Bakken Regains Its Footing

The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. This quarter we take a closer look at the Bakken.

Production and Activity Levels

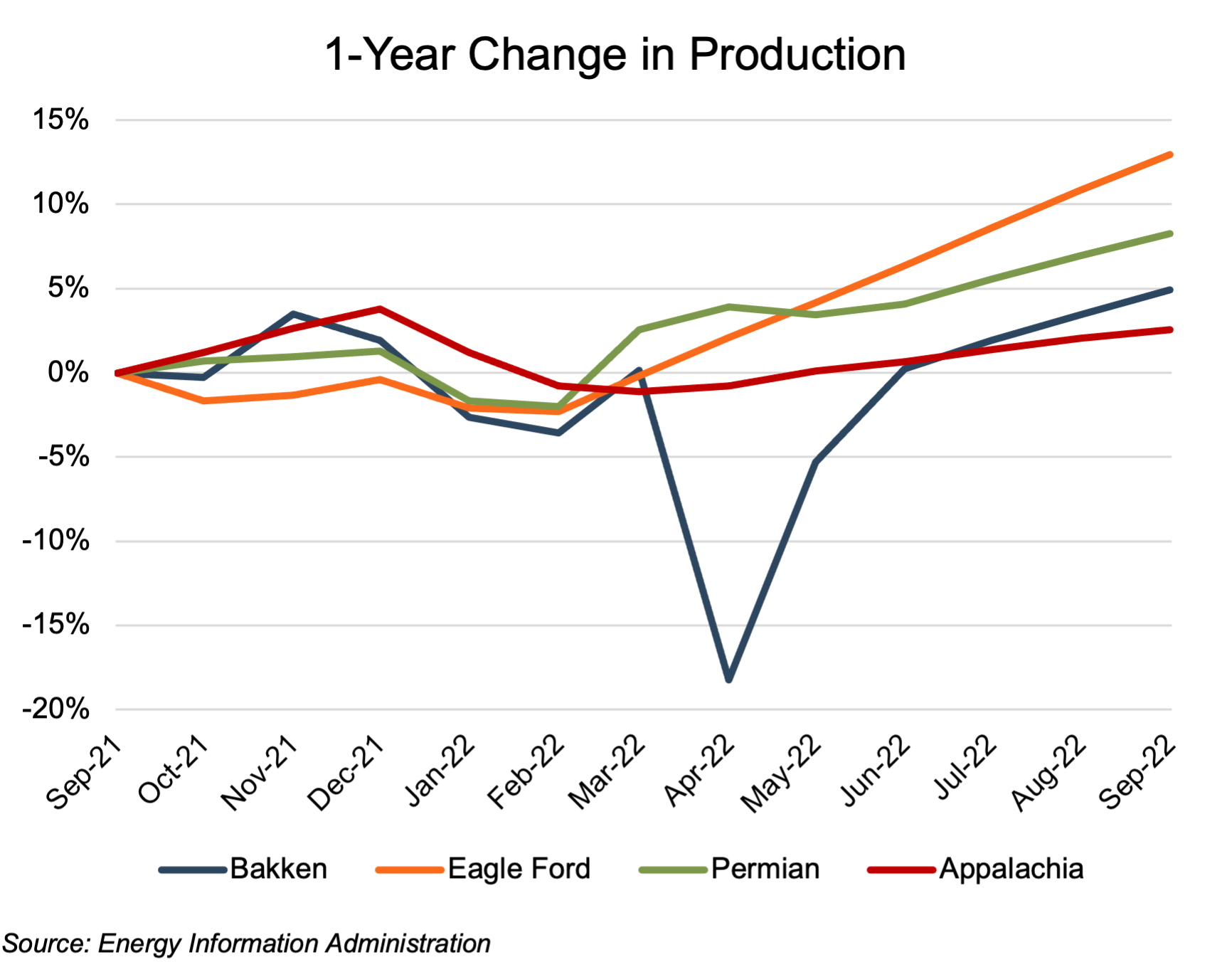

Estimated Bakken production (on a barrels of oil equivalent, or “boe” basis) increased by 5% year-over-year in September. Bakken production, relative to the September 2021 level, plunged nearly 20% in April due to the impact of back-to-back blizzards but had recovered to the September 2021 level by June 2022. Production in the Eagle Ford and Permian were 13% and 8% higher, respectively than in September 2021, without the short-lived plunge seen in the Bakken. The gas-focused Appalachia region production relative to September 2021 levels was more stable than the oil-focused regions, with relative production only varying within a band of -1% to 4%, ending at a year-over-year 3% increase in September 2022.

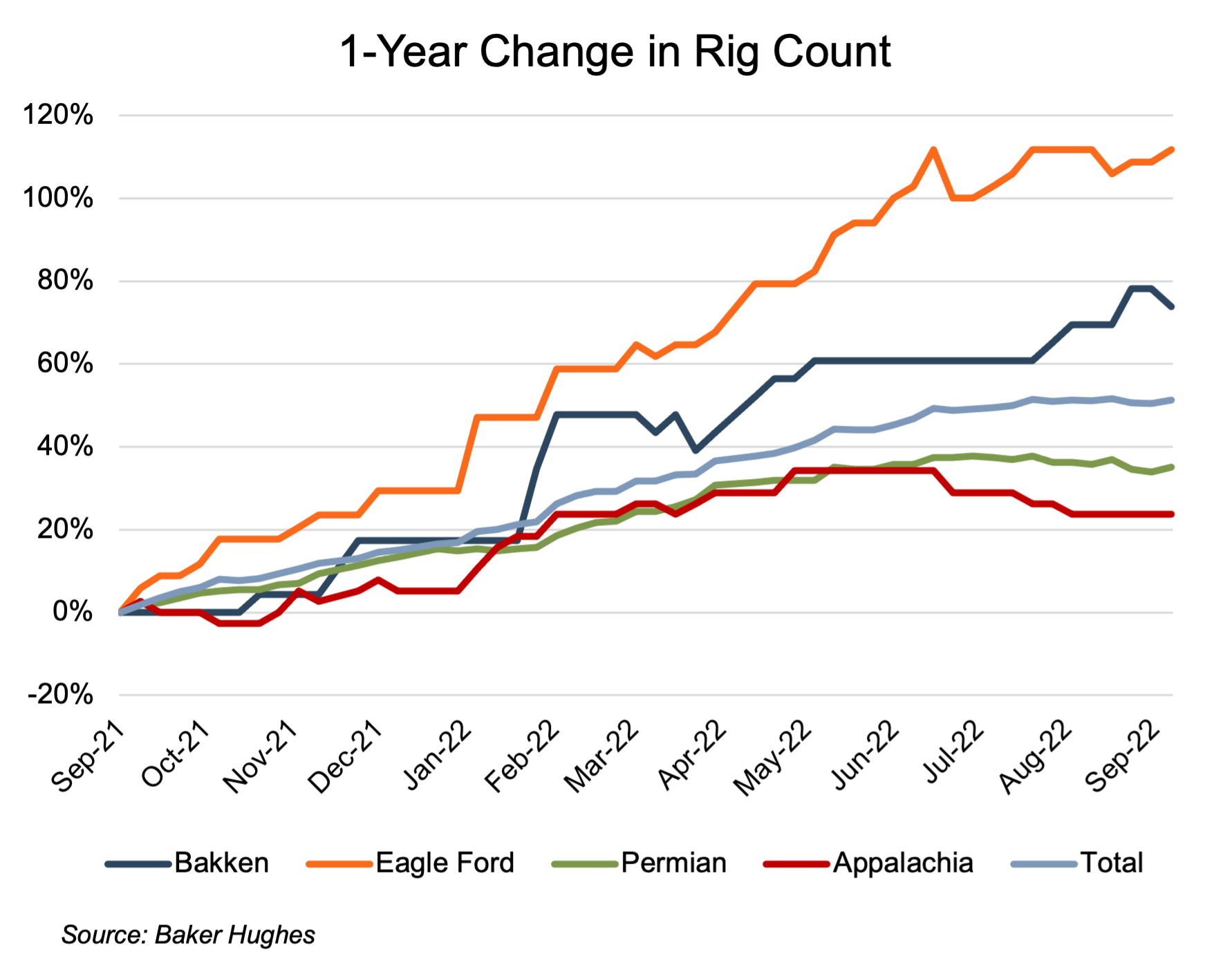

As of September 16, 2022, 40 rigs were operating in the Bakken, marking a 74% increase from September 10, 2021. Eagle Ford, Permian, and Appalachia rig counts were significantly higher than year-earlier levels at 112%, 35%, and 24% increases, respectively. The Permian continued to command the largest number of rigs at 343, with the Eagle Ford and Appalachia closer in-line with the Bakken at 72 and 47 rigs, respectively.

Oil Climbs While Gas Shows Heightened Volatility

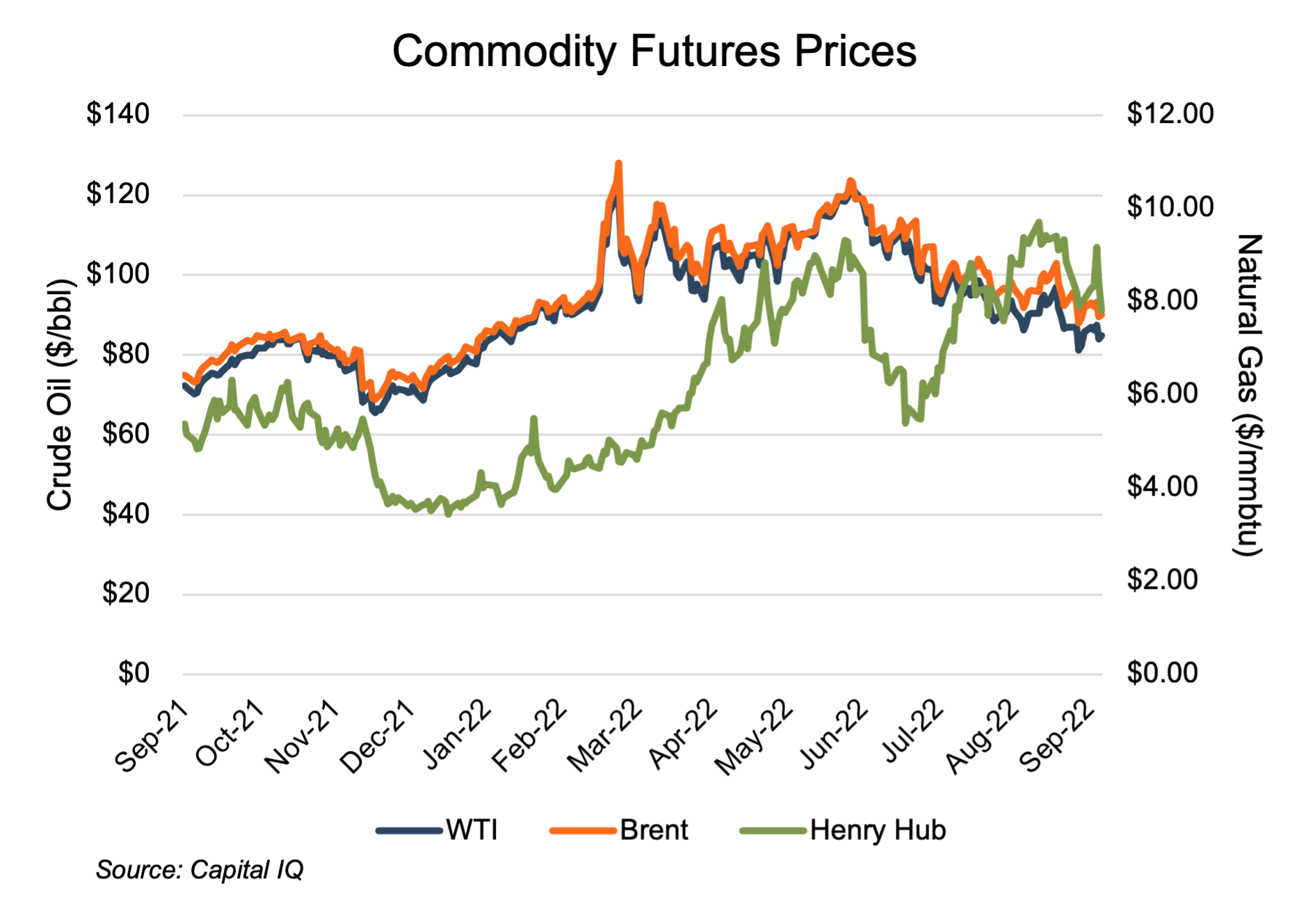

Oil prices, as benchmarked by West Texas Intermediate (WTI) and the Brent Crude (Brent), rose from $72/bbl and $75/bbl, respectively, in September 2021 to $85/bbl and $90/bbl, respectively, as of September 16, 2022. While the rise in pricing was fairly steady through mid-February 2022, the Russian invasion of Ukraine spurred a series of ups and downs, with prices spiking to a high of $120/bbl (WTI) and $128/bbl (Brent) in early March, immediately followed by a plunge to $94/bbl and $96/bbl in mid-March. Subsequent spikes and dips were somewhat more muted, but prices remained volatile through early June. A general price decline during the third quarter resulted in prices at the $85/bbl and $90/bbl level.

Henry Hub natural gas front-month futures prices dipped from a late 2021 high of $5.48/mmbtu to a low of $3.44/mmbtu near 2021 year-end as commodity markets incorporated indications of rising production levels and ebbing weather-driven demand. Pricing subsequently rose to as high as $9.29/mmbtu in June on weather-driven demand and lacking supplies due to a reduction in Russian exports. In mid-June Henry Hub pricing began a sharp decline on the announcement that prices recovered over the remaining two months of the September LTM period, albeit with some volatility, to end at $7.81/mmbtu.

Financial Performance

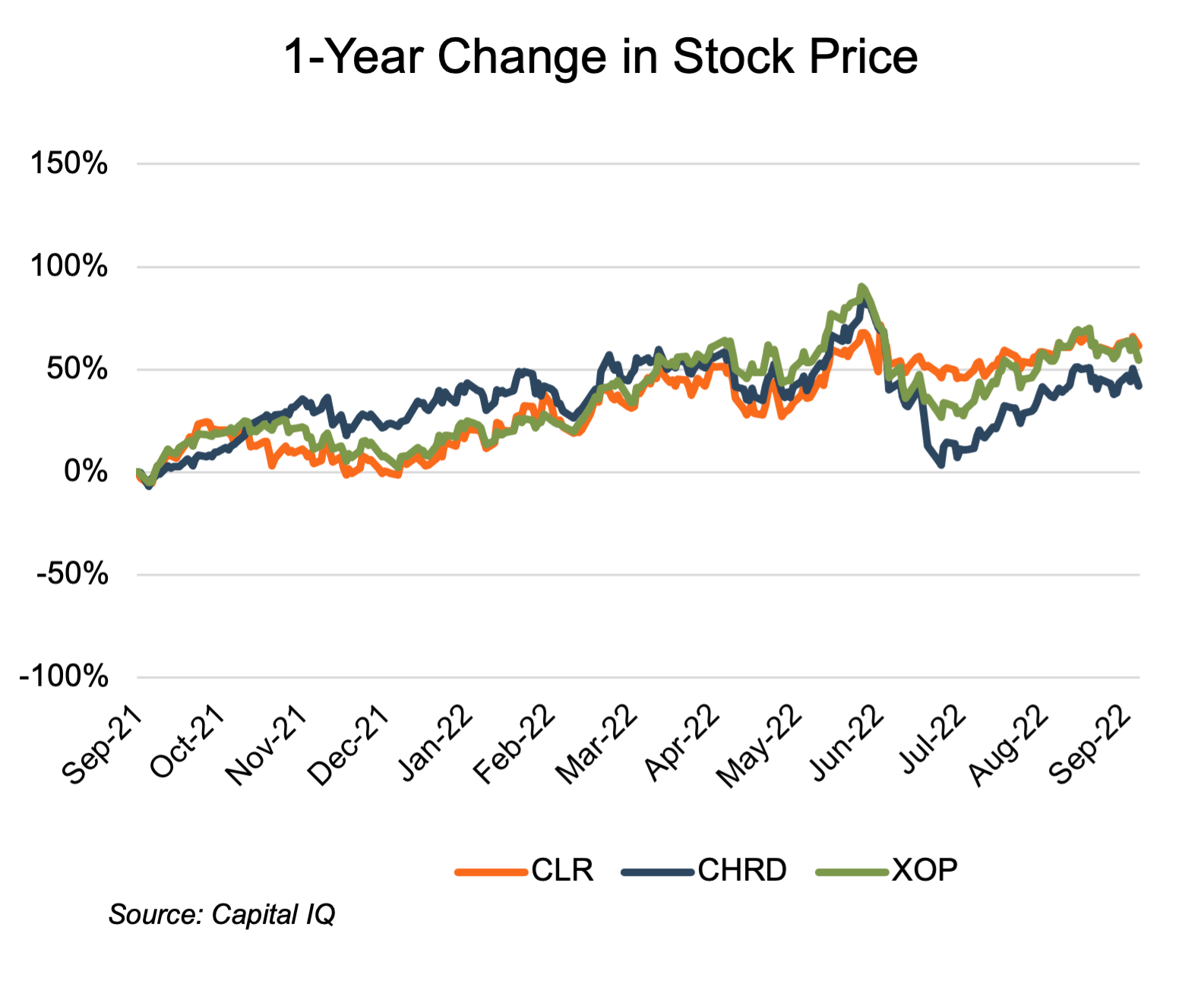

The Bakken public comp group’s latest twelve-month financial performance (stock price) analysis was reduced to two subject companies and the XOP SPDR, as a result of the Whiting and Oasis merger in March 2022. The combined Whiting/Oasis company, Chord Energy, appears in our analysis as CHRD.

The Bakken comp group showed strong price performance from year-end 2021 through early June, with increases ranging from 63% to 83%, largely reflective of oil prices. The subsequent decline in commodity prices, which ran nearly un-checked for two months, slashed the analysis period performance to increases of only 3% and 46%, with Chord posting a decline that nearly wiped out its post September 2021 gains. Prices have recovered since July with one-year gains of 42% (Chord) to 61% (Continental).

Conclusion

The Bakken showed a general increase in activity over the last year, albeit with a large winter storm disruption and subsequent production recovery along the way. Rig counts have risen on strong commodity pricing, despite the oil price decline in Q3 2022. Share prices generally increased early in the latest twelve-month period, with a sharp decline in Q3 tied to oil prices slipping. Share prices recovered enough in late Q3 to show reasonably strong year-over-year growth as of September.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights