Challenges for U.S. Drilling Amid Tariff Uncertainties

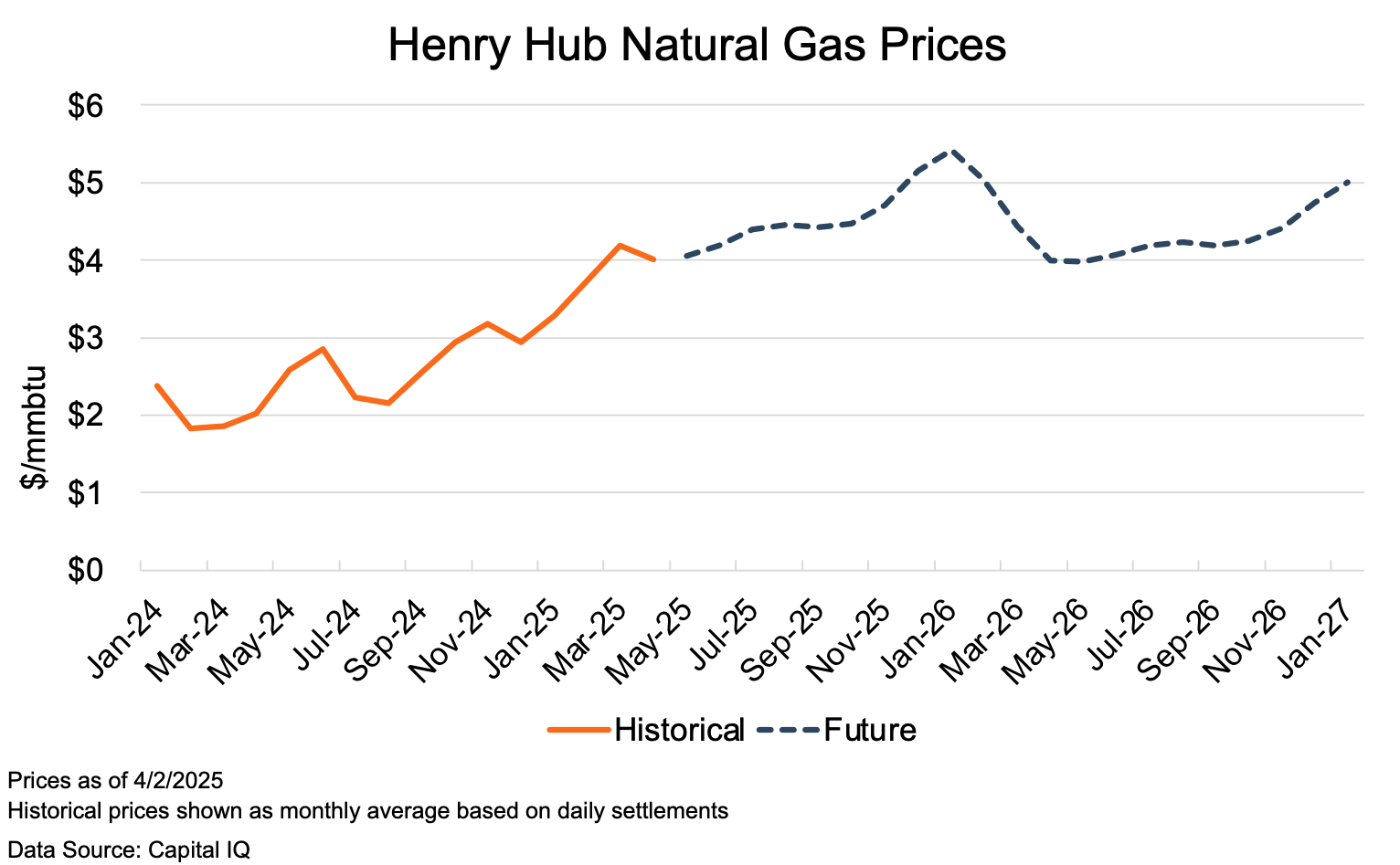

Natural gas producers have continued to reduce costs and refrain from increasing production despite strong fourth-quarter earnings that surpassed consensus expectations. While natural gas futures are as optimistic as they’ve been since 2022, management guidance on capital spending is lower than a year ago. Most natural gas-focused E&Ps have adopted low-cost maintenance drilling strategies aimed at keeping production flat until natural gas prices demonstrate sustained resilience above $4/mmbtu for an extended period. Based on the backwardation observed in the natural gas futures curve and signals from management teams, significant natural gas production increases are unlikely to materialize before 2026.

Tariffs

As in most other industries, President Trump’s tariff policy has created uncertainties for oil and gas businesses, where there is reduced confidence in the stability of commodity prices and the economics for drilling. On April 2nd, Trump announced a 10% across-the-board tariff and additional tariffs on China, the European Union, and Japan. Although energy commodities are exempted from these tariffs, U.S. hydrocarbons are still subject to risks from likely retaliatory tariffs and a slowdown in global economic growth.

The day after Trump’s “Liberation Day” announcements, OPEC+ announced member countries will increase oil production in May by 411,000 bbls/d, increasing the speed of its plan to phase out its recent production cuts. Before the announcement, OPEC+ planned to increase May production by 135,000 bbls/d. WTI was trading at 7% below its settlement price at the time of writing.

One concern for U.S. drilling is the tariffs’ impact on the price of steel, a material used in drilling operations and imported mainly by U.S. companies. More notable, though, is how the market would play out, as it appears ambiguous related to the amount of additional U.S. production that could feed domestic energy consumption without risking a supply glut and price shocks. The extent to which parties ultimately bear most of the burden and where along the supply chain costs would be absorbed is unclear.

The United States remains a net importer of oil, with net imports of approximately 2.5 million barrels per day, the majority sourced from Canada. According to analysis from RBN Energy, the United States would likely have the upper hand in a trade war, as Canadian crude supplied to the Midwest could be replaced by oil transported via pipeline or truck from other U.S. regions. Since the market for Canadian crude oil is also largely limited to the U.S., Canadian companies could ultimately have to bear most of the incremental cost by lowering prices in order to compete.

Chinese Market for LNG

Prior forecasts have had China as the largest growth market for U.S. liquefied natural gas (LNG) exports. In February, before the 34% additional tariff included in Trump’s Liberation Day announcement, China reacted to Trump’s 10% tariff added to existing tariffs on Chinese imports with a 15% tariff on U.S. LNG and a 10% tariff on U.S. crude oil. Chinese companies have been diverting and reselling U.S. LNG from previous contracts to Europe, and China has not received a shipment of U.S. LNG in nearly two months. While China only accounted for 5% of U.S. LNG exports in 2024, forecasted growth from China’s demand for LNG has been a significant driver of investment in the U.S. LNG infrastructure.

Conclusion

U.S. rig counts have generally stayed flat, with 592 rigs at the end of March 2025, according to Baker Hughes data, one less than a month ago and three more than at the start of the year. Ultimately, drilling and capital spending decisions are more challenging and complex for U.S. producers, which can be expected to keep their drilling spending restrained and production growth muted in the near term.

The professionals of Mercer Capital assist clients with various valuation needs in the upstream oil and gas industry in both conventional and unconventional plays in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights