Eagle Ford M&A

Transaction Activity Plummets Over the Past 4 Quarters

Over the past twelve months, deal activity in the Eagle Ford has fallen off a cliff, with only two deals closing compared to 13 transactions closed in the prior twelve-month period. Significant volumes of wet gas, NGLs, and rich condensate combined with the proximity to the Port of Corpus Christi fueled deal momentum in the twelve months ended February 28, 2023. So why did this momentum come to a screeching halt during the remainder of 2023 and into the first two months of 2024?

According to a report from Deloitte, M&A activity declined as E&P companies committed themselves to capital discipline. Free cash flows were diverted away from investing, acquiring for growth, and increasing market share toward paying dividends and share buybacks. The old drivers of M&A activity seem to have been replaced by new drivers.

Recent Transactions in the Eagle Ford

During the twelve months ended February 29, 2024, Silverbow Resources purchased 42,000 acres from Chesapeake Energy for $700 million, while Crescent Energy purchased 75,000 acres from Mesquite Energy for $600 million. The total deal value of the two deals, $1.3 billion, equals the median deal value of the 13 deals for the twelve months ended February 28, 2023. A table detailing these two transactions is shown below.

Click here to expand the image above

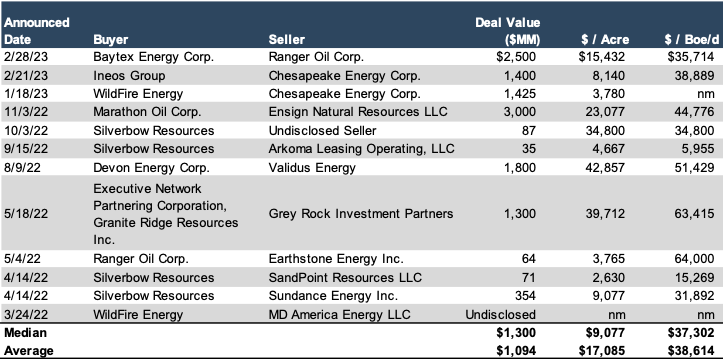

Chesapeake’s sale to Silverbow Resources is an extension of Chesapeake’s sell-off during the twelve months ended February 28, 2023 (see table below), during which Chesapeake sold a combined 549,000 acres over two deals. On the flip side, Silverbow Resources has continued its buying binge by purchasing assets from Chesapeake, adding to the four purchases it made during the twelve months ended February 28, 2023 (see table below). Silverbow Resources spent $547 million on these four purchases, adding 76,000 acres to its portfolio at $7,197/acre.

Click here to expand the image above

Rock, Returns, and Runway: Why Chesapeake is a Seller

Chesapeake announced the sale of its remaining Eagle Ford shale assets to Silverbow Resources on August 14, 2023. The sale of these assets affirmed Chesapeake’s commitment to the Marcellus and Haynesville shales, noting that the Eagle Ford was no longer core to its strategy. Further, Chesapeake’s activist investor Kimmeridge Energy Management, had urged a shift toward solely natural gas production. The Marcellus and Haynesville shales are both natural gas-rich formations. We note that the shift out of the Eagle Ford shale preceded Chesapeake’s merger with Southwestern Energy, which was announced on January 11, 2024.

As Chesapeake’s CEO Nick Dell’Osso noted, the divestiture of the remaining Eagle Ford assets allows Chesapeake “to focus our capital and team on the premium rock, returns, and runway” of its assets within the Marcellus and Haynesville shales.

Scale, Capital Efficiency, and Commodity Exposure: Why Silverbow Is Buying

While Chesapeake has completely exited the Eagle Ford, Silverbow Resources is the other side of the coin. The acquisition of the Chesapeake assets has propelled the company into the largest public pure-play Eagle Ford operator.

Silverbow Resources CEO Sean Woolverton noted “We are excited to close the Chesapeake transaction, which materially increases our scale in South Texas…Our differentiated growth and acquisition strategy has positioned us with … a portfolio of locations across a single, geographically advantaged basin. The acquired Chesapeake assets further enhance our optionality to continue allocating capital to our highest return projects and will immediately compete for capital.”

Conclusion

M&A activity in the Eagle Ford has plummeted over the last twelve months, with only two deals announced, one of which portrays two very different attitudes towards the Eagle Ford. However, according to Enverus Intelligence Research, the Eagle Ford shale is one of a few areas that can expect an uptick in M&A activity in 2024 as the list of attractive targets in the Permian Basin has dwindled due to heavy M&A activity in that play in 2023. Enverus also notes that “The core of the Eagle Ford is the gift that keeps giving for operators with the best acreage.” Despite denser development, recoveries remain high in these core areas of the Eagle Ford.

Mercer Capital has assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space. We can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights