitures of U.S. operations by MUFG and BNP and several larger transactions inflated the aggregate value.

Pricing—as measured by the average price/tangible book value (P/TBV) multiple—was unchanged compared to 2021. As always, color is required to explain the price/earnings (P/E) multiple based upon reported earnings.

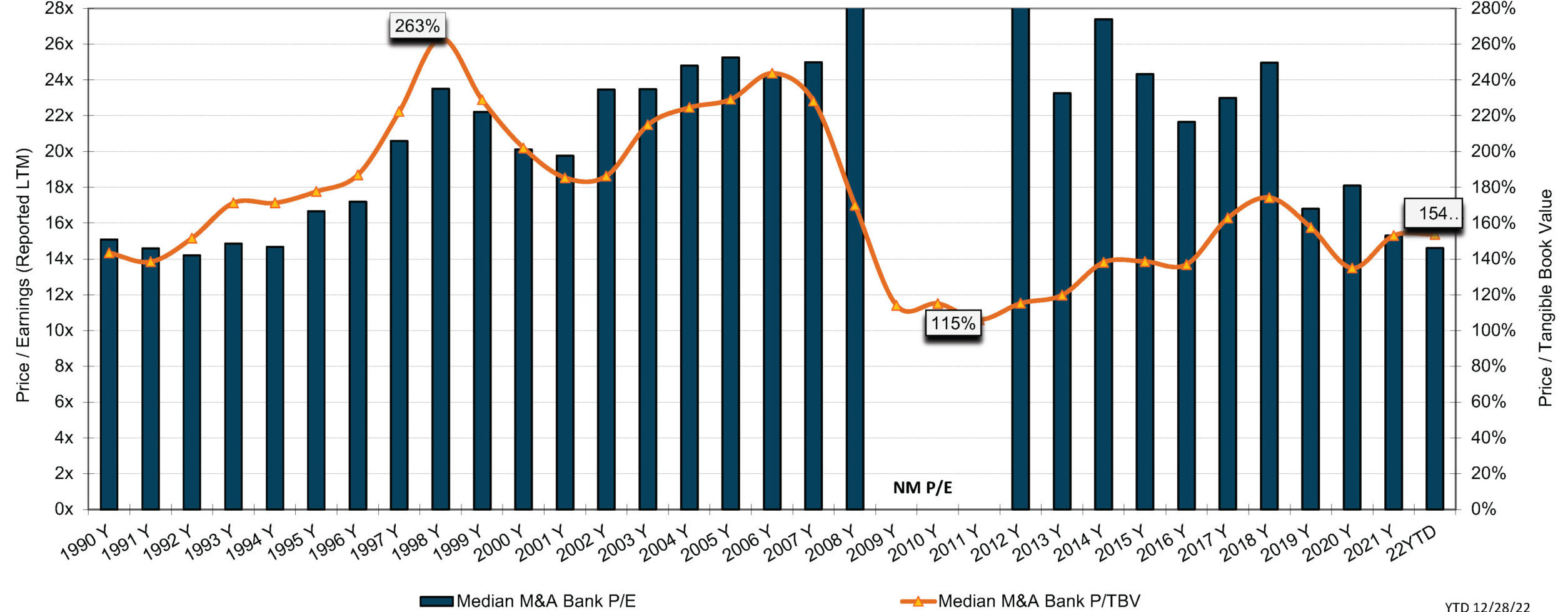

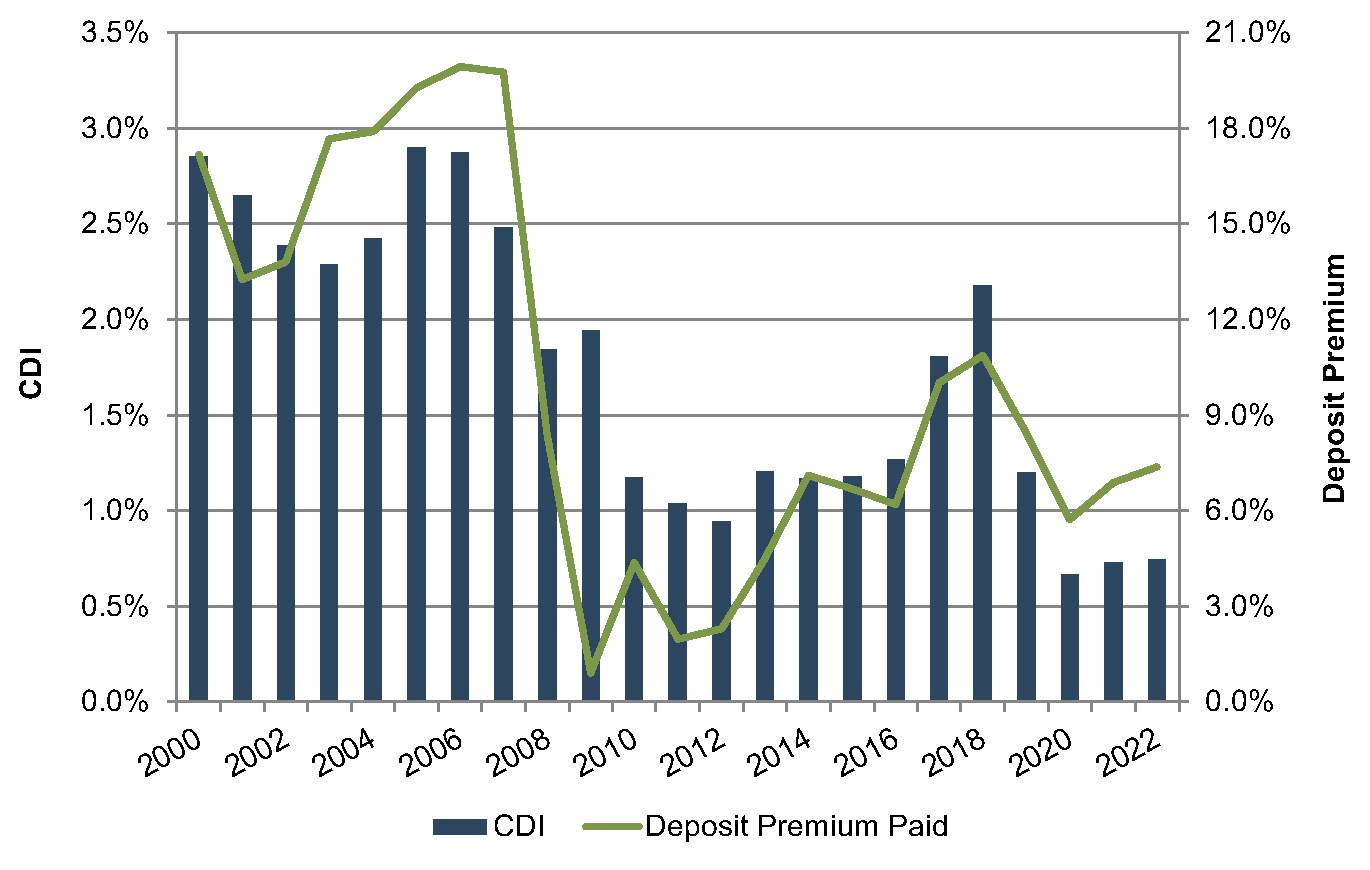

The median P/TBV multiple was 154% in 2022. As shown in Figure 1, the average transaction multiple since the Great Financial Crisis (GFC) peaked in 2018 at 174% then declined to 134% in 2020 due to the impact of the short but deep recession on economic activity and markets.

The median P/E in 2022 eased slightly to 14.6x from 15.3x in 2021; however, buyers focus on pro forma earnings with fully phased-in expense saves that often are on the order of 7x to 8x unless there are unusual circumstances. Accretion in EPS is required by buyers to offset day one dilution to TBVPS and to recoup the increase in TBVPS that would be realized on a stand-alone basis as investors expect TBVPS payback periods not to exceed three years.

Figure 1 :: 1990-2022 National Bank M&A Multiples

Click here to expand the image above

Public Market Multiples vs Acquisition Multiples

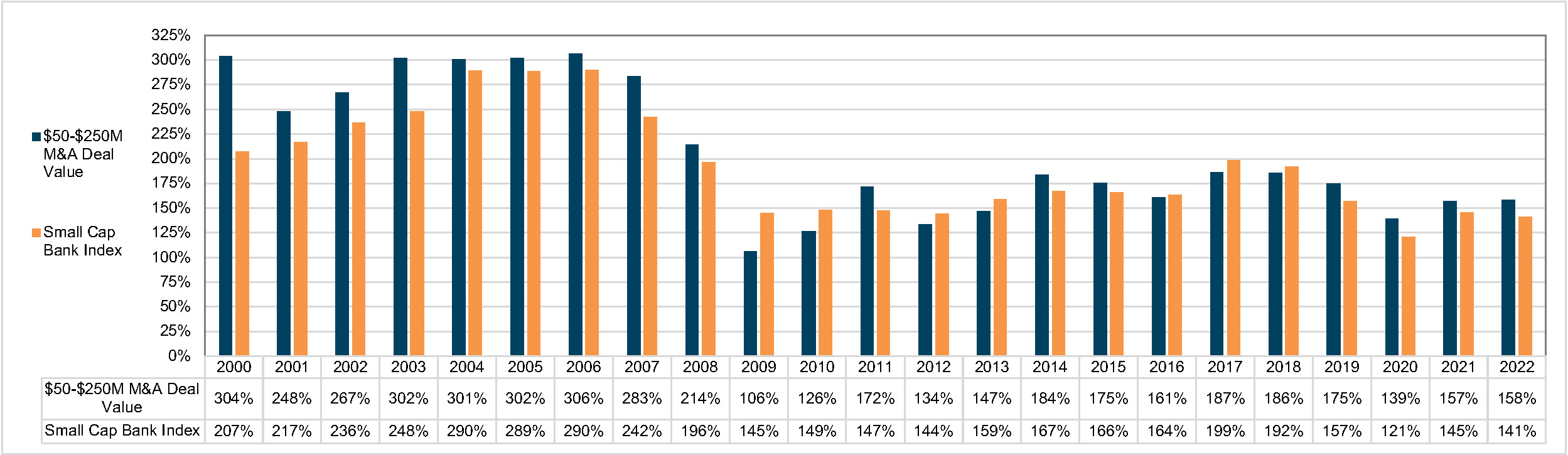

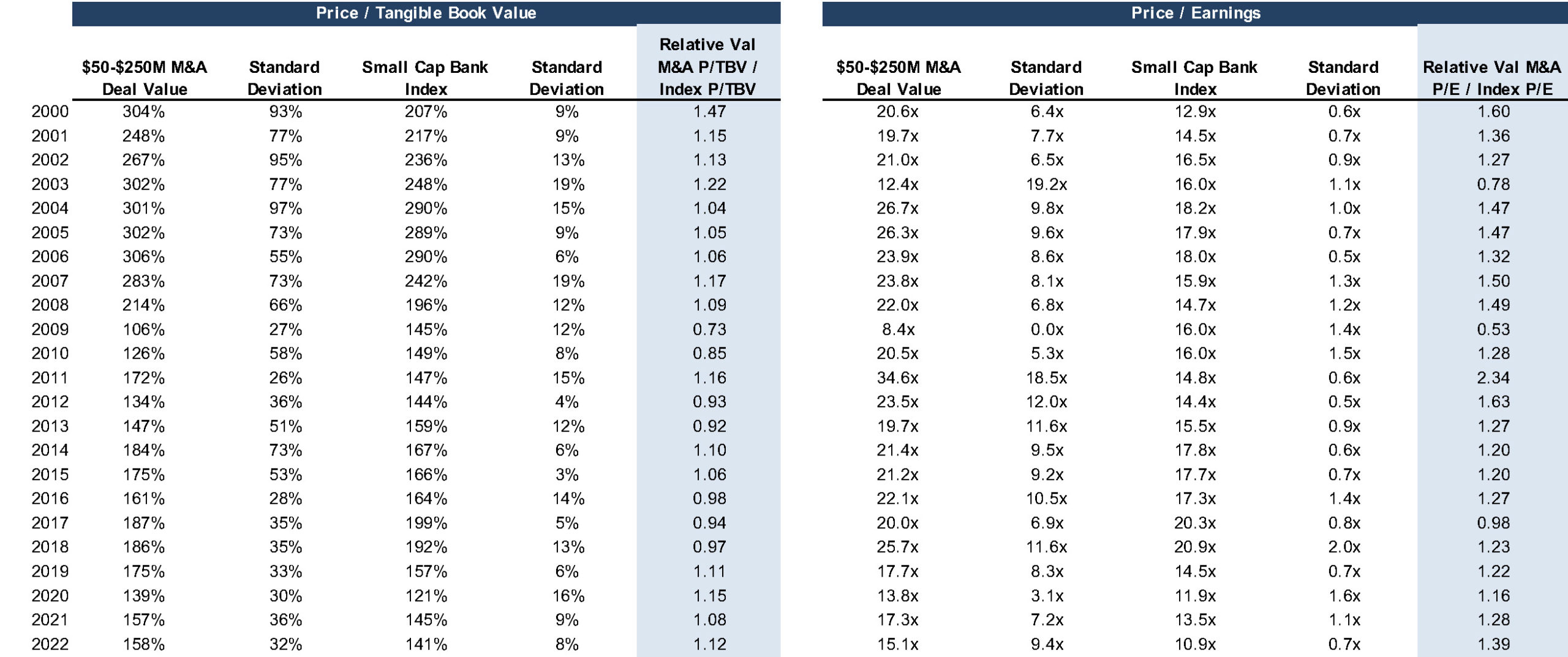

Figure 2 compares the annual average P/TBV and P/E for banks that were acquired for $50 million to $250 million since 2000 with the average daily public market multiple each year for the SNL Small Cap Bank Index.1 Among the takeaways are the following:

- Acquisition pricing prior to the GFC as measured by P/TBV multiples approximated 300% except for the recession years of 2001 and 2002 when the average multiples were 248% and 267%.

- Since 2014, average P/TBV multiples have been in the approximate range of 160% to 180% except for 2020.

- The reduction in both the public and acquisition P/TBV multiples since the GFC reflects a reduction in ROEs for the industry since the Fed adopted a zero-interest rate policy (ZIRP) other than 2017-2019 and 2022.

- Since pooling of interest accounting ended in 2001, the “pay-to-trade” multiple as measured by the average acquisition multiple relative to the average index multiple has remained in a relatively narrow range of roughly 0.9 to 1.15 other than during 2009 and 2010.

- P/E multiples based upon unadjusted LTM earnings have approximated or exceeded 20x prior to 2019 compared to 14-18x since then.

- Acquisition P/Es have tended to reflect a pay-to-trade multiple of 1.25 since the GFC but the pay-to-trade multiples are comfortably below 1.0x to the extent the pro forma earnings multiple is 7-8x, the result being EPS accretion for the buyer.

Figure 2 :: 2000-2022 Acquisition Multiples vs Public Market Multiples

Click here to expand the image above

Figure 3 :: 2000-2022 M&A TBV Multiples vs. Index TBV Multiples

Click here to expand the image above

Premium Trends Subdued

Investors often focus on what can be referred to as icing vs the cake in the form of acquisition premiums relative to public market prices. Investors tend to talk about acquisition premiums as an alpha generator, but long-term performance (or lack thereof) of the target is what drives shareholder returns.

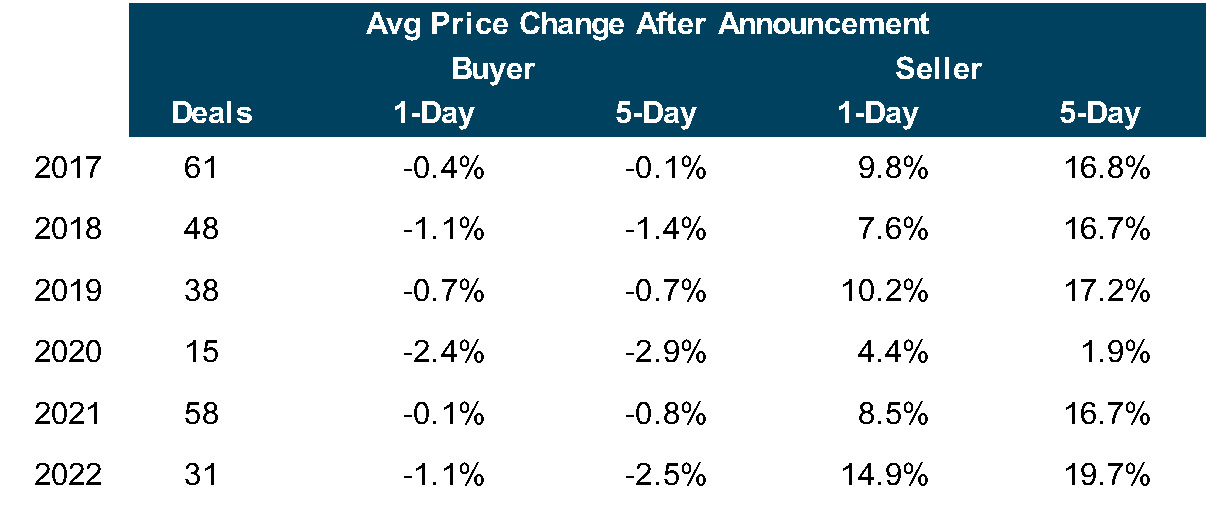

As shown in Figure 4, the average five-day premium for transactions announced in 2022 that exceeded $100 million in which the buyer and usually the seller were publicly traded was about 20%, a level that is comparable to recent years other than 2020. For buyers, the average reduction in price compared to five days prior to announcement was 2.5%. There are exceptions, of course, when investors question the pricing (actually, the exchange ratio), day one dilution to TBVPS and earn-back period. For instance, Provident Financial (NASDAQ: PFS) saw its shares drop 12.5% after it announced it would acquire Lakeland Bancorp (NASDAQ: LBAI) for $1.3 billion on September 27, 2022.

Figure 4

About Mercer Capital

M&A entails a lot of moving parts of which “price” is only one. It is especially important for would be sellers to have a level-headed assessment of the investment attributes of the acquirer’s shares to the extent merger consideration will include the buyer’s common shares. Mercer Capital has 40 years of experience in assessing mergers, the investment merits of the buyer’s shares and the like. Please call if we can help your board in 2023 assess a potential strategic transaction.

MedTech & Device – Industry Scan 2022

For this quarterly update, we bring together a couple of strands of our medtech and device industry practice. First, as long-term observers, public market developments in 2022 were interesting and perhaps marked an inflection point for the short to medium term. Second, in October, we attended a medtech industry conference, where we were able to gather a rich set of perspectives. The implications for some of the larger companies in the space are probably clear-cut. The downstream reverberations to private, development stage companies may be less straightforward. Nevertheless, since development stage companies are typically constrained by currently available funds and continually contemplating the next funding round, these developments are of critical importance.

2022: A Brief Review

A tumultuous year in the public markets is coming to a close. By the end of the third quarter 2022, the S&P 500 was down nearly 25%, marking a near-bottom for the year. The broader medtech and devices industry largely followed suit. On the brighter side, established large, diversified companies, while lagging their own previous benchmarks, outperformed the broader market. As a group, some biotech and life sciences companies (see next section) also seemed to fare relatively well. A closer look reveals that within the group some of the larger companies with more diversified revenue bases and, perhaps more importantly, profitable operations performed much better than smaller companies promising higher growth but deferred profits.

Current profitability also appeared to differentiate better stock price performers among the medical device and healthcare technology companies. At the same time, negative sentiment was more apparent for wide swathes of these two groups compared to the broader industry. It is obvious in hindsight but over the course of 2022, as interest rates rose and remained high, markets seemed to prefer existing earnings and nearer-term cash flows over future (rosier) prospects.

The shift towards more caution also manifested in other measures of market sentiment and activity. Wholesale downward revisions of earnings (growth) estimates have not occurred so far (this may yet come to pass), so much of the price decline reflects compressing valuation multiples. The pace of M&A transactions, which had gone from strength to strength during 2020 and 2021 despite myriad disruptions and distractions, decelerated significantly in 2022. By our measure, total transactions volume in the industry through the first three quarters of 2022 was roughly equal to that of just the fourth quarter of 2021. The number of IPOs also slowed to a trickle.

Looking Ahead to 2023 and Beyond: A Few Notes for Development Stage Companies

No industry is an island but as we and others have pointed out, several long-term trends, demographic and otherwise, suggest a favorable overall outlook for the medtech and device space. Even against the seemingly dour recent market backdrop, a multitude of attendees at the medtech conference agreed on the relative merits of the industry compared to the broader economy and market. We work with a number of development stage medtech and device companies over the course of a typical year. From that perspective, we find the long-term trends interesting because of the structural emphasis on continual innovation that improve outcomes for patients and clinicians.

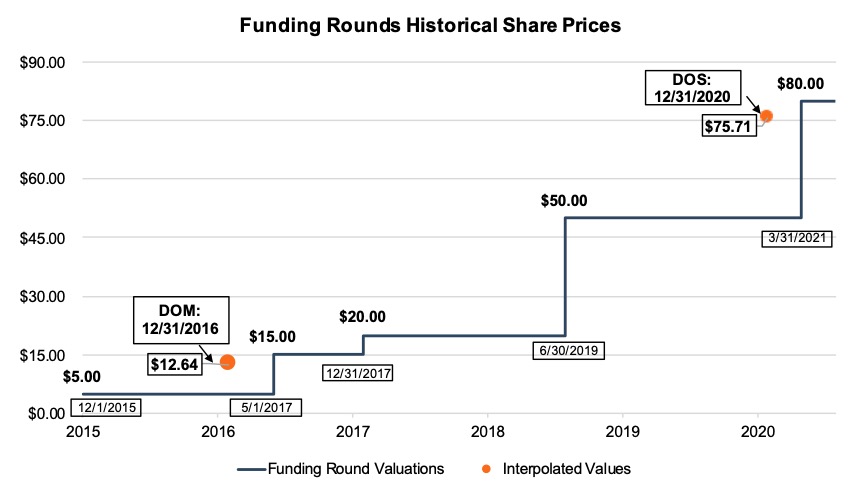

A defining feature of medtech innovation funding is that it occurs over multiple tranches as the technologies and companies achieve various developmental milestones. In this context, some observations for development stage companies:

An obvious first order effect of the recent public market developments over the past year is that development stage companies should expect generally lower valuations for funding rounds (at least) over the next couple of years.

Lackluster exit activity, via either M&A or IPO, delays and/or reduces deployable capital for venture capital funds, which will make them more cautious in considering investment decisions.

The sentiment shift towards more caution is shared by all investors, although the degrees will differ. Accordingly, in addition to valuation compression, some types of companies (for example, those at the pre-clinical stage) will find fundraising to be extremely difficult.

As a corollary, investors are likely to prize clean clinical data. Companies focused on demonstrating good clinical outcomes will be better prepared for future funding rounds.

Similarly, companies that can stretch their existing funds until they can achieve a good (clinical) milestone will be better rewarded in the next funding round.

Commercial traction after hurdling regulatory approval remains an important structural consideration, especially for the non-corporate investors.

Wrap-up

Beyond the near-term market dynamics, a key conference takeaway for us was that the medtech funding eco-system is deep and diverse. We met and heard from traditional venture capital investors, corporate investors, and folks who operate in the continuum between them. The goals for the various investors differ to some degree, with some focused on financial attributes while others (like corporate VCs) include strategic considerations in the mix. Investors with broader goals and considerations are, to an extent, less sensitive to the prevailing market conditions and can afford to take a longer-term view. Even among these investors, financial terms and preferred deal structures vary considerably.

For development stage companies contemplating fundraising efforts, a deep and diverse investor eco-system can provide plenty of optionality. In keeping with a recurring theme of this update, a note of caution – evaluating a potential funding round requires both an examination of the financial terms and an understanding of the structural features and their longer-term implications.

Mercer Capital has broad experience in providing valuation services to medtech and device start-ups, larger public and private companies, and private equity and venture capital funds involved in the sector. Please contact us to discuss how we may be of help.

For a more in-depth review of the industry, take a look at our most recent newsletter.

5 Things to Know About the SEC’s New Pay Versus Performance Rules

In August 2022, the SEC adopted final rules implementing the Pay Versus Performance Disclosure required by Section 953(a) of the Dodd-Frank Act. These rules go into effect for the 2023 proxy season and introduce significant new valuation requirements related to equity-based compensation paid to company executives. What does this mean, and how does it apply to you? What are the requirements, and why might there be significant valuation challenges involved? We discuss all that and more below.

Executive Summary

- The new SEC proxy disclosure rules introduce several new requirements, including that registrants calculate and disclose a new figure (Compensation Actually Paid), alongside existing executive compensation information. For most registrants, the rules will apply to upcoming 2023 proxy season.

- A new Pay Versus Performance table will detail the relationship between the Compensation Actually Paid, the financial performance of the registrant over the time horizon of the disclosure, and comparisons of total shareholder return.

- The newly introduced concept of Compensation Actually Paid will require companies to measure the period-to-period change in the fair value of all equity-based compensation awarded to named executive officers.

- The type of equity awards that have been granted will determine the complexity of the valuation process. Equity-based awards such as stock options might require updated Black Scholes or lattice modeling, while awards with performance or market conditions may require more complex Monte Carlo simulations.

- Registrants should understand that if equity awards have been granted on a consistent basis for a period of years, the new rules could require a large number of historical valuations for this initial proxy season and a significant amount of disclosure complexity.

Advance planning and processes will be needed to establish the scope and complexity of complying with the new rules, including identifying how many equity-based awards will require updated valuations to measure the period-to-period changes.

1. Overview and Background

The new disclosures were mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act and were originally proposed by the SEC in 2015. These rules will add a new item 402(v) to Regulation S-K and are intended to provide investors with more transparent, readily comparable, and understandable disclosure of a registrant’s executive compensation. The new provisions apply to all reporting companies other than (i) foreign private issuers, (ii) registered investment companies, and (iii) emerging growth companies.

The rules apply to any proxy and information statement where shareholders are voting on directors or executive compensation that is filed in respect of a fiscal year ending on or after December 16, 2022. As such, the vast majority of registrants will be required to include related disclosure for their 2023 proxy statements, though there are relaxed requirements for smaller reporting companies.

The new SEC proxy disclosure rules introduce several new requirements, including that registrants calculate and disclose a new figure (Compensation Actually Paid), alongside existing executive compensation information. For most registrants, the rules will apply to upcoming 2023 proxy season.

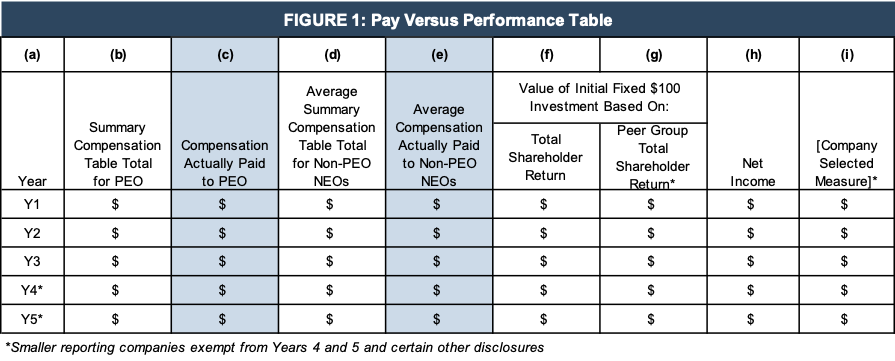

2. The Pay Versus Performance Table

The new rules require registrants to describe the relationship between the Executive Compensation Actually Paid (“CAP”) and the financial performance of the registrant over the time horizon of the disclosure. Additional items include disclosure of the cumulative Total Shareholder Return (“TSR”) of the registrant, the TSR of the registrant’s peer group, the registrant’s net income, and a company-selected measure chosen by the registrant as a measure of financial performance. These items are to be disclosed in tabular form (based on an example included in the final rule), which is replicated below.

Click here to expand the table above

The table includes the following components:

- Year. The form applies to the five most recent fiscal years (or three years for smaller reporting companies)

- Summary Compensation Table Total for Primary Executive Officer (PEO). These are the same total compensation figures as reported under existing SEC proxy disclosure requirements. However, additional columns may need to be added if there was PEO turnover in the relevant periods.

- Compensation Actually Paid to PEO. For each fiscal year, registrants are required to make adjustments to the total PEO compensation reported in Item (b) for pension and equity awards that are calculated in accordance with US GAAP. This item is potentially complex and is discussed in detail below.

- Average Summary Compensation Table Total for Non-PEO Named Executive Officers (NEOs). These average figures would be calculated using the same compensation figures as reported under existing SEC proxy disclosure requirements for NEOs. Different individuals may be included in the average throughout the five (or three) year period. Footnote disclosure is required to list the individual NEOs.

- Average Compensation Actually Paid to Non-PEO NEOs. These amounts would be calculated using the same methodology as in Item (c), but then averaging the amounts in each year.

- Total Shareholder Return. The registrant’s TSR is to be determined in the same manner as is required by existing Regulation S-K guidance. TSR is calculated as the sum of (1) cumulative dividends (assuming dividend reinvestment) and (2) the increase or decrease in the company’s stock price for the year, divided by the share price at the beginning of the year.

- Peer Group Total Shareholder Return. This is calculated consistently with the methodology used for Item (f). Registrants are required to use the same peer group they use for existing performance graph disclosures or compensation discussion and analysis.

- Net Income. This is simply GAAP net income for the relevant period.

- Company Selected Measure. This item is intended to represent the most important financial performance measure the registrant uses to link compensation paid to its PEOs and other NEOs to company performance. The registrant can select a GAAP or non-GAAP financial measure.

The remainder of this article focuses on the two shaded columns (c) and (e) which address Compensation Actually Paid and the valuation inputs that support these disclosures.

A new Pay Versus Performance table will detail the relationship between the Compensation Actually Paid, the financial performance of the registrant over the time horizon of the disclosure, and comparisons of total shareholder return.

3. What Is Compensation Actually Paid?

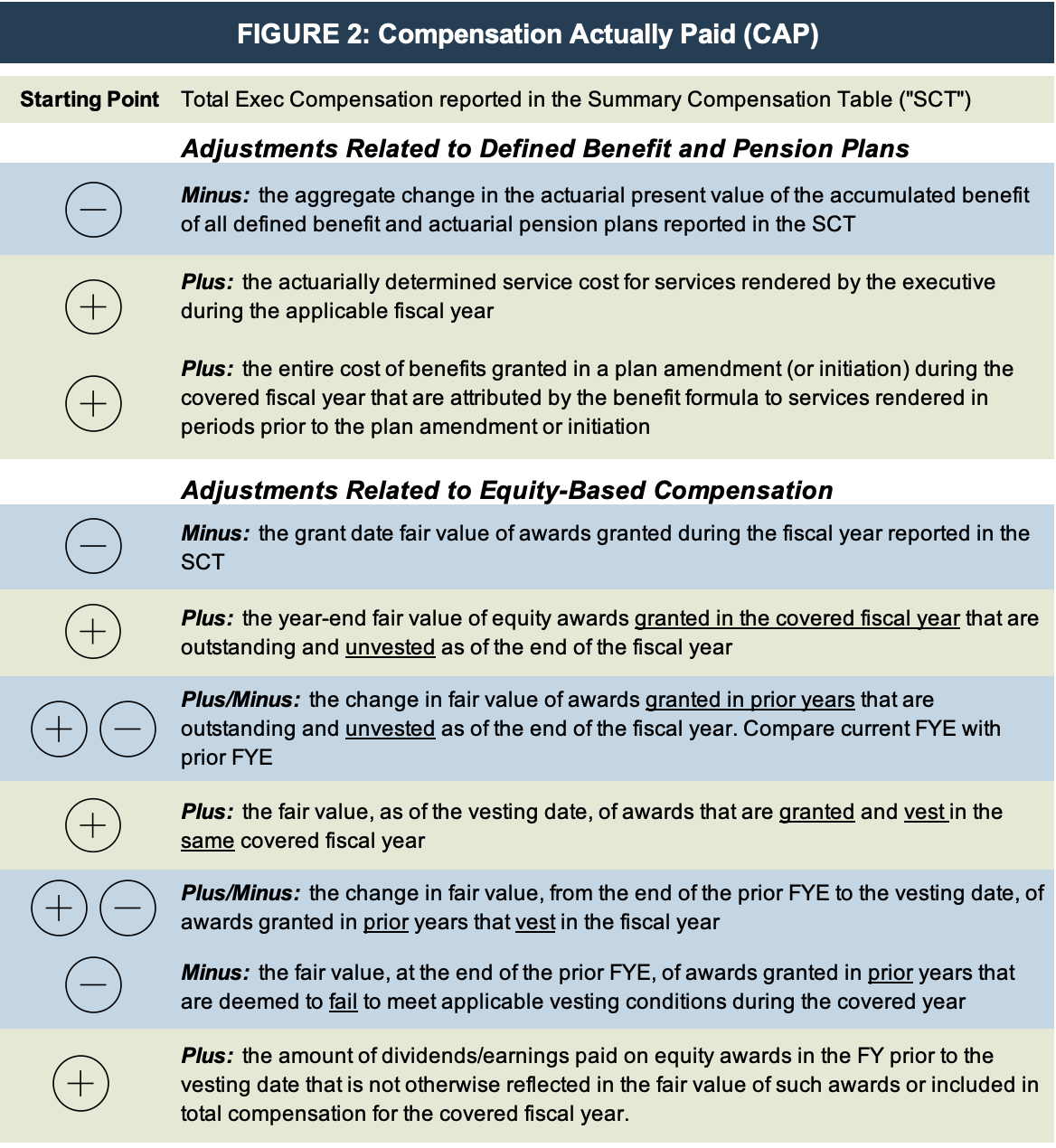

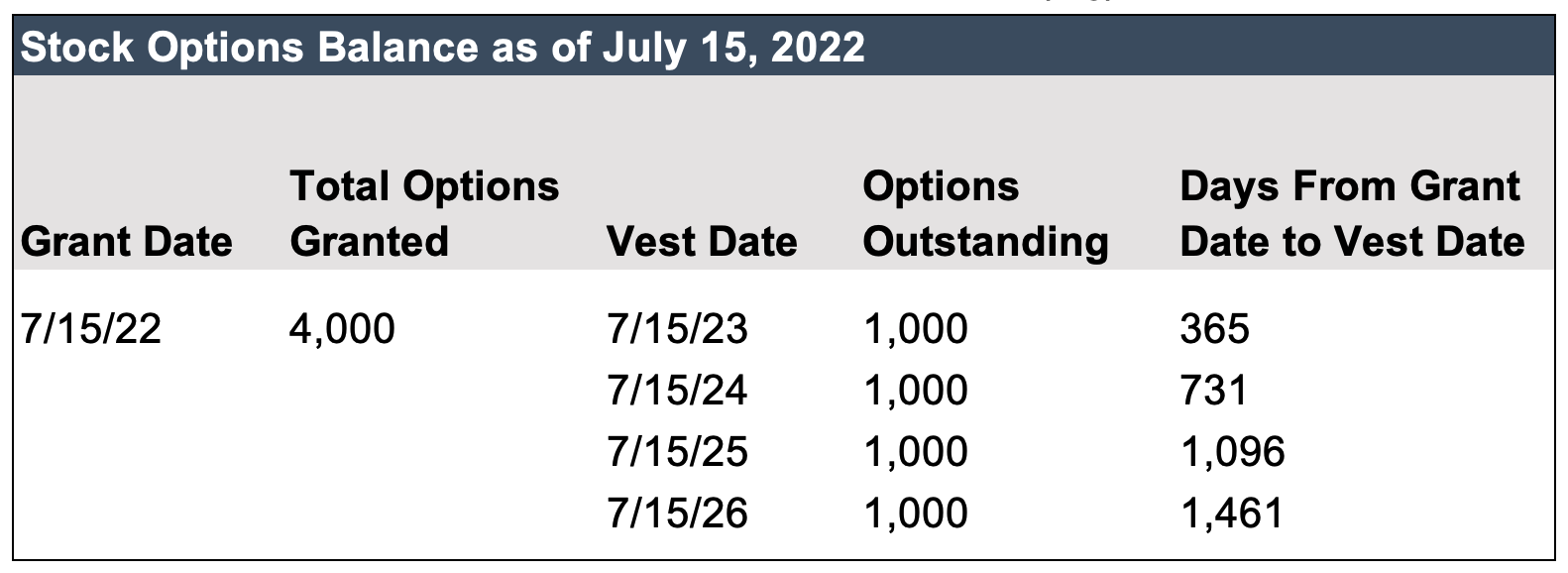

For each fiscal year, registrants are required to adjust the total compensation reported in Columns (b) and (d) for pension and equity awards that are calculated in accordance with US GAAP. The following table describes these adjustments in detail.

The pension-related adjustments should be calculated using the principles in ASC 715, Compensation – Retirement Benefits. The equity-based compensation adjustments will require registrants to disclose the fair value of equity awards in the year granted and report changes in the fair value of the awards until they vest. This means that it will be necessary to measure the year-end fair value of all outstanding and unvested equity awards for the PEO and other NEOs under a methodology consistent with what the registrant uses in its financial statements. For most registrants, this will be ASC 718, Compensation – Stock Compensation.

Appropriate footnote disclosure may also be required to identify the amount of each adjustment and any valuation assumptions that materially differ from those disclosed at the time of the equity grant.

The newly introduced concept of Compensation Actually Paid will require companies to measure the period-to-period change in the fair value of all equity-based compensation awarded to named executive officers.

4. What Are the Different Types of Equity Awards?

The procedures used to calculate fair value will vary depending on the type of equity award.

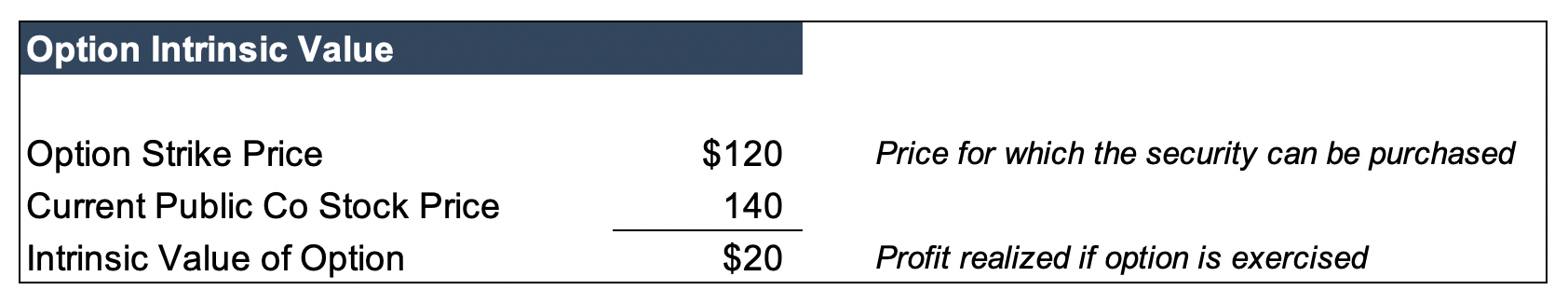

- For restricted stock and restricted stock units (RSUs), fair value can be calculated using observed share prices at the grant date, fiscal year-end, and the vesting date. The change in fair value would simply be the difference between these dates.

- For stock options and stock appreciation rights (SARs), fair value at the grant date is often calculated using a Black-Scholes or lattice model. Therefore, updated fair values at year-end and at the vesting date should be based on updated assumptions in those models, including current stock price, volatility, expected term, risk-free rate, dividend yield, and consideration of a sub-optimal exercise factor (in a lattice model). Care should be taken to ensure that expected term appropriately considers moneyness of the options at the new date. The use of historical and/or option-implied volatility should be evaluated for consistency and continued applicability.

- For performance shares and performance share units (PSUs), the fair value calculations may be more complex due to the presence of a performance condition (e.g., the award vests if revenues increase by 15% and EBITDA margin is at least 20%) or a market condition (e.g., the award vests if the registrant’s total shareholder return over a three-year period exceeds its peer group by at least 5%). The performance condition will require updated probability estimates at year-end and at the vesting date. Awards with market conditions are typically valued at their grant date using Monte Carlo simulation and so a reassessment at subsequent dates using a consistent simulation model with updated assumptions will be necessary.

The type of equity awards that have been granted will determine the complexity of the valuation process. Equity-based awards such as stock options might require updated Black Scholes or lattice modeling, while awards with performance or market conditions may require more complex Monte Carlo simulations.

5. Special Considerations for Market Condition Awards Using Monte Carlo Simulation

Market condition awards come in many different flavors. Three of the most common types of plans include:

- Market condition based upon performance in the registrant’s own stock. In this plan, vesting might be achieved if the registrant’s share price exceeds a certain level for a defined number of trading days or reaches an agreed-upon measure of total shareholder return.

- Market condition based upon relative total shareholder return. In this plan, the award vests based upon the registrant’s TSR in comparison to a similarly calculated TSR for a broad market benchmark index, an industry index, a peer company, or group of peer companies. Some plans employ a modification factor that adjusts the size of the award based upon varying levels of relative TSR performance.

- Market condition based upon ranked total shareholder return. In these plans, award vesting is based upon a numerical ranking of the registrant’s TSR against the TSRs of a group of peer companies or all of the companies on a particular broad market or industry index. The numerical or percentile ranking then determines the modification factor that adjusts the size of the award.

Each of the above plans has inputs and assumptions that drive the Monte Carlo simulation. When performing a subsequent year-end or vesting date fair value analysis, each of the grant-date assumptions will need to be reevaluated. For example, for a relative TSR plan with a three-year term, the subsequent year-end valuations will necessarily have shorter terms (2-year and 1-year), which will require new inputs for volatility and correlation factors. Shorter terms may make the use of option-implied volatility more relevant if sufficient market data is available.

For relative TSR plans that reference a group of companies or an index, some of the peers may have been acquired or merged in the subsequent periods. The plan documentation will often describe the steps to be taken when the composition of the peer group changes or there is a change in the benchmark index. A different group (or number) of companies will affect the correlation assumption as well as the percentile calculations in a ranked plan.

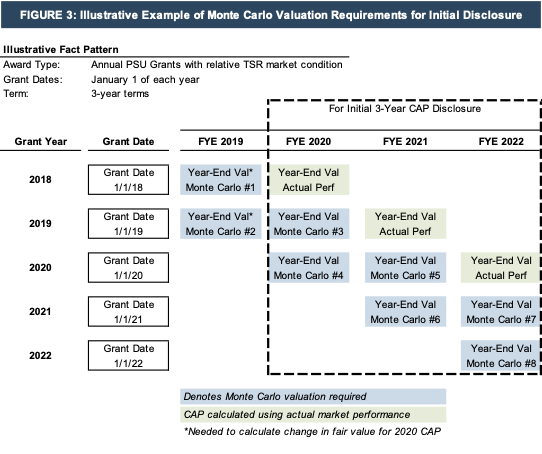

Regardless of the type of plan, it is important for registrants to understand how even a relatively simple award, if granted consistently for a period of years, can lead to a large number of Monte Carlo simulations for this initial proxy season and a significant amount of disclosure complexity.

As shown in Figure 3 below, if a company has made annual PSU grants (with a market condition) for each of the last five years, then up to eight Monte Carlo valuations could be required to calculate the CAP in each period.

Click here to expand the example above

In the example above, the blue boxes indicate when a valuation of prior grants would be necessary to calculate the change in fair value for each period of the CAP disclosure. For the final period of a relative TSR market condition plan, the company could use the actual market performance of its stock (and the comparative index) to calculate the expected value of the award.

Registrants should understand that if equity awards have been granted on a consistent basis for a period of years, the new rules could require a large number of historical valuations for this initial proxy season and a significant amount of disclosure complexity.

Summary and Next Steps

While the new SEC Pay Versus Performance disclosure rules can seem daunting, they can be managed with proper planning and a systematic approach. For the CAP disclosures, registrants need to understand the details of all equity awards that have been awarded to named executive officers (how many and what type of award). The award characteristics will determine which valuation method is most appropriate and how many valuations need to be performed.

If you have questions about the valuation techniques used for the various types of equity compensation awards or would like to discuss the process, please contact a Mercer Capital professional.

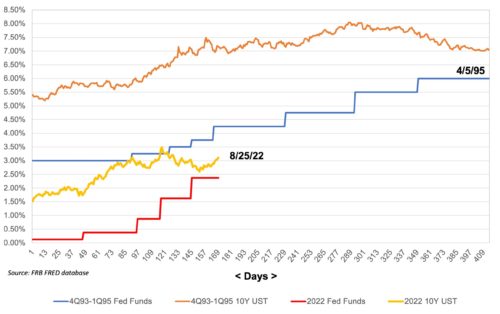

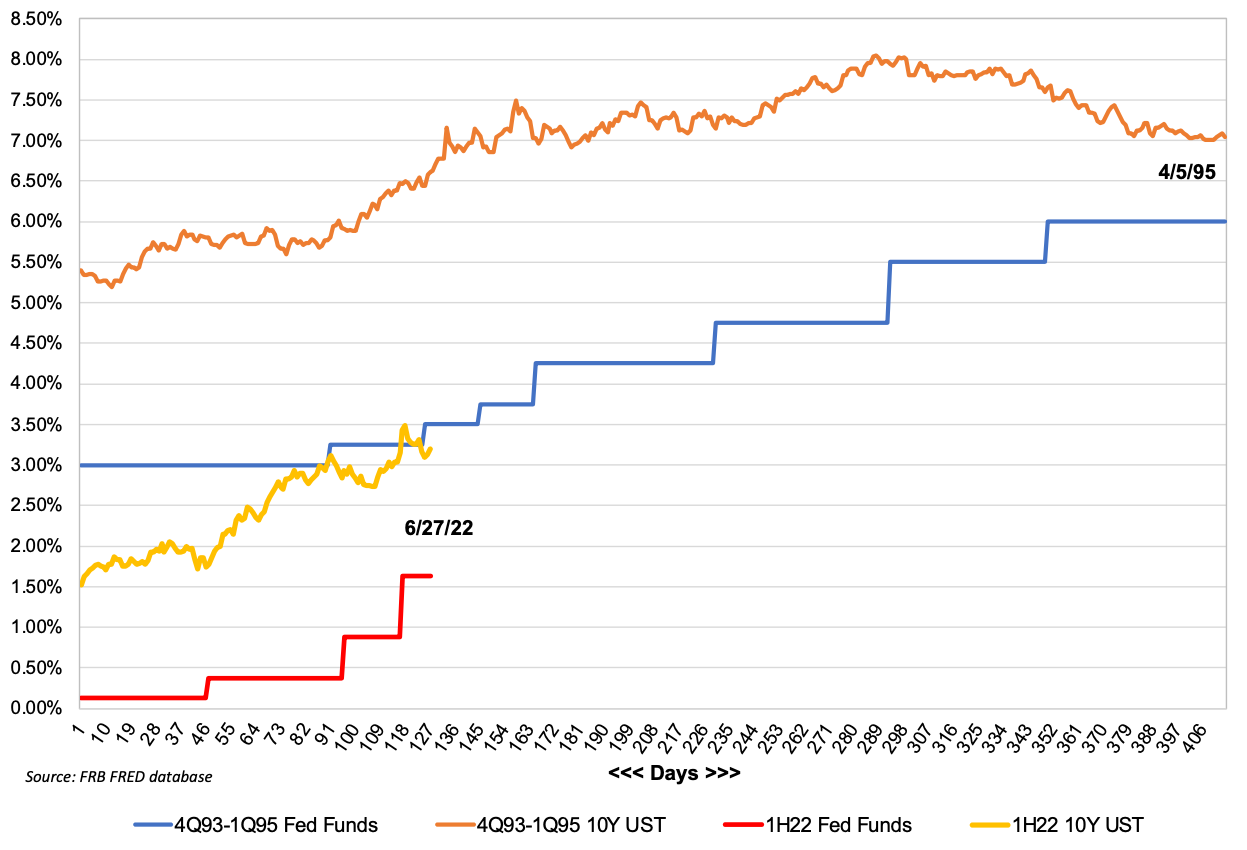

Bond Portfolio Update

The U.S. bond market is undergoing its worst bear market in decades. Barclays U.S. Aggregate Bond Market Index produced a total return of negative 14.5% through September 30, 2022 and negative 16.0% through November 8, 2022. Excluding coupon income, the year-to-date loss was 17.2% which speaks to how low coupon income is given the nominal difference between price change and total return.

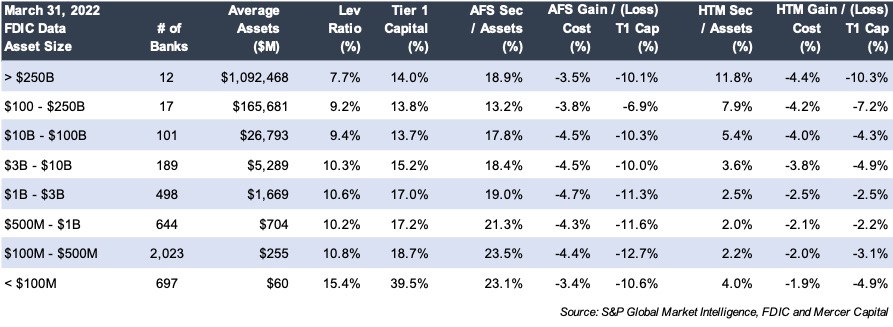

Click here to expand the image above

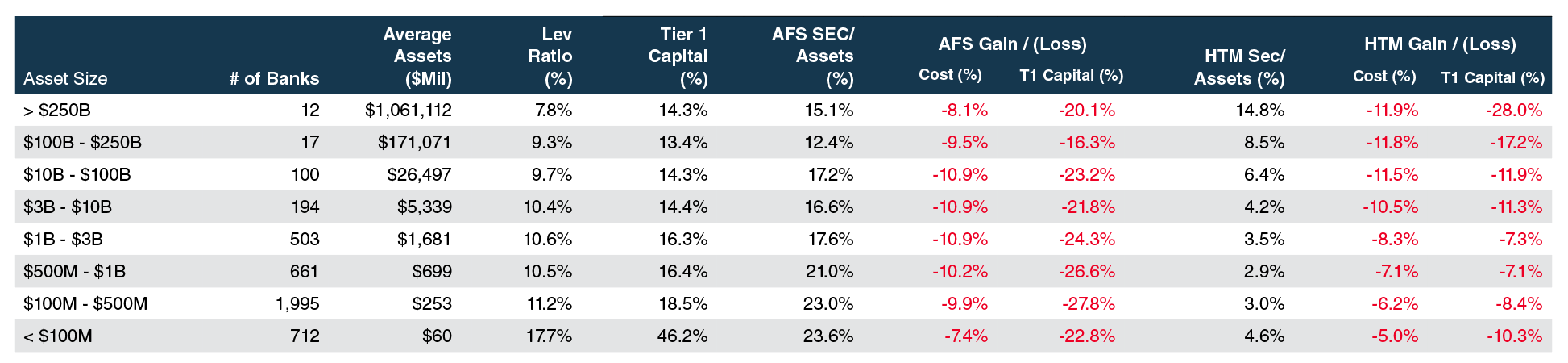

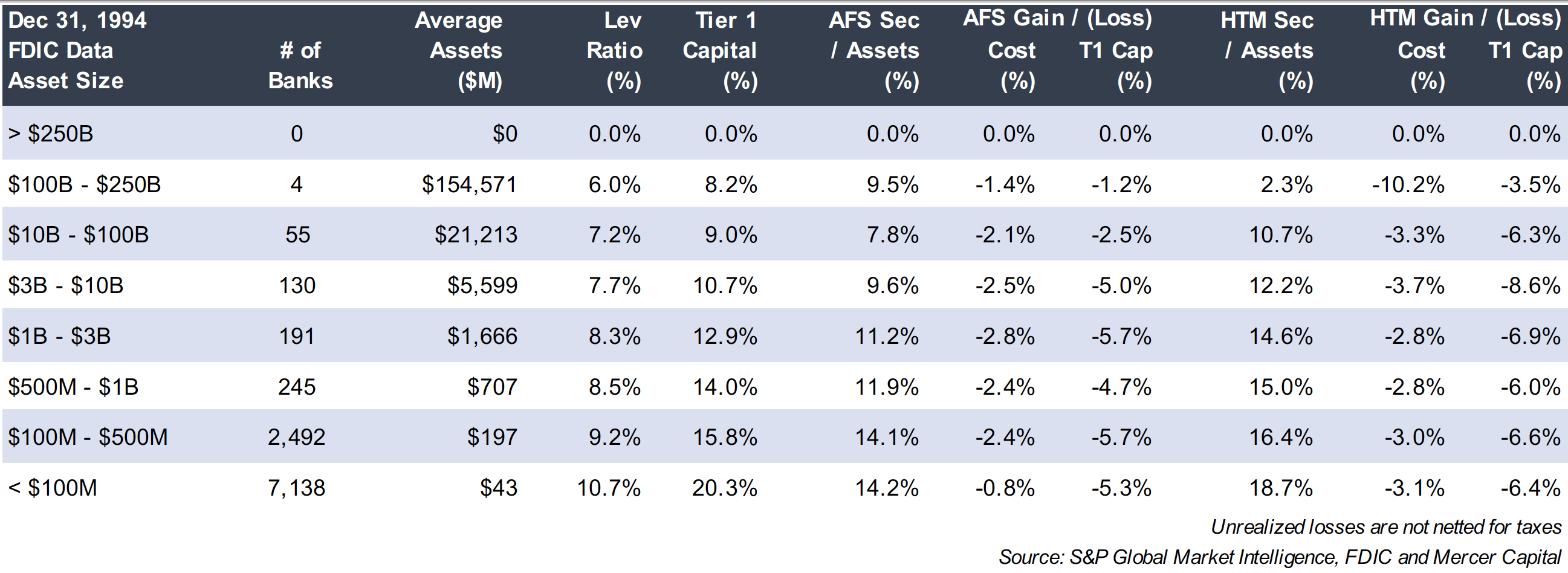

As shown in the figure below, U.S. commercial banks have suffered unrealized losses in their bond portfolios equal to roughly 10% of the cost basis of both AFS and HTM classified portfolios as of September 30, which compares to a price reduction of 15.6% in the Barclay’s index as of quarter end.

The less-worse performance by U.S. banks likely reflects less duration than the index, which has an effective duration of 6.25 years and weighted average maturity of 8.25 years. Our observation is that for the most part outsized losses among U.S. banks reflect an outsized position in municipals and/or MBS. The index composition is heavily skewed to U.S. Treasuries and U.S. Agency obligations given the heavy issuance of government backed debt the past 15 years or so.

While management and directors at most banks are unhappy with their bond portfolios, institutional investors have taken a more nuanced view of the impact of rising rates based upon the tenor of third quarter earnings calls and the reaction of most stocks upon the release of earnings. Rising rates have supported bank earnings even though fixed-rate loan and bond portfolios are slow to reprice as floating-rate loans have repriced and banks have lagged deposit rates.

Investor concern is more focused on liquidity risks. Some (or many) banks eventually may have to raise deposit rates sharply to stem outflows and/or fund loan growth because selling bonds is not a viable option given the magnitude of unrealized losses that if realized will reduce regulatory capital.

Our prior commentary on bank bond portfolios following the release of the first and second quarter Call Reports can be found here and here.

Community Bank Loan Portfolios Have Unrealized Losses Too

Fixed income is undergoing one of the deepest bear markets in decades this year. There has been a lot of discussion surrounding the impact of rising rates on bank bond portfolios and bank stocks as rising rates have resulted in large unrealized losses in bank bond portfolios. My colleague, Jeff Davis, provides an update to his previous commentary on the topic based on third quarter Call Report data here.

If subjected to mark-to-market accounting like the AFS securities portfolio, most bank loan portfolios would have sizable losses too given higher interest rates and wider credit spreads; however, unrealized “losses” in loan portfolios do not receive much attention because there is not an active market for most loans unlike most bonds that populate bank portfolios. Further, accounting standards do not mandate mark-to-market for loans other than those held-for-sale.

While the trend in loan portfolio fair values is harder to examine given the lack of data, the following charts provide some perspective based on a survey of periodic loan portfolio valuations by Mercer Capital. To properly evaluate a subject loan portfolio, the portfolio should be evaluated on its own merits, but markets do provide perspective on where the cycle is and how this compares to historical levels.

Fair value is guided by ASC 820 and defines value as the price received/paid by market participants in orderly transactions. It is a process that involves a number of assumptions about market conditions, loan portfolio segment cash flows inclusive of assumptions related to expected prepayments and expected credit losses, appropriate discount rates, and the like.

The fair value mark on a subject loan portfolio includes two components – an interest rate mark and a credit mark. The interest rate mark is driven by the difference in the weighted average discount rate and weighted average interest rate of the subject portfolio. The discount rate that is applied to a subject loan should reflect a rate consistent with the expectations of market participants for cash flows with similar risk characteristics. The credit mark captures the risk that the borrower will default on payments and not all contractual cash flows will be collected.

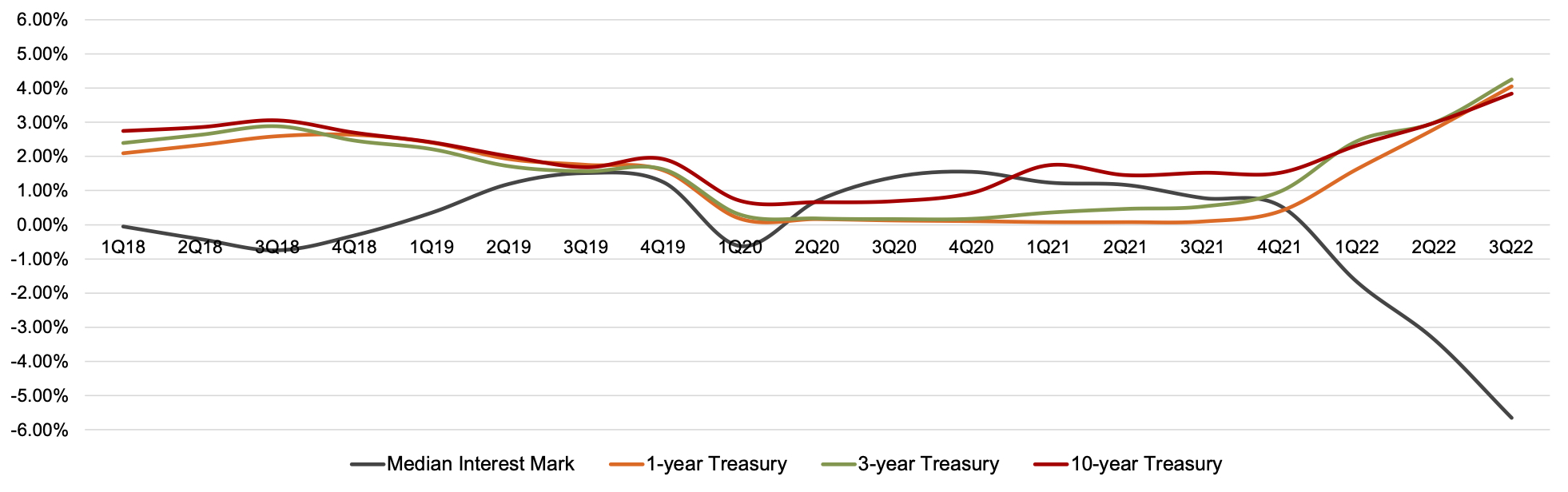

Since the end of 2021, rising market interest rates have been the predominant factor driving the change (i.e., reduction) in loan portfolio fair values. As shown in Figure 1, the median interest rate mark for our data sample has fallen from a modest 0.55% premium at December 31, 2021 to a 5.65% discount as of September 30, 2022. While bank earnings benefit from a higher rate environment and net interest margin expansion, it takes time for the increase in market rates to be passed on to customers via higher loan rates and for lower, fixed-rate loans to roll out of the portfolio. In talking with Mercer Capital clients and in our loan portfolio valuation practice, so far it seems that banks have been unable to fully pass on the increase in rates to loan customers.

Figure 1: Trends in Interest Rate Marks

Click here to expand the image above

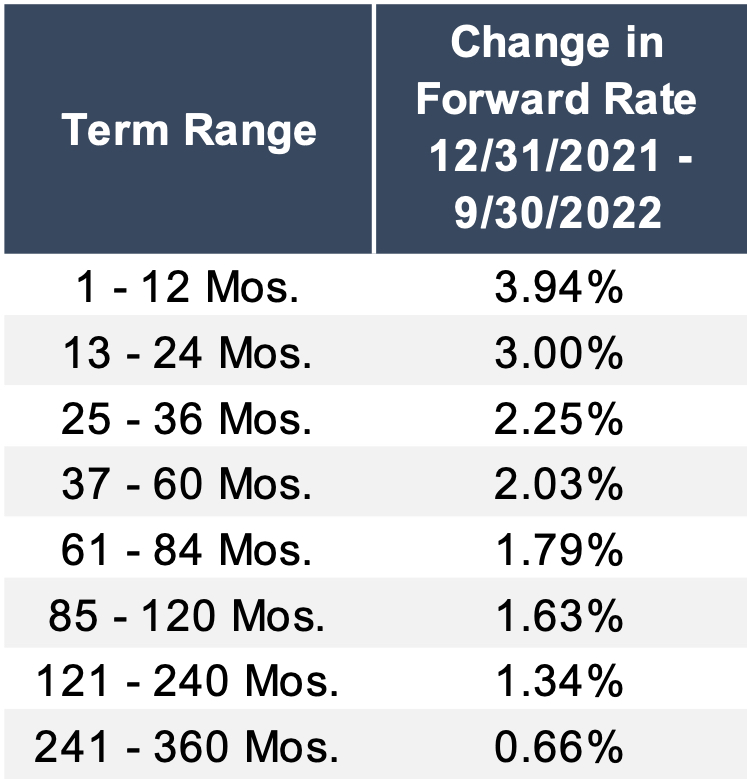

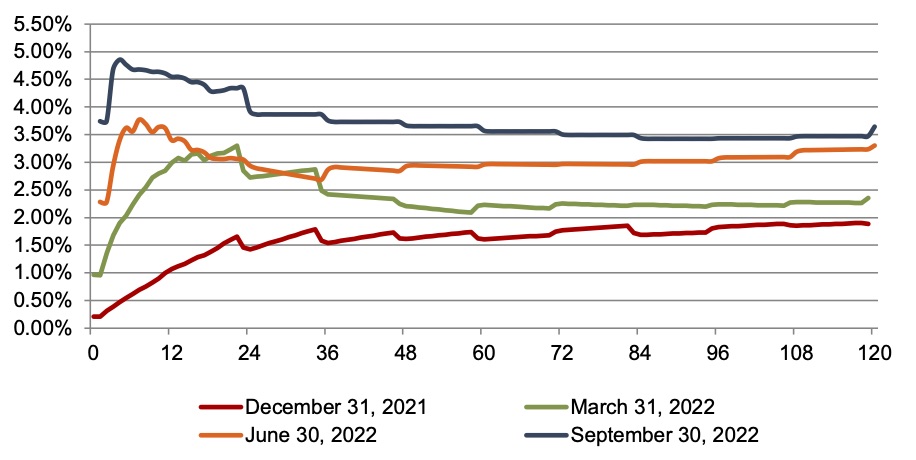

The shift in the valuation adjustment attributable to interest rates reflects an increase in market interest rates. Figure 2 depicts the LIBOR forward curve at December 31, 2021, March 31, 2022, June 30, 2022, and September 30, 2022. Relative to December 31, 2021, forward LIBOR rates have increased 66 bps to 394 bps on average with the largest increases occurring for periods ranging from 1 to 12 months following the valuation date.

Figure 2: LIBOR Forward Curve

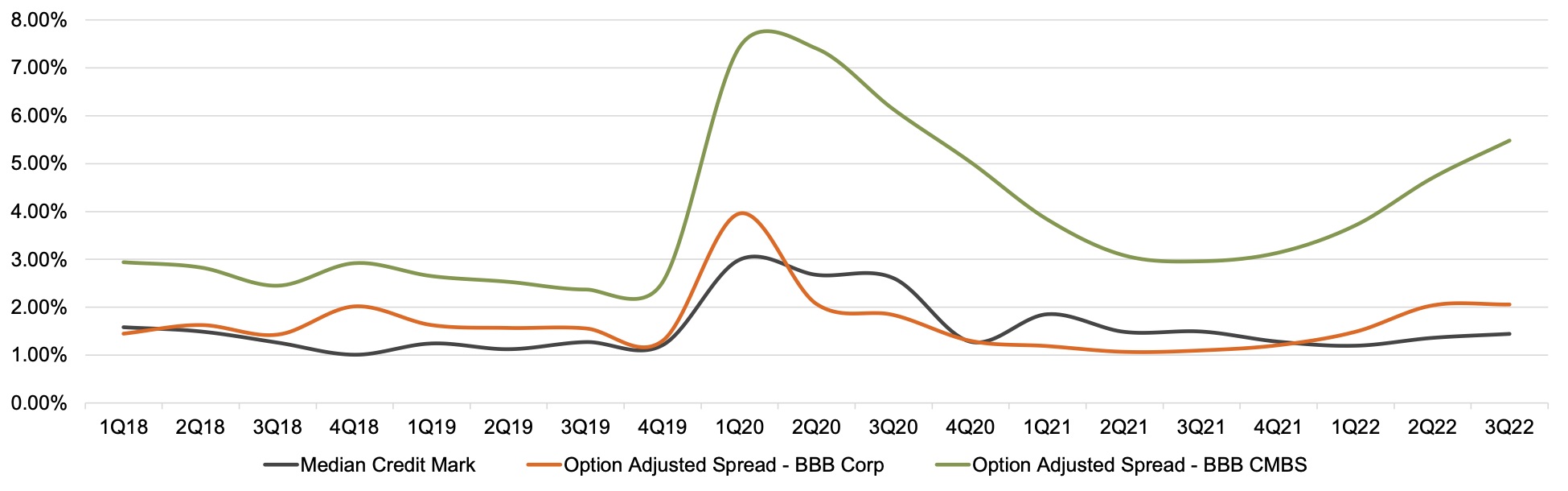

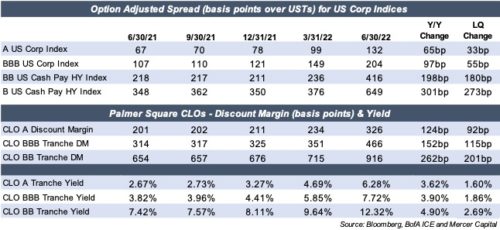

Figure 3 depicts the trend in the credit mark for our data sample relative to credit spreads. Credit spreads provide perspective on a number of factors, including where the credit cycle has been and where we may be headed.

Figure 3: Trends in Credit Marks

Click here to expand the image above

Over the period shown in Figure 3, credit marks peaked at the start of the pandemic given the uncertainty and expectation of higher losses on loan portfolios. Credit marks trended down from the March 31, 2020 peak through the first quarter of 2022, as did banks’ loan loss provisions, as credit quality remained stable. While credit quality continues to remain strong, both credit spreads and credit marks have ticked up in 2022 with the weakening economic outlook and concerns that the Federal Reserve’s tightening interest rate policy may trigger a sharper downturn in economic activity.

Mercer Capital has extensive experience in valuing loan portfolios and other financial assets and liabilities including depositor intangible assets, time deposits, and trust preferred securities. Please contact us if we can be of assistance.

2022 Family Law Team Conference Wrap-Up

In-person conferences are back in 2022 and so are we. Our professionals have been speaking at and attending numerous conferences, so we thought it a good idea to reflect on a few of these conferences and share selected PowerPoint decks with you. Why? Because there are valuable materials on valuation, forensic and financial topics included in these PowerPoint decks. If your organization needs a speaker at your next conference or meeting, feel free to contact us.

We hope you have enjoyed our content in 2022 and we look forward to connecting further in 2023!

Selected Speaking Engagements

Nashville Bar Association | February 28, 2022

Business Valuations in Litigation:

A Guide for Attorneys

Scott A. Womack, ASA, MAFF

In this presentation, we ask and answer the questions “what is the purpose of a business valuation?”, “when and why a valuation is needed?” and explore what to look for in a valuation expert. In addition, this presentation provides an overview of valuation approaches and common valuation discounts. Active vs. passive appreciation and personal vs. enterprise goodwill are also presented. If you need a solid valuation overview, download the deck.

Knoxville Estate Planning Council | March 24, 2022

The Art and Science of Business Valuations:

A Guide for Attorneys/Advisors

Scott A. Womack, ASA, MAFF

Is valuation an art or a science? This presentation begins with an overview of valuation theory. In addition, we include common flaws in valuations, provides an example of double/triple counting, and includes a valuation report checklist. For more, download the powerpoint deck.

AAML Connecticut Chapter May CLE Meeting | May 2, 2022

The Double Dip … Debate – Plus: Does Personal / Enterprise Goodwill Factor into the Analysis?

Karolina Calhoun, CPA, ABV, CFF

Particularly when the marital estate includes a business asset, subject to a valuation, the topic of double counting must be considered. Is the same income stream which is creating a valued asset on the marital balance sheet also being used for income determination for support? Or, has compensation and business earnings properly been allocated to the asset and to the income? Further, what if there is a carve out to personal goodwill – how, if at all, does this impact the asset division as well as the income basis for support? We address these questions in this presentation.

2022 Forensic Accounting and Litigation Conference:

Society of Kentucky Certified Public Accountants | August 18, 2022

Critical Issues in Valuation for Divorce Purposes

Karolina Calhoun, CPA, ABV, CFF

What are the nuances and critical issues of valuation, forensic, and other analyses for marital dissolution? In this presentation, we delve into specific issues that must be considered since they are unique to marital dissolution as well as state statute and precedent. Specifically, we touch on if a marital asset ever become a separate asset or vice-versa, personal vs. enterprise goodwill, valuation adjustments in marital dissolution engagements, double-dipping, asset tracing, and how to construct a lifestyle (pay and need) analysis.

NACVA 2022 Business Valuation & Financial Litigation Hybrid Super Conference | August 19, 2022

The State of the Business Valuation Profession

Z. Christopher Mercer, FASA, CFA, ABAR

Chris Mercer is one of the founding fathers of business valuation. Given his place in the profession, he is one of the few qualified to opine to the future of the business valuation profession. In this presentation, he begins by discussing the profession’s current realities and then ventures into what the future might hold about the profession, valuation theory, and how to reach the market.

2022 AAML/BVR National Divorce Conference 2022 | August 19, 2022

All in the Family-Related Companies in Divorce

Karolina Calhoun, CPA, ABV, CFF

In this presentation, our Karolina Calhoun along with Kevin Segler from Koons Fuller, covered all things related-party in divorce valuation, including entity structure issues, multi-layering with discounts, and tracing marital vs. separate asset ownership with complex multi-entity ownerships. Karolina and Kevin also discussed related parties in the business and said impact on ownership, valuation, and division – including the consideration of classes of stock in division, such as GP vs. LP or voting vs. non-voting.

The Association of Divorce Financial Planners 2022 Virtual Retreat | November 4, 2022

Business Valuation, Legal, and Tax Risks Panel

David W. R. Harkins, CFA, ABV

David Harkins joined Karen Shapiro of Stein Sperling and Michele Laws of Turning Point Financial Group on a panel moderated by Cheryl Panther of Panther Financial Planning, to discuss the nuances of a case study presented to members of the ADFP. The case had numerous potential pitfalls with considerations for attorneys and divorce financial planners alike. Topics included business valuation, fraud, forensics, separate vs marital, etc. The crowd had numerous thought-provoking questions which led to an enlightening dialogue for all involved.

The 2022 AICPA & CIMA Forensic & Valuation Services Conference | November 14, 2022

Personal vs. Enterprise Goodwill:

How the Analysis Lies Within the Facts

Karolina Calhoun, CPA, ABV, CFF

Karolina Calhoun and Audra Moncur of Wipfli, LLP tackled the questions: what is goodwill?; what is personal vs. enterprise goodwill?; and why is personal vs. enterprise goodwill important in valuations for divorce or transactions? They also presented an illustration of goodwill in transactions and presented case precedent for goodwill in divorce along with methods and considerations for determination allocation to personal and enterprise goodwill.

Selected Sponsorships

The AAML Florida Chapter 44th Annual Institute

As we assist with complex financial and valuation issues on many Florida matters, this year we decided to sponsor and attend the AAML Florida Chapter Annual Institute. We enjoyed meeting and seeing familiar faces, and also appreciated conversations about complex valuation and financial issues. Mercer Capital’s Litigation Team looks forward to attending in future years!

Attending the Conference was:

Karolina Calhoun, CPA, ABV, CFF

The AAML Foundation Lifetime Members Luncheon

November 10, 2022 | Chicago, Illinois

We were honored to be a Diamond Sponsor of the AAML Foundation Lifetime Members Luncheon, supporting the Foundation’s mission to assist families and children. Chris Mercer, Karolina Calhoun, and Scott Womack are members of the Forensic & Business Valuation Division of the AAML Foundation.

Attending the Luncheon were:

Scott A. Womack, ASA, MAFF

Karolina Calhoun, CPA, ABV, CFF

David W. R. Harkins, CFA, ABV

|

|

|

The AAML Florida Chapter

|

The AAML Florida Chapter

|

2022 AICPA & CIMA Forensic & Valuation Services ConferencePictured (L-R): Bethany Hearn (CLA), Karolina Calhoun, Natalya Abdrasilova (BDM), and Nicole Lyons (WithumSmith+Brown) |

|

|

|

2022 AAML Foundation Lifetime Members LuncheonPictured (L-R): Scott Womack, Karolina Calhoun, and David Harkins |

2022 AAML Foundation Lifetime Members LuncheonPictured (;-R): David Harkins, Bill Dameworth (Forensic Strategic Solutions), Jay Fishman (Financial Research Associates), Karolina Calhoun, and Scott Womack |

2022 AAML Foundation Lifetime Members LuncheonPictured (L-R): Paul Thiel (Northern Trust), Scott Womack, Karolina Calhoun, and David Harkins |

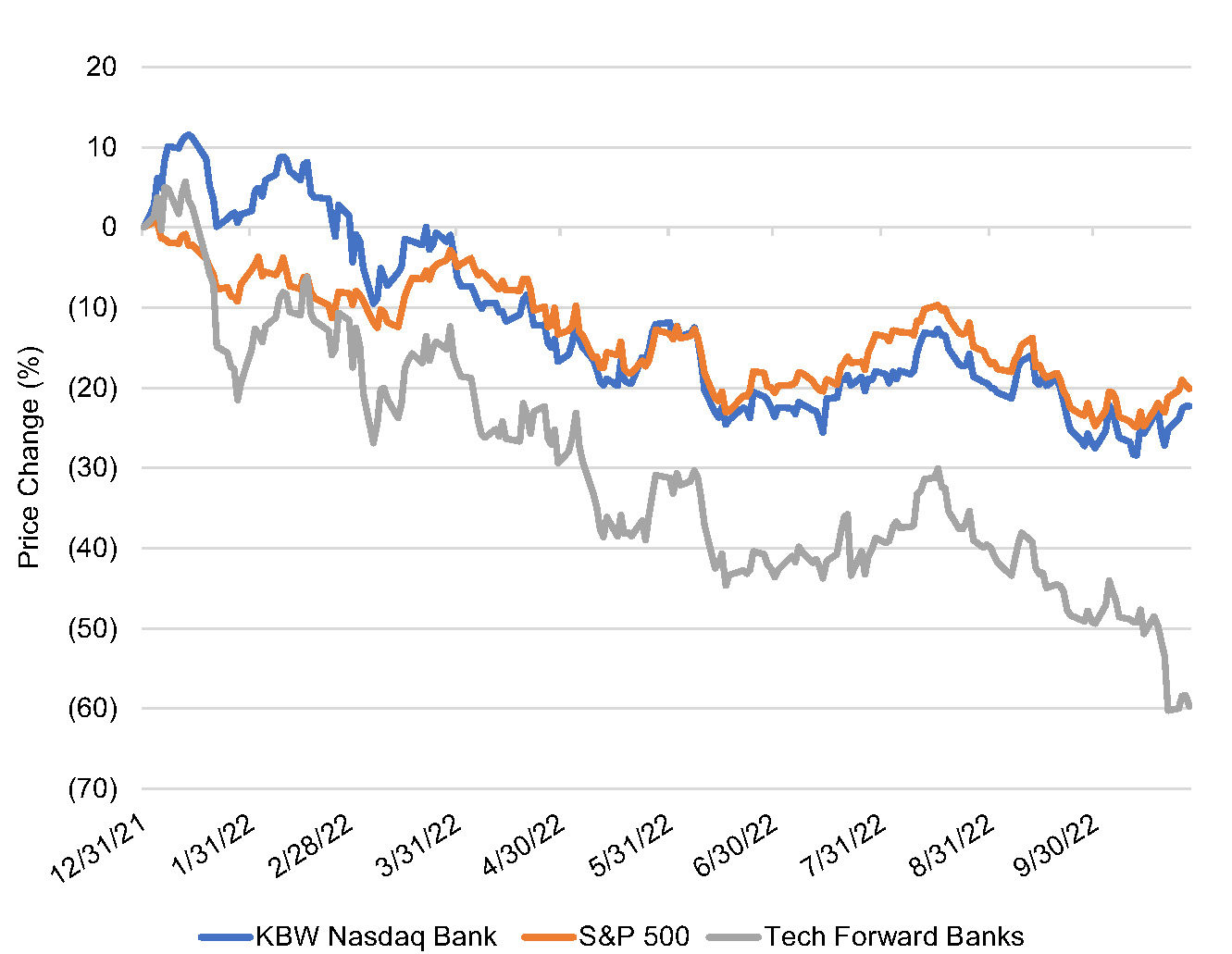

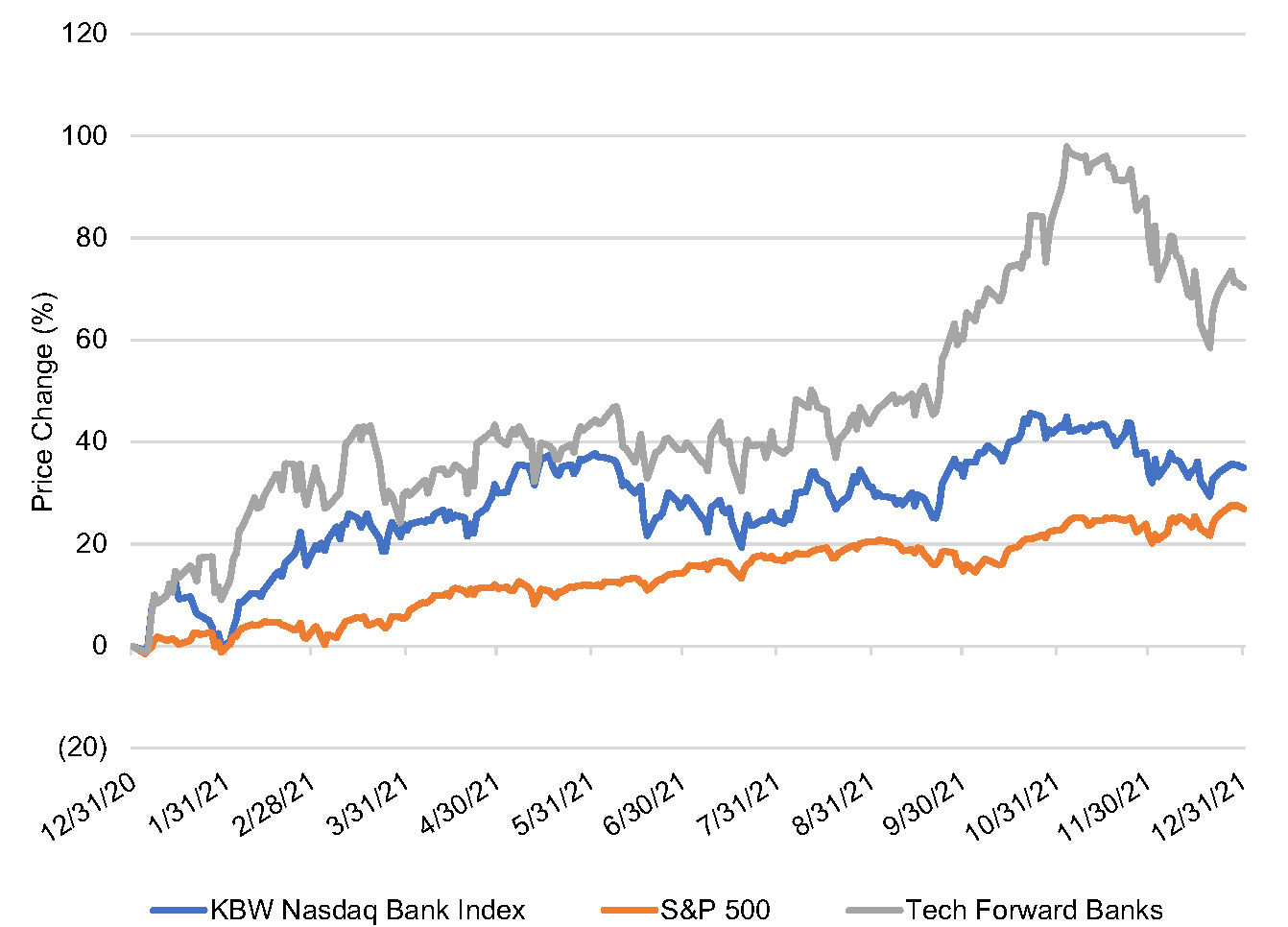

How Are Tech-Forward Banks Performing?

In the year-to-date period, the KBW Nasdaq Bank Index has declined 22%, compared to a decline of 20% in the S&P 500 through October 27. Tech-forward banks have underperformed the broader banking sector, down 60% in the year-to-date period.1 This is a reversal of the trend in 2021 when tech-forward banks outperformed the broader banking sector, logging a 70% increase compared to an increase of 35% in the KBW Nasdaq Bank Index.

Figure 1 :: Year-To-Date Performance (Through October 27, 2022)

Source: S&P Capital IQ Pro.

Source: S&P Capital IQ Pro.

Figure 2 :: 2021 Performance

Source: S&P Capital IQ Pro.

The tech-forward bank landscape encompasses a variety of business models but generally refers to banks utilizing technology or partnering with fintechs to deliver financial products or services. Banks that partner with fintechs are often referred to as providing “banking as a service (BaaS)”. This model involves an FDIC member bank offering bank products to fintech customers, for example, credit and debit cards or personal loans. The bank holds the deposits associated with the accounts and earns a fee based on a percentage of interchange income specified in an agreement negotiated with the fintech partner. Other models are focused on facilitating payments or providing financial services to a specific niche, such as cryptocurrency.

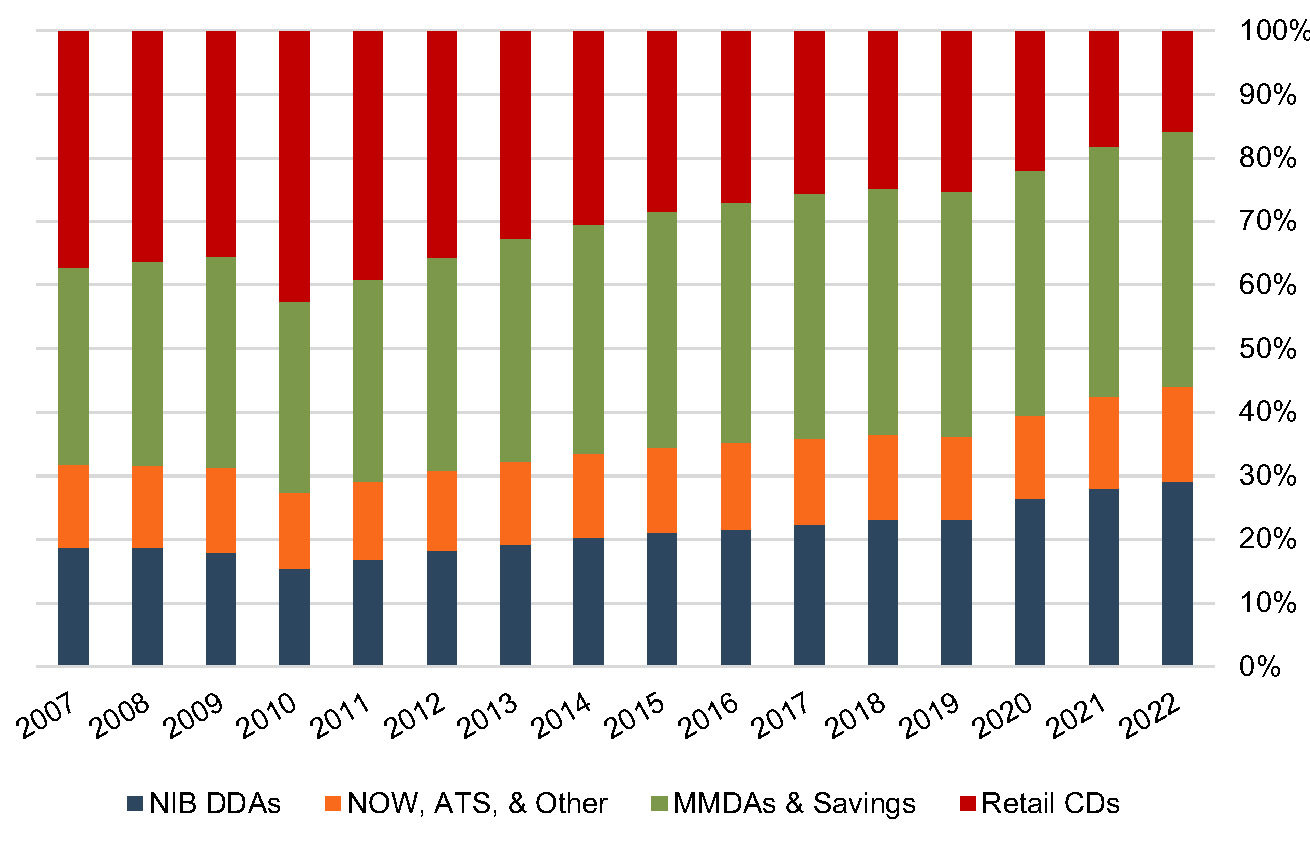

While the largest banks have the resources to be at the forefront of technology adoption, many smaller banks have partnered with fintechs in recent years. This is due in part to the Durbin Amendment which places limits on interchange income for banks above $10 billion in assets. In many cases, the partnerships have accelerated growth and created new income streams for the bank partners.

However, bank partners also face unique risks. As displayed in the market performance, tech-forward banks have been more volatile than traditional banks. Tech-forward bank performance has been moored, to some degree, to more volatile technology stocks, which explains the stock market outperformance in 2021 followed by a larger retrenchment in 2022. For a community bank pursuing a fintech partnership strategy, there are multiple considerations, including the following.

Deposit Growth

Many fintech partner banks have continued growing deposits this year even though most banks have seen deposit growth stagnate or turn negative in the rising rate environment. An analysis performed by S&P Global Market Intelligence showed that fintech partner banks with assets between $1 billion and $3 billion experienced deposit growth of 15% (annualized) in the first half of 2022. This compares to deposit growth of 3% for commercial banks in the same asset size range.

The deposits generated from fintech partnerships are often noninterest bearing accounts, which are especially valuable in the current rising rate environment. Bank partners earn spread income from the deposits, often holding them at the Federal Reserve due to their volatility and uncertain duration. Balances at the Fed reprice immediately with changes to the Fed’s benchmark rate.

Noninterest Income

The largest impact on the revenue side typically shows up in noninterest income. Fintech partner banks tend to have a higher ratio of noninterest income to total income relative to traditional banks as they earn a share of the interchange income. In a period of flat or declining interest rates, this diversification of revenue can help to offset net interest margin compression.

For the tech-forward banks included in Figure 1 and 2, the median ratio of noninterest income to operating revenue was 29% in the trailing twelve

month period.

Concentration Risk

While fintech partnerships can be a source of growth, bank partners should be cautious about revenue or deposit concentrations. Fintechs can grow rapidly, and, as a result, a bank partner may develop a concentration within their deposit base or revenues. Banks must periodically renegotiate contracts with fintech partners, and there is a risk that the fintech will find another bank partner or demand more favorable terms. This single event could eliminate a major source of deposits or reduce noninterest income, causing a much greater impact than the ordinary loss of traditional bank customers.

For example, Green Dot Corporation (GDOT) provides the Walmart MoneyCard product and offers other deposit account products at Walmart. Green Dot’s second quarter 10-Q discloses that approximately 21% of its operating revenue in the year-to-date period was derived from products and services sold at Walmart locations.

Regulatory Risk

Regulators have stepped up their scrutiny of bank-fintech partnerships this year, focusing on risk management controls. Many banks partnering with fintechs have less than $10 billion in assets, and banks that do not currently serve fintechs may not have the necessary compliance infrastructure to effectively manage potential fintech relationships. Compliance capability must be built over a long period of time and serves as somewhat of a barrier to entry for banks desiring to pursue this strategy.

Additionally, certain fintech partnerships may present an added element of risk as the bank could be impacted by the regulatory and compliance practices of the fintechs or the evolving regulatory/compliance landscape. One recent example of this risk arose in the crypto fintech niche as the FDIC released an order to a crypto brokerage firm demanding that it cease and desist from making false and misleading statements about its deposit insurance status, while the FDIC contemporaneously issued an advisory to insured institutions regarding FDIC deposit insurance and dealings with crypto companies.2

Valuation & Performance

Bank stocks’ underperformance in 2022 has largely been attributed to economic uncertainty and the potential for recession brought on by the Fed’s aggressive rate hikes. Fintech partner banks have been more volatile than the broader banking market. The business models entail certain risks, as detailed above, that do not pertain to traditional banks to the same degree. In addition, the earnings from fintech partnerships are less predictable and potentially further out in the future.

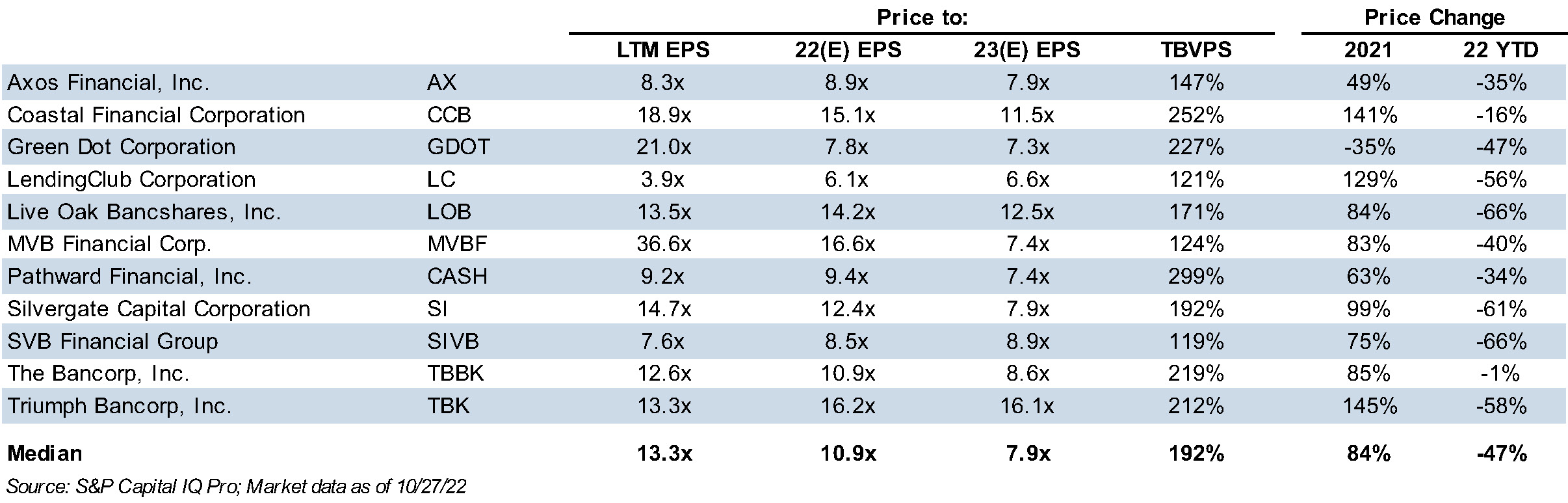

As seen in figure 3, the range of valuation multiples observed for tech forward banks is wide, with forward P/Es ranging from 6.6x to 16.1x but most trade at 7x to 9x estimated 2023 earnings. It is important to note that the banks included in the table above represent a variety of sizes, strategies and niches, so comparability may be somewhat limited. Tangible book multiples likewise exhibit a wide range, but in general are high relative to the broader banking sector. In valuing fintech partner banks, investors weigh the growth potential provided by the partnership versus the risk that earnings growth does not materialize.

Figure 3 :: Multiples and Price Change of Tech-Forward Banks

Click here to expand the image above

Conclusion

Mercer Capital has experience valuing and advising both banks and fintechs. If you are considering partnership opportunities or have questions regarding their valuation implications, please contact us.

1Tech-forward banks include AX, CCB, GDOT, LC, LOB, MVBF, CASH, SI, SIVB, TBBK, and TBK. Year-to-date performance through 10/27/22

2https://www.arnoldporter.com/en/perspectives/advisories/2022/08/regulators-crack-down-on-fintechs

Five Trends to Watch in the Medical Device Industry: 2022 Update

Medical Devices Overview

The medical device manufacturing industry produces equipment designed to diagnose and treat patients within global healthcare systems. Medical devices range from simple tongue depressors and bandages to complex programmable pacemakers and sophisticated imaging systems. Major product categories include surgical implants and instruments, medical supplies, electro-medical equipment, in-vitro diagnostic equipment and reagents, irradiation apparatuses, and dental goods.

The following outlines five structural factors and trends that influence demand and supply of medical devices and related procedures.

1. Demographics

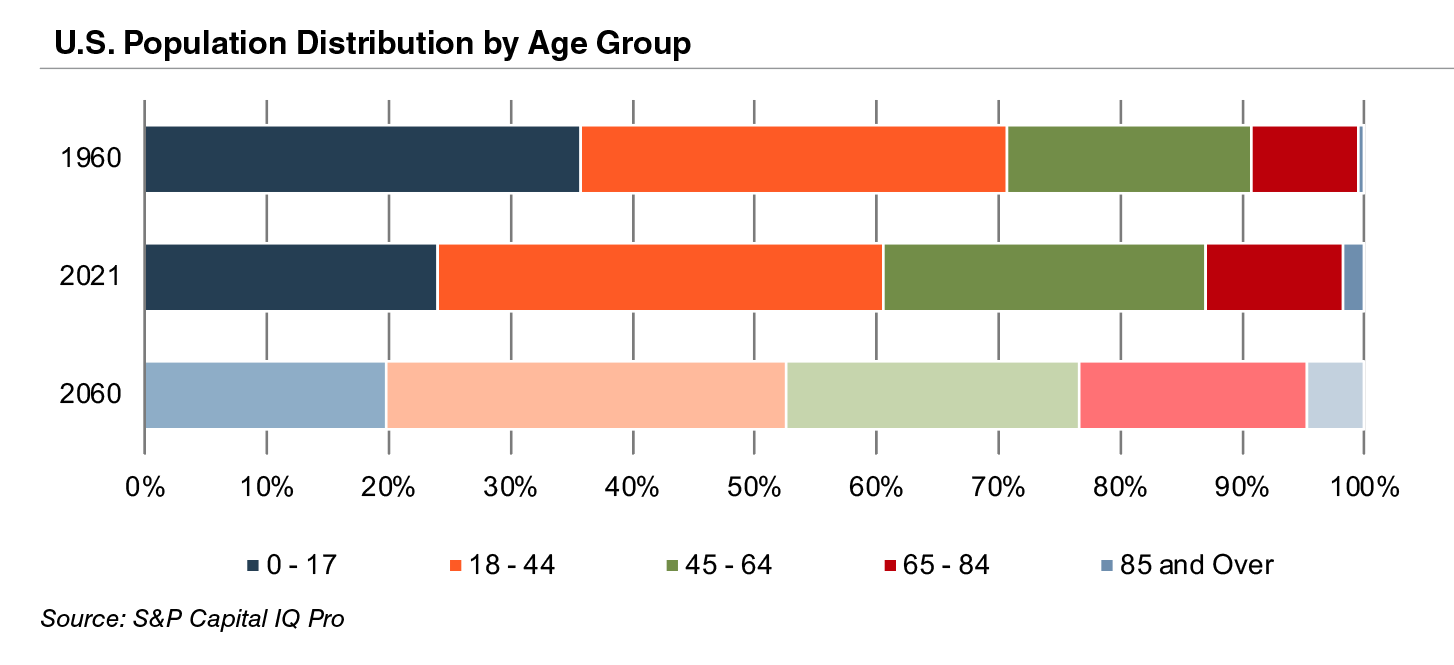

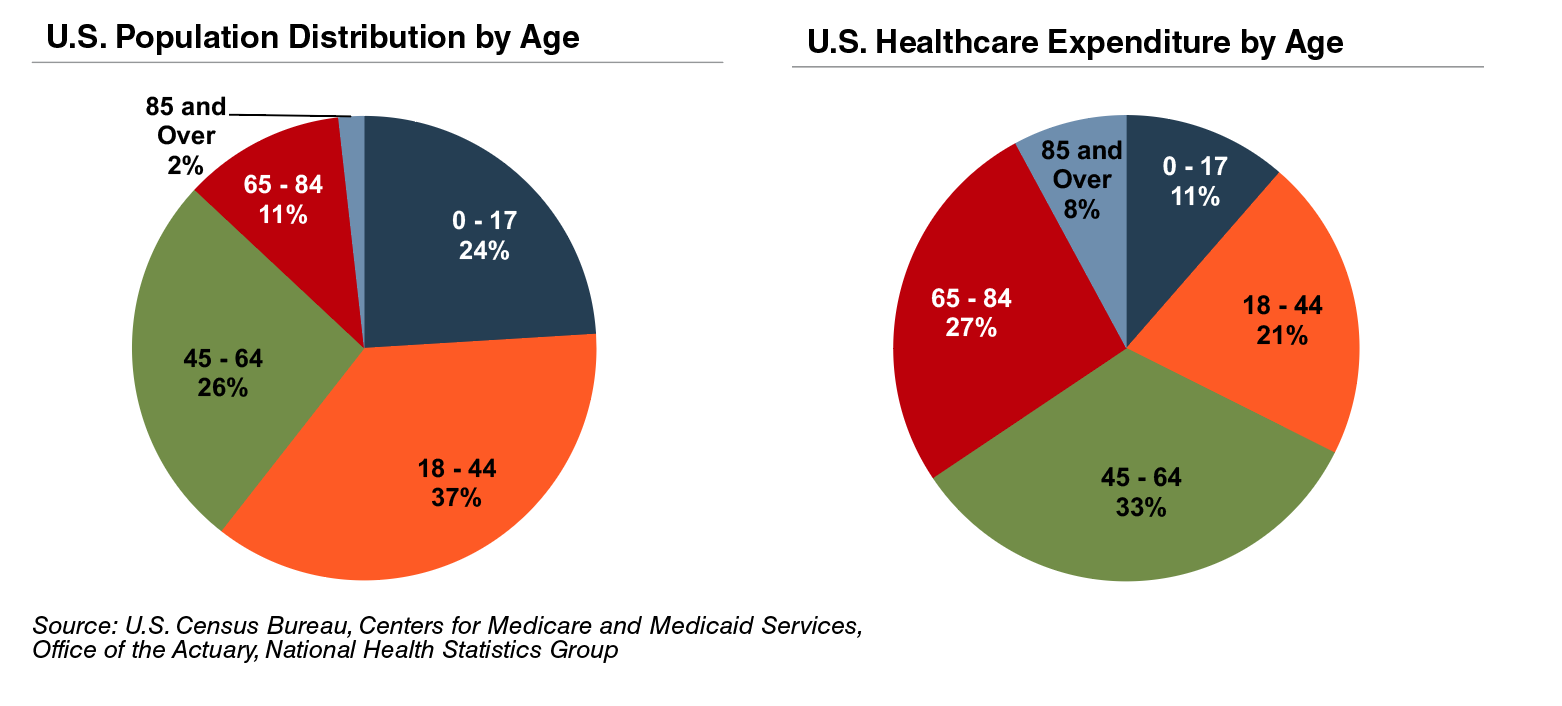

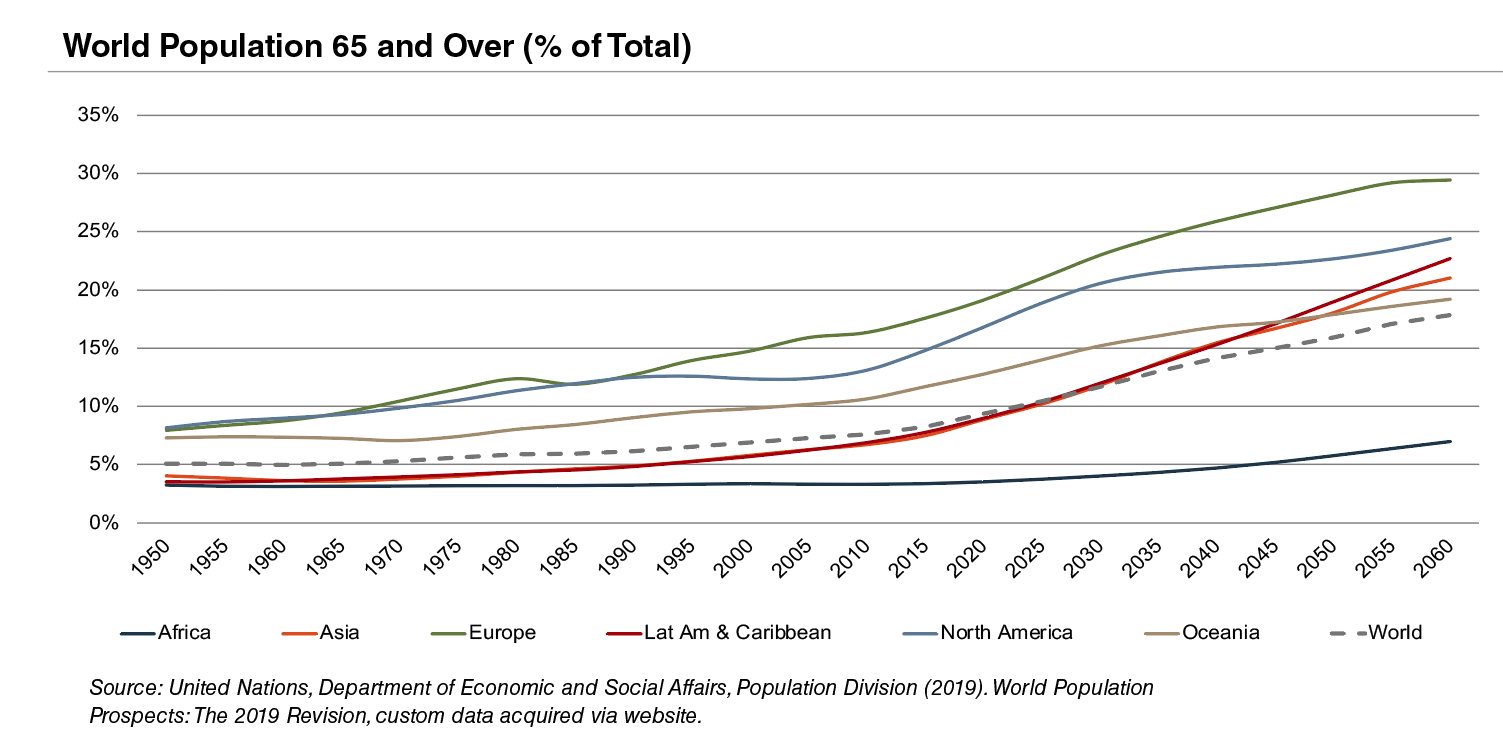

The aging population, driven by declining fertility rates and increasing life expectancy, represents a major demand driver for medical devices. The U.S. elderly population (persons aged 65 and above) totaled 40.3 million in 2021 (13% of the population). The U.S. Census Bureau estimates that the elderly will more than double by 2060 to 95 million, representing 23% of the total population.

The elderly account for nearly one third of total healthcare consumption in the U.S. Personal healthcare spending for the population segment was approximately $19,000 per person in 2014, five times the spending per child (about $3,700) and almost triple the spending per working-age person (about $7,200).

According to United Nations projections, the global elderly population will rise from approximately 608 million (8.2% of world population) in 2015 to 1.8 billion (17.8% of world population) in 2060. Europe’s elderly are projected to reach approximately 29% of the population by 2060, making it the world’s oldest region. While Latin America and Asia are currently relatively young, these regions are expected to undergo drastic transformations over the next several decades, with the elderly population expected to expand from approximately 8% in 2015 to more than 21% of the total population by 2060.

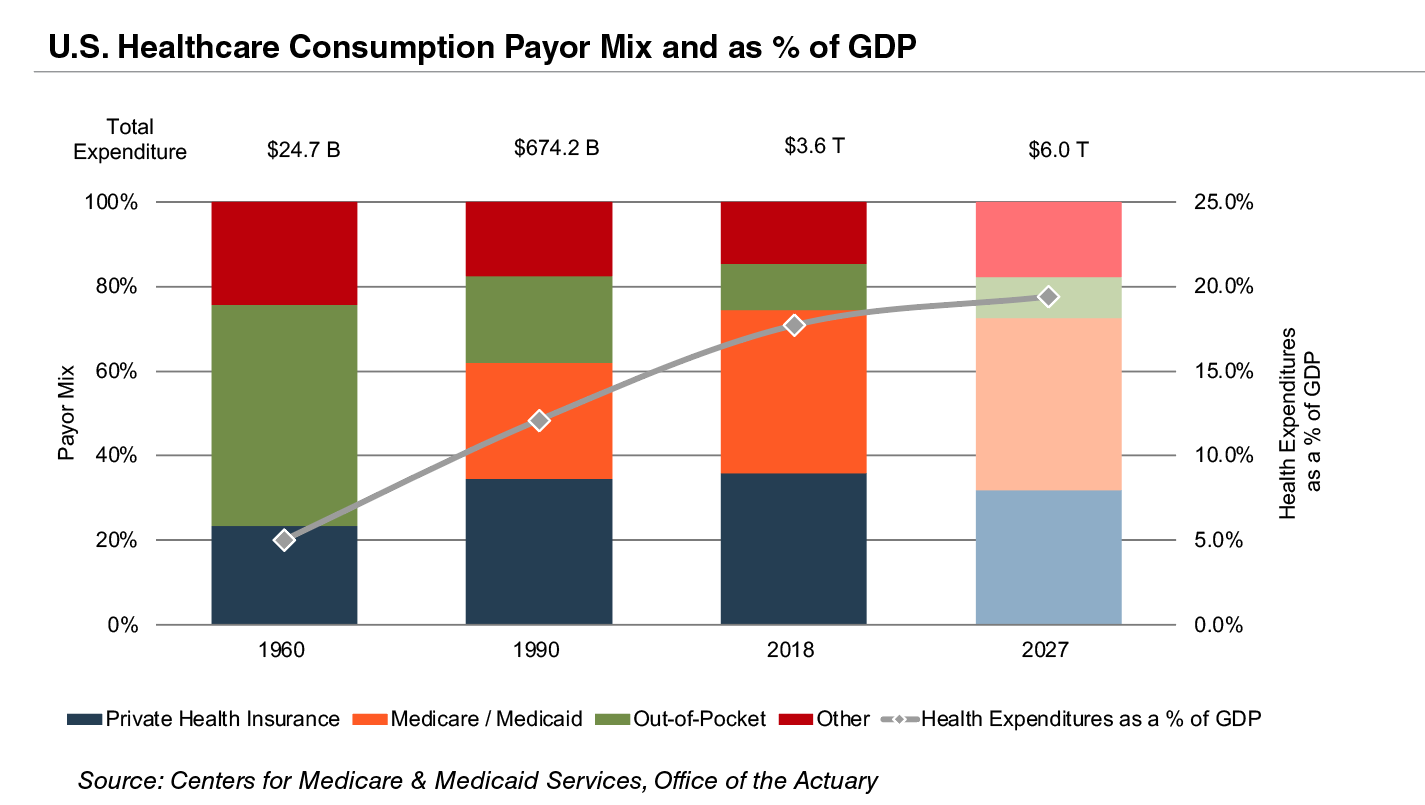

2. Healthcare Spending and the Legislative Landscape in the U.S.

Demographic shifts underlie the expected growth in total U.S. healthcare expenditure from $4.1 trillion in 2020 to $6.2 trillion in 2028, an average annual growth rate of 5.4%. This projected average annual growth rate is faster than the observed rate of 3.9% between 2009 and 2018. Projected growth in annual spending for Medicare (4.3%) and Medicaid (5.6%) is expected to contribute substantially to the increase in national health expenditure over the coming decade. However, growth in national healthcare spending has slowed in 2021 to 4.2%, down from 9.7% in 2020. Healthcare spending as a percentage of GDP is expected to remain virtually unchanged from 19.7% in 2020 to 19.6% by 2030.

Since inception, Medicare has accounted for an increasing proportion of total U.S. healthcare expenditures. Medicare currently provides healthcare benefits for an estimated 60 million elderly and disabled people, constituting approximately 15% of the federal budget in 2018 and is expected to rise to 18% by 2028. Medicare represents the largest portion of total healthcare costs, constituting 20% of total health spending in 2020. Medicare also accounts for 25% of hospital spending, 30% of retail prescription drugs sales, and 23% of physician services.

Due to the growing influence of Medicare in aggregate healthcare consumption, legislative developments can have a potentially outsized effect on the demand and pricing for medical products and services. Net mandatory benefit outlays (gross outlays less offsetting receipts) to Medicare totaled $776 billion in 2020 and are expected to reach $1.5 trillion by 2030.

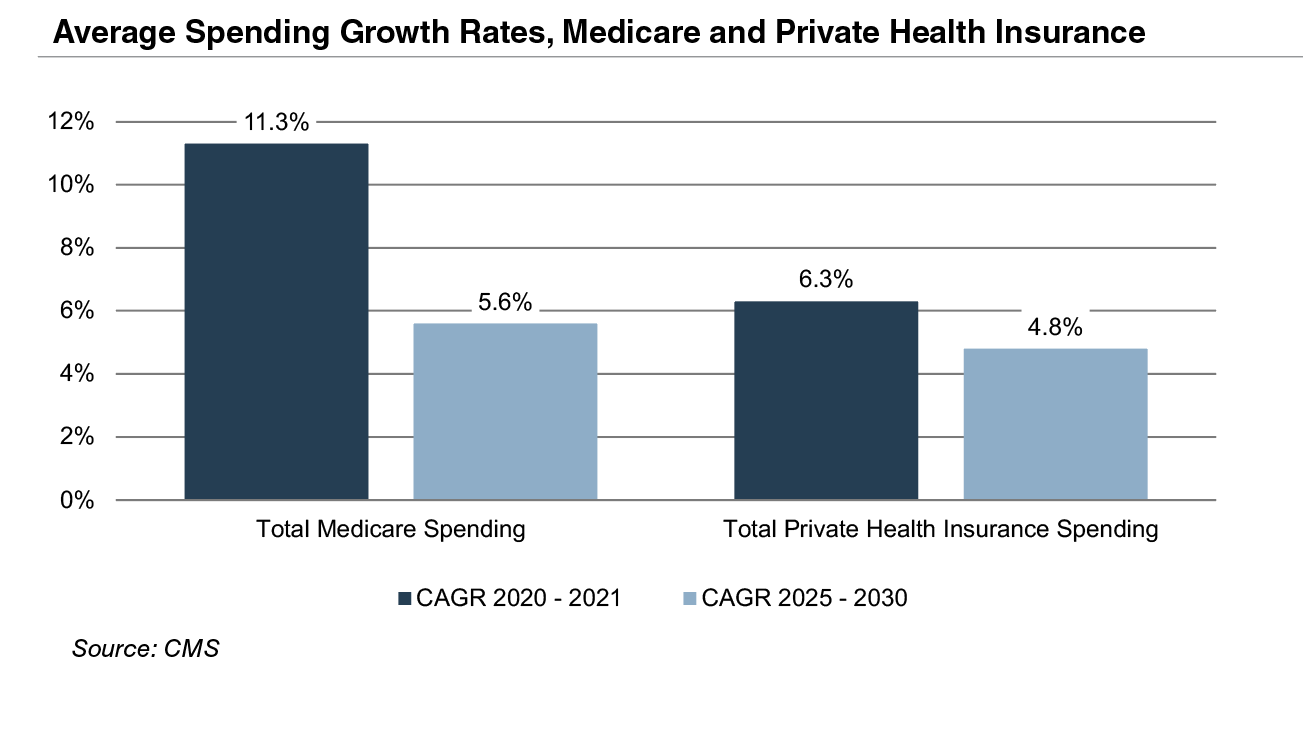

The Patient Protection and Affordable Care Act (“ACA”) of 2010 incorporated changes that are expected to constrain annual growth in Medicare spending over the next several decades, including reductions in Medicare payments to plans and providers, increased revenues, and new delivery system reforms that aim to improve efficiency and quality of patient care and reduce costs. While political debate centered around altering the ACA has been a continuous fixture in American politics since its passing, it is unlikely that material reform to the ACA occurs in the near future under the Biden Administration. Total Medicare spending is projected to grow at 5.6% annually between 2025 and 2030, compared to year over year growth of 11.3% in 2021 and 3.5% in 2020.

3. Third-Party Coverage and Reimbursement

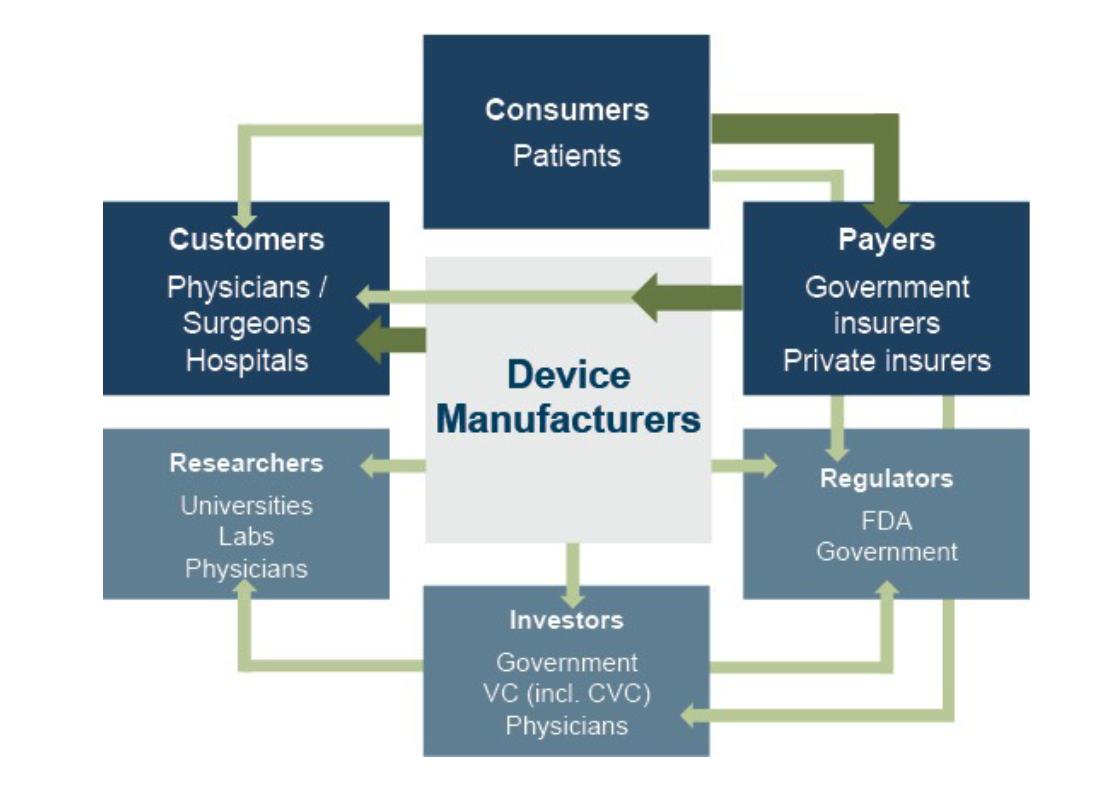

The primary customers of medical device companies are physicians (and/or product approval committees at their hospitals), who select the appropriate equipment for consumers (patients). In most developed economies, the consumers themselves are one (or more) step removed from interactions with manufacturers, and therefore pricing of medical devices. Device manufacturers ultimately receive payments from insurers, who usually reimburse healthcare providers for routine procedures (rather than for specific components like the devices used). Accordingly, medical device purchasing decisions tend to be largely disconnected from price.

Third-party payors (both private and government programs) are keen to reevaluate their payment policies to constrain rising healthcare costs. Several elements of the ACA are expected to limit reimbursement growth for hospitals, which form the largest market for medical devices. Lower reimbursement growth will likely persuade hospitals to scrutinize medical purchases by adopting i) higher standards to evaluate the benefits of new procedures and devices, and ii) a more disciplined price bargaining stance.

The transition of the healthcare delivery paradigm from fee-for-service (FFS) to value models is expected to lead to fewer hospital admissions and procedures, given the focus on cost-cutting and efficiency. In 2015, the Department of Health and Human Services (HHS) announced goals to have 85% and 90% of all Medicare payments tied to quality or value by 2016 and 2018, respectively, and 30% and 50% of total Medicare payments tied to alternative payment models (APM) by the end of 2016 and 2018, respectively. A report issued by the Health Care Payment Learning & Action Network (LAN), a public-private partnership launched in March 2015 by HHS, found that 35.8% of payments were tied to Category 3 and 4 APMs in 2018, compared to 32.8% in 2017.

In 2020, CMS released guidance for states on how to advance value-based care across their healthcare systems, emphasizing Medicaid populations, and to share pathways for adoption of such approaches. Ultimately, lower reimbursement rates and reduced procedure volume will likely limit pricing gains for medical devices and equipment.

The medical device industry faces similar reimbursement issues globally, as the EU and other jurisdictions face similar increasing healthcare costs. A number of countries have instituted price ceilings on certain medical procedures, which could deflate the reimbursement rates of third-party payors, forcing down product prices. Industry participants are required to report manufacturing costs, and medical device reimbursement rates are set potentially below those figures in certain major markets like Germany, France, Japan, Taiwan, Korea, China, and Brazil. Whether third-party payors consider certain devices medically reasonable or necessary for operations presents a hurdle that device makers and manufacturers must overcome in bringing their devices to market.

4. Competitive Factors and Regulatory Regime

Historically, much of the growth of medical technology companies has been predicated on continual product innovations that make devices easier for doctors to use and improve health outcomes for the patients. Successful product development usually requires significant R&D outlays and a measure of luck. If viable, new devices can elevate average selling prices, market penetration, and market share.

Government regulations curb competition in two ways to foster an environment where firms may realize an acceptable level of returns on their R&D investments. First, firms that are first to the market with a new product can benefit from patents and intellectual property protection giving them a competitive advantage for a finite period. Second, regulations govern medical device design and development, preclinical and clinical testing, premarket clearance or approval, registration and listing, manufacturing, labeling, storage, advertising and promotions, sales and distribution, export and import, and post market surveillance.

Regulatory Overview in the U.S.

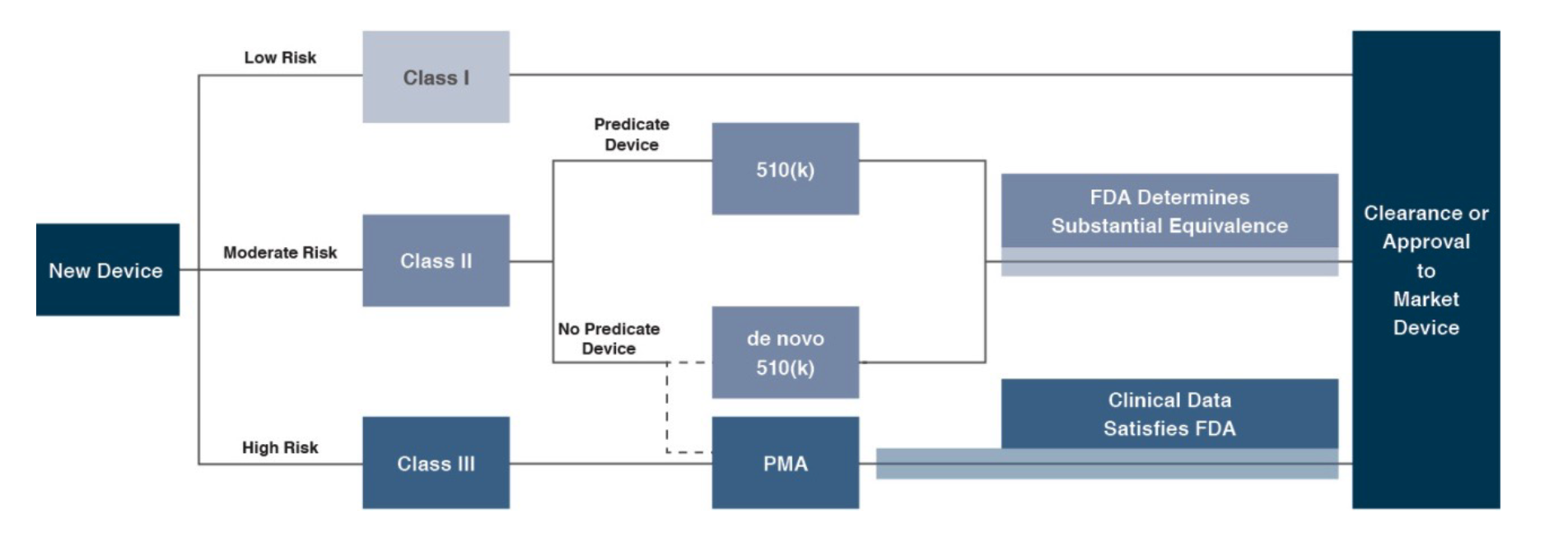

In the U.S., the FDA generally oversees the implementation of the second set of regulations. Some relatively simple devices deemed to pose low risk are exempt from the FDA’s clearance requirement and can be marketed in the US without prior authorization. For the remaining devices, commercial distribution requires marketing authorization from the FDA, which comes in primarily two flavors.

The premarket notification (“510(k) clearance”) process requires the manufacturer to demonstrate that a device is “substantially equivalent” to an existing device (“predicate device”) that is legally marketed in the U.S. The 510(k) clearance process may occasionally require clinical data and generally takes between 90 days and one year for completion. In November 2018, the FDA announced plans to change elements of the 510(k) clearance process. Specifically, the FDA plan includes measures to encourage device manufacturers to use predicate devices that have been on the market for no more than 10 years. In early 2019, the FDA announced an alternative 510(k) program to allow medical devices an easier approval process for manufacturers of certain “well-understood device types” to demonstrate substantial equivalence through objective safety and performance criteria. The plans materialized as the Abbreviated 510(k) Program later in the year.

The premarket approval (“PMA”) process is more stringent, time-consuming, and expensive. A PMA application must be supported by valid scientific evidence, which typically entails collection of extensive technical, preclinical, clinical, and manufacturing data. Once the PMA is submitted and found to be complete, the FDA begins an in-depth review, which is required by statute to take no longer than 180 days. However, the process typically takes significantly longer and may require several years to complete.

Pursuant to the Medical Device User Fee Modernization Act (MDUFA), the FDA collects user fees for the review of devices for marketing clearance or approval. The current iteration of the Medical Device User Fee Act (MDUFA IV) came into effect in October 2017. Under MDUFA IV, the FDA is authorized to collect almost $1 billion in user fees, an increase of more than $320 million over MDUFA III, between 2017 and 2022. Intended to begin in 2020, negotiations for MDUFA V were delayed due to the COVID-19 pandemic. The FDA and industry groups reached a deal for MDUFA V, slated to go into effect beginning fiscal 2023, which would generate up to $1.9 billion in fees to the agency over five years. The U.S. House of Representatives passed MDUFA V in June 2022 and the Senate is expected to follow suit by September 2022.

Regulatory Overview Outside the U.S.

The European Union (EU), along with countries such as Japan, Canada, and Australia all operate strict regulatory regimes similar to that of the FDA, and international consensus is moving towards more stringent regulations. Stricter regulations for new devices may slow release dates and may negatively affect companies within the industry.

Medical device manufacturers face a single regulatory body across the EU. In order for a medical device to be allowed on the market, it must meet the requirements set by the EU Medical Devices Directive. Devices must receive a Conformité Européenne (CE) Mark certificate before they are allowed to be sold in that market. This CE marking verifies that a device meets all regulatory requirements, including EU safety standards. A set of different directives apply to different types of devices, potentially increasing the complexity and cost of compliance.

5. Emerging Global Markets

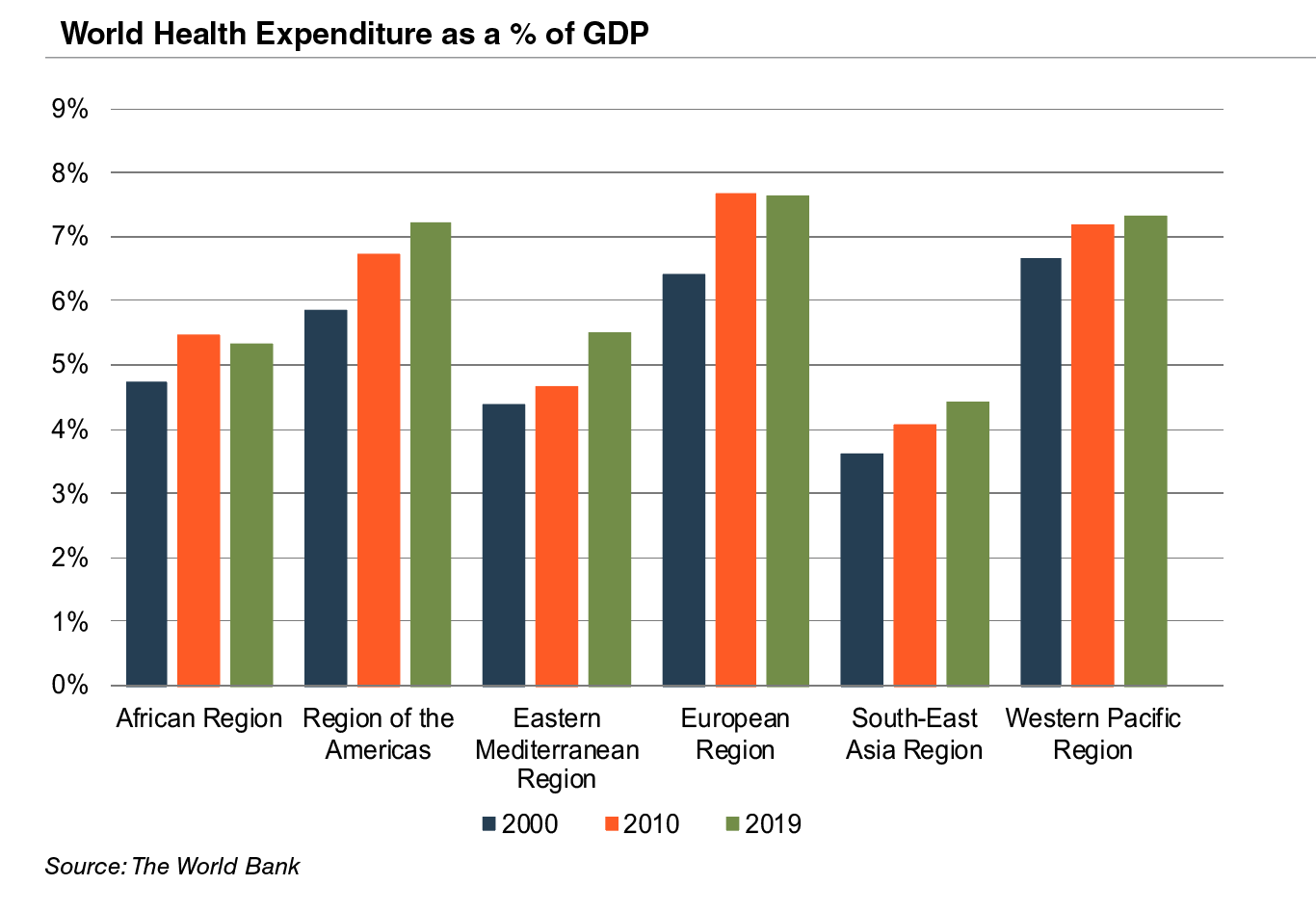

Emerging economies are claiming a growing share of global healthcare consumption, including medical devices and related procedures, owing to relative economic prosperity, growing medical awareness, and increasing (and increasingly aging) populations. According to the WHO, middle income countries, such as Russia, China, Turkey, and Peru, among others, are rapidly converging towards outsized levels of spending as their incomes increase. When countries grow richer, the demand for health care increases along with people’s expectation for government financed healthcare. Middle income country share, the fastest growing economic sector, increased from 15% to 19% of global spending between 2000 and 2017. As global health expenditure continues to increase, sales to countries outside the U.S. represent a potential avenue for growth for domestic medical device companies. According to the World Bank, all regions (except Sub-Saharan Africa and South Asia) have seen an increase in healthcare spending as a percentage of total output over the last two decades.

Global medical device sales are estimated to increase 5.4% annually from 2021 to 2028, reaching nearly $658 billion according to data from Fortune Business Insights. While the Americas are projected to remain the world’s largest medical device market, the Asia Pacific and Western Europe markets are expected to expand at a quicker pace over the next several years.

Summary

Demographic shifts underlie the long-term market opportunity for medical device manufacturers. While efforts to control costs on the part of the government insurer in the U.S. may limit future pricing growth for incumbent products, a growing global market provides domestic device manufacturers with an opportunity to broaden and diversify their geographic revenue base. Developing new products and procedures is risky and usually more resource intensive compared to some other growth sectors of the economy. However, barriers to entry in the form of existing regulations provide a measure of relief from competition, especially for

newly developed products.

FreightTech Update

Automated Trucks, VC Frenzy, and the Rise of Brokerages

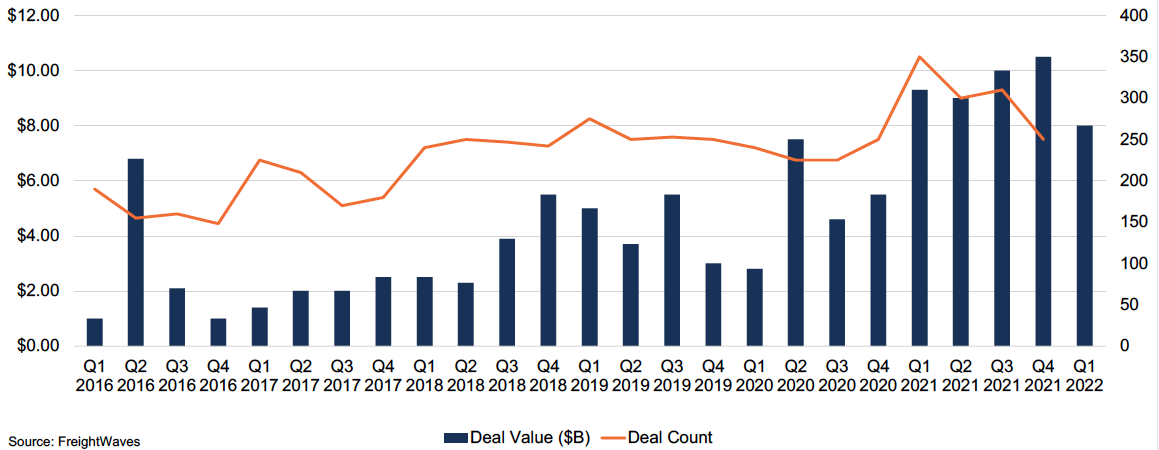

The COVID-19 pandemic brought economic hardship to many. The second quarter of 2020 might go down as one of the quickest economic downturns ever recorded. However, in an effort to protect the economy, the Fed created an extremely hospitable environment for venture capital, and with the glaring supply chain issues, FreightTech became a cushy landing place for investor’s money. We have written about venture capital and FreightTech before, and it has only gotten bigger since then.

In the fourth quarter of 2020, American and European FreightTech companies raised a combined $4.1 billion from venture capitalists. This was a 21% increase quarter-over-quarter, and an increase of 49% on an annual basis. In less than twelve months, 2020 went from a dark and gloomy place for businesses to a 4th of July fireworks parade, during which $12.6 billion was poured into 555 deals in America and Europe.

The parade continued marching into 2021, with average pre-money valuations increasing by 28.4% to $30 million, and late-stage valuations increasing by 95.3% to $120 million. During these six quarters, companies like Loadsmith continued to introduce digital technologies that seek to revolutionize the brokerage industry and allow smaller brokerages and 3PLs to compete with the largest asset-based carriers.

Click here to expand the image above

Self-driving trucks have also remained a point of focus. Though one of our clients maintains that self-driving trucks are “always ten years away,” they are the holy grail of FreightTech. The trucking industry has long struggled with an exodus of workers, and during COVID a large portion of its aging labor force decided to either retire due to fears of contracting the virus or moved on to less-regulated sectors. To prevent driver shortages and reduce turnover, many companies are increasing driver pay. For example, Walmart began paying their drivers $110,000 in their first year. With a fleet of 12,000 drivers, that is a very expensive endeavor, so it is no surprise that companies like TuSimple, that develop self-driving trucks, already have deals in place with ready-to-pay customers. The CEO of Werner Enterprises was quoted as saying that “We look forward to building a hybrid world where drivers continue to haul freight while autonomous trucks supplement rising demand,” showing that self-driving freight modes are no longer only a fantasy of Silicon Valley, but a future of the industry.

Despite all the positive growth between the third quarter of 2020 and the fourth quarter of 2021, the proverbial truck ran into a roadblock. As the Federal Reserve increased interest rates in its efforts to tame inflation, the first quarter of 2022 recorded decreases of 3.6% and 20.4% on a quarterly and annual basis, respectively. Startups raised only $14 billion. The number of IPO listings decreased dramatically, alongside the average valuations of FreightTech firms.

While the number of new FreightTech startups has decreased, an opportunity in the form of higher gas prices, created by the Russia-Ukraine conflict, emerged. High gas prices have made electric vehicles much more attractive both to the consumer as well as the manufacturers. Ford begun production on the first ever electric pickup truck (beating Tesla’s Batmobi…excuse me Cybertruck to the punch), and GM has promised to release its own fully electric truck in the spring of 2023. Artificial intelligence has also evolved in the FreightTech world, running robots in warehouses (which exponentially increases efficiency in over-capacity facilities) and even analyzing space and creating the mathematically most optimal way of storing items in a container for maritime shipping.

Even though the current economic outlook can appear somewhat gloomy, the transportation sector can still expect money to be available for startups, though it might be harder to get. Ryan Schreiber, Vice President of Growth and Industry for supply chain consultant Metafora stated that “One founder described it to me as saying in early ’21, if you had any revenue, you could raise and at a valuation you preferred,” compared to the current situation where “You’ve got to have a $1.5 million annual recurring revenue, and you are going to be grateful to get any valuation.” Schreiber advises FreightTech firms to not burn through their runway, and to not sell equity unless for a very good reason.

There is also good news for FreightTech entrepreneurs. A McKinsey survey revealed that 77% of supply chain executives intend on investing in supply chain visibility, among other things. That combined with the growth of the e-commerce industry, it is fair to anticipate a decent amount of investment to still be poured into the sector.

The best inventions often came from times of crisis. Nuclear fission was invented during World War II, antiseptic disinfectant was invented to stop a cholera epidemic in Germany, and in the midst of the ‘08 financial crisis, Beyonce released her hit single “Single Ladies.” So it is no surprise that the COVID-19 pandemic and the Russia-Ukraine war have sparked a new wave of innovation in the FreightTech industry. And while, perhaps, startups are no longer getting as much funding as they did in 2021, it is clear that it will remain a hot sector for as long as we face supply chain bottlenecks and restrictions.

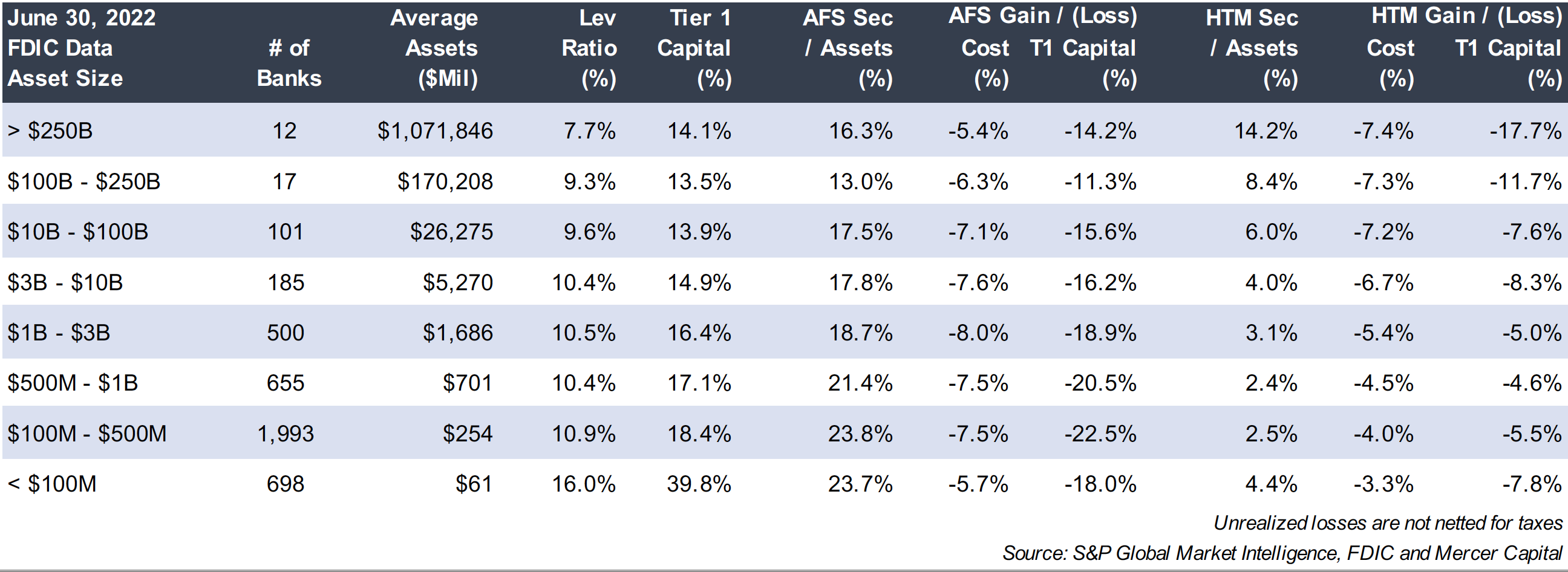

The Importance of Normalizing Financial Statements for a Business Valuation

What is normal? A question we seem to have been asking ourselves for the last few years. When it comes to making sense of the “normal” in this new day and age, we cannot offer any advice there. But we can speak on the process and importance of normalizing financial statements for a business valuation.

It is common for a business valuator to make adjustments to reported financial statements to more accurately reflect ongoing, operating cash flows of a business. These adjustments are part of the “normalization” process, with an ultimate goal of determining the earnings capacity of the business.

In litigation, when two financial experts’ valuation reports are compared, both the adjustments deemed necessary, and the dollar amount attributed to each can be a factor in the differences in valuation conclusions.

Understanding Before Adjusting

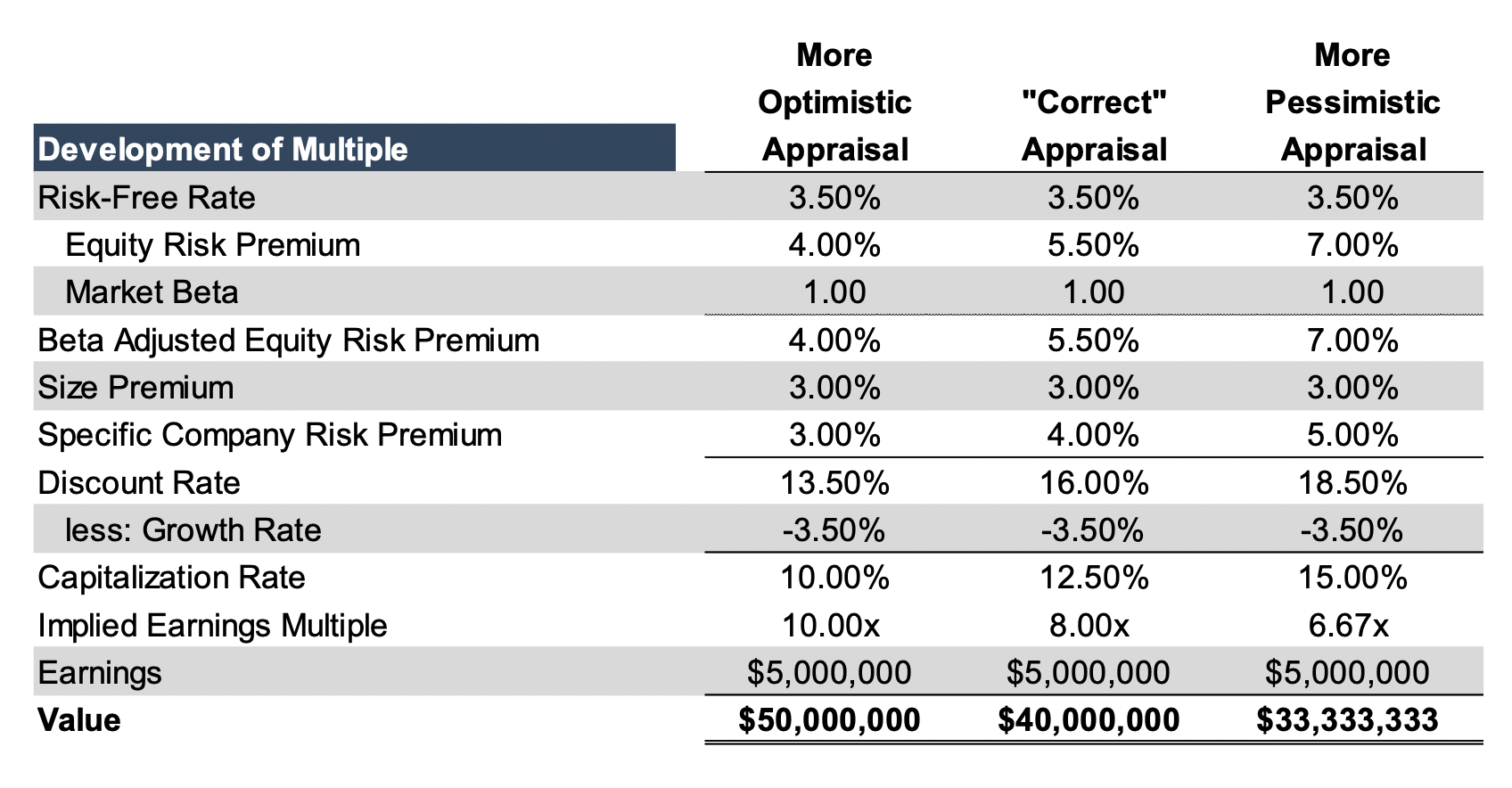

To perform an accurate business valuation, appraisers must have a clear understanding of the subject company’s true financial position and historical earnings capacity. This knowledge is vital to comprehend the company’s future income-generating ability and assess its financial performance relative to industry peers as well as its own historical performance.