Was 2014 a Lesson Learned?

Overview of the Macro Oil and Gas Environment at the End of 1Q 2018

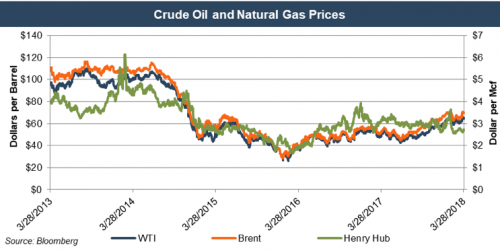

The oil and gas market continued to show improvement in the first quarter of 2018. Positive momentum in production growth in the U.S. continued and prices increased from an average of $55 in Q4 2017 to an average of $63 in Q1 2018. Mercer Capital’s Senior VP, Grant Farrell, at the beginning of the quarter said, “a repeat of 2017 would be a welcomed event” and it appears we are on track. Oil prices are ticking up, domestic production has increased to a 50 year high, and the U.S. is exporting more crude oil than ever before.

Too Good to be True

If you are like me, you can’t ignore the wary feeling in your gut that makes you ask, “Is it too good to be true?”

According to Reuters, global inventories could increase due to the rapid increase in production in the U.S. which “could well outweigh any pick-up in demand.”

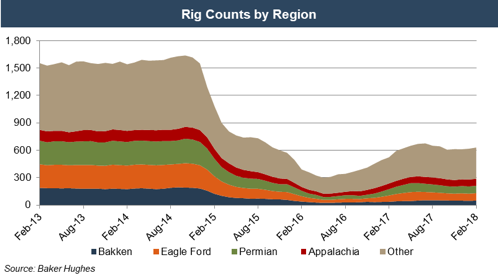

Rig counts in 2018 were expected to increase to 945 active rigs. [1] However, Baker Hughes reports that we have already met this target and currently have 993 active rigs versus 824 a year ago.

Have we already forgotten the lesson we learned in 2014: too much supply, too fast leads to a decline in prices? Additionally, what will happen to demand as transportation becomes more fuel efficient and we shift further away from oil in favor of renewable energy resources?

Easing Concerns

Thankfully, I am not the only one asking these questions. A survey of oil and gas professionals in the February 2018 Issue of the Oil and Gas Journal showed that 63% of oil and gas senior professionals are optimistic about 2018. However, this optimism does not stem from a forecasted favorable price environment. Rather, their confidence is supported by the knowledge that they can now operate profitably in a $55 per barrel price environment.[2] Oil and gas exploration companies today are more cost-efficient than ever. The collapse in prices in mid-2014 gave companies two options: adapt to the new price environment or go away. Today we are left with a more cost-aware sector that has used technology to reduce risks and cut costs.

Further, domestic E&P companies today have the ability to quickly adjust their operations in response to price changes. Jude Clemente, a recent contributor for Forbes recently wrote, “The U.S. has now become the world’s swing oil producer and is the main factor that will limit how high prices can go.”

BP Chief Economist Spencer Dale recently responded to similar questions asked across the energy industry: “Will oil and gas lose dominance to renewable fuels in the future?” BP argues that crude oil demand will continue to increase in the foreseeable future but will begin to reach a plateau in the next twenty years. While renewable energy is the fastest growing energy source, developing nations across the world will drive energy demand in the future. The mix of crude oil and renewable energy will shift, and crude oil will likely meet 85% of oil demand in 2040 instead of 94% of demand today. This does not, however, mean demand for crude oil will disappear.

Overview

The forecast for the oil and gas industry in 2018 was positive and we seem to be meeting or even exceeding investor expectations. The U.S. is expected to give up its title of the largest crude oil importer and exports are expected to continue growing as new pipelines and export terminals allow for increased capacity.

The positive momentum in the industry is being reflected in private company valuations both as a result of improved earnings forecasts and reductions in risk. Growth in production and increases in price are increasing revenue, and more of the top line is flowing down to net income as companies have cut costs. Earnings improvement is being magnified by the recent tax cuts which have significantly increased net income. Further, the risk profiles of E&P companies have improved as companies are better equipped to handle price volatility and E&P companies are generally taking on projects with shorter payback periods.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Because drilling economics vary by region it is imperative that your valuation specialist understands the local economics faced by your oilfield service company. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Endnote

[1] US oil, gas industry capital spending to increase in 2018. US Oil and Gas Journal. March 2018.

[2] Survey: Oil, gas professionals express optimism for 2018 challenges. Oil and Gas Journal. February 2018

Energy Valuation Insights

Energy Valuation Insights