2024 Oil and Gas Outlook

A Year Of Divergence

January, and the new year in general, is a time of planning and setting expectations. We all do it (or should anyway). We attempt to evaluate where we’re going based on where we are, who we are, and where we have been. When it comes to the oil and natural gas upstream markets, it appears each commodity and their producers are heading to different places in 2024. We can see it through market sentiment, prices, production, and corporate actions such as mergers.

U.S. oil seems to be headed toward a period of decreasing growth and increasing upward price pressure. U.S. natural gas on the other hand, appears to be back in a somewhat oversupplied position while hoping that LNG market channels ease the price pressure that has pushed it back under $3 per Mcf again. U.S. oil’s drilling inventory and reserves are showing some signs of increasing in value and relative attractiveness. The top shale locations are dwindling, and quality reserves are coming at more of a premium.

Natural gas’s drilling inventories remain vast across several plays in the Lower 48

On the other hand, natural gas’s drilling inventories remain vast across several plays in the Lower 48 and unless there are first-class characteristics to a company’s PUD inventory (such as being economically strong and proximate to LNG market channels such as perhaps the Haynesville Shale play) the market appears to be less interested in paying a whole lot extra for it. This dichotomy extends not only to the broader markets themselves, but also to the larger firms and smaller firms within them. Larger companies, like the majors and large independents have a different view on how to approach 2024 than smaller firms. Let us look at some of these dynamics and how they might play into the upstream outlook for this year.

Oil – Production Growth Waning

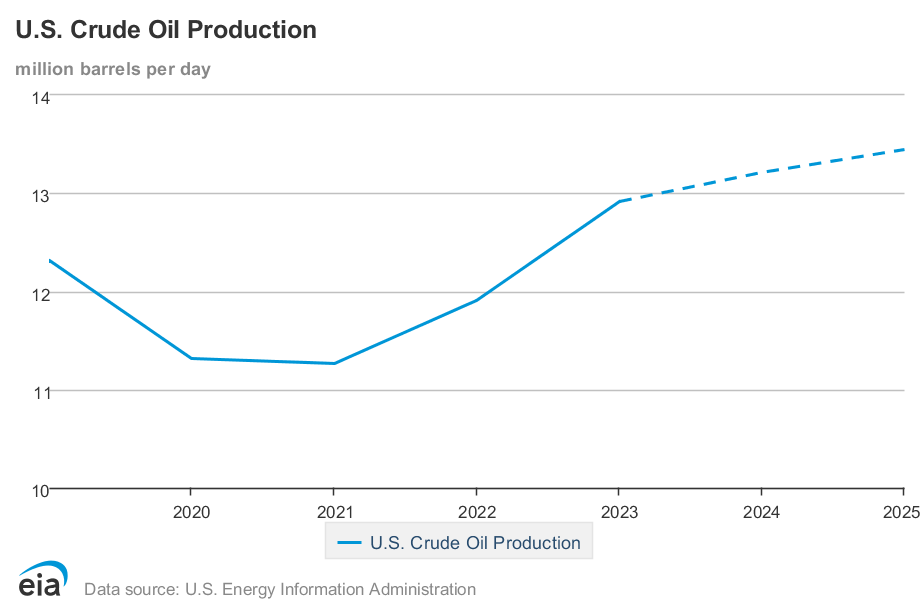

Crude oil prices rose recently due to a surprise weekly draw due to the cold weather. However, overall production for the year according to the EIA, while rising, is expected to wane. Other market players expect that production will fall this February everywhere except the Permian Basin. The latest Dallas Fed Survey from December presents a similar sentiment. Oilfield services firms are reporting a downward drift in activity, while capital expenditure planning presents a flat yet mixed picture. Smaller firms are seeking to grow or at least maintain production mostly, while larger firms are focusing more on acquiring assets with their cash flow and at the same time reducing debt.

There does appear to be some stability on the oil side from a corporate planning standpoint as the Dallas Fed Survey suggests that firms are preparing their capital expenditures around a $70-75 per barrel pricing environment this year. However, a complicating factor is that the shift of institutional development capital away from the oil space due to ESG and carbon emission concerns will continue to hamper capital flow that firms might otherwise want to deploy in the space. One Dallas Fed Survey respondent’s remarks centered around the idea that inventory for U.S. onshore oil drilling will be extremely valuable in five years, due in part to the dearth of capital, and that young people in the industry should learn about offshore and international exploration sooner rather than later. That is not exactly a ringing endorsement of today’s upstream investment conditions.

In addition, the past year’s increases in interest rates will disincentivize debt capital in the upstream space; not that the industry has been relying much on it anyway in recent years. In fact, a lot stay away from debt if they can. It comes with too many restrictive provisions. Many producers, particularly natural gas producers, privately (and sometimes publicly) gripe about the pricing hedges, swaps and collars that bankers demand from firms these days which are sometimes perceived as a handcuff on equity holders’ upsides.

On the international front, OPEC announced “voluntary” cuts about a month ago. I’m not exactly sure what that means and how effective it will be. However, it does signal that OPEC is not seeking to boost production either, so the pressure for U.S. shale producers to ramp up production in the name of maintaining global market share may not be weighty this year. That’s also not to mention the possibility of OPEC announcing more cuts in 2024 leading up to the U.S. election. Some speculate that OPEC would rather have petroleum and gasoline prices rising before the election as opposed to falling. This may also be fueling some of the perceived rationale for the majors’ acquisitions in 2023, particularly Chevron’s acquisition of Hess. More on that in a moment.

Natural Gas – Still Plentiful and Cheap

The US is expected to have 1.9 trillion cubic feet of natural gas stored by March, which is 15% above its storage levels at the same time in 2023. For those of you who are slow on the uptake, this is a sign of oversupply. The inventory levels are the result of sharply increasing production as well as warmer-than-expected temperatures throughout the winter thus far (with the notable exception of the week prior to the publishing of this post). On top of those short-term impacts, multiple LNG export terminals have been experiencing delays to their startup times, such as ExxonMobil’s Golden Pass. These delays may cause lower-than-expected demand until they become operational. Once they are online there will likely be high demand, but exports may remain artificially limited up until 2025.¹

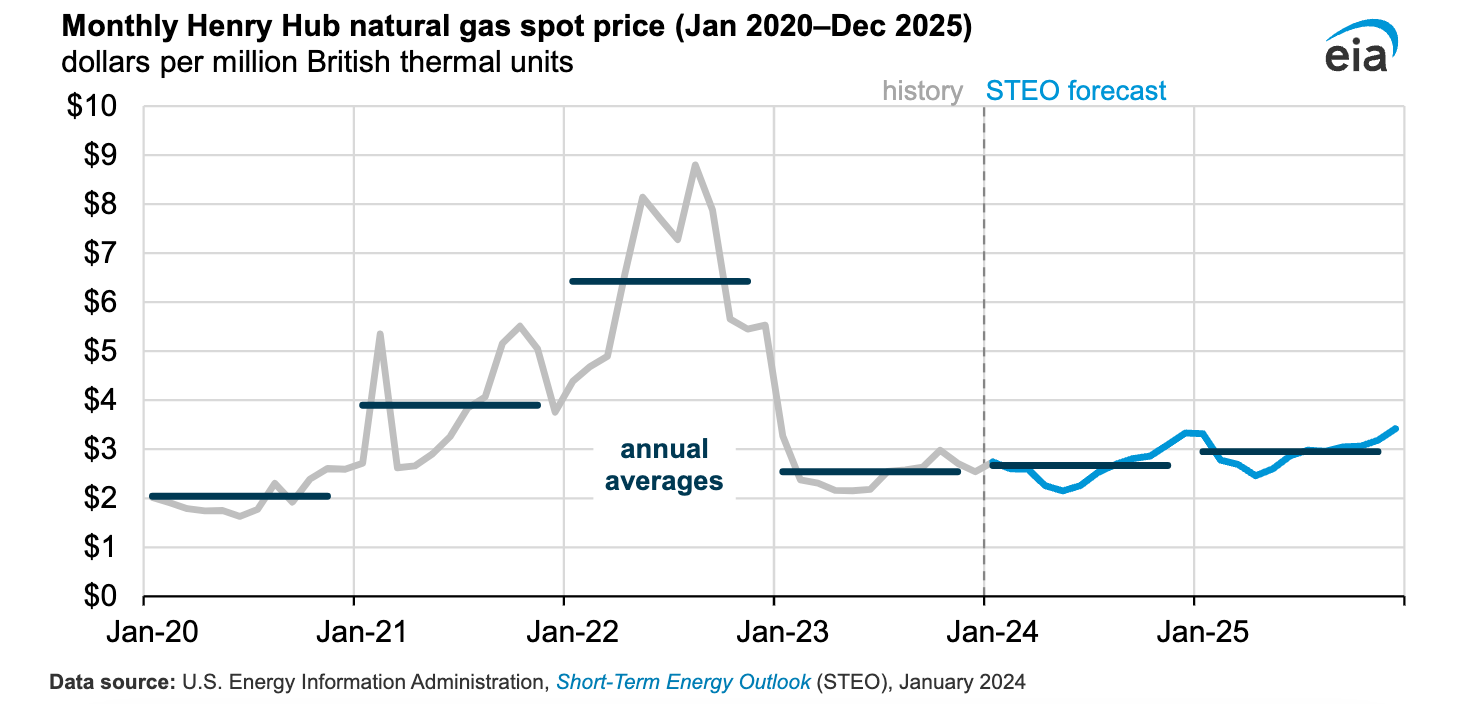

The EIA’s U.S. natural gas market outlook states that the U.S. benchmark natural gas spot price at the Henry Hub is expected to average under $3.00 per million British thermal units (MMBtu) in 2024 and 2025 due to strong natural gas production and storage inventories. This is more in line with gas prices in recent years except for 2022. It also forecasts that U.S. natural gas demand will eventually increase over that period, driven by growth in LNG exports and colder winter weather. The EIA suggests that the demand growth will be partially offset by less consumption in the industrial and electric power sectors. In other words, despite increasing demand the EIA believes the natural gas market is expected to remain relatively low-priced in the next two years.

Reading the Merger and Acquisition Tea Leaves

Another indication of industry direction can be observed in the merger and acquisition markets, which have been more active in the past six months. Large deals such as the Exxon acquisition of Pioneer, Chevron’s purchase of Hess, and just last week the Chesapeake and Southwestern merger can give insight into where the upstream industry is headed.

As the consolidation trend continues in the oil and gas industry heading into 2024, Exxon and Chevron have made the biggest splashes in a few years by acquiring Pioneer and Hess for around $60 billion each. The transactions have several things in common. First, they bought companies from a dwindling pool of large publicly traded strategic targets that are even available. As I see it there are only a couple of targets out there now worth over $50 billion (Oxy, EOG) and a handful more worth $20 to $40 billion (Marathon, Apache, Diamondback, EQT Coterra). However, as the size gets smaller the business model fit for a buyer like Exxon or Chevron tends to become less diversified and basin specific. Almost coincidentally, the prices for Pioneer and Hess were almost on top of each other ($65 billion vs. $60 billion). They also were both bought for a modest premium to the 30-day stock price leading up to the announcement of the deal.

One notable item that I observed from these deals was the increasing premiums paid for future drilling inventory.

One notable item that I observed from these deals, particularly the Chevron and Hess deal, was the increasing premiums paid for future drilling inventory. Most transactions in recent years have been mostly centered around current production and profitability, with future inventories tending to be less of a valuation focus. However, Chevron’s purchase of Hess had a significant theme of future inventories in its investor communications, namely Hess’ Guyana offshore Strabroek Block. A significant part of the purchase price was attributable to this upside opportunity and the Strabroek Block is expected to be one of the central growth engines in Chevron’s future production plans. Now there are risks to be sure, but most deals have been valued primarily on the production and EBITDA at the time of the deal, not five years from the time of the deal. It makes me wonder if the majors and larger acquirers might be investing on the notion that the tail end of the forward curve is wrong, and that reserve inventory will increase in value as quality shale locations decline.

On the natural gas side of the ledger, Chesapeake and Southwestern announced a merger just last week. Investors have reacted positively towards the transaction, even though some analysts perceived both companies as “not all that appealing on their own.” This is a little unusual, as typically, acquirers will experience a temporary decline in their stock due to taking on debt for the acquisition and the burden of paying a premium for the acquired firm.

The theme in this deal was more oriented towards cost synergies and immediate cash flow accretion. Do not mistake me, the other deals highlight this too, but this feature was more of a bedrock item for the natural gas companies. In addition, the combined company’s positioning around future LNG markets was a big rationale for the deal. In recent times, investors have moved away from small and mid-size operators in favor of larger entities. This is one of the primary drivers behind recent consolidation in the upstream energy sector, although until now natural gas producers have lagged oil-focused operators in terms of acquisitive activity due to low bid-ask spreads. It seems likely that part of the appeal that Wall Street sees in the deal is the creation of a large new operator that can compete with more established players. Nonetheless, it is easier to characterize this as a defensive move by the natural gas companies who are waiting for LNG markets to reinforce them, whereas the majors’ acquisitions appear more strategically oriented from a future growth perspective on the oil side.

Overall, it appears that oil is positioning itself as an increasingly valuable commodity in 2024 whereas natural gas remains closer to neutral. Smaller players are trying to stay cash flow positive and get a good return on their new wells, while larger players are spending more time sharking around and eyeing smaller companies to get growth and cost synergies. Either way, until the delayed LNG markets get ramped up, oil appears to have valuation’s upper hand over natural gas in 2024. We will see where it goes from here.

1. “Natural-Gas Prices Remain under Pressure Despite Cold Snap” written by Jinjoo Lee for the Wall Street Journal. Published on January 16, 2024 and available at https://www.wsj.com/finance/commodities-futures/natural-gas-prices-remain-under-pressure-despite-cold-snap-25c33973?mod=finance_feat1_hots_pos2

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights