An asset retirement obligation (ARO) in oil and gas refers to the legal or regulatory requirement for a company to dismantle, remove, and restore a site once an asset (such as an oil well, offshore platform, or pipeline) reaches the end of its useful life. These obligations arise due to environmental laws and lease agreements requiring companies to clean up and restore the land or seabed. Typical costs include plugging and abandonment, reclamation, and remediation.

Key Aspects of ARO in Oil & Gas

AROs are recognized as a liability on the balance sheet when a company has a present obligation due to past activities. The liability is recorded at the present value of the estimated future costs of retirement. Over time, the ARO liability increases due to the passage of time (accretion expense), which is recorded as an operating expense. The corresponding asset retirement cost (ARC) is capitalized and amortized over the useful life of the asset.

Impact of AROs on Deal Structuring in Oil & Gas M&A

AROs significantly influence how oil and gas transactions are structured as buyers seek to manage the financial and legal risks of these future liabilities.

Purchase Price Adjustments: Buyers often adjust the purchase price downward to reflect the present value of AROs. In asset deals, AROs are explicitly deducted from the estimated value of reserves and infrastructure.

Escrows & Holdbacks: Sellers may be required to place a portion of the proceeds in an escrow account to cover future ARO-related costs. Holdbacks are common when there is uncertainty around decommissioning costs or regulatory changes.

Asset vs. Stock Purchase Considerations: Buyers prefer asset purchases when possible to avoid assuming legacy liabilities, including AROs. AROs are explicitly accounted for in the purchase agreement, and the buyer may negotiate a price reduction. If acquiring an entire company (equity deal), the buyer inherits all existing AROs. Due diligence is critical to assess potential undisclosed liabilities. Buyers may require indemnification clauses to protect against unexpected ARO costs.

Use of Contingent Consideration & Earnouts: Buyers may structure deals where a portion of the price is paid over time, reducing upfront risk. If actual ARO costs are lower than expected, sellers may receive additional payments.

Decommissioning Trusts: Companies may set up funded decommissioning trusts to cover the future costs of dismantling, removing, or restoring long-lived assets at the end of their useful life.

Who Typically Bears the ARO Risk?

Large oil companies selling off older assets often accept price reductions or offer indemnifications to offload AROs. Private equity firms acquiring assets with AROs frequently use structured financing or find ways to repackage liabilities before selling the assets. Smaller E&P buyers may accept higher ARO exposure in exchange for seller financing or earnouts.

Estimating the Fair Value of AROs

The fair value of AROs becomes increasingly meaningful as the retirement date approaches, particularly in comparison to AROs with longer lives. AROs are recorded at their present value when recognized, using a discount rate that reflects the time value of money and risk.

AROs with longer lives are more sensitive to changes in discount rates and inflation assumptions. When the retirement date is far in the future, even small changes in assumptions can materially affect liability estimates, but as the obligation nears, uncertainty decreases, making fair value estimates more precise. As the decommissioning event approaches, ensuring that the trust is sufficient to cover the ARO becomes more critical.

What Can Happen When AROs Are Not Properly Estimated?

The Division of Corporation Finance (the “Division”) of the U.S. Securities and Exchange Commission (“SEC”) periodically issues “comment” letters to public filers upon completion of the review of a company’s filings. Comment letters and response letters are public information and can provide unique insight into the impact AROs have on a company’s financial results.

On October 7, 2021, the Office of Energy & Transportation of the Division issued a comment letter to Whiting Oil and Gas Corporation (“Whiting”) in response to its review of Whiting’s 10K for the fiscal year ended December 31, 2020. The Division noted that,

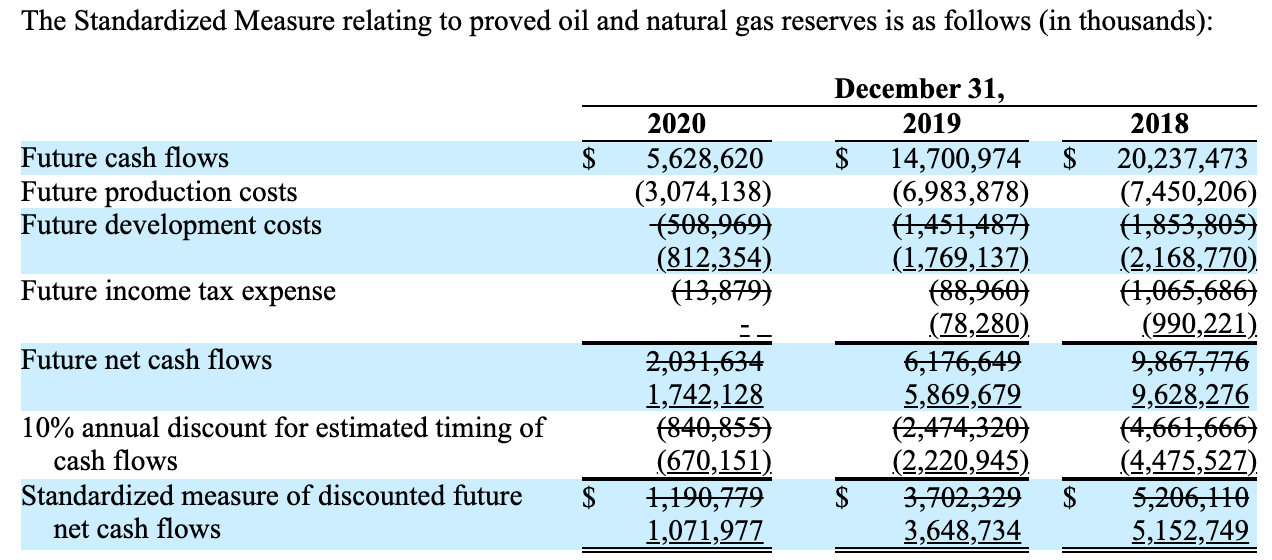

“... you systematically omit your estimates of the net asset retirement costs as part of the future development costs used in the calculation of your standardized measure [of discounted future net cash flows relating to proved oil and gas reserves]…it appears that your omission of the estimated asset retirement obligations results in an understatement of your future development costs by approximately 37.4%, 18.0% and 14.5%, an overstatement of your future net cash flows of approximately 14.9%, 5.1% and 3.2%, and an overstatement of your standardized measure by approximately 10.4%, 1.4% and 1.2% for the years ended December 31, 2020, 2019, and 2018, respectively. Please provide us with an illustration of the disclosure revisions relating to your presentation of the standardized measure...”

Whiting replied with the following recalculation of the standardized measure of discounted future net cash flows.

Based on Whiting’s recalculation of estimated future development costs (line three in the calculation above) to include estimates of AROs, the standardized measure of discounted future net cash flows declined by $118.8 million, $53.6 million, and $53.4 million in 2020, 2019, and 2018, respectively. Clearly, the correct accounting of AROs can have a material impact on valuation and, therefore, prices buyers are willing to pay sellers.

Based on Whiting’s recalculation of estimated future development costs (line three in the calculation above) to include estimates of AROs, the standardized measure of discounted future net cash flows declined by $118.8 million, $53.6 million, and $53.4 million in 2020, 2019, and 2018, respectively. Clearly, the correct accounting of AROs can have a material impact on valuation and, therefore, prices buyers are willing to pay sellers.

Conclusion

Properly accounting for AROs as part of due diligence in an oil and gas transaction is essential for ensuring a fair and accurate valuation of the assets being bought or sold. These obligations represent significant future liabilities, and failing to account for them properly can lead to financial misstatements, regulatory issues, and unexpected costs for the acquiring party.

Buyers must assess AROs carefully to avoid overpaying, while sellers should transparently disclose them to maintain credibility and compliance. Proper ARO accounting enhances transaction fairness, facilitates informed decision-making, and helps mitigate financial and environmental risks associated with asset decommissioning.