The November election brought optimism to many oil producers who felt hamstrung by the Biden Administration’s policies. Even Biden’s ban on offshore drilling is expected to be challenged or changed when Trump is sworn in. However, administrations can only do so much when it comes to global supply and demand dynamics. In fact, they can usually do little in the big picture; and the big picture is that there is probably going to be more supply coming online in 2025 than demand to meet it. Therefore, U.S. upstream producers are not planning on blowing their budget on aggressive drilling plans, no matter what Trump says, especially considering the lukewarm pricing environment that the market foresees. In addition, the U.S.’ shale dominance may be headed towards inevitable decline. There’s a lot to consider, so let us jump in.

Supply: Tainted Optimism

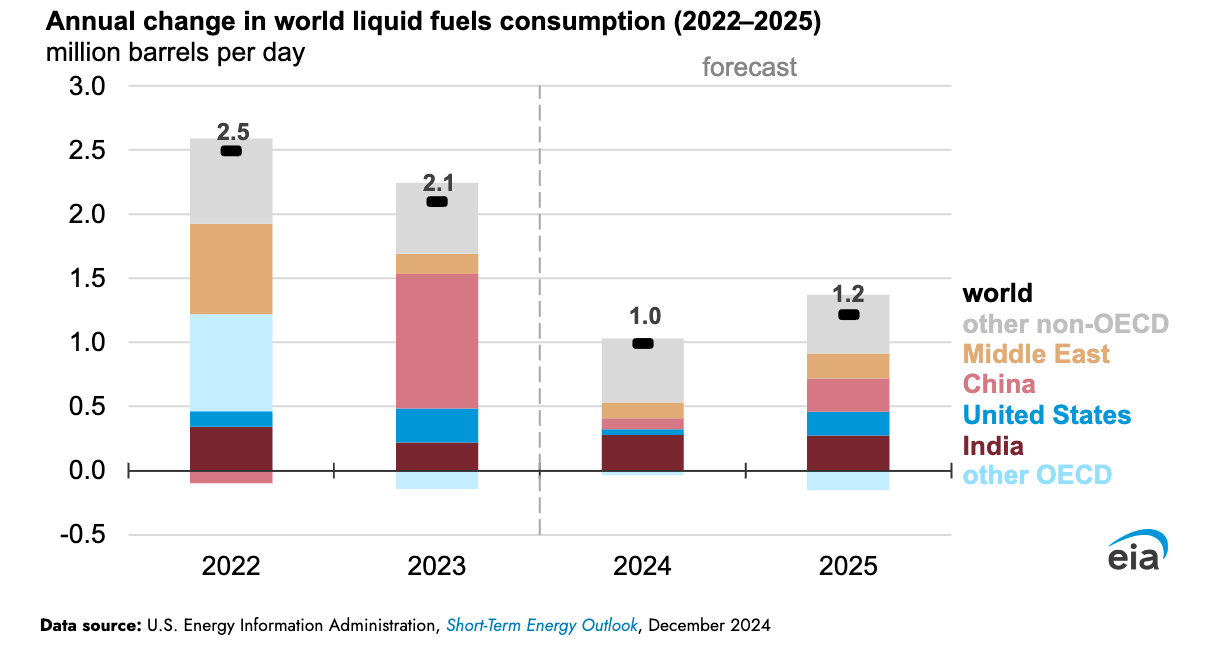

The incoming Trump Administration has promised to pull back regulatory restraints and unleash the industry to “drill baby drill”. Most industry players have responded favorably to this and anticipate faster permitting processes for federal lands. In addition, the Dallas Fed Energy Survey has indicated activity and outlook upticks from upstream producers after the election. The industry is encouraged. Yet, as college football announcer Lee Corso says – “Not so fast my friend!” Most of the active U.S. oil activity is not on federal lands, but on private or state lands. In addition, oil is a global commodity, not a regional one and it appears that the supply in 2025 is heading towards more of a glut status as opposed to a tight one. The latest Short Term Energy Outlook estimates that production outside of OPEC+ will be up about 1.6 million barrels per day in 2025 with concurrent demand only up about 1.2 million barrels per day. The U.S., Canada, and South America will be leading that charge.

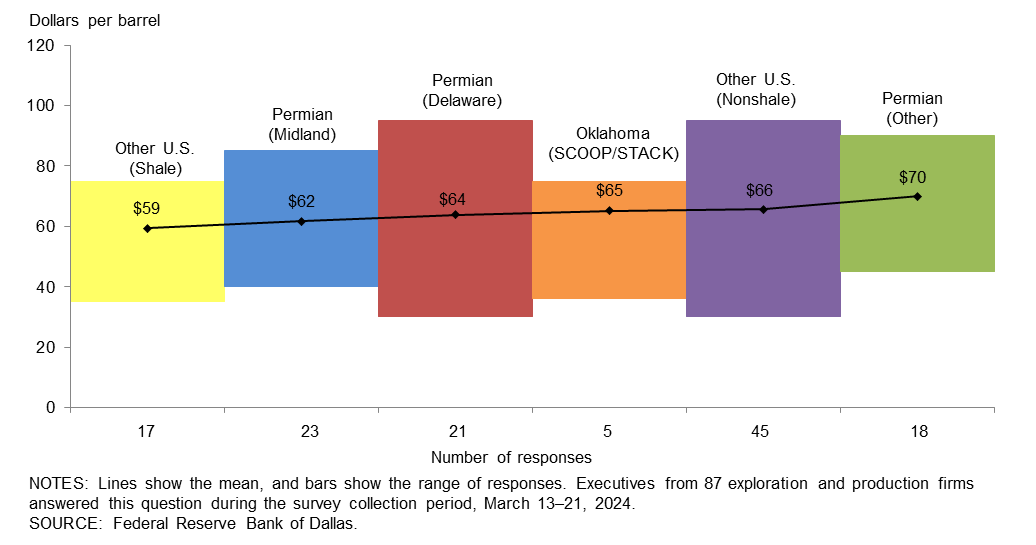

In the meantime, OPEC+ has held fast on a plan of production restraint whereby there are about six (6) million barrels per day of production capacity that is being held back. Saudi Arabia possesses about half of that. Most U.S. firms surveyed recently are not planning on increasing their investments for 2025, even after now knowing who will be in the White House for the next four years. In fact, industry consultant Wood Mackenzie just released a report on 2025 guidance for upstream companies capital budgets. They estimate 2025 corporate capital budgets to be down by 1.8% compared to 2024. These are not indicators of an industry that is “chomping at the drill bit” right now. One reason is that breakeven prices to drill new wells ranged from $59 – 70 as an industry average in 2024 according to the Dallas Fed Survey suggesting a mediocre economic prospect.

With West Texas Intermediate crude priced at around $76 currently, it is profitable to drill, but not overly profitable. In addition, many U.S. drillers hedge their sale prices to satisfy banks and investors’ limited risk appetites which further limits profit upside. Therefore, aggressive drilling strategies will not be heavily incentivized in boardrooms this year for most U.S. producers.

With West Texas Intermediate crude priced at around $76 currently, it is profitable to drill, but not overly profitable. In addition, many U.S. drillers hedge their sale prices to satisfy banks and investors’ limited risk appetites which further limits profit upside. Therefore, aggressive drilling strategies will not be heavily incentivized in boardrooms this year for most U.S. producers.

U.S. Shale Oil Peaking?

Hydraulic fracturing in shale formations revolutionized the oil industry a little over a decade ago. During that time technology and innovations have continued to improve. Production of oil for every rig that drills new wells has continued to increase. There have been efficiencies and innovations that have contributed to this trend. However, it won’t last forever, and there are signs that it may be close or already peaking. The same EIA report that shows more productivity per rig, also shows nearly every basin having steeper legacy oil production change from last year. It’s harder to fill a bathtub if the drain is getting bigger.

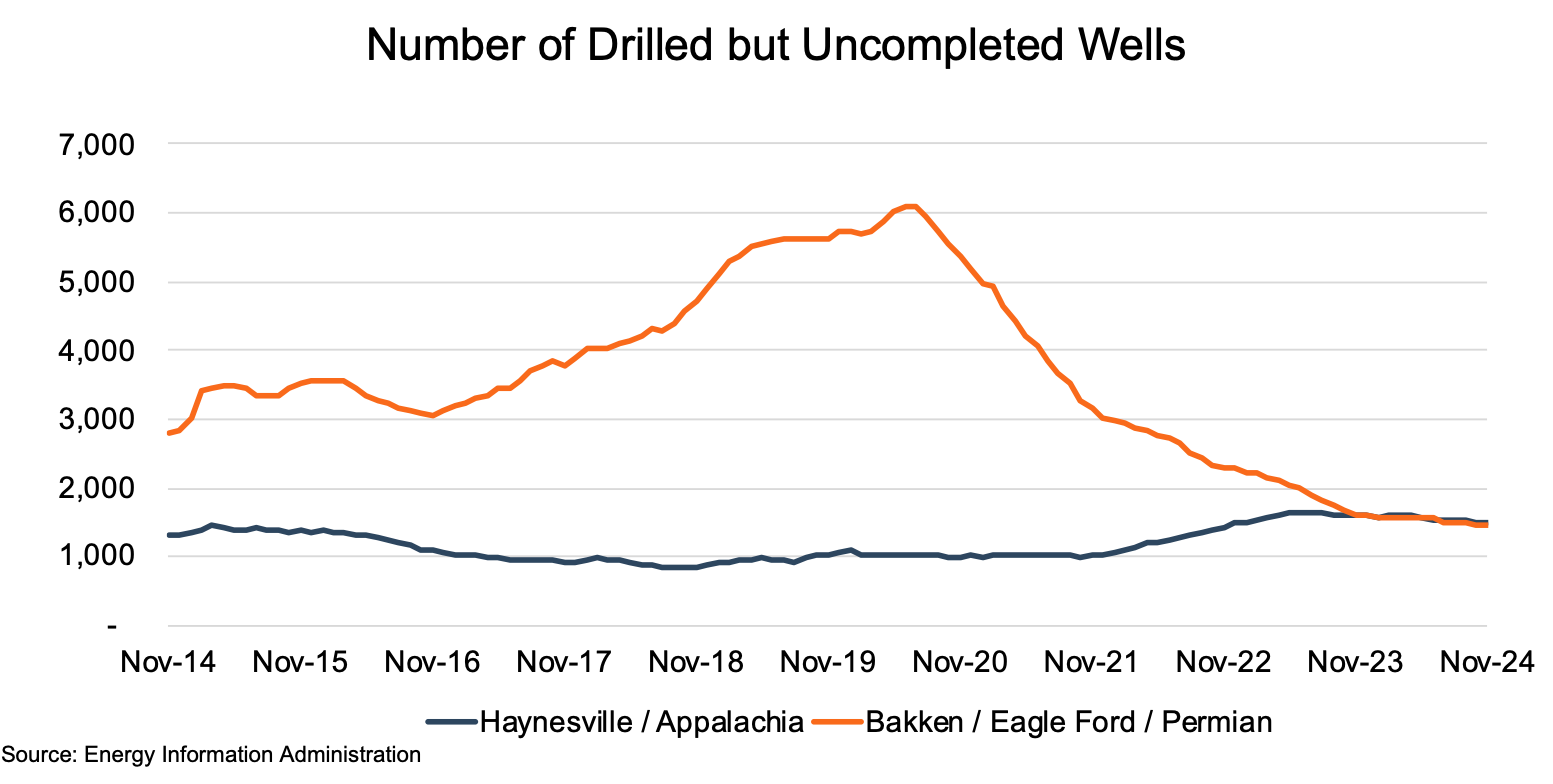

In addition, there is a shrinking inventory of drilled but uncompleted (“DUC”) wells in the U.S. These kinds of wells are available to be fracked but haven’t yet started producing. I discussed this dynamic in my column years ago, and the clock appears to be running out on this inventory. There are fewer DUC wells now in the predominantly oil producing basins (Permian, Eagle Ford, Bakken) than since the EIA started publishing the statistics.

This is not a new theory. It has been known that there are only so many “Tier 1” shale well locations left in the U.S. There are other “Tier 2” wells out there, but they are far less productive than Tier 1 wells, with similar costs to drill and complete, thereby making them less economically attractive. A 2023 report by Goehring & Rozencwajg, an investment firm, in 2023 predicted that shale would peak in the Permian Basin by the end of 2024. They called it Hubbert’s Peak after an eponymously named geologist. If they are right, then oil production growth will not be coming from the U.S. soon. A wry commenter in the September 2024 Dallas Fed Survey put it this way:

“We stand by the hypothesis that the world is swiftly running out of $60 barrels on the way to $100+ barrels within the next five years. OPEC is being punished short term for ceding market share. To us, it appears to be a savvy “oil storage” policy. U.S. shale will decline in a similar fashion to how Hemingway went bankrupt: “Gradually, then all of a sudden.” Why do you think very sophisticated firms, worth tens of billions of dollars, are selling out to the super majors for equity despite a market-leading Permian footprint?”

Demand: China’s Thirst Subsides

Demand around the world is growing for oil. EIA estimates consumption to be up by 1.2 million barrels per day. However, the pace for growth has slowed, particularly in China. Demand growth was hacked nearly in half in 2024 compared to 2023. China is importing 300,000 barrels a day less than at the end of 2023. Deflationary pressures and banking issues continue to reduce demand. It has also given way to India as the leading global source of oil demand.

Price Expectations: Muted For 2025 And Perhaps Beyond

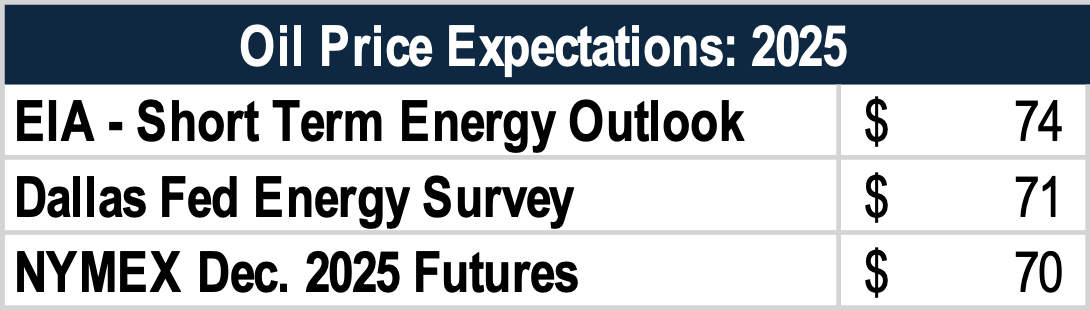

All these factors, and I’m sure more that I haven’t covered here, have led to a softer oil price market for 2025. EIA, Dallas Fed Survey, and NYMEX futures all currently estimate prices to be in the low 70’s for this year. Estimates can vary of course, and oil prices are so sensitive to geopolitical events that these estimates could be out the window in short order. However, the supply surplus and tempered global demand have put the market in a relatively weak pricing position.

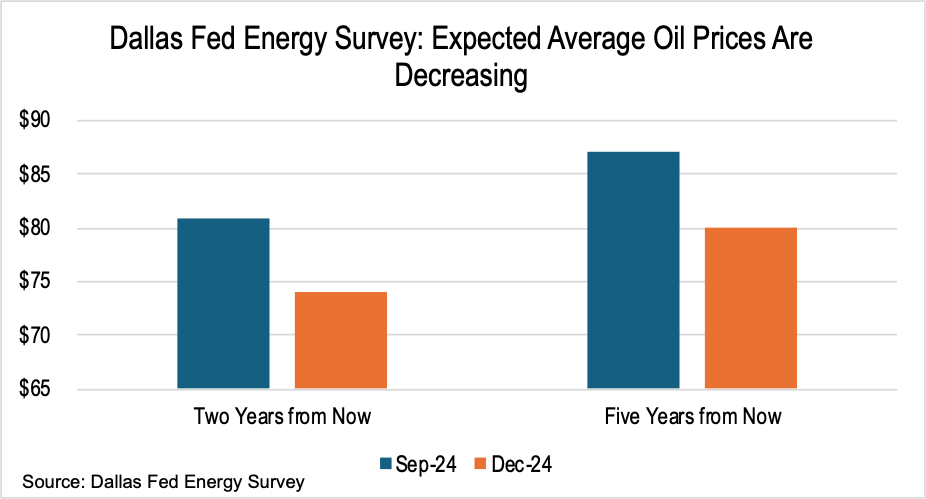

That sentiment is continuing into longer term estimates as well. The NYMEX curve was in contango as of the time of this article, meaning that futures prices are lower than current prices. The December 2028 contract was below $64. The Dallas Fed Survey respondents were more optimistic about overall prices but displayed a similar declining trend in their estimates. More respondents estimated lower prices on average than higher prices. Two-year price estimates fell from $81 as of September 2024, to $74 as of December 2024. Same for longer term estimates as well.

It may be that survey participants believe that OPEC+ will continue to be conservative on the production side. If OPEC+ continues to hold back on its production capacity, then prices could continue to be steady or even rise. While market share growth is tempting for the Saudis, unloading cheap oil is not in their interest. Nonetheless, the tables may be turning, and the U.S. may not be the world’s swing producer for much longer, thereby giving OPEC+ more leverage with every declining U.S. shale well.

Originally appeared on Forbes.com.