2016 M&A Overview

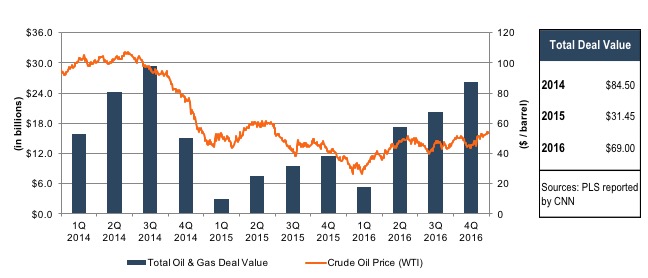

When oil prices collapsed in mid-2014, the M&A market soon came to a standstill as investors waited for clarity regarding the future of the domestic oil and gas market. The low price environment led to a disconnect between the value of oil and gas reserves and the price that buyers and sellers negotiated in a distressed market. As prices remained low, deal volume picked up in the beginning of 2016 as companies were forced to sell assets in order to quickly generate cash to pay off debt and avoid bankruptcy. As the year continued, M&A activity increased and total deal value at the end of 2016 doubled that of 2015.

Factors Leading to Increased M&A activity in 2016

- Price stabilization of crude in the range of $45 to $54 played a role in the increase in M&A activity as investors regained confidence in the sector.

- Cost reduction in certain plays from new technology has allowed more cost-efficient drilling.

- The low price environment made distressed companies’ assets acquisition targets as these companies were willing to sell them for heavy discounts.

- In order to decrease break-even costs, companies merged to realize potential synergies.

- Recent discoveries and low break-even costs in the Permian Basin attracted investors and producers to the play and increased overall M&A deal volume.

Price Stabilization

Crude oil price volatility declined over the last year as excess supply began to decline. Since mid-April of 2016, US crude oil inventories have declined by approximately 6%. Additionally, OPEC production declined in the second quarter of 2016 and had slower-than-normal growth in the fourth quarter, which helped to reduce excess supply 1.

Cost Reduction

In a stacked play, multiple horizontal wells can be drilled from one main wellbore. This provides increased productivity as multilateral wells have greater drainage areas than single wellbore. Additionally, it can reduce overall drilling risk and cost. For deep reservoirs, a multilateral well eliminates the cost of drilling the total depth twice. In some plays such as the Permian, the reservoir is deep enough at some points that operators can drill multiple horizontal wells from one main wellbore. This advancement of drilling technology has allowed producers in certain plays to reduce costs so that drilling in lower price environment is economically feasible.

Only the Strong Survive

In early 2016, banks decreased lending to oil and gas companies. In a low price environment, the value of a company’s reserves falls when valued using a traditional PV-10 calculation. Lower valuations have led to decreased borrowing capacity, which in turn has caused cash flow pressure for many companies. Thus many companies have had to sell non-core assets in order to ease cash flow pressures. But in order to generate liquidity quickly, they often were forced to accept heavily discounted prices. This increased deal volume in 2016 as many companies tried to avoid bankruptcy and buyers moved quickly to get their hands on cheap assets.

Mergers for Synergies

As companies worked to reduce break-even prices, many looked for strategic acquisition targets in hopes of realizing operational efficiencies which could reduce costs and give them a competitive advantage in the market. This increased the number of mergers in 2016 in the E&P industry and also in the midstream sector which benefits from the network effect.

The Permian Basin

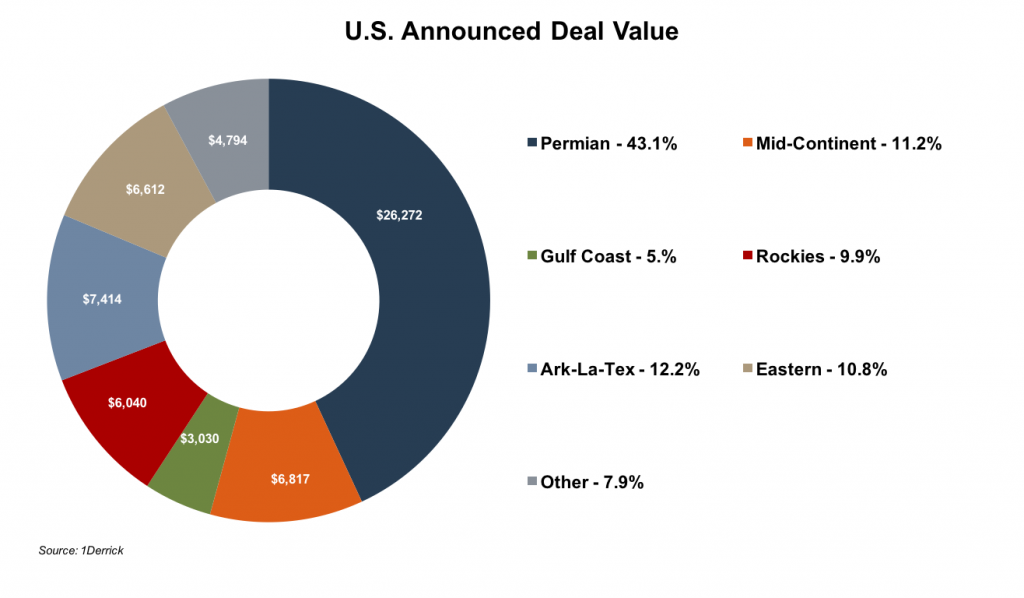

Approximately $69 billion dollars of North American E&P assets and companies changed ownership during 2016 with the Permian Basin resource accounting for nearly 40% of the deal dollar volume.

The most significant trend in E&P this year was production companies’ move to the Permian Basin. Out of the 15 deals that were valued at over $1 billion, 8 were in the Permian Basin. The Permian became the center of the M&A stage due to its low drilling costs, resource diversity, and large remaining reserves. Although the Permian was discovered in the 1920s, the true potential of the Permian was not realized until 2007 when hydraulic fracturing techniques were used to access the tight sand layers of the play. Since then the Permian has been revitalized as producers have begun using unconventional drilling techniques in addition to traditional vertical wells.

Because the crude in the shale layers has only recently been explored, there are still tremendous reserves left. Just this year the USGS announced an estimated 20 billion barrels of crude oil, 1.6 billion barrels of NGLs, and 16 trillion cubic feet of natural gas were discovered in four layers of shale in the Wolfcamp formation. Additionally, the Permian is a stacked play—which means that companies can drill multi-lateral horizontal wells to reduce costs. And, companies that operate in the Permian do not have to choose between oil and gas, but can diversify operations.

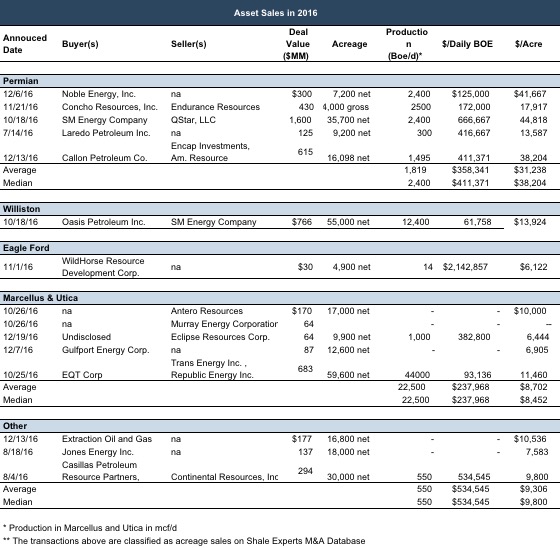

Last week, we briefly looked at the six largest transactions in 2016. Recent asset deals in the US are summarized below. Due to the factors discussed above, average deals in Permian transacted at higher dollar per-acre multiples than other plays such as the Williston Basin.

When prices declined, production in the Permian continued increasing while production in other domestic plays such as the Bakken and the Eagle Ford declined significantly. Unlike the Eagle Ford and the Bakken, which are mostly drilled for oil, the Permian holds a more diverse combination of oil, gas, and NGLs, making it more economical to produce at low prices.

The Bakken was center stage in the early 2000s during the onset of hydraulic fracturing. The Eagle Ford, which was once the most active shale plays in the world, was the center of the M&A market in 2013 and 2014 when drilling activities increased there. M&A in the Eagle Ford and Bakken was sluggish in 2016, and the transactions that did occur there were largely motivated by distressed companies looking for liquidity or an exit.

M&A Overview

M&A activity is expected to remain strong in 2017. It is expected that OPEC will follow through on production cuts and excess inventory should be absorbed in early 2017. This will cause the price of oil to continue increasing. As the price of oil continues to rise, drilling in other plays besides the Permian Basin will begin to become more economical and M&A activity should increase in other plays. However, it is expected that oil and gas companies will have to turn to private equity in order to gain liquidity as banks remain cautious in lending to the energy sector.

End Note

1 Data from Bloomberg

Energy Valuation Insights

Energy Valuation Insights