Details and Analysis of Kimbell Royalty Partners’ Acquisition of Haymaker Minerals & Royalties, LLC

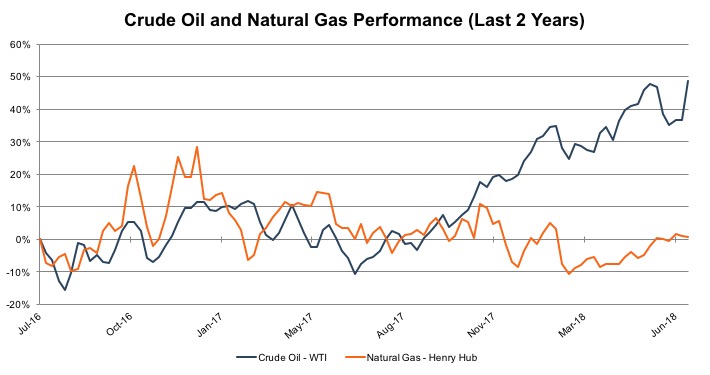

As we have discussed in previous posts, there are 21 main oil and gas-focused partnerships that are publicly traded, as of June 30, 2018. Publicly traded royalty partnerships have been slowly regaining the value lost when crude oil prices fell below $30 per barrel in early 2016. In the two years since June 2016, 16 of the 21 royalty partnerships have had positive returns with an average return of 48%. Over the past two years, the remaining five partnerships experienced a negative 31% average return. In those two years, natural gas prices have experienced an insignificant increase of just 5%, while oil prices have risen more than 50%. The underperformance of natural gas prices is due to the surge in production of shale gas since 2006 and the more recent rise of natural gas production as a result of increased oil production.

Kimbell Royalty Partners, LP (KRP)

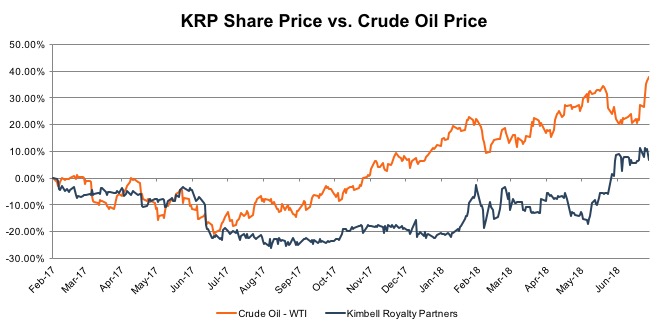

The youngest of the 21 partnerships, Kimbell Royalty Partners, LP (“Kimbell,” “KRP,” or the “Company”), went public in February 2017. The Company’s IPO opened at $18.00 per share, initially offering 5 million shares. Since going public, KRP’s price struggled in its infancy and fell under $16 per share in mid-August 2017. This year has been much kinder to Kimbell due to the high crude price with its share price peaking at $23. Approximately 70% of Kimbell’s revenues are from oil and natural gas liquids.

Of the 21 mineral partnerships, Kimbell, Dorchester Minerals LP, Black Stone Minerals LP, and Viper Energy Partners LP are the only non-trust royalty partnerships and are either C Corporations or MLPs. These MLPs and C Corps are designed to gather assets and grow through acquisitions, focusing on both dividend payments and the growth of shareholder value. On the other hand, the other 17 are royalty trusts, which have a limited pool of assets and must return most of the cash flow earned from the royalties to the shareholders through dividends. Trusts’ capital structures limit opportunities for reinvestment, making it difficult to grow their asset base through acquisitions. Of the MLPs/C Corps, Kimbell has the highest dividend yield at 7.63%, with Dorchester, Black Stone, and Viper at 6.23%, 6.76%, and 6.02%, respectively. KRP is the smallest of the four partnerships with a market capitalization of $370 million, while Black Stone and Viper each have market capitalizations near $3.7 billion. 1

Acquisition Overview

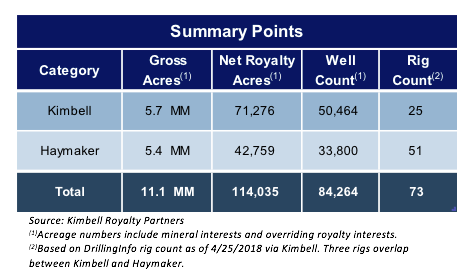

Prior to its acquisition of Haymaker Minerals & Royalties, LLC and Haymaker Resources, LP (collectively, “Haymaker”), Kimbell had nearly 5.7 million gross acres in nearly every major oil and gas basin across 20 states with a primary focus in the Permian Basin and the Mid-Continent. Kimbell solely invested in mineral and royalty interests with the largest portion of its production concentrated in the Permian Basin, where it had 1.75 million gross acres of mineral interests and ~200,000 acres of overriding royalty interests (ORRIs). Currently, KRP has 25 active drilling rigs on its acreage and mineral and ORRIs on 50,000 wells. Kimbell’s holdings in the Permian Basin alone account for 26% of its net royalty acres, 60% of its gross acreage, and 60% of active wells on its total acreage.

In comparison, Haymaker had ~5.4 million gross acres and ~43,000 net royalty acres primarily focused in the Mid-Continent. Haymaker had royalty interests in 33,800 wells and had more than double the number of active drilling rigs than Kimbell with 51.

Kimbell acquired Haymaker for $404 million with $210 million of cash and 10 million newly issued common units going to Haymaker’s sponsors. The acquired company’s private equity sponsors are KKR & Co. LP (“KKR”) and Kanye Anderson Capital Advisors, LP (“Kayne Anderson”). Alongside the acquisition, Kimbell converted its tax status from an MLP to a C Corp. Kimbell believes that this conversion will give the company access to a much broader base of investors and access to a more “liquid and attractive currency.” Kayne Anderson’s and KKR’s willingness to take the newly issued shares, which will account for ~37% of Kimbell’s outstanding common units, shows the potential for investment growth that is achievable for Kimbell but not necessarily for Haymaker. Kimbell estimates that the acquisition will not only be accretive due to the quality of the assets, the acquisition will also be highly scalable and reduce the G&A costs on a per Boe basis.

After the acquisition, Kimbell will have more than 11 million gross acres spanning 28 states, with 38,000 of its 84,000 wells in the Permian Basin. As of April 27, 2018, Kimbell’s 73 rigs account for 7% of the total rigs in the United States. To calculate price per acre, Haymaker’s 42,759 net royalty acres must be converted to the industry standard 1/8 conversion since Kimbell uses a non-standard method of calculating net royalty acres. The conversion, which assumes eight royalty acres for every mineral acre, results with Kimbell acquiring 342,072 net royalty acres for $404 million. This results in an implied price of $1,181 per net royalty acre. At the time of the transaction, Kimbell’s market capitalization was approximately $327 million with an 8.7% yield. Post-transaction, KRP’s FCF yield rose to 12%, implying a 15% yield for Haymaker prior to the transaction.

Much of Haymaker’s acreage is congruent to Kimbell’s existing acreage and is an evenly split oil and natural gas mix. Haymaker’s acres enhance the Company’s position in the Permian and Mid-Continent and also increase its exposure in the Appalachian Basin and the Marcellus and Utica Shales. After the transaction, Kimbell’s production will be approximately 2/3 liquids and 1/3 gas. KRP believes that through the consolidation of costs, their pro-forma G&A expense can decrease by as much as 50% to $3.22 per Boe. This decrease is due to the increased scalability of Kimbell after the transaction. The transaction is also projected to increase the net production per unit by 56%. The Company estimates the increased production and the cutting of costs alone could lead to a 20% increase in distributable cash flow per unit.

Analysis

Why would two companies with relatively comparable assets have such drastically different yields? Is it due to the fact that Kimbell is publicly traded while Haymaker is private? Perhaps the solution lies between the vast differences in public and private mineral market share sizes.

Kimbell estimates that the total mineral buying market is close to $500 billion, excluding ORRIs. Public companies only make up 2.5% of the total market with a combined enterprise value of ~$12.3 billion. The two largest public, Black Stone Minerals and Viper Energy Partners, make up a combined $8.3 billion of that total value. While the public minerals market is only made up of a handful of companies giving public investors a limited number of investment options, the private minerals market is highly fragmented.

Small mineral aggregators can operate with a higher attention to acreage details. These aggregators have the ability to negotiate directly with the landowners and handpick the acreage of their choosing. As a result, they expect higher yields than the public companies. While these yields are higher, the acreage is typically much more focused on certain areas. Combined with their small size, these investments are inherently riskier than a larger, more diverse pool of assets, such as those held by public royalty trusts.

Kimbell’s acquisition of Haymaker demonstrates the disconnect between the public and private markets and the discounts at which private LPs are valued. It seems that private royalty LPs simply do not have the same access to capital as the public MLPs or C Corps. This lack of access is potentially why KRP and Haymaker have distinctly different yields, 8.7% and 15%, respectively, and why KRP was able to successfully negotiate such a highly accretive deal. Private equity investors/sponsors seem to recognize this–Haymaker’s sponsors for example. Haymaker’s sponsors, a well-respected private equity firm (KKR) and one of the leading energy investors (Kayne Anderson), most likely saw the potential behind the accretive mix of the two companies, which is why they were willing to accept roughly 50% of the purchase price in Kimbell shares. Not only was Kimbell public, its transition to a corporation opened itself up to a broad array of inexpensive capital, far less expensive than what Haymaker could find. This access to cheaper capital makes it easier for Kimbell to grow through acquisitions and continue to increase its returns and shareholder value. Kimbell has the potential for growth as a public corporation far beyond what a private company like Haymaker could achieve.

Public investors are looking for opportunities to invest in mineral plays; however, many of these investors’ only opportunity to do so is through public companies. Following the rise of crude oil prices, the increased demand from public investors has driven up the prices of the royalty trusts and MLPs and, in turn, lowered the yields. More and more investors, including institutional investors, are looking towards the mineral market to find investment growth. The emerging field of mineral aggregators has the potential to provide this growth through accretive acquisitions, as well as steady dividend payments, that public investors crave.

We have assisted many clients with various valuation and cash flow issues regarding royalty interests. Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

[1] Capital IQ

Our thanks to Daniel Murchison who drafted and did much of the research for this post in collaboration with our Energy Group.

Energy Valuation Insights

Energy Valuation Insights