Bountiful Barrels, Booms and….Bankruptcies?

Last month we learned something that might not be a shock to those closely following the oil and gas markets, but might be something of a bombshell to everyone else. A report from Rystad Energy (an international oil and gas consultant and research firm) estimated that in July 2016, for the first time ever, the United States has more recoverable oil than any other country on the planet – 264 billion barrels.1 Yes, this includes Saudi Arabia (212 billion) and Russia (256 billion).

Now let’s be clear here: “Recoverable Oil” (as defined by Rystad) is a much broader metric than the more recognized “Proven” reserve categories. Consider that banks regularly lend money to E&P companies based on Proven reserves (particularly producing or “PDP” reserves); whereas promulgating Rystad’s recoverable oil figure on a loan application might not make it past an administrative assistant – much less an underwriter. However, it does mark a significant if not historic shift in energy markets and geopolitics and can even been understood through the proliferation of summer road trips.

The American oil and gas industry has pulled off the improbable, resulting in a stronger United States and cheaper oil for the world. What was the reward for E&P firms? Ironically, it has unfortunately turned out to be a long line at bankruptcy courts.2

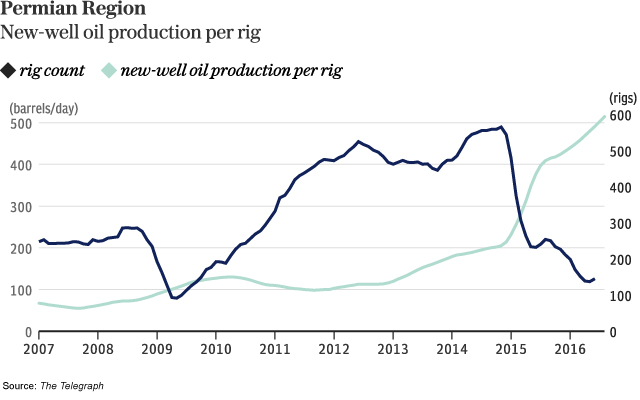

These developments, of course, were chiefly driven by the shale oil boom in the United States. This explosion was born in the Barnett Shale in the mid 2000’s, developed in the Bakken a few years after that, and matured in the Texas shale oil plays in recent years. U.S. shale output has risen exponentially and will continue to grow. A recent article cited Scott Sheffield, the outgoing chief of Pioneer Natural Resources, comparing the Permian Basin to the giant Ghawar field in Saudi Arabia. In addition, well productivity has rocketed up as well. For example, the ‘decline rate’ of production for shale oil wells was often 90% for the first four months of production in 2006. The article claims it’s closer to 18% today. Multi-pad drilling, where three or more wells are drilled from the same rig, is commonplace now As a result – oil supplies, which 10 years ago were a dwindling threat like a doomsday clock, are booming today.

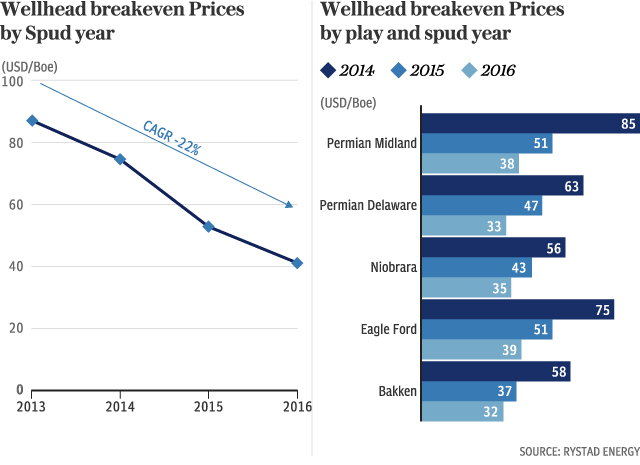

Why then all the bankruptcies (with more predicted to come)? The problem for producers, banks, courts, and appraisers points towards reconciling how the cost side of the equation catches up to the reserves. Many of the loans that have underperformed were funded years ago when proven reserves were estimated at $70-$90 price decks.3 Those days are gone, but a lot of the legacy debt remains. In order for debtholders to recover their investment and for equity holders to see just about any value, producers must drive down their breakeven prices. Time is of the essence in this race and technology is the critical engine that can drive everyone to this finish line. As mentioned above, many well productivity metrics have already highlighted the furious advances in technology in the past few years. According to Rystad Energy, breakeven prices have already fallen below $40 per barrel in some Permian plays and many more can cope with $40-$50 pricing. So the good news is that this bankruptcy trend might be a temporary issue with many companies creeping towards on the profitable side of breakeven prices.

What does this mean for the E&P producers caught up in financial distress caused by these market changes? For one thing, management and boards must try to persevere (or perhaps restructure – if already in bankruptcy) with the mindset that more and more reserves will regain market value as technology and productivity catches up to where the discovery boom has already been. A key will be maintaining a long-term perspective on the optionality of future reserves, while managing relatively short-term liquidity and production issues with banks, courts and consultants. If this balance can be achieved, it can set a company on the path to maximizing results for all stakeholders. It also could mean a lot longer reserve life as well – and that is worth smiling about.

For more information about the optionality of future reserves see our blog post “Bridging Valuation Gaps.” Contact Mercer Capital to discuss your needs in confidence and learn more about how we can help you succeed.

End Notes

1 Most likely estimate for existing fields, discoveries and yet undiscovered fields. All reserve numbers include crude oil and condensates – including non-commercial volumes.

2 As a reminder – this blog is about energy valuation and economics, not cosmic justice.

3 It appears much of those funds were put to very productive use. Dare we say…too productive?

Energy Valuation Insights

Energy Valuation Insights