Accounting for Risk in Oil and Gas Reserve Valuations

Reserve Adjustment Factors and Risk-Adjusted Discount Rates

One of the most complex aspects of oil and gas valuation is accounting for the risk associated with proved developed nonproducing reserves (PDNP), proved undeveloped reserves (PUD), and the less certain probables and possibles (P2 and P3 Reserves).

When valuing proved developed producing reserves, estimates of future production, pricing, and expenses are based on historical results. However, production projections and expense forecasts are more speculative when it comes to PDNP reserves as they are not based on recent production history, and are even more abstract when it comes to PUD reserves since the wells have not yet been successfully drilled.

Accounting for Risk

Generally, there are three ways to account for the additional risk associated with PDNP, PUD reserves, probables, and possibles:

- Using a risk-adjusted discount rate (RADR),

- applying a reserve adjustment factor (RAF), or

- utilizing a modified option pricing model.

In this post, we outline the basics of risk-adjusted discount rates and reserve adjustment factors.

Some of the best guidance on measuring this risk is published by the Society of Petroleum Evaluation Engineers (SPEE). Every year at its annual meeting in June the SPEE presents the results to its annual survey to better understand the parameters used in property evaluation.

The SPEE Survey is a global study, however, the majority of participants evaluate U.S. properties. The June 2018 survey had a total of 266 responses with over 80% of participants spending over half of their time evaluating U.S. properties. It covers a wide range of topics such as futures prices, costs and escalation, accounting for risk, reserve disclosures, and probabilistic methods. The survey presents the average RAF and RADR, as well as the 10th percentile, 50th percentile, and 90th percentile results, based on the reserve type.

What are RADRs and RAFs?

A RADR is used to discount future cash flows to their present value while compensating for the additional risk associated with estimating future production from PDNP, PUD, P2, and P3 reserves. A RADR is higher than a discount rate used in a typical discounted cash flow analysis associated with companywide cash flows. Risk-adjusted discount rates generally fall within the range of 10% to 27%, according to the SPEE Annual Survey.

Reserve adjustment factors are applied to the present value of all future cash flows after a standard discount rate has been applied. RAFs vary widely; PDNP reserves generally have RAFs of 100% (no discount), while we have observed appraisals that have applied an RAF of 0% (implying a 100% discount) to PUD, P2, and P3 reserves.

There are many qualitative factors that should be considered when determining the appropriate RAF or RADR.

- The current pricing environment. Is it economical to drill or start producing in the region given the current pricing environment for oil, natural gas, and NGLs?

- Regional infrastructure issues. Is the necessary infrastructure in place to move products to market or is future production dependent upon increasing infrastructure out of the region?

- Outlook/health of operators. For non-operators, there is additional risk associated with this relationship with a third party. Is the operator considering exiting the region due to the local drilling economics? Does the operator have enough capacity to bring new projects online? Is the operator financially stable or at risk of going out of business?

These are just some of the many pertinent questions to ask when analyzing the risk associated with PDNP and PUD reserves.

Applying a RAF or RADR

Generally the application of a RADR and RAF are interchangeable; however, it is important to avoid double counting risk when determining an appropriate discount rate to use in conjunction with a RAF.

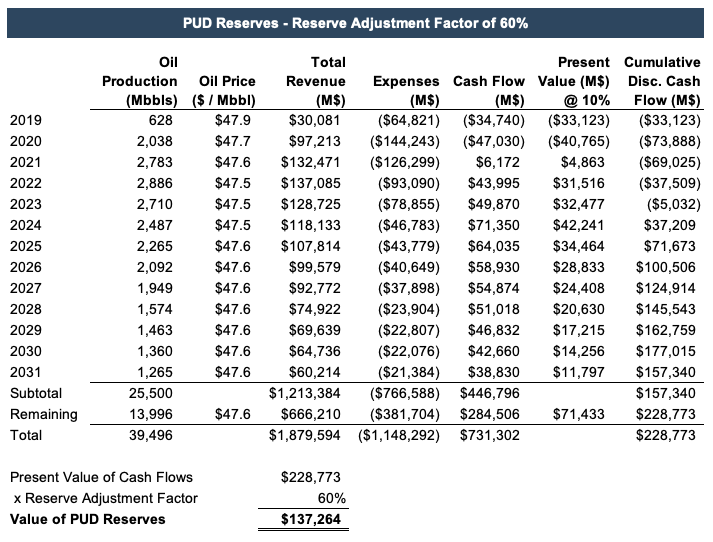

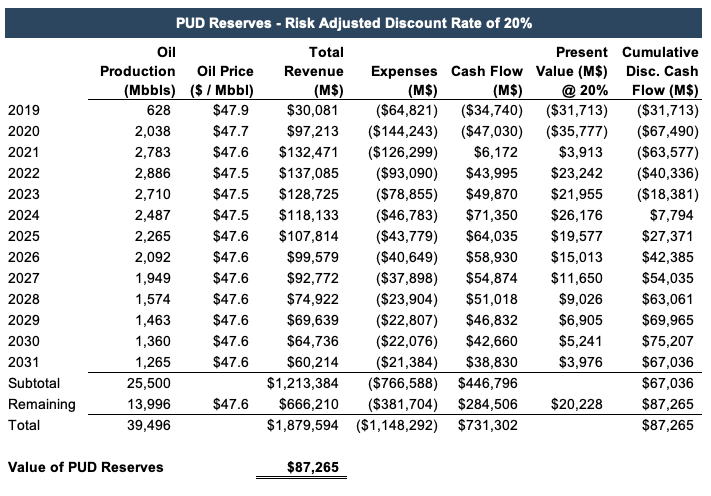

The examples below show typical valuations of PUD reserves. The first applies the 50th percentile result of the SPEE Survey for the reserve adjustment factor (60%) and the second uses the 50th percentile result for the risk-adjusted discount rate (20%).

The results presented in the survey do not necessarily present reserve adjustment factors and risk-adjusted discount rates that compensate for the same level of risk, as shown by the lower valuation conclusion reached when using the RADR from the 50th percentile. For a test of reasonableness, it is important to consider the implied risk-adjusted discount rate based on the selected RAF. In the example above, a 60% RAF is approximately equivalent to a 15.25% risk-adjusted discount rate.

Market Evidence for RAFs and RADRs

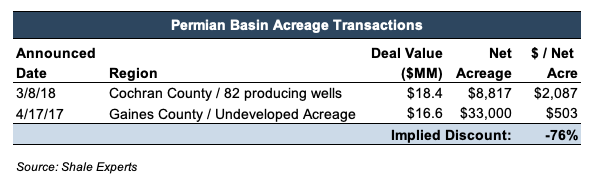

There is evidence in the public marketplace that undeveloped reserves are priced at a discount to their proven producing counterpart.

For example, a recent acreage transaction in Gaines County was priced at a significantly lower acreage multiple than a transaction in Cochran County Texas, although the acreage was relatively close (only one county away). The acreage in Gaines County is in the Midland Basin, but the acreage in Cochran County is in the Northern Shelf; thus, in theory, the acreage in Gaines County is considered to be of higher quality. The acreage in Gaines County, however, consisted entirely of undeveloped acreage whereas the acreage in Cochran consisted of mostly producing acreage.

The transaction of undeveloped acreage in Gaines County of the Midland Basin transacted at a 76% discount to acreage in Cochran County in the Northern Shelf, which equates to a reserve adjustment factor of 24%.

While there are unique aspects of every transaction which make them hard to compare, there is a logical case to be made for the appropriateness of reserve adjustment factors and risk-adjusted discount rates. In the valuation profession, the most commonly used standard of value is “fair market value” which is defined as:

The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.[1]

A hypothetical investor would weigh the risks associated with the development of PUD reserves and would consider an investment in these assets to be inherently riskier than an investment in PDP reserves. As valuation professionals, we account for this risk by application of a RADR or RAF.

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, biofuels, and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

[1] American Society of Appraisers, ASA Business Valuation Standards (Revision published November 2009), “Definitions,” p. 27.

Energy Valuation Insights

Energy Valuation Insights