Over the last year, deal activity in the Eagle Ford was relatively muted after the impact that the Saudi-Russian conflict and COVID-19 had on the price environment. M&A deals were largely halted in the second quarter of 2020 as companies turned to survival mode amid challenging realities. Frankly, transaction due diligence was most likely last on companies’ agendas. However, announced, and rumored transactions in the Eagle Ford picked up, relative to early 2020, towards the second half of the year as a price recovery began to take hold.

Recent Transactions in the Eagle Ford

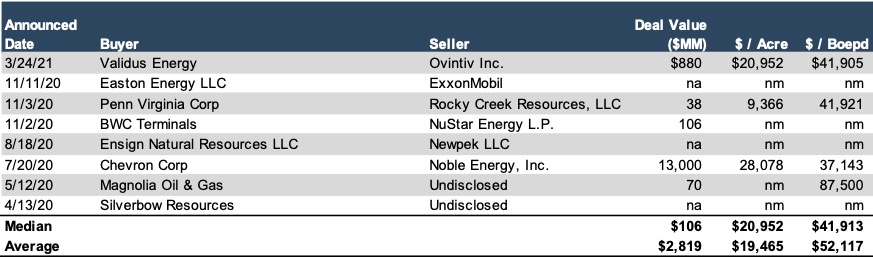

A table detailing E&P transaction activity in the Eagle Ford over the last twelve months is shown below. Relative to 2019, deal count decreased by four, and median deal size declined by approximately $74 million, however it is important to note the small sample of disclosed deal metrics.

Chevron Adds to Eagle Ford Play and Global Portfolio with Noble Acquisition

On July 20, 2020, Chevron announced that it was acquiring Noble Energy, Inc. in an all-stock transaction valued at $10.38 per Noble share, based on the price of Chevron’s stock before the announcement and an exchange ratio of 0.1191 Chevron shares per Noble share, representing an approximate premium of nearly 12% on a 10-day average based on the closing prices as of July 17, 2020. The total enterprise value of the deal (including debt) was pegged at $13 billion in the transaction press release. The deal closed on October 5, 2020, marking the completion of the first big-dollar energy deal since the market turmoil began in March 2020. The acquisition makes Chevron the second U.S. shale oil producer behind EOG Resources, Inc. Noble’s international plays also add 1 Bcf of international natural gas reserve to Chevron’s portfolio. Noble Energy’s domestic plays include the Permian Basin, Denver-Julesburg Basin, and the Eagle Ford.

Ovintiv Further Deleverages with Eagle Ford Asset Sale

On March 24, 2021, Ovintiv Inc. agreed to sell its South Texas assets for $880 million to Validus Energy (portfolio company of Pontem Energy Capital), a privately owned operator. The transaction occurred roughly two weeks after sources rumored that Ovintiv was in advanced discussions to divest its Eagle Ford assets. The deal announcement comes shortly after Ovintiv’s debt reduction initiative outlined in February 2021, which includes generating approximately $1 billion by divesting certain domestic and international assets. In 2019, Ovintiv’s debt increased to nearly $7 billion after its purchase of Newfield Exploration. The company aims to reduce debt by 35% to about $4.5 billion by 2022 in order to gain investor confidence. The company announced that the transaction will allow them to reach the debt target by the middle of next year. Ovintiv has divested two geographic positions in consecutive quarters, with the first sale being their Duvernay position in Q4 2020. The company’s Eagle Ford position was purchased for $3.1 billion in 2014 from Freeport-McMoRan Inc. The company expects the deal to close in the second quarter of 2021.

Conclusion

M&A transaction activity in the Eagle Ford was fairly quiet throughout 2020 before Chevron’s $13 billion deal with Noble Energy. The Chevron-Noble Energy transaction and the Ovintiv-Validus deal could be foreshadowing a busier M&A market in 2021, whether companies try to bolt onto previous acreage, or are forced to divest to pay down debt.

Mercer Capital has assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, we provide investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. Our Professionals also have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence