Challenges in Appraising Refinery Businesses

The appraisal of businesses involved in the refining of crude oil entails a number of challenges. Some are unique to the industry, and others are more common. The challenges arise primarily in two areas – assessing the level of uncertainty inherent in the entity’s future cash flows and forecasting the entity’s future operating results.

The greater the range of future cash flows, the greater the rate of return an investor will require to invest in the business.

Assessing the level of uncertainty for a particular business’ future cash flows is a key part of any business valuation. Basic economics tells us that the present value of an expected future cash flow is greater if the possible range of the cash flow is +/-10% from the expected level, compared to the possible range of the cash flow being +/-30% from the expected level. Investors aren’t willing to pay as much for an expected future cash flow with a potentially high divergence from expectations than for an expected future cash flow with a potentially low divergence from expectations. The greater the range of future cash flows (the degree of uncertainty of the future cash flows), the greater the rate of return an investor will require to invest in the business.

In addition to the challenges posed in the risk (uncertainty) assessment, the appraisal of an oil refinery business also carries particular challenges in forecasting future operating results. Oil refining entails not only a commodity input (feedstock), but also commodity products – gasoline, diesel, liquefied petroleum gases, jet fuel, residual fuel oils, still gases, lubricants, and waxes. Complexity increases in these product markets since they are significantly influenced by international, domestic and local supply and demand, heavy regulation, domestic politics and international politics. Add to those enormous capital requirements and high barriers to entry and you have an industry rife with forecasting complexity.

Assessing Uncertainty

Assessing the level of cash flow uncertainty for a particular crude oil refining business requires a thorough analysis of the subject company’s internal operations. This analysis includes its facilities, suppliers, customers, level of integration, and use of hedging. Additionally, external factors, such as infrastructure availability and limitations, feedstock and product supply and demand, government and environmental policies, geopolitical matters, and currency exchange rates must be considered. Some potentially key uncertainty assessment considerations are addressed as follows:

Configuration

Configuration refers to a facility’s ability to accept a range of crude oils (light-sweet crude, or heavy crude) as feedstock. Refineries with limited feedstock abilities lack the flexibility of shifting from one type feedstock oil to another, thereby exposing the business to uncertainties regarding particular feedstock supply and demand. For example, refineries that were specifically designed (configured) to process heavy crude would be exposed to the negative economics of an unexpected decrease in heavy crude availability. On the contrary, refineries configured for greater feedstock flexibility would potentially avoid the negative impact of a reduced supply of heavy crude by shifting to a light crude feedstock.

Secondary Processing Systems

Secondary processing capabilities refers to the ability to engage in processing crude oil beyond initial distillation to processes involving catalytic cracking and reforming. These secondary processes allow a refinery to shift between maximizing distillate production in the winter months when heating oil is in higher demand and gasoline production during the summer months when automotive fuel is in demand. Without secondary processing systems, a refinery is more vulnerable to the negative economics of seasonal product supply and demand shifts.

Feedstock Source Constraints

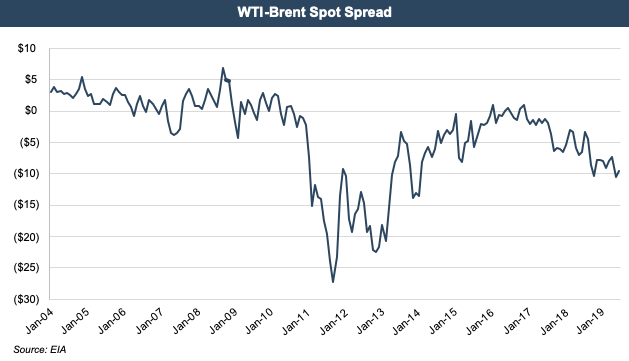

Feedstock source constraints refer to the refinery’s ability to economically choose between feedstock sources. Facilities that are located along the U.S. coastline have the option of using either the WTI (inland U.S. produced) or the Brent (North Sea produced) varieties of crude oil. As such, they have the ability to favorably respond to shifts in WTI versus Brent pricing (the Brent-WTI spread). Refineries located in the U.S. interior have a much lower economic ability to utilize Brent and are therefore subject to the impacts (positive or negative) of pricing variations between the two varieties.

Inventory Exposure

Refineries typically hold significant levels of inventory (feedstock and product inventory) with these inventories comprising 13% to 17% of total assets. Due to the potential for material swings in the market price for the feedstock inventories (crude oil) and end products, refiners face a significant level of uncertainty regarding their profits. Market-driven increases/decreases in crude prices can raise/reduce the value of feedstock holdings, while market-driven increases/decreases in end product prices can raise/lower revenues and profit margins. While protection against the negative impacts of such market changes is available through commodity price hedging, refining businesses vary in the degree to which they utilize hedging strategies. In appraising a particular oil refining business, the appraiser must gain a clear understanding as to the commodity price risks that are hedged and those that remain unhedged.

Ability to Pass-on Costs

The ability to pass-on the higher feedstock costs is often dependent on the current conditions in the local and international end product markets.

When crude oil prices are rising, oil refinery businesses may be able to pass those higher feedstock prices on to customers in the form of higher-end product prices and thereby maintain margins. The ability to pass-on the higher feedstock costs is often dependent on the current conditions in the local and international end product markets. If the petroleum product market is experiencing particularly high supply, or low demand, the refiner’s ability to pass-on higher crude oil prices may be significantly limited. However, in situations of lower supply, or higher demand, higher crude prices may more readily be passed through to customers. As such, an appraiser must not only be aware of near-term expectations for crude prices, but also near-term expectations for the various end products of the particular refining business in order to correctly assess the level of uncertainty that should be factored into the appraisal analysis. In performing this part of the analysis, the appraiser must take into consideration the degree to which the uncertainty would be expected to be avoided by the subject company’s use of hedging.

Integration

Some oil refiners are integrated in that they are also involved in the ownership/control of crude oil reserves, or as with many larger refineries, they also own the petrochemical plant customer of the refiner. Such integrated refineries can allow for the shifting commodity price risks between the refinery and the entity that owns the crude reserves or the petrochemical producer. As such, an important part of the refinery appraisal involves a careful assessment of how the commodity price risk is being handled between the entities involved, and how such handling of the risk should be incorporated into the appraiser’s assessment of future cash flow uncertainty.

Infrastructure Changes

Infrastructure changes can have a significant impact on a refinery’s profitability. Changes in the availability of the necessary infrastructure for bringing crude oil “to market” (to local refineries, more distant refineries, or to a port for export) can have a significant impact on the refinery’s profitability. For example, for years various market forces (high international demand for Brent, high WTI supply and interior U.S. pipeline capacity deficiencies) maintained a Brent-WTI spread that was advantageous to U.S. refineries. However, more recently shifts in market forces, including improvement of U.S. pipeline capacity, has contributed to a significant narrowing of the Brent-WTI spread. These shifts have resulted in the loss of a considerable portion of the crude supply cost advantage for U.S. refineries. A particular refinery’s exposure to potential changes in crude transportation infrastructure must be considered by an appraiser as part of the analysis in determining the relative uncertainty of the refinery’s cash flows.

Facility Efficiency

The efficiency of a particular refinery can be a material contributor to cash flow uncertainty. The oil refining industry is subject to a large number of market forces that can have a material impact on profitability. In considering the refinery’s ability to successfully adjust to changes in those many market forces, one must consider the facility’s efficiency. In an environment where the number of facilities is expected to downsize and consolidate in the short-term, facilities with lower levels of efficiency are more subject to having their utilization trimmed back, or even being shut-down.

Government Regulation

The oil refining industry is subject to an extensive array of both federal and state regulations, which can be changed, delayed, or accelerated, depending on the political climate. While some of these regulations are static, others have restrictions that are implemented over time. For example, MarPol 2020 represents a significant, albeit long foreseen, change beginning January 1, 2020 where the allowable sulfur for fuel used in ocean-bound vessels is reduced from 3.5% to just 0.5%. U.S. refiners with the ability to produce a higher proportion of lighter, low-sulfur fuels from each barrel of oil will stand to profit from the change in legislation, particularly if supply is low in the short term following the change.

One must be aware of potential regulatory changes and the facility’s ability to conform.

In the appraisal of a refining business, one must be aware of potential future regulatory changes and the particular facility’s ability to conform to such regulations. In some cases, this flexibility may be tied to the configuration of the plant, and in others may be tied to technology-related efficiency. Any factors that create a question as to the ability or willingness from a financial perspective to comply with potential regulatory changes must be considered in assessing the uncertainty of future cash flows.

Forecasting Operating Results

Forecasting future operating results can present a challenge for many industries. With the number of market forces in play, several considerations in the forecasting process deserve special attention when appraising a business in the oil refining industry. Some of the areas for particular attention include commodity pricing considerations on volumes and margins, and capital intensity considerations.

Commodity Pricing Considerations

The commodity nature of refinery feedstock (crude oil) makes the forecasting of future revenues worthy of particular attention. International, domestic and local supply and demand, heavy regulation, domestic politics and international politics all come into play in the oil refining industry and the uncertainty as to the impact of these various factors is why hedging plays such a significant role within the industry. While careful analysis can identify pertinent short-term and long-term trends, the future direction of feedstock prices always remains uncertain to some degree. As such, the appraiser of a refinery business must be familiar with the mix of factors that can impact future feedstock prices and accurately factor the “knowns” and “unknowns” into projections of future revenue levels.

The factors that come into play in forecasting future refinery revenues can also impact future operating margins, but not necessarily. As previously mentioned, the ability to pass-on changes in feedstock prices can vary over time based on supply and demand dynamics regarding the refinery’s products. Similar to the refinery’s crude oil feedstock, the end products are also commodities and are therefore subject to pricing changes that are well beyond the control of the refinery operator. In some cases, those dynamics may allow for changes in crude oil prices to be passed on to the refinery’s customers, thereby maintaining operating margins. However, end product market dynamics may create an environment where increases in crude oil prices can’t be passed-on such that future operating margins would be expected to be trimmed.

Capital Intensity

Capital expenditures in the oil refining business can be much more significant and much less steady in magnitude than in other industries.

Petroleum refining is a capital intensive process requiring large investments in property, plant, and equipment (PP&E). While machinery and equipment maintenance expenses are often somewhat steady over time, certain aspects of such expenses can be much more irregular. In contrast, capital expenditures in the oil refining business can be much more significant and much less steady in magnitude than in other industries. Short-term capital expenditures expectations can vary widely depending on past maintenance expenditures and the facility’s past acceleration, or delaying, of major expenditures. Longer-term capital expenditures, or periodic expenditures, are typically significant and quite large. A detailed discussion with facility management is often necessary in order to gain a clear understanding as to both timing and cost expectations for such expenditures. With the high level of industry regulation, often environmentally focused, the timing and magnitude of some capital expenditures may well be outside of facility management control.

In addition to the more direct impact of oil refinery capital intensity on maintenance and capital expenditures is the impact on tax expenditures from the depreciation of the machinery and equipment. With PP&E assets totaling hundreds of millions, or even billions of dollars, tax depreciation of those assets can have a significant impact on expected cash flows. The difference of results between a simplified straight-line depreciation modeling and a more detailed accelerated (MACRS) tax depreciation modeling can be significant even before incorporating potential bonus depreciation and Section 179 immediate expensing of qualifying property.

While appraisers may be provided with detailed tax depreciation schedules for existing machinery and equipment, it may be within the appraiser’s scope of service to develop the expected tax depreciation scheduling for machinery and equipment that will be put in place during the forecast period. The detailed tax depreciation forecasting may not be particularly pertinent in less asset-intensive industries, but it can have a material impact in the appraisal of more asset-intensive businesses such as oil refining.

Mercer Capital has a breadth and depth of experience in the appraisal of businesses in the oil and gas industry that is rare among independent business appraisal firms. Our Energy Team is led by professionals with 20 to 30+ years of experience involving upstream businesses (E&Ps, oilfield product manufacturers and oilfield service providers), midstream (gathering systems, pipeline MLPs, pipeline processing facilities), and downstream (refining, processing, and distribution). Feel free to contact us to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights