Earnings Stability and Geopolitical Volatility

Two Foes Are Battling Once More

In the mire of much of the chaotic goings-on of the world energy markets over the past year, a lot of things have changed. A lot of other things have not gone according to predictions or plans. War in Ukraine remains. Interest rates have gone up. Recession questions haunt the market: are we close to one or already in one? Uncertainty has ruled the day.

Take this quote from the latest Dallas Fed Energy Survey:

“Our industry has been affected negatively by the Russia-Ukraine war, and now there are concerns over the banking system. The continued mixed messages put out by the administration are also contributing to the uncertainty and unwillingness to put additional funds toward development and growth”

Yet commodity prices continue to drift back down this year, even contributing to the announced production cuts by OPEC+. The past warm European winter has muted much speculation that a significant portion of Russia’s production would be frozen or shut in. In fact, Russian exports have rebounded to the point that in February they announced that they will cut production by 500,000 barrels a day, ostensibly in retaliation for the G7 price cap. At the same time, U.S. production continues to creep back up, but at a slowing pace; and natural gas prices have dropped back down to the low $2 range again.

What to make of this? Read between the apparently contradictory lines and there is more optimism for the upstream industry. We will look at a few recent fundamental dynamics and the merger and acquisition market briefly to exemplify some of this.

Growth and Profits Hanging On

Based on the recently released Dallas Fed Survey, growth remained in the sector but slowed amid cost inflation and outlook uncertainties about the global economy. It is so uncertain that price estimates from survey participants ranged from $50 to $160 per barrel by the end of 2023.

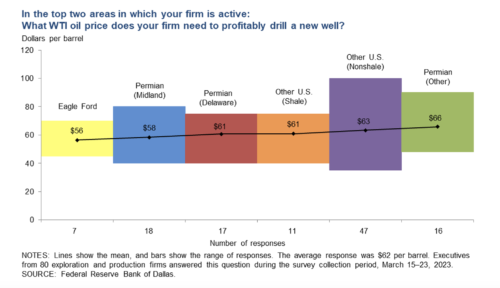

Costs rose for the ninth quarter in a row with employment costs continuing to drift up. However, amid these rises, most producing regions can still offer profitable new wells at around today’s $80 WTI per barrel. Consider the chart below:

Click here to expand the image above

The Eagle Ford leads the way at $56 per barrel as West Texas costs have risen from $52 per barrel last year to $61 per barrel this year. The survey also notably highlights the economies of scale that larger firms tend to enjoy. Smaller firms (less than 10,000 b/d of production) need $64 per barrel while larger firms require $55 per barrel. Part of those costs reflect the increased compensation needed to attract workers to the space. The cyclical nature of the industry alongside the perception that career potential will be limited due to the energy transition have made it even more difficult to recruit and retain industry talent.

However, the productivity of these wells is in question too. I wrote an article about a year and a half ago that discussed the shrinking inventory of drilled but uncompleted (DUC) wells in the U.S. Today that clock has run out as they have returned to 2014 levels off from their 2020 peak. There simply are not as many potential wells that are more easily converted into production.

Yet profitability remains.

2022 was the best cash flow year the industry had seen in many years. According to a McKinsey article, free cash flows reached about $85 billion in 2022 with a cash balance between $70 billion and $100 billion. McKinsey estimates that cash flows will remain high for years to come even in a $65 to $70 oil environment. With capex expected to remain disciplined and debt loads continuing to fall, shareholder returns are expected to be a priority. One of the ways to enhance returns is to acquire productive assets with the cash received.

M&A Market Buzzing

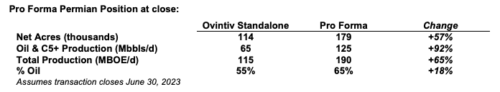

The buildup of cash in 2022 had many observers and analysts wondering how much merger and acquisition activity would be a factor in 2023. This was partially answered last week with Ovintiv’s $4.2 billion acquisition of three EnCap portfolio companies.

The market responded positively to this last week, bumping Ovintiv’s stock from about $36 per share to about $39 per share this week. It is not the only Permian-based acquisition being discussed right now. Acquisition rumors are boosting shale producers, particularly Pioneer which is reportedly a target for Exxon Mobil. Exxon is flush with cash and is looking for productive ways to spend it. With diminishing returns in some areas as the shale revolution matures, there could be a lot more activity to come this year. Names like Exxon and Chevron could be pursuing companies such as Diamondback, Devon, Coterra, APA Corp., and Permian Resources.

What could be interesting is that these potential target companies are cash flow positive and becoming increasingly de-levered, so there may not be as much of an immediate need to sell. Less motivation to sell could stimulate the offering of acquisition premiums to shareholders that have not been observed much in the past several years. We will see.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights