Appalachia M&A

Rangebound Gas Prices and Preoccupied Management Teams Cause Slowdown in Activity

It was a quiet year for M&A in Appalachia as only a handful of transactions occurred. Surging associated gas production in places like the Permian and Bakken have kept a lid on gas prices, which have largely remained between $2 and $3/mmbtu for the year. Near term expectations aren’t much better, with futures prices below $3 through 2029. Management teams were likely preoccupied with various corporate and capital structure issues instead of changes to the underlying reserve base. However, a bright spot is the easing of takeaway constraints that previously plagued the region.

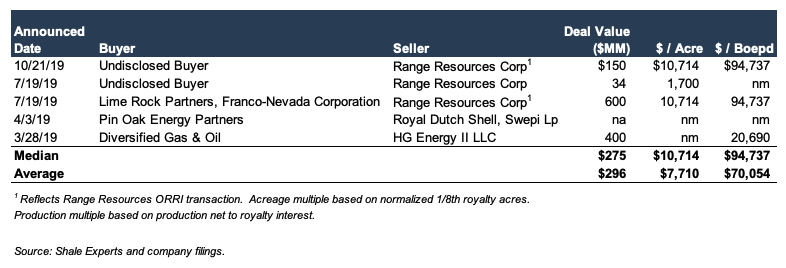

Recent Transactions in Appalachia

A table detailing E&P transaction activity in Appalachia during 2019 is shown below. Overall, deal count and average deal size declined relative to 2018. Diversified Gas & Oil’s acquisition of HG Energy II was the only non-royalty transaction of meaningful size during the year. Cabot recently announced a $256 million divestiture of its 20% interest in NextEra Energy’s Meade Pipeline, though that transaction is not included in the E&P transactions listed below.

Range Resources ORRI Sales

Range Resources was the most active market participant in the basin with two overriding royalty interest (ORRI) sales and the sale of 20,000 non-producing acres in Pennsylvania. The company intends to use the proceeds to paydown debt, offsetting much of the lost cash flow from the assets with decreased interest expense. The company also announced a $100 million share repurchase program.

Diversified Gas & Oil Acquisition of Unconventional Assets from HG Energy II

Diversified Gas & Oil acquired 107 gross producing wells and related surface rights from HG Energy II. The acquisition is consistent with the company’s strategy of buying mature, low-decline PDP assets in Appalachia. However, the transaction does represent somewhat of a departure from the company’s historical focus on conventional (non-shale) assets. Management indicated that the transaction would be accretive on various per-share metrics including earnings and free cash flow.

Operators Focused on Changes to Corporate and Capital Structure Rather than Asset Base

While it has been a quiet year in Appalachia on the M&A front, it was a tumultuous year for management teams and board members.

Toby and Derek Rice’s proxy battle for control of EQT made headlines during the first half of the year. The Rice brothers cited EQT’s poor operational performance after its acquisition of Rice Energy as a reason to shake up management and the board. The brothers proposed a business plan which they indicated would generate an estimated incremental $400 – $600 million of pre-tax cash flow and unlock shareholder value. They succeeded in July with Toby Rice replacing Robert McNally as President and CEO of EQT. An organizational streamlining was announced in September, which included a 23% reduction in employees.

Gulfport Energy, which has been targeted by activist investor Firefly Value Partners, announced a $400 million stock repurchase program in January 2019. However, the company suspended the program in November, citing “current market conditions and a weak near-term gas price outlook.” The same press release also announced that the company reduced its headcount by 13%, two board members were stepping down, and the chairman of the board would not seek re-election at the next shareholder meeting.

Diversified Gas & Oil Company announced a novel financing transaction that may pave the way for other E&Ps looking for creative ways to fund operations. The company created a special purpose vehicle that issued non-recourse, asset-backed securities collateralized by a working interest in the company’s PDP assets. The company plans to utilize the proceeds from the financing to pay down borrowings on its existing revolving credit facility.

Antero Resource’s midstream affiliate, Antero Midstream (AM), completed one of the more complicated MLP simplifications earlier in 2019. In June, after Warburg Pincus divested its remaining ownership interest in the company, Warburg’s two board members resigned, reducing Antero’s board to just seven directors. In December, Antero announced a $750 million to $1 billion asset sale program, which the company kicked off by selling $100 million of AM shares back to the midstream affiliate. Management indicated that future asset sales could consist of “lease acreage, minerals, producing properties, hedge restructuring or sale of AM shares to Antero Midstream.” As management teams work to fix capital structures through potential asset sales, 2020 might be a more active year for transactions in the basin.

Conclusion

M&A transaction activity in Appalachia was muted in 2019 as gas prices remained rangebound and management teams focused on corporate and capital structure issues rather than M&A. However, with operators feeling the pressure from sustained low gas prices, and Antero’s announced asset sale program, 2020 will hopefully be a more active year.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights