U.S. LNG in 2025

The Future is Bright, Though with Potential Headwinds

Expectations for the LNG industry in 2025 were modestly positive before the November 2024 U.S. elections but are notably more robust with the transition from the decidedly pro-green/renewable, anti-carbon energy Biden administration to the decidedly pro-American energy dominance Trump administration. However, as always true of domestic commodity markets subject to international market influences, the outlook for the U.S. LNG industry in 2025 is tempered by a number of potential domestic, international, and geopolitical pressures that could hamper actual results relative to expectations.

Continued Export Growth

Although 2024 was not a particularly strong year for U.S. LNG projects, the consensus holds that 2025 has much greater promise for LNG sector expansion with the U.S. as the key provider for the global LNG demand. U.S. LNG exports have grown every year since 2016, when the first major export facility in the lower 48 states became operational.

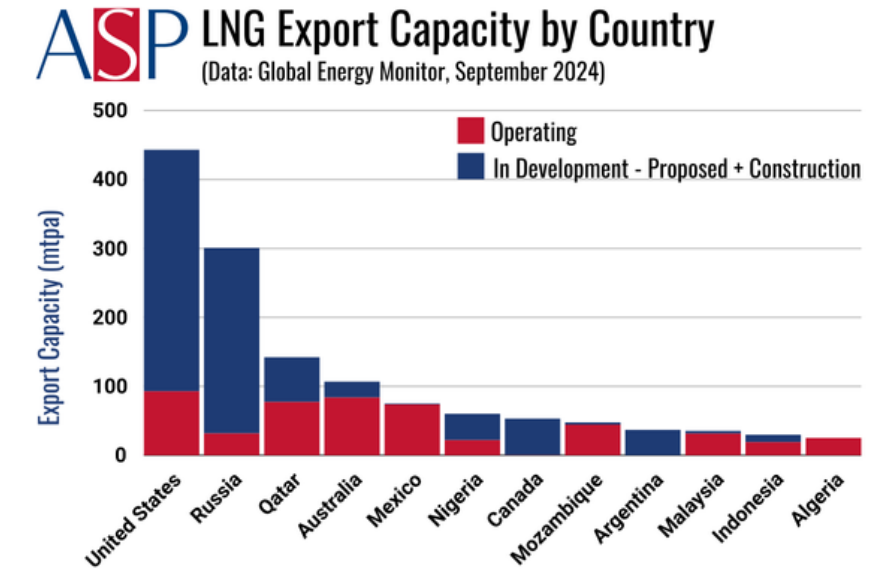

During the last four years, despite the bent of the Biden administration against carbon-based energy, the U.S. became the world’s largest LNG supplier, exceeding both Australia and Qatar. Per Gas Outlook, the U.S. is currently on track for its export capacity to nearly double by 2028, with LNG projects already under construction. With these facilities, Gas Processing & LNG reports that U. S. LNG capacity will rise from 13.8 Bft3d in 2024 to 24.7 Bft3d in 2028.

Now, in 2025, as the U.S. LNG sector rebounds following a period of sharply reduced growth from the Biden administration’s “pause” on LNG export authorizations, the sector is poised to expand its contribution to U.S. GDP, the country’s economic influence, and global LNG trade. Forbes, citing an S&P Global study, noted several benefits resulting from U.S. LNG expansion, including a $1.3 trillion contribution to GDP that will support nearly 500,000 U.S. jobs by 2040, $2.5 trillion in revenues for U.S. businesses, over $900 billion in expenditures, and $165 billion in tax revenue.

Geopolitical Benefits

In addition to the obvious economic benefits of an expanding U.S. LNG sector, there are also geopolitical benefits to be gained. At present, U.S. LNG exports account for a mere 12% of the domestic natural gas market. However, those same exports account for nearly 25% of global LNG supplies, making the U.S. the world’s largest single LNG supplier.

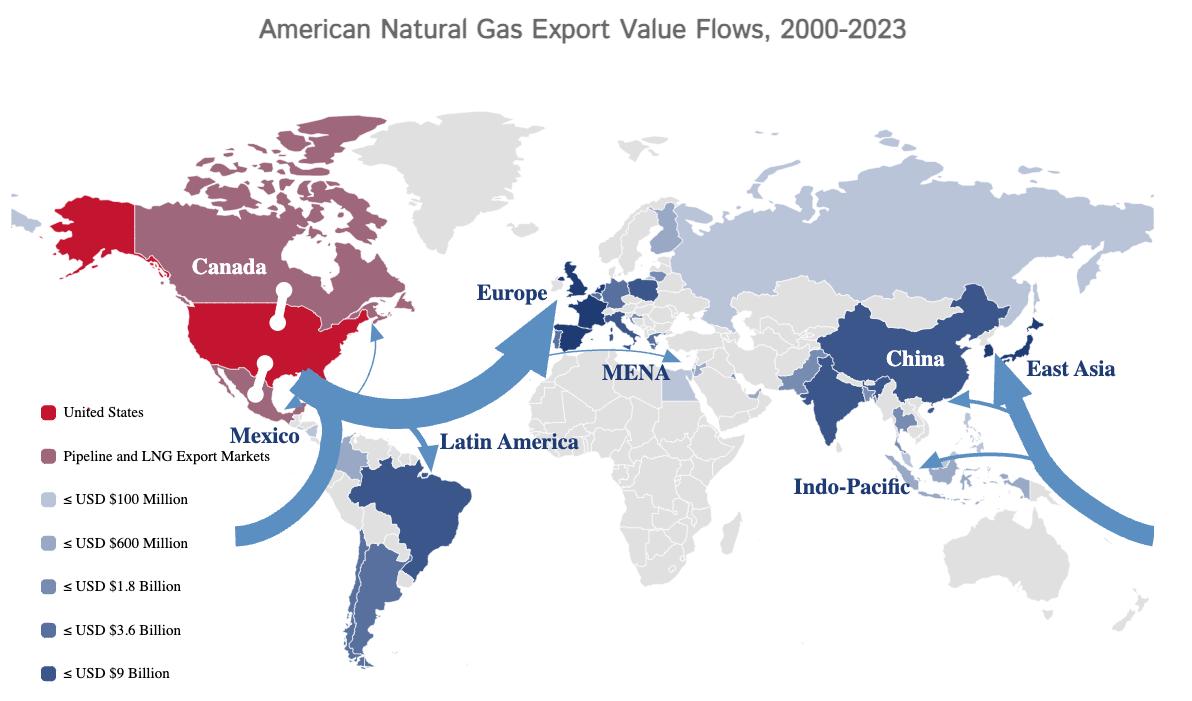

With the U.S. as the leading supplier of affordable LNG, this enables a global transition away from importing fossil fuels from problematic countries and regions such as Russia and the Middle East, as well as the associated geopolitical risks. Daniel Yergin and Madeline Jowdy, with the Atlantic Council, noted the geopolitical importance and strategic need of U.S. LNG export strength was demonstrated in January 2025 when Vladimir Putin cut pipeline gas supplies to Europe in an effort to undermine Ukraine support. That move did not have the desired impact on Europe due to the U.S. LNG export capacity replacing 40% of Russian gas production within a short period of time.

An additional European shift away from Russia may take place in 2025 as some European Union member states have called for sanctions that would end imports of LNG from Russia. While the measure has not yet reached a consensus, the growth of LNG export capacity, particularly in the U.S., allows the EU to exert pressure on Putin. S&P Global Vice Chairman Daniel Yergin noted that “U.S. LNG adds a new dimension to the influence and geopolitical position of the U.S. in the world,” namely due to the country’s ability to quickly fill an otherwise LNG void.

Potential Headwinds

Despite clear indications of demand growth and a pro-American energy dominance administration in Washington, it is not smooth sailing for the U.S. LNG sector. Infrastructure and regulatory/legal barriers exist that could hamper near-term growth.

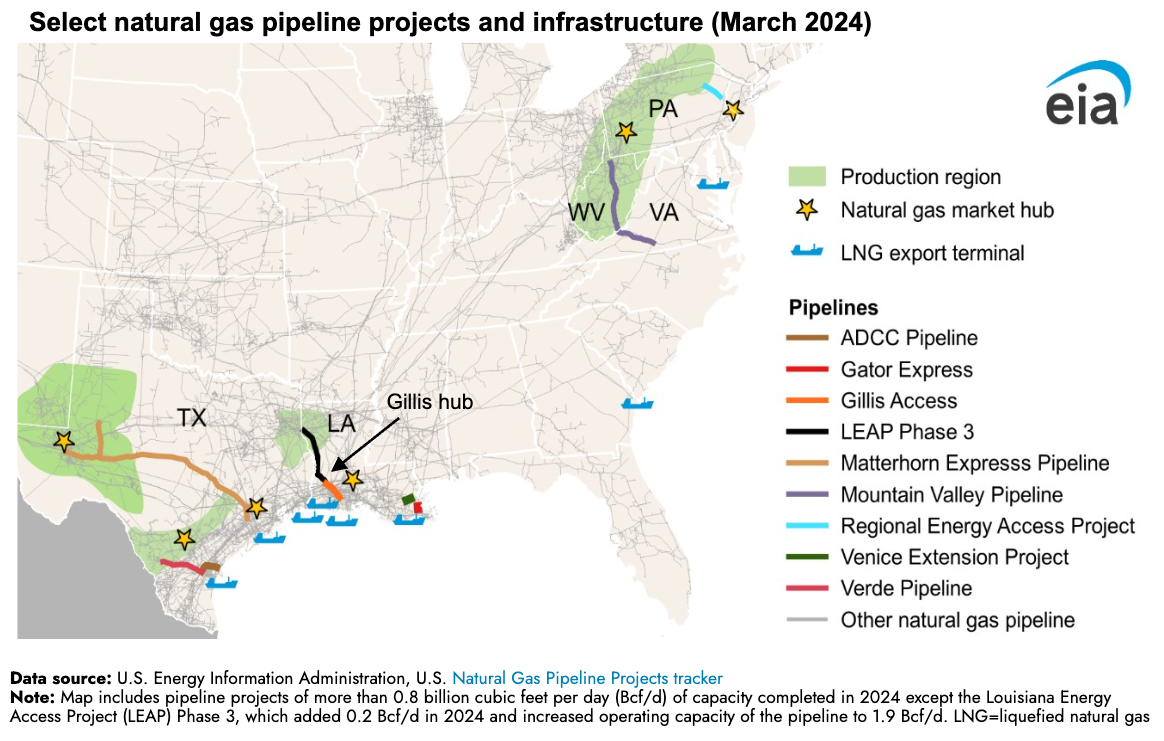

The Energy Information Administration (EIA) reported that 2024 pipeline completions in the U.S. added 17.8bcfd of takeaway capacity, with 8.5bcfd specifically supporting transporting natural gas to Texas and Louisiana Gulf Coast LNG export terminals.

However, Toby Rice, CEO of EQT, the nation’s number two producer of natural gas, notes that pipeline capacity has still not caught up with production in the Appalachian basins, partly due to a series of pipeline project cancellations in recent years. “We have the gas, we just don’t have the pipelines to get it to places, so now you see a situation where it doesn’t matter how much we produce,” Rice stated in a recent interview.

Rice further expressed that political considerations have overridden market forces in recent years, deterring new natural gas pipeline projects. While the new administration in Washington will undoubtedly be more favorably disposed to new pipeline projects, the resulting increase in capacity will not be felt for several years.

Click here to expand the image above

The U.S. LNG industry is set to enjoy a much more favorable regulatory environment from the Trump administration, which is expected to boost contracting for U.S. LNG and re-start final investment decisions (FIDs) that languished under the Biden administration. However, the potential for legal challenges and the risk of unintended consequences from the imposition of tariffs could create obstacles to new LNG export developments.

Almost immediately upon his inauguration, President Trump lifted the Biden administration’s moratorium on new LNG export facility permits. S&P Global noted in its 2025 LNG Strategic Report that it is expected that President Trump’s Department of Energy (DOE) will likely move to quickly authorize 54 MMtpa of pending export license applications on LNG export terminal projects with existing approval from the U.S. Federal Energy Regulatory Commission (FERC).

S&P further notes that an additional 60 MMtpa of projects with expiring authorizations will likely have permit extensions approved by the new administration without delay. However, due to 2024 court rulings that overturned existing FERC permits for Gulf Coast LNG export projects, it is anticipated that FERC will take on a more thorough review process for future permit applications to avoid legal challenges. That clearly could bring about delays in the permitting process.

Lastly, President Trump made it quite well known during the presidential campaign that he intended to increase tariffs on many of the U.S.’s more significant trading partners to force more fair trading policies with those partners. However, as those tariffs are now beginning to be imposed, it’s quite possible that the policy will complicate new LNG export offtake contract negotiations and may raise LNG facility construction costs if construction materials are sourced from those same trading partners. China, in particular, is both a leading source of many U.S. construction materials and simultaneously one of the largest importers of U.S. LNG. The results of the tariffs remain to be seen but certainly carry the potential for unintended consequences.

Click here to expand the image above

Conclusion

In summary, demand for U.S. LNG exports remains strong and U.S. export capacity is expected to double over the next four years. That, combined with the new pro-American energy dominance of the Trump administration, creates a favorable environment for continued and accelerated LNG industry growth. However, potential headwinds to that industry growth are prevalent in the form of infrastructure constraints, regulatory impediments, and environmental challenges.

Energy Valuation Insights

Energy Valuation Insights