Trends in the Refining Industry Display Cautious Optimism

A general theme across refiners’ earnings calls and updates over the last few months was a story of cautious optimism. In this blog post, we outline prevalent general themes in the downstream oil market that have given refiners hope for 2018 as well as those that cause skepticism about the future.

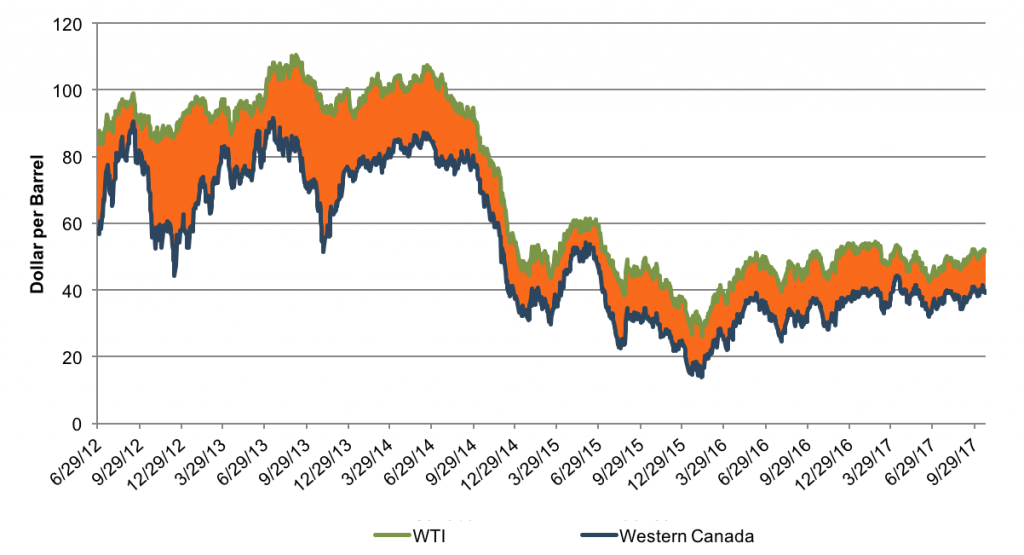

Sweet & Sour Differential

The price differential between light, sweet crude and heavy, sour crude has been shrinking since the fall of oil prices in 2014. From a max differential of $42.50 in December 2012, the differential has fallen to an average of $11 over the last month.

“OPEC cuts have impacted the available supply of medium and heavy sour grades resulting in narrow feedstock differentials which is a challenge to our complex refining system.” – Thomas J. Nimbley, Chairman and CEO at PBF Energy on Second Quarter Earnings Call

The differential has been shrinking as the global supply of oil has remained high causing crude benchmark prices to converge. Since the price of light, sweet U.S. crude has fallen, the cost savings that companies used to realize when purchasing heavy feedstock cannot make up for the higher costs of cracking it.

Retrofitting Refineries

As explained by Canada Oil Sands Magazine, “Refineries typically blend different grades of crude with varying quality specifications. Depending on the configuration of the refinery, each facility has a limited ability to handle heavy grades of crude and Sulphur.” U.S. refineries were traditionally retrofitted to handle heavy crude because it allowed for higher refining margins. The U.S. traditionally has more complex refineries than Europe and Canada, which allows them to better crack heavy molecules into light, value-add products, such as jet fuel.

However, starting in mid-2014, US refiners began struggling to keep up with the amount of light sweet crude available for sale in the US markets since most refineries were not built to handle such light crude. It was thought that the initial relaxation and eventual elimination of the crude oil export ban would relieve US refiners from this pressure. But the over-supply of oil across the globe dampened this effect.

Because the price of light, sweet crude and heavy, sour crude has started to converge, there is potential for higher margins from light crude. Even if refiners have to pay the upfront investment costs to retrofit their facilities to handle lighter crude, they can face lower operating expenses going forward as it is easier to refine light crude than heavy crude into higher margin products.

“We expect to see improved margin capture as we are now able to upgrade components of our gasoline pool into higher octane, low sulfur finished product.”

-Thomas J. Nimbley, Chairman and CEO at PBF Energy on Second Quarter Earnings Call

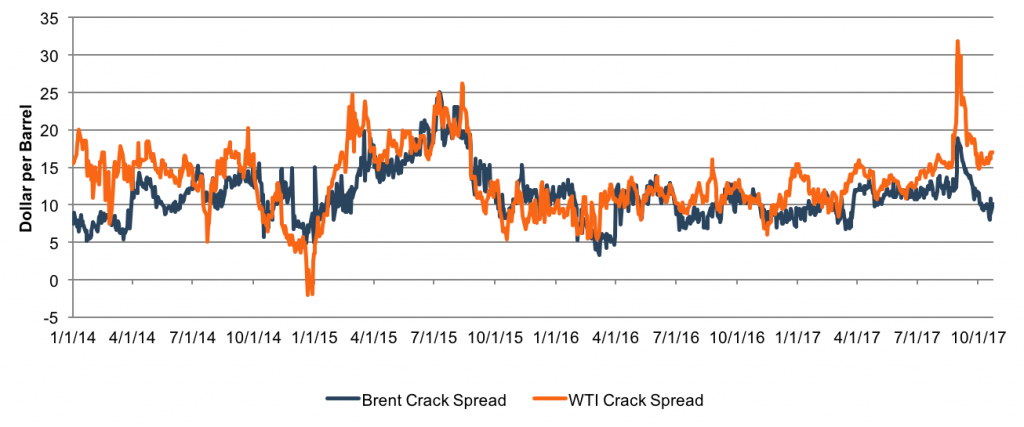

Widened Crack Spread

The crack spread is the price differential between crude oil and its refined oil products. The 3-2-1 crack spread approximates refinery yield using the industry average for refinery production. For every three barrels of crude oil the refinery processes, it makes two barrels of gasoline and one barrel of distillate fuel.

The crack spread is a good indication of refiners’ profit margins. As shown in the chart above, the WTI crack spread increased over the first half of the year giving the downstream markets optimism about the rest of the year to come. The crack spread peaked at the end of August as many refiners were forced to shut down due to damage caused by Hurricane Harvey and the price of refined products spiked. The spread has since fallen to approximately $17 per barrel of WTI.

“The decrease to refining margin was primarily driven by the higher RINs cost, which were partially offset by the increase in the Group 3 2-1-1 crack spread.”

– Susan M. Ball, CFO & Treasure of CVR Refining GP LLC on CVRR’s Second Quarter Earnings Call

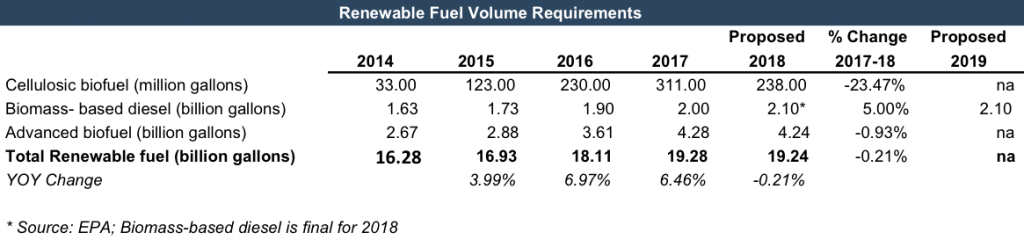

Higher RIN Costs

The Renewable Fuels Standards (RFS) Program has continued to have a significant impact on the refining sector over the last year. The RFS were signed into law by President George W. Bush in order to reduce greenhouse gas emissions and boost rural farm economies. Each November, the EPA issues rules increasing Renewable Fuel Volume Targets for the next year. RINs (Renewable Identification Numbers) are used to implement the Renewable Fuel Standards. At the end of the year, producers and importers use RINs to demonstrate their compliance with the RFS. Refiners and producers without blending capabilities can either purchase renewable fuels with RINs attached or they can purchase RINs through the EPA’s Moderated Transaction System. While large, integrated refiners have the capability to blend their petroleum products with renewable fuels, small- and medium-sized merchant refiners do not have this capability and are required to purchase RINS, which have significantly increased in price.

RIN expenses have remained high and although President Trump promised to help small- and medium-sized merchant refiners who were disadvantaged by RFS, he also spoke fondly of the RFS program during his campaign.

On July 5, 2017, the EPA issued proposed volume requirements under the Renewable Fuel Standard program, which are summarized below.

A public hearing was held on August 1, 2017, and on October 17, 2017, the EPA provided a public notice and an opportunity to comment on potential reductions in the 2018/ 2019 biomass-based diesel, advanced biofuel, and total renewable fuel volumes. The final rule should be available in December.

Conclusion

Refiners were generally optimistic about their performance over the first six months of 2017. Higher crack spreads have allowed margins to increase and many believe that the Trump administration will help relieve some of the pressure caused by the RFS. Additionally, it is possible that the RFS volume requirements could be reduced further which would relieve margin pressure for merchant refiners.

The quote below from HollyFrontier’s second-quarter earnings call appropriately summarizes the current state of the industry.

“Our refining outlook for 2017 remains cautiously optimistic. We anticipate solid economic growth will continue to support refined product demand and sustained growth in domestic crude oil production will lead to improved crude differentials. We are also optimistic that a more favorable regulatory environment could provide a tailwind for both the refining industry and the economy as a whole. With a large portion of our scheduled maintenance behind us, we are poised for strong financial and operational performance for the remainder of the year.”

– George J. Damiris, CEO, President, & Director at HollyFrontier – on Second Quarter Earnings Call

Mercer Capital has significant experience valuing assets and companies in the energy industry, throughout the upstream, midstream, and downstream sectors. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights