Eagle Ford M&A

Transaction Activity Over the Past 4 Quarters

Deal activity in the Eagle Ford increased over the past year as energy prices recovered from a tumultuous 2020. As we noted in June of last year, production in the Eagle Ford remained relatively flat over the prior year despite 146% growth in the regional rig count, suggesting the significant increase in drilling activity was just enough to offset the decline in already-producing wells, but not economical enough to spur production growth meaningfully. This may also have signaled to potential buyers that the time was right to increase their footprint in southern Texas while conversely providing for an exit for sellers who could either capitalize on the prospect of a continued upswing in energy prices or redeploy capital elsewhere. Whatever the exact incentives may have been that drove the M&A activity, the result was ten deals closed in the Eagle Ford over the past four quarters, up from eight transactions closed in the prior four quarters.

Recent Transactions in the Eagle Ford

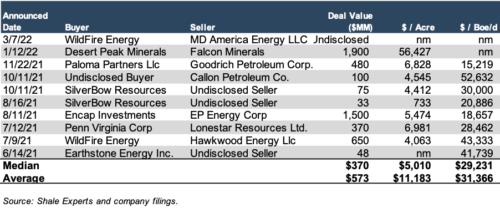

A table detailing E&P transaction activity in the Eagle Ford over the last twelve months is shown below. The median deal value in the past four quarters ($370 million) was approximately $282 million higher than the median deal value from Q2 2020 to Q1 2021, excluding Chevron’s acquisition of Noble Energy in July 2020. The average deal value over the past year ($573 million) was more than double the average value ($274 million) over the prior year (excluding the Chevron-Noble Energy deal). Also notable, larger positions were transacted over the past year, with a median size of 45,000 net acres as compared to 26,500 net acres in the prior year (excluding Chevron-Noble Energy), and an average deal acreage of nearly 80,000 net acres this past year which was more than double the average of 34,775 net acres in the prior year.

SilverBow Resources Builds Up Its Eagle Ford Assets

On October 4, 2021, SilverBow Resources announced the closing of its purchase to acquire oil and gas assets in the Eagle Ford from an undisclosed seller in an all-stock transaction. The aggregate purchase price for these assets was $33 million, with the transaction consisting of approximately 1.5 million shares of SilverBow’s common stock. In late November 2021, SilverBow announced another transaction closed with its purchase of oil and gas assets from an undisclosed seller for $75 million, including $45 million in cash and approximately 1.35 million shares of SilverBow’s common stock.

Of this second transaction, Sean Woolverton, CEO of SilverBow, commented, “This is the third acquisition we have closed in the second half of this year. This transaction represents SilverBow’s largest to date. As we look to 2022, the Company is set to grow production by double digits in part from the incremental development locations and a full year’s worth of contribution from the acquired assets. With greater cash flow and liquidity, SilverBow remains well-positioned for strategic M&A and further de-levering.”

Callon Petroleum Divests Non-Core Eagle Ford Assets

On October 5, 2021, Callon Petroleum – one of the upstream companies we follow regularly in our quarterly review of earnings call themes from E&P operators – announced it had entered into an agreement to sell non-core acreage in the Eagle Ford as part of its acquisition of leasehold interests and related oil, gas, and infrastructure assets in the Permian basin from Primexx Energy Partners. Total cash proceeds from the divestiture were approximately $100 million. The Eagle Ford properties included approximately 22,000 net acres in northern LaSalle and Frio counties. Net daily production from the properties was approximately 1,900 Boe/d (66% oil) on average in the third quarter through month-end August. Callon noted in its press release that the sale would eliminate approximately $50 million in capital expenditures related to continuous drilling obligations over the next two years, allowing for redeployment of capital to higher return projects.

Conclusion

M&A activity in the Eagle Ford has picked up over the past year in terms of both deal count and the amount of acreage involved. The ten deals noted over the past year were split evenly between property/asset acquisitions and corporate transactions, such as the Desert Peak Minerals-Falcon Minerals Corporation merger announced in mid-January of this year. This signals a notable increase in corporate-level activity as only one of the eight transactions in the prior year involved a corporate transaction, possibly foreshadowing greater industry consolidation in the Eagle Ford moving forward.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights