Eagle Ford Activity and Production Grow, Despite Price Easing

The economics of oil & gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. This quarter we take a closer look at Eagle Ford.

Production and Activity Levels

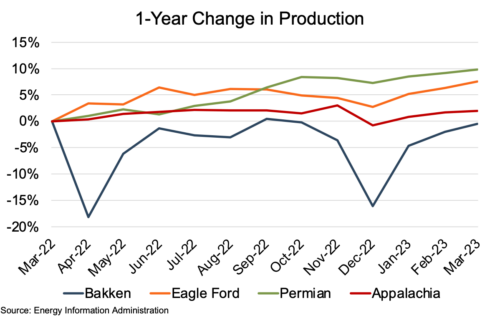

Eagle Ford production (on a barrels of oil equivalent, or “boe” basis) increased 7% year-over-year through March. Production was consistently above March 2022 levels, despite a 3% decline from August to December. The Eagle Ford production climb was second only to that of the Permian, which rose 10% over the year. Appalachian production showed a modest increase through November before a 4% decline in December. By March, Appalachian production had climbed back to a year-over-year increase of 2%. Bakken production was slightly down year-over-year, though significant winter storm interruptions in April and December caused 18% and 16% monthly declines, respectively.

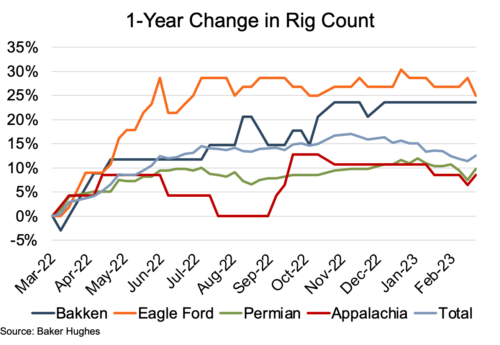

The Eagle Ford rig count growth soared in the LTM period ending March 2023, jumping 29% (from 56 to 72 rigs) through June, with only minimal variations over the remaining nine months (between 70 and 72 rigs). The Bakken rig count growth kept pace with the Eagle Ford’s through May before lagging behind with a growth rate of 12% to 21% through early November. Since then, the Bakken rig count has grown between 21% and 24% compared to March 2022. Permian and Appalachia rig count growth over the year was more muted, with 9% and 8% increases, respectively, over the year. The Permian count was the more stable of the two, holding steady between 7% and 12% over March 2022 levels since June. The Appalachia rig count growth was much more varied over the year, rising to 9% by May before multiple declines took it back to the March 2022 level (47 rigs) in August. It subsequently hit the 12-month high of 53 rigs (15% above the March 2022 count) in October.

Overall rig counts for the four covered plays climbed steadily over the year from 670 to 754, for a 13% increase to March 2023.

As has become typical, the Eagle Ford’s much higher percentage rig count growth over the Permian’s did not result in greater Eagle Ford production growth. Instead, even with the advantage of a rig count growth that has exceeded that of the Permian by double digits since May 2022, the Eagle Ford production growth lagged that of the Permian by 2% to 5% since September. The disconnect between rig count growth and production growth between the two basins lies in legacy production declines and new well production per rig. Both factors favor the Permian such that the Permian requires a lower number of rigs to active wells ratio to maintain production levels.

Commodity Prices Backing Down

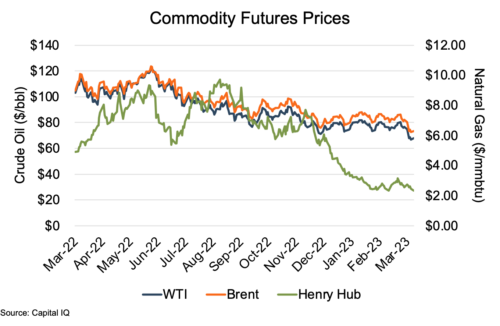

As represented by the WTI and Brent indices, oil prices generally declined over the year ending March 2023, with only two short-lived periods of increases in late May/early June and late October/early November. Other than those brief periods, the WTI declined from $115 in late March 2022 to $67 in mid-March 2023 for a 42% year-over-year reduction. The Brent followed the same pattern with an overall decline from $118 to $74 for a slightly lower 38% year-over-year decline.

Natural gas prices, represented by the Henry Hub index, showed much greater volatility. Prices rose from $4.93 in March 2022 to $8.96 in June, back down to $5.49 in July, only to reach a 12-month high of $9.42 in August. After those five months of ups and downs, the index price generally fell over the remainder of the year with a notable 67% slide from $7.33 in late November to $2.40 in early February. The summer surge in natural gas prices was partly due to the typical demand spike associated with high summer temperatures. This was coupled with the geopolitical supply and demand impacts of the end of Russian natural gas supplies to Europe and fears of European gas shortages for the upcoming winter months. However, an unusually mild winter allayed the European gas shortage expectations by reducing demand, resulting in the sharp price decline over the last three months of the review period.

Financial Performance

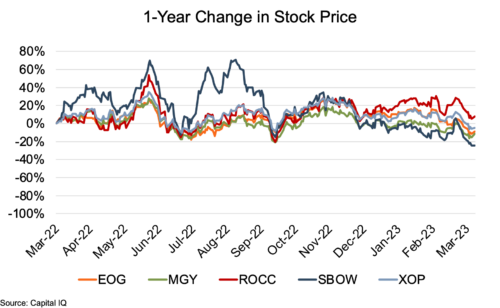

The public comp group for Eagle Ford showed stock price declines over the March 2022 to March 2023 period of 9% to 24%, with the sole exception of ROCC, which posted a year-over-year price increase of 8%. While there was a fairly steady decline from mid-November to the review period end, there were significant ups and downs in the first half. SilverBow and Ranger showed the greatest price volatility, with SilverBow posting March 2022 price changes ranging from -5% to 36% and Ranger from -1% to 23%. EOG and Magnolia showed markedly lower price volatility, with price changes from March 2022 ranging from -2% to 15% and -4% to 9%, respectively.

Eagle Ford Wells Among Most Economic

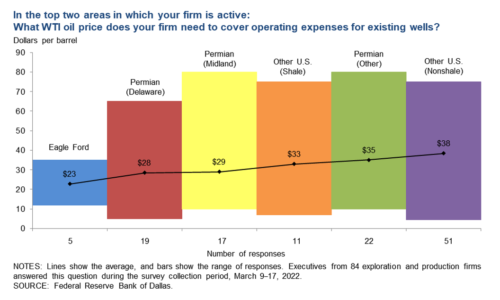

As indicated in the Dallas Fed Energy Survey from 2022, Eagle Ford wells are among the most economical in the nation based on existing well operating expenses. While the Survey is now a year old, the relative economics of the various regions is unlikely to change materially, with the 2023 survey update due to be published in the coming weeks.

Click here to expand the image above

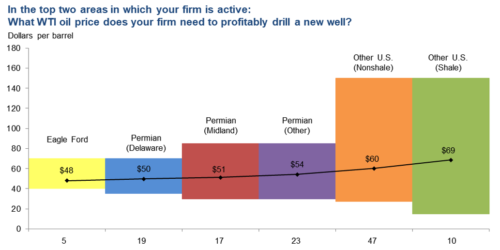

Survey results show that the average breakeven WTI price on existing Eagle Ford wells was $23/bbl, well below the average breakeven in the Permian at $28-$29 and other parts of the US at $30+. Although the economic advantage diminishes somewhat with respect to new wells, the Eagle Ford also had the lowest average breakeven price for new well development, with producers needing WTI at $48/bbl to drill profitably. That Eagle Ford level bested the Permian figure at $50-51 and other parts of the country at $54-$69.

Click here to expand the image above

The economic advantage for Eagle Ford is in its geology and geography, as the basin’s proximity to Gulf Coast refining and export markets gives it a distinct advantage over the more inland basins.

Conclusion

Strong rig-count growth spurred an Eagle Ford production increase that was second only to the Permian. However, production improvement was offset by commodity price easing in the latter half of 2022 and early 2023, resulting in Eagle Ford comp group stock price declines over the last year. Despite those dynamics, interest in the Eagle Ford remains high, with Devon doubling its presence in the basin in late 2022 and SilverBow making significant acquisitions (SandPoint and Sundance) last year.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights