5 Takeaways from NARO Appalachia’s Annual Conference

I recently attended the National Association of Royalty Owners (NARO) Appalachia Chapter Annual Conference in White Sulfur Springs, West Virginia. Over the two day conference, speakers addressed many topics including certain aspects of lease agreements, current legislation affecting mineral owners, clean water solutions, clean energy programs, legal issues affecting mineral owners, midstream and storage development, and more.

While I hope to dig deeper into some of these topics in future blog posts, here is an overview of five key takeaways from the conference.

1. Lack of Infrastructure Limits Growth

The true potential of the Marcellus and Utica Shale was not realized until 2007/2008; that means the infrastructure development in the region is still years behind regions like West Texas. The amount of natural gas being produced in the Northeast exceeds the infrastructure available to move supplies across the U.S., resulting in a supply surplus. This has pushed the price of natural gas in the region lower than the Henry Hub Benchmark. The northeast has been dealing with this issue since 2010, but infrastructure development has been slow going. In order to increase the growth potential of the region, the northeast needs more natural gas storage, petrochemical plants, and transportation.

There has been a big push for a proposed $10 billion Appalachian Natural Gas Storage Hub, which would include underground ethane storage. According to a presentation by the United States Department of Energy (USDE), there have been four crackers announced to date in the region, bringing a combined capacity of 4.0 million metric tons to the region. Better infrastructure would likely help bring natural gas prices in the region more in line with the Henry Hub benchmark.

2. Why NGLs Are Important

The Marcellus and Utica formation is one of the largest domestic producers of natural gas liquids (NGLs). Natural gas liquids are one of the most common feedstocks for ethylene which is one of the most important chemicals in American manufacturing because it is a building block in many materials such as plastic. The production of ethylene takes a tremendous amount of energy. The process through which you produce ethylene is called cracking because you “crack” apart the molecules to form a new molecule. Because oil and gas prices have remained so low, many petrochemical companies are looking to invest in more manufacturing infrastructure.

3. Post Production Deductions May Be Higher in Appalachia

The Marcellus Shale Coalition defines post production deductions (PPDs) as “the expenses incurred in order to get the gas from the wellhead to market.” These costs include gathering, compression, processing, marketing, dehydrating, transportation, and more. In its raw form, natural gas has little value. In order to make it more marketable, the gas has to be processed so that it is ready to be transported and sold. Further, in Appalachia, the lack of a trading hub forces producers to take on expensive, long-term transportation contracts in order to get their gas to market. Thus, royalty owners in Appalachia often realize a lower price for their natural gas and crude oil (due to excess supply in the region) and higher post production expenses.

4. Why We Need So Much Natural Gas

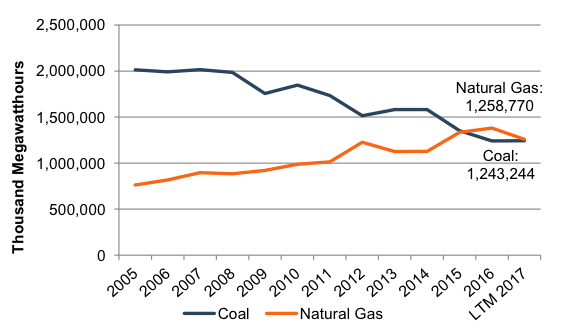

In 2016, natural gas overtook coal as the leading source of electricity generation. Many power plants have switched their electric power system over from coal to natural gas because natural gas is cheaper and cleaner than coal.

In the mid-2000s coal generated over 50% of the US’ electricity while natural gas was under 20%. If this trend continues, demand for natural gas will continue to increase.

5. “Super Vertical” Wells Are Indeed Super

Oleg Tolmachev, Vice President of Drilling and Completions at Eclipse Resources spoke about super vertical wells and why they are useful in a low price environment. A super vertical well exceeds 15,000 feet in length. In May of 2017, Eclipse broke its own record for the longest land-based lateral well in the world when it drilled a 3.7 mile long well in the Utica. Eclipse was able to complete the well in less than 17 days and according to Mr. Tolmachev their average cost per lateral foot was 30% less than their competitor. Eclipse’s breakeven price for its super vertical wells is around $2.75 per mcf. Further, Eclipse’s super vertical wells have not seen steeper declines than traditional vertical wells.

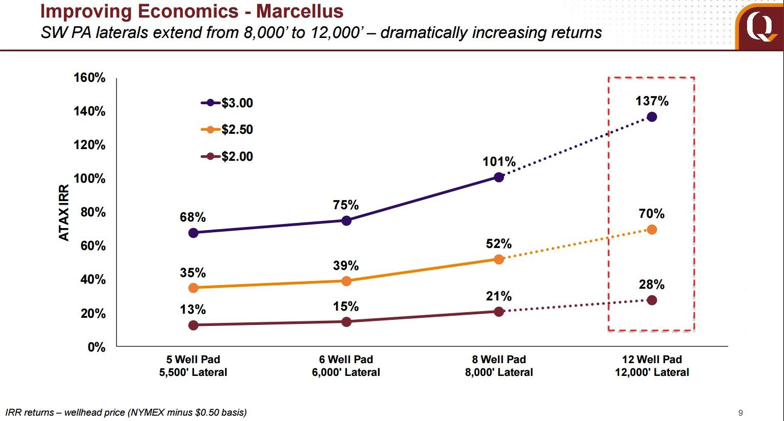

In a low price environment, super vertical wells allow for companies to increase returns, as shown in the chart below from EQT’s July 2017 analyst presentation.

Conclusion

These five takeaways were only some of the many topics discussed at the NARO Appalachia conference. The conference had educated speakers who talked on a broad range of topics and encouraged royalty owners to ask questions, and continue learning no matter how long they have worked in the industry. The conference reminded me of why industry expertise is so important in the field of business valuation.

In order to fully understand the operations of a business, an analyst must have knowledge of all aspects of the industry. Mercer Capital has over 20 years of experience valuing assets and companies in the oil and gas industry. We have valued companies and minority interests in companies servicing the E&P industry and assisted clients with various valuation and cash flow issues regarding royalty interests. Contact one of our oil and gas professionals today to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights